Overview on Dowry vs. Marriage Gift vs. Stridhan treatment

Page Contents

All about the tax treatment on Dowry vs. Marriage Gift vs. Stridhan

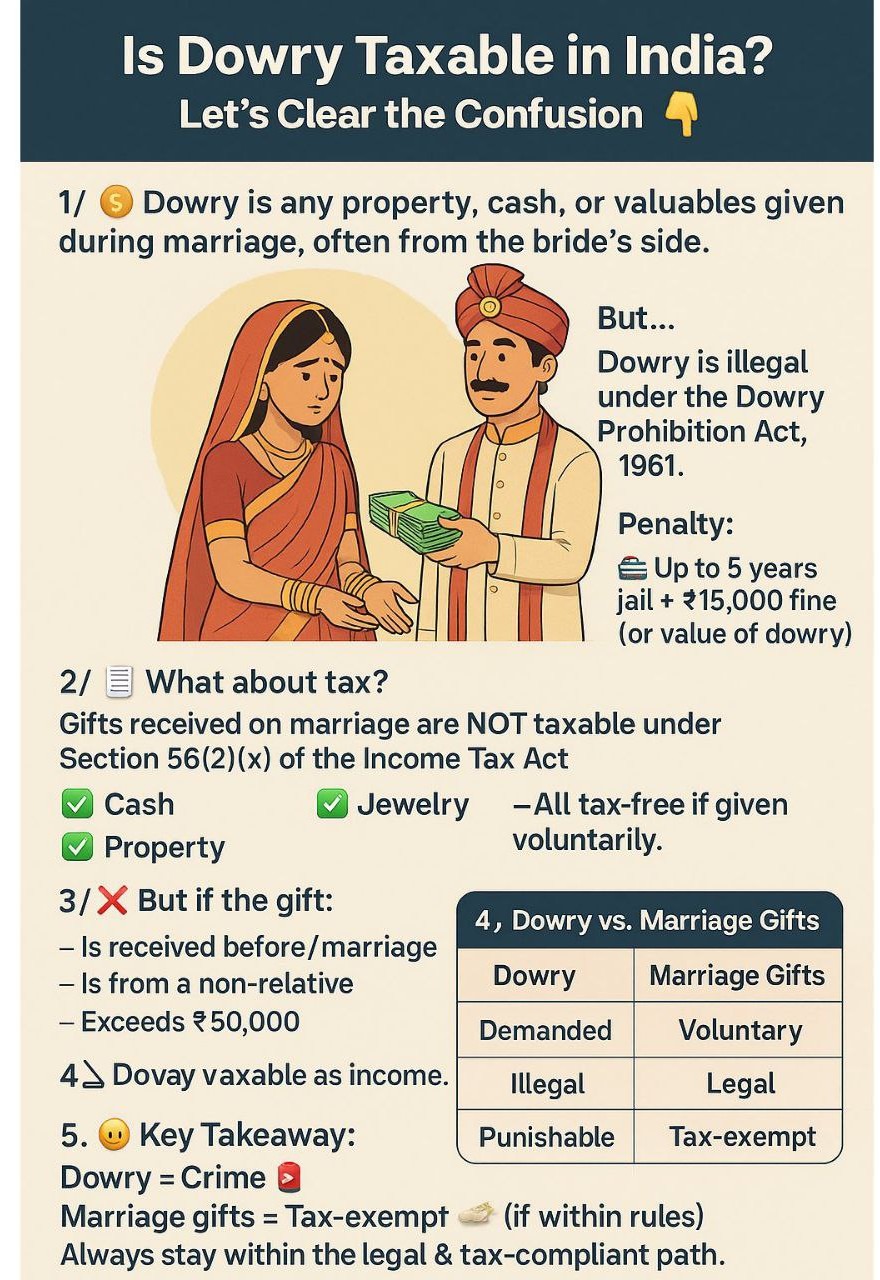

Dowry Prohibition Act, 1961 makes giving, taking, or demanding dowry a criminal offence. Punishable with imprisonment up to 5 years and a fine. Dowry here means property or valuable security given or agreed to be given directly or indirectly in connection with marriage. In practice, most “dowry” is disguised as marriage gifts, which are tax-exempt if challenged only on tax grounds. However, if law enforcement proves it’s dowry (via complaints, investigations, etc.), tax exemption becomes irrelevant criminal penalties take priority. Let people declare any money (without revealing source), pay tax on it, and walk away free from criminal liability for the origin. Following are the pros and cons are mention here under :

Pros:

- More money comes into the formal economy.

