GST Advisory on Payment via Credit card/Debit Card/UPI

Page Contents

GST Advisory on Payment via Credit card or Debit Card & UPI w.e.f. 19/01/2024

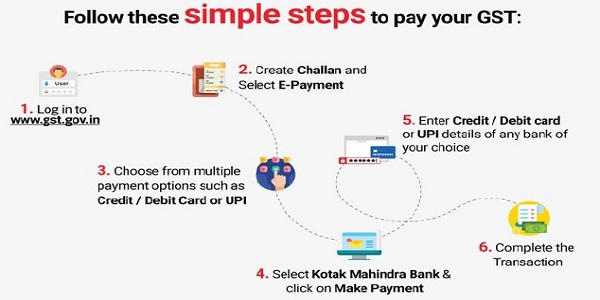

To facilitate the GST taxpayer registered under Goods & Services Tax with more methods of payment, 2 new Payment methods have now been provided under online GST E-payment in addition to net-banking. The 2 new methods are Credit or debit Cards & Unified Payments Interface . Credit or debit Cards facility includes Credit Card (CC) and Debit Card (DC) like Visa, RuPay, Mastercard, Diners issued by any Nationalized or Private Indian bank.

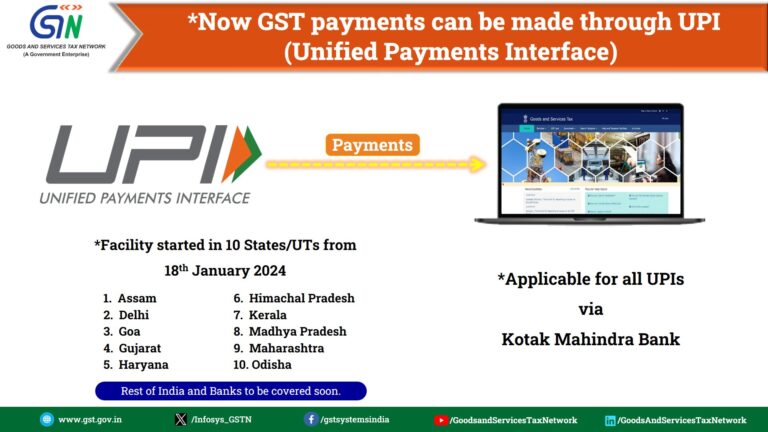

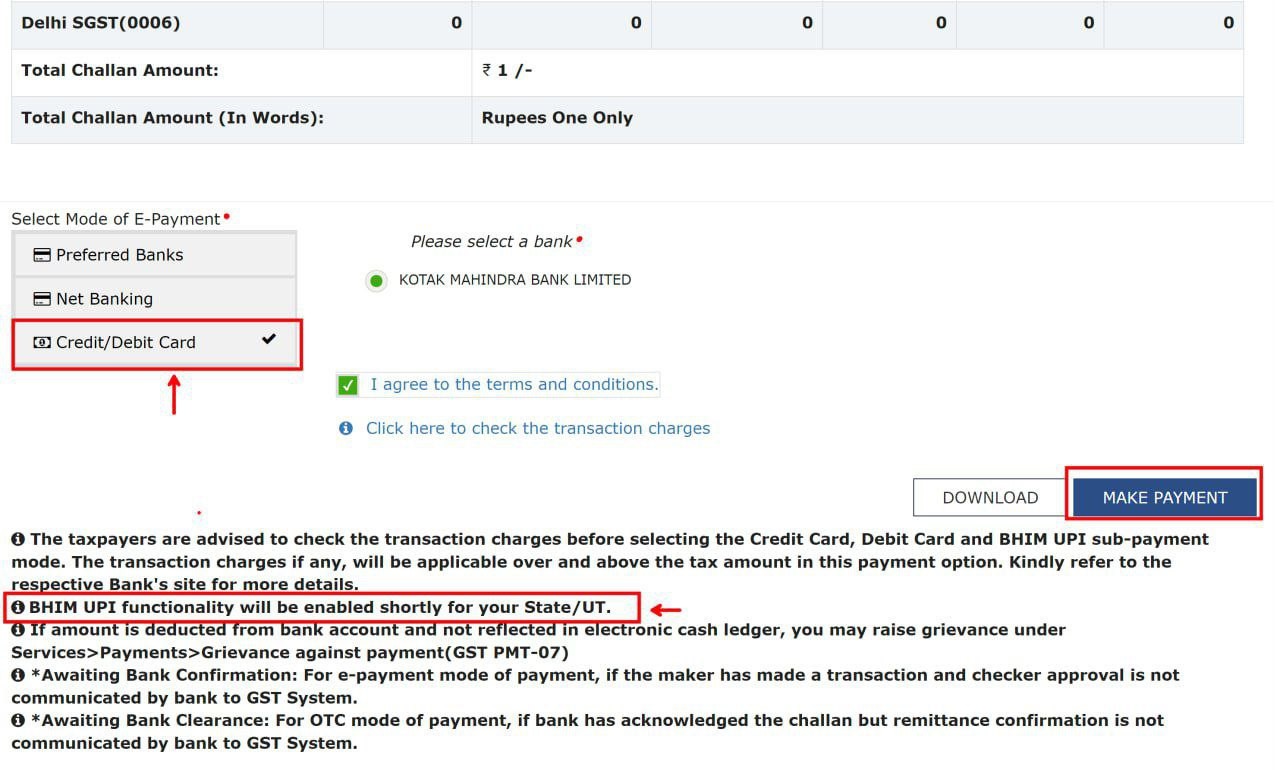

New GSTN Advisory on Payment via Credit Card (CC) & Debit Card (DC) like Visa, RuPay, Mastercard, Diners. To facilitate the Goods & Services Tax taxpayer registered under GST with more methods of payment, two new facilities of payment have now been provided under e-payment in addition to net-banking. The two new methods are Cards and Unified Payments Interface (UPI). Cards facility includes Credit Card (CC) and Debit Card (DC) like Visa, RuPay, Mastercard, Diners issued by any Indian bank. Payment via DC/ CC/UPI can be made via Kotak Mahindra Bank irrespective of Credit Card (CC) and Debit Card (DC) issued by any Indian bank. Other banks are in the process of integration. At present the facility is available in 10 states & remaining states are expected to join soon.

Goods and Services Tax Network Launched UPI Option in 10 States- GST Payments Go Digital

GST Payment can now be made through Debit and Credit Card. Also UPI Method will be enable soon for GST Payment.

Complete GSTN Advisory on Payment via Credit card/Debit Card/UPI-19/01/2024

Important Financial Limit in 2025 for UPI and other transactions

Important Financial Limit in 2025

Issue: Excess ITC Claims Post Delinking of CN/DN from Original Invoice

- After September 2020, based on the 28th GST Council Meeting recommendation, the GST system delinked Credit Notes (CN) and Debit Notes (DN) from their original invoices.

- While this change simplified reporting, it inadvertently opened a loophole, enabling taxpayers to potentially claim excess Input Tax Credit (ITC) in cases where CN/DN values exceeded the corresponding invoice amount.

Proposed Solution

- To address this issue, a system-level filter can be implemented on the GST portal: For a single GSTIN, the total value of credit notes accepted should not exceed the total value of invoices issued to that same GSTIN.

- Rather than reinstating invoice-level linking, this GSTIN-level linking approach would Maintain flexibility and ease of compliance for taxpayers, prevent the misuse of excess CNs across multiple invoices & Ensure accurate ITC flow and control over credit reversals in B2B transactions.

- This simple validation mechanism would effectively close the loophole while preserving the operational benefits introduced by the delinking measure.