FAQs on New Tax vs Old Tax Regime

Page Contents

FAQs on New Tax vs Old Tax Regime

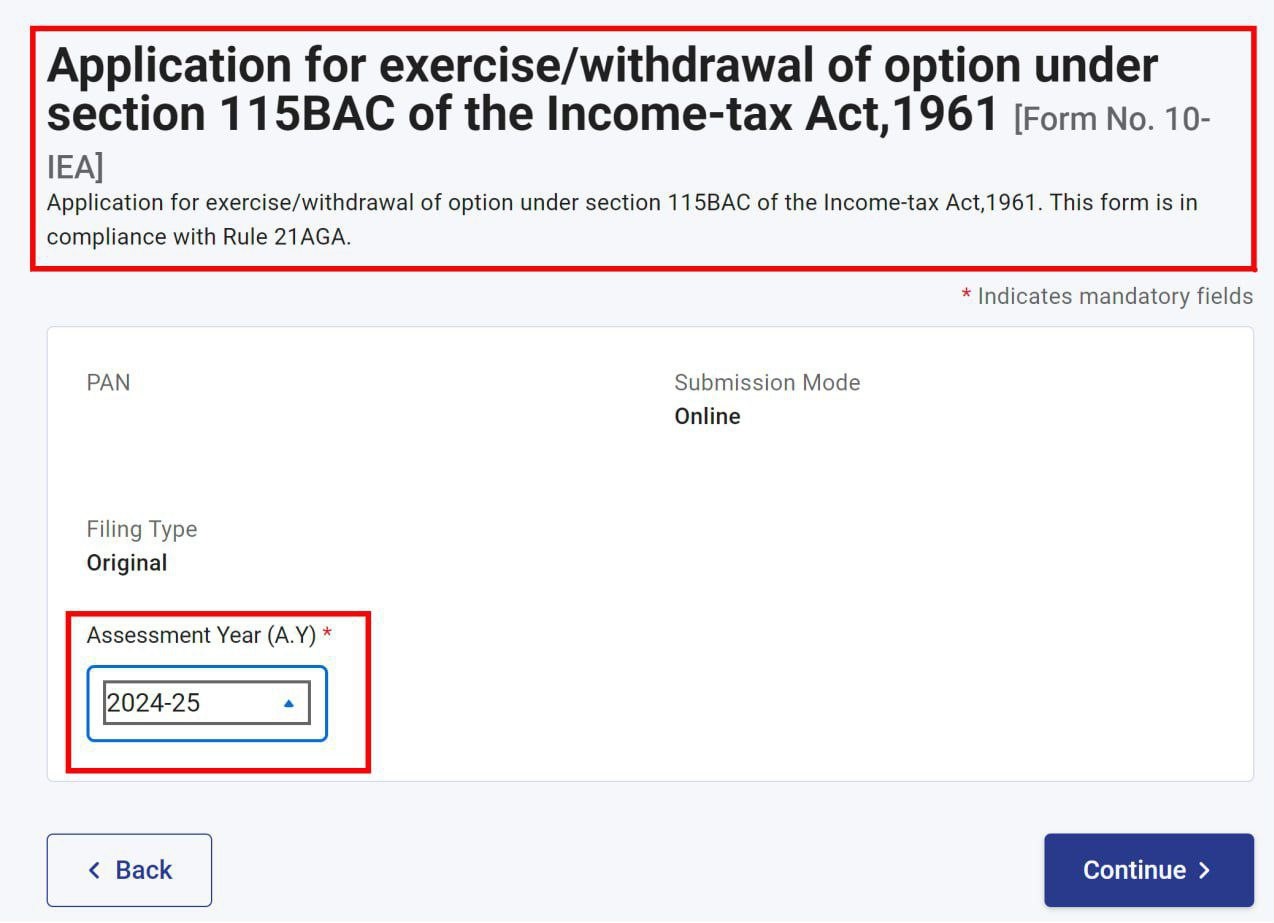

From AY 2024-25, the new tax regime under Section 115BAC is the default tax regime for Individuals, HUFs, AOPs (excluding co-operative societies), BOIs, and Artificial Juridical Persons. However, taxpayers can opt out of the new regime and choose the old regime.