- Government earns revenue.

- Black money gets “whitened” through tax.

Cons:

- Could indirectly legalise crime.

- Might incentivise illegal activities (“If I just pay 30% tax, I’m fine”).

- Undermines justice for victims (e.g., corruption, trafficking).

Current Reality- Dowry Is Illegal — First and Foremost

Tax Perspective — How the Income Tax Act Views It : Even if an activity is illegal, the Income Tax Act still covers the income from it. Here’s the breakdown:

Gifts on Marriage — Exemption Exists : Section 56(2)(x) of the Income Tax Act says Any sum of money or property received on the occasion of your marriage is fully exempt from income tax — without any monetary limit. This applies regardless of the value, and covers gifts from relatives and non-relatives. This exemption exists to respect genuine wedding gifts is not to legitimise dowry. The fine is ₹15,000 or the value of the dowry, whichever is higher; which the graphic shows but could emphasise that “higher” condition for clarity. Dovay vaxable” should be “Dowry taxable.

This should be clearly marked to avoid confusion. To make it even more obvious, use a red box around “Dowry = Crime” and a green box around “Marriage Gifts = Tax-exempt” so viewers instantly grasp the legal vs. tax point.

Key Differences between Dowry vs. Marriage Gift

| Feature | Marriage Gift | Dowry |

| Definition | Voluntary gift given to bride/groom out of love, affection, or goodwill on the occasion of marriage. | Property, money, or valuables given or demanded as a condition of marriage. |

| Legality | Legal | Illegal under Dowry Prohibition Act, 1961. |

| Consent | Given willingly by the giver. | Often demanded, expected, or agreed upon before/during marriage. |

| Timing | Usually given at wedding or related ceremonies. | May be demanded before, during, or after marriage as part of a precondition. |

| Purpose | To congratulate, bless, or help the couple start their life. | To fulfil demands or expectations linked to marriage. |

| Tax Treatment | Fully exempt u/s 56(2)(x) if received on the occasion of marriage, no limit. | Also falls under same exemption if given at marriage — but criminal liability overrides tax benefit. |

| Penalty | None (if voluntary & legal). | Up to 5 years imprisonment + fine; confiscation of dowry possible. |

| Proof & Dispute | Usually no dispute unless unusually large & suspicious. | Can be proven via written/verbal agreements, witness statements, or evidence of demand. |

Key Differences between Dowry vs. Stridhan

| Aspect | Stridhan | Dowry |

| Meaning | Property exclusively owned by a woman, received voluntarily before, during, or after marriage from relatives or others. | Property or valuables given or agreed to be given by bride’s family to groom/groom’s family as a condition of marriage. |

| Origin | Ancient Hindu law; mentioned in Smritis, Mitakshara, and Dayabhaga. | Social custom, now prohibited by law. |

| Legality | Legal — woman has absolute ownership (Hindu Succession Act, 1956, Sec. 14(1)). | Illegal under Dowry Prohibition Act, 1961. |

| Consent | Voluntary gift. | Often demanded or coerced. |

| Control | Woman has complete rights to use, sell, gift, or will it away. | Belongs to the groom’s side; bride usually loses control. |

| Purpose | Financial security for the woman (especially in widowhood/divorce). | Fulfils demands or expectations linked to marriage. |

| Legal Protection | Can be claimed anytime (Sec. 406 IPC, PWDVA 2005). | Criminal offence to give/take/demand (punishable with jail + fine). |

| Judicial View | SC in Pratibha Rani v. Suraj Kumar — Stridhan remains a woman’s absolute property. | Courts treat dowry demands as criminal acts, even if disguised as gifts. |

| Tax Treatment | Tax-exempt if received on occasion of marriage under Sec. 56(2)(x). | Also tax-exempt if given at marriage — but criminal liability overrides. |

| Social Impact | Empowers women, ensures independence. | Leads to exploitation, harassment, violence. |

Illegal income is actually taxable in India (and many other countries) : Under the Indian Income Tax Act, all income — legal or illegal — is taxable. This includes money from smuggling, corruption, or other unlawful means. The law doesn’t say “if it’s illegal, you don’t pay tax.” In fact, Section 68–69C covers unexplained income and expenditures, which can be taxed at a high flat rate without deductions.

