E-way bill Generation

Page Contents

Quick Guide on GST E-Way Bill Exemptions

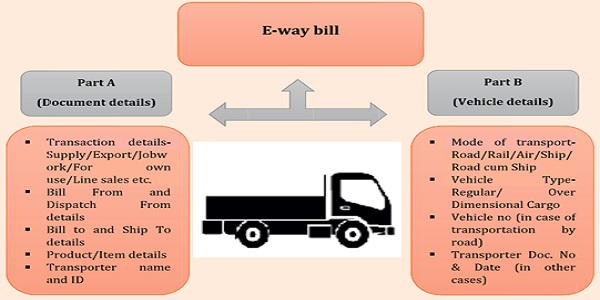

E-Way Bill: An E-Way Bill is an electronic document generated on the GST portal for movement of goods valued over ₹50,000, to ensure tax compliance during transport. We needed to Check Rule 138(14) list before dispatch. Always verify inter-State vs intra-State movement inter-State job work & handicraft goods still need E-Way Bill even below ₹50,000. GST taxpayer maintain delivery challan or invoice copy as backup proof of movement. & Keep supporting documents (e.g., transporter ID, vehicle number) for any inspection

When E-Way Bill is Not Required

GST E-Way Bill Exemptions: as per Rule 138 of CGST Rules, 2017 and latest CBIC updates Quick Guide on GST E-Way Bill Exemptions in following cases

Value-Based Exemption- Value / Nature of Movement

- No E-Way Bill required if consignment value is ₹50,000 or less. In case Consignment value ≤ ₹50,000 (except for inter-State movement of certain goods by principal/job worker or handicraft goods).

- Exceptions: Inter-State movement of handicrafts and job-work items still require an E-Way Bill.

- Non-supply movements like:

- Import/export under customs bond.

- Movement of goods within 10 km for delivery to transporter’s place for further transportation.

- Goods transported for weighment purposes (within 20 km, returnable).

Goods Exempt from E-Way Bill – Specific Goods Exempted

As per Annexure to Rule 138(14) – E-Way Bill not required for the following goods:

| Category | Examples |

| Natural & Agricultural Products | Fresh fruits, vegetables, meat, milk, curd, honey, seeds, rice, cereals, flour, etc. |

| Petroleum & Related Products | Petrol, diesel, ATF, kerosene, LPG for non-domestic use, natural gas. |

| Postal / Courier Items | Goods transported by the Department of Posts. |

| Liquor | Alcoholic liquor for human consumption. |

| Government & Defence Movements | Goods transported by Defence formations or under Ministry of Defence. |

| Low-value goods | Household personal effects. |

| Empty containers / cargo / packaging | Empty cargo containers, crates, cylinders, etc. |

| Exempted / NIL-rated goods | Goods fully exempt under GST or non-GST goods. |

- Essential items: Fruits, vegetables, milk, eggs, curd, bread, rice, pulses, flour, seeds

- Other exempt goods: Books, newspapers, hearing aids, human blood, Prasad, kumkum, bangles, handloom products, LPG (domestic), kerosene (PDS), relief materials

Transport-Based Exemptions – following Specific Transport Situations

- Non-motorised conveyance (e.g., hand carts)

- Empty cargo containers

- Movement through port, airport, ICD, CFS for Customs clearance

- By Non-motorised conveyance (e.g., handcart, bicycle, rickshaw).

- Within same State / Union Territory area, where government has notified exemption (e.g., intra-city movements).

- Movement under Customs supervision or between customs stations/warehouses.

Special Cases- Exemption for Certain Entities:

E-Way Bill not required when goods are moved by:

- Customs authorities.

- Government / local authority for non-commercial use.

- Transporters of goods under Schedule III (not treated as supply, e.g., funeral articles, personal effects).

- Transit cargo to/from Nepal or Bhutan- Transit cargo from/to Nepal or Bhutan.