- Non-Business Income Cases: Option can be chosen every year directly in the ITR.

- Business/Profession Income: Must file Form 10-IEA before the due date u/s 139(1) to opt out of the new regime.

Q.1. What is the difference between the old and new tax regime?

- Old Regime: Higher tax rates, but many exemptions/deductions available (e.g., HRA, 80C, 80D).

- New Regime: Lower tax rates, but limited deductions allowed

Q.2. Which regime is better?

It depends on your income composition and deductions. Use the Income Tax Calculator on the Income Tax Portal to compare.

Q.3. Should employees inform employers about their chosen regime?

Yes. If no intimation is given, employer assumes default new regime and deducts TDS accordingly.

But note: Intimating the employer is not equivalent to opting out. You must still choose the regime in your ITR or file Form 10-IEA (if applicable).

Q.4. Can I claim HRA exemption under the new regime?

No, HRA exemption u/s 10(13A) is not allowed in the new tax regime.

Q.5. Is standard deduction of ₹50,000 allowed in the new regime?

Yes, from AY 2024-25, standard deduction is available in both regimes.

Q6. Are Chapter VI-A deductions allowed in the new regime (e.g., 80C, 80D, 80G)?

Generally, No, except:

- 80CCD(2) – Employer’s NPS contribution

- 80CCH – Agniveer Corpus Fund

- 80JJAA – Employment of new employees

To claim others, opt for old regime via ITR or Form 10-IEA (for business income).

Q.7. Can I claim interest on housing loan for self-occupied property in new regime?

No, such interest deduction is not allowed in the new regime.

Q.8. Are there senior citizen benefits in the new regime?

- Old regime: ₹3,00,000 (senior), ₹5,00,000 (super senior) basic exemption.

- New regime: No differential slabs, but rebate available on income up to ₹7,00,000.

Q.9. How does Section 87A rebate differ in both regimes?

- Old regime: Rebate up to ₹12,500 for income ≤ ₹5,00,000.

- New regime: Rebate up to ₹25,000 for income ≤ ₹7,00,000.

Q.10. Is Form 10-IEA required to opt for old regime in ITR filing?

- Yes, only for taxpayers with business/profession income (ITR-3, 4, 5).

- No, for salaried or other non-business taxpayers (ITR-1, 2); just select “Opting Out” in the ITR.

Q.11. Can I switch regimes every year?

- Non-business income: Yes, switch every year.

- Business income: Only once can you switch back to the new regime after opting out. No further switching allowed after that.

Q.12. I opted out in past years. Will I remain in old regime for AY 2024-25?

No, the new regime is default from AY 2024-25. You must submit Form 10-IEA again to opt out.

Q.13. I filed Form 10-IEA but want to use new regime. Can I withdraw?

No, once Form 10-IEA is filed, it cannot be revoked for that AY. You can re-enter the new regime next year only via new Form 10-IEA.

Q.14. I am filing ITR-5. Should I file Form 10-IEA or 10-IFA?

- Form 10-IEA: For AOP, BOI, AJP (non-cooperative societies).

- Form 10-IFA: For new manufacturing cooperative societies opting for Section 115BAE.