Why it’s still not declared? : Because openly declaring it would amount to self-incrimination for the underlying crime. If you say “₹50 lakh from smuggling,” the tax department might collect the tax, but the police or ED could also arrest you. So people hide it, creating black money.

International Approaches to handle these kind of matter

- In the united States: IRS taxes illegal income (even stolen property must be reported!) but law enforcement can still prosecute you for the crime.

- In Italy & Colombia: At times, they’ve had partial amnesty schemes to pull hidden money into the banking system.

- India: Had several Income Disclosure Schemes in the past (1970s–2016), but they were one-time windows, not permanent immunity.

Wedding Gifts Not Taxable: ITAT Deletes INR 10 Lakh Cash Deposit Addition

The Bangalore Bench of the Income Tax Appellate Tribunal has ruled that wedding gifts are customary in Indian culture & exempt from income tax. In the case of Shruthi Kishore vs. ITO, the Assessing Officer had added ₹10 lakh as unexplained cash deposit u/s 69A of the Income Tax Act, 1961. The assessee explained that the amount represented cash gifts received during her wedding.

The Income Tax Appellate Tribunal accepted this explanation, notingthe customaryy nature of such gifts, and deleted the addition. Additionally, the Tribunal allowed a deduction of INR 10,000 u/s 80TTA towards Savings Bank Interest.

In Short- about Dowry vs. Marriage Gift vs. Stridhan

|

Situation |

Tax Treatment | Legal Status |

| Genuine marriage gift (any amount, from anyone) | Fully exempt u/s 56(2)(x) | Legal |

| Dowry (cash, gold, property, demanded or agreed in connection with marriage) | Technically also tax-exempt if received on marriage — but can be seized/confiscated | Illegal, punishable under Dowry Prohibition Act |

| Any gift after marriage (not on the occasion) | Taxable if from non-relative & value > INR 50,000 | Legal if voluntary |

From a tax point of view, marriage-time transfers (even dowry) fall under the exemption — but from a law point of view, dowry is a criminal offence, and tax immunity doesn’t mean immunity from prosecution.

Section 56(2)(x) exemption : It’s correct that marriage-time gifts (cash, jewellery, property) are fully tax-exempt, regardless of amount and even if given by a non-relative. INR 50,000 limit in the graphic applies only to gifts received outside marriage or other exempt occasions.

Dovay vaxable as income should be “Dowry taxable as income” (though technically dowry is tax-exempt if received on marriage but still illegal so maybe reword to “Taxable if received outside marriage exemption”). Put “Dowry = Crime” in bold red box and “Marriage Gifts = Tax-exempt” in a green box for instant clarity.

Marriage gift = legal, tax-free, socially accepted. And Dowry = illegal, punishable, even if technically tax-exempt at marriage time. Tax exemption doesn’t protect you from criminal charges for dowry.

Penalty amount in the Dowry Prohibition Act : INR 50,000 rule : In the “But if the gift section, it currently says “Exceeds INR 50,000” the INR 15,000 fine (or value of dowry)” legally it’s INR 15,000 or the value of the dowry, whichever is higher. This limit applies only to gifts outside marriage. For marriage-time gifts, there is no monetary limit, even from non-relatives.

Key Takeaway

Cash gifts received on the occasion of a wedding are fully exempt u/s 56(2)(x), provided they can be substantiated as genuine and customary. However, taxpayers should maintain proper evidence (e.g., gift lists, affidavits) to defend such claims in case of scrutiny.

Tax it and prosecute the crime : discourages illegal activities but doesn’t bring much black money into the open. In case we are taking a Lenient route then Allow no-questions-asked declarations brings in money but risks moral hazard. It’s essentially a trade-off between maximising tax revenue and upholding the rule of law.