- Movement by Defence formations under the Ministry of Defence

Important State-level Relaxations

- Some states have notified special relaxations for:

- Intra-city or intra-district movements (like Delhi, Maharashtra, Gujarat).

- Movements up to a specified distance (e.g., 10–50 km) from consignor to transporter depot.

In Summary E Way Bill Exemptions

Exemptions – Based on Value / Purpose

| Condition | E-Way Bill Required? | Remarks |

|---|---|---|

| Consignment value ≤ INR 50,000 | NO | Except inter-State job work & handicraft goods |

| Goods sent for weighment within 20 km | No | With delivery challan |

| Movement of goods for testing, repair, sample | No | If not supply & within prescribed limits |

| Goods moved under customs bond | No | To or from customs station / ICD / port |

| Movement within 10 km (consignor–transporter) | No | Within same State/UT |

Exemptions – Based on Nature of Goods (Rule 138(14) of CGST Rules)

| Category | Examples / Description | E-Way Bill Required? |

|---|---|---|

| Agriculture & food | Fruits, vegetables, milk, curd, rice, cereals, seeds | No |

| Petroleum products | Petrol, diesel, ATF, kerosene, LPG, natural gas | No |

| Liquor | Alcoholic liquor for human consumption | No |

| Postal & courier | Goods transported by India Post | No |

| Empty containers | Cylinders, crates, drums, cargo containers | No |

| Government/Defence | Goods transported under MoD authority | No |

| Non-GST / exempt goods | Fully exempt or non-GST goods (Schedule III) | No |

Exemptions – Based on Mode / Route

| Situation | E-Way Bill Required? | Remarks |

|---|---|---|

| Transport by non-motorised conveyance | No | Handcart, cycle, etc. |

| Movement within notified intra-city area | No | State-specific notification required |

| Goods in transit to/from Nepal or Bhutan | No | Under customs control |

| Transit cargo or customs-warehouse transfers | No | Under supervision |

Exempt Entities

| Entity / Purpose | E-Way Bill Required? | Remarks |

|---|---|---|

| Customs authority | No | For import/export clearance |

| Government / local body (non-commercial) | No | Administrative use |

| Funeral articles / personal effects | No | Schedule III – not treated as supply |

Quick Verification Points (Before Dispatch)

- Check if consignment value exceeds INR 50,000

- Identify if goods fall under exempt list (Rule 138(14))

- Confirm if movement is intra- or inter-State

- Verify transport mode (motorised / non-motorised)

- Keep invoice / delivery challan ready

- Record vehicle number & transporter ID (if applicable)