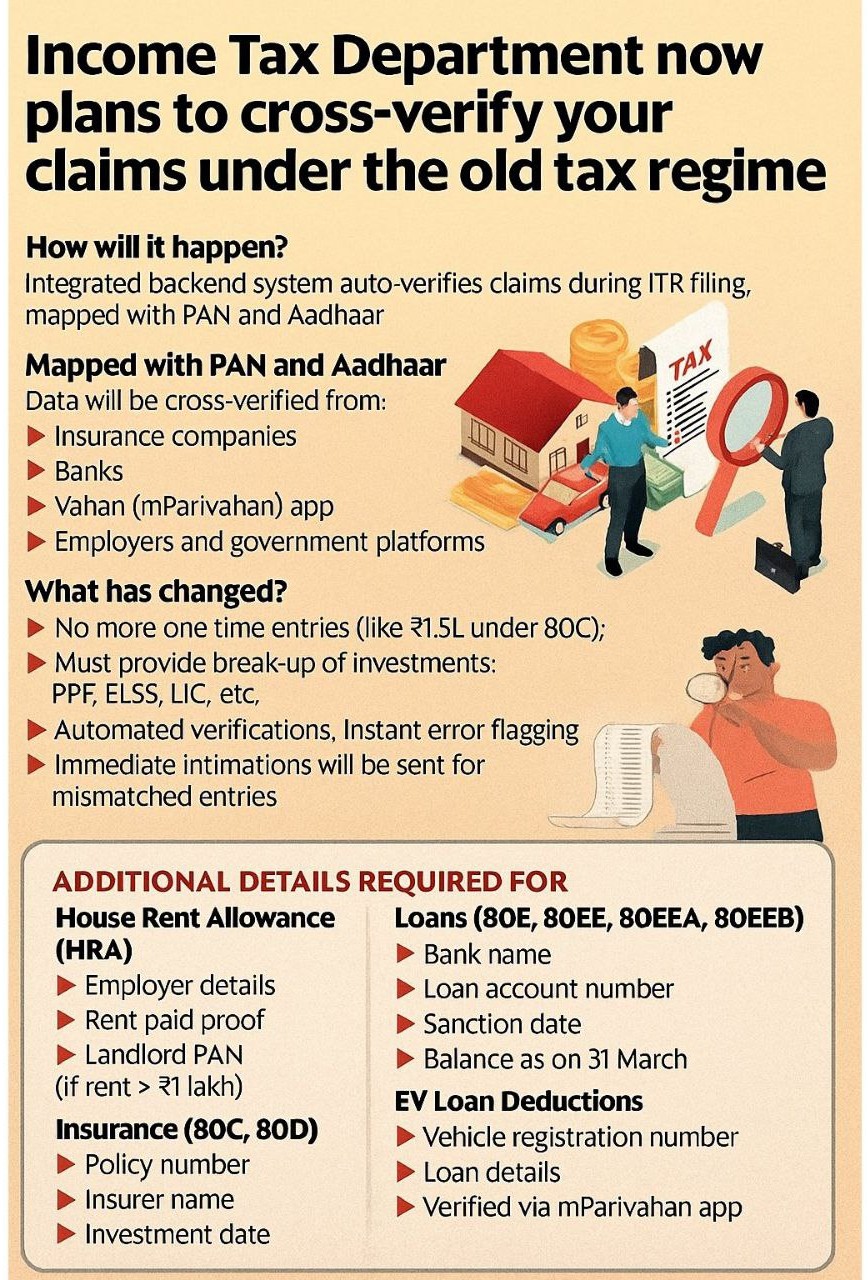

Income Tax Department now plans to cross-verify your claims under the old tax regime

How It Will Happen to cross-verify your claims under the old tax regime

The tax department’s backend integration means that all old-regime deductions (80C, 80D, HRA, housing/education/EV loans, etc.) will now be digitally verified against third-party data. Taxpayers must maintain accurate, detailed proofs and ensure all entries match official records to avoid scrutiny or mismatch notices. An integrated backend system will automatically verify claims during ITR filing, mapped with your PAN and Aadhaar. Data will be cross-verified from

-

Insurance companies

-

Banks

-

Vahan (mParivahan) app

-

Employers and government platforms

What Has Changed

-

No more one-time lump-sum entries (e.g., ₹1.5 lakh under Section 80C).

-

Must provide break-up of investments (PPF, ELSS, LIC, etc.).

-

Automated verifications and instant error flagging.

-

Immediate intimations will be sent for mismatched entries.

Additional Details Required

1. House Rent Allowance (HRA)

-

Employer details

-

Rent paid proof

-

Landlord’s PAN (if rent > ₹1 lakh/year)

2. Insurance (80C, 80D)

-

Policy number

-

Insurer name

-

Investment date

3. Loans (80E, 80EE, 80EEA, 80EEB)

-

Bank name

-

Loan account number

-

Sanction date

-

Balance as on 31 March

4. EV Loan Deductions

-

Vehicle registration number

-

Loan details

-

Verified via mParivahan app