- Maintain document proof for exempt movements

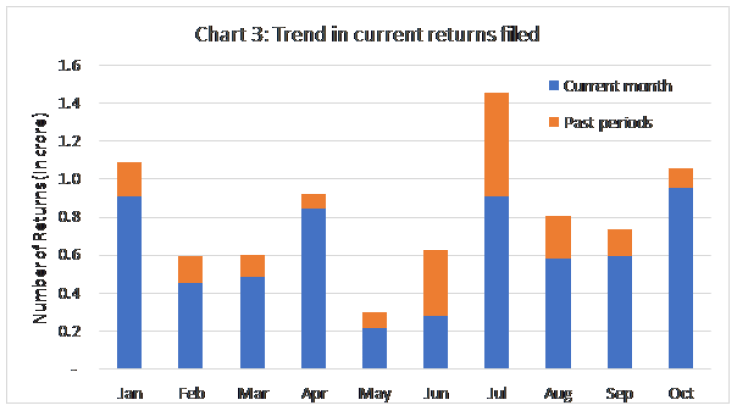

E-way bill Generation at a 6 Month high in last Quarter of 2021: GST

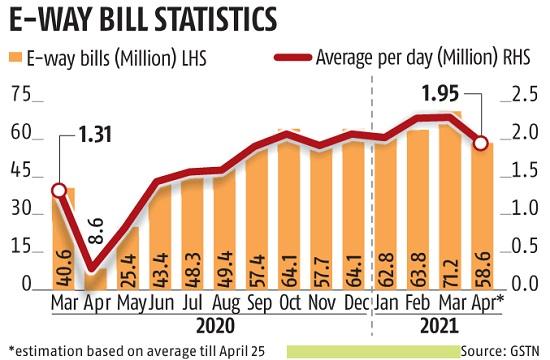

Since June, when the second wave of the Covid-19 pandemic was at its apex, e-way bill generation has been steadily increasing after falling below four crore in May. September’s figure was 70% higher than May’s and 3% higher than August’s. In September, daily e-way generation increased by 6.5 percent month over month to 22.65 lakh, up from 21.26 lakh in August.

52.69 lakh e-way bills were generated in the first 3 days of October, with a daily creation of 17.56 lakh. In October, when data for the entire month is collected, the daily average is likely to rise, based on recent weekly trends.

Businesses generated 6.59 crore e-way bills in August, up from 6.42 crore in July and 5.5 crore in June, thanks to the lifting of lockdowns. Before the second wave of crisis hit the economy in April-May, it was 7.12 crore.

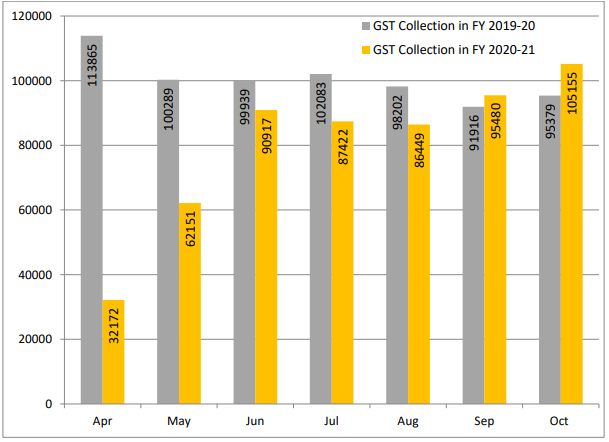

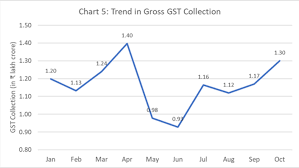

The average monthly gross GST collection for the second quarter of the current financial year was Rs 1.15 lakh crore, which is 5% more than the first quarter’s average monthly collection of Rs 1.1 lakh crore.

Gross GST revenue collected in October for INR 1,30,127 Cr.

The increased GST collections and e-way bill generation show that trade and commerce are on the rise. For the second quarter of the current fiscal year, gross GST collections averaged Rs.1.15 lakh crore every month. It’s a 5% increase over the average monthly income of Rs.1.1 lakh crore in the first quarter of the fiscal year. These figures show that the economy is recovering at a faster rate.

Chief Economist at ICRA, explain that Avg no of E-way invoices generated is promising in light of Challenges facing some sectors such as the automotive sector.

“Pre-holiday inventories and early shipment attempts to avoid Pre-Christmas season logistics delays are expected to further improve this indicator in Oct 2021. GST collection will be in the next 2 months. It is expected to increase gradually to around INR Each is 12k to 13k. “

As economic activity picks up ahead of the Festive season, e-way bill generation for goods transportation under the Goods and Services Tax (GST) system reached 6.79 crore in September, the highest since the start of the current financial year.

“This certainly suggests that the economy is rapidly rebounding. Anti-evasion operations, particularly action against false billers, have also contributed to increased GST receipts when combined with economic growth. The favourable trend in revenues is projected to continue, with stronger revenues predicted in the second half of the year,” the ministry of finance said in a statement on October 1.

E-way GST Invoice Generation at Highs for the 1st Time in 6 Months in Sept 2021 : Green Shoot for Economic Recovery