Direct Tax & Advance Tax collections for FY 2024-25

Page Contents

Data on Direct Tax (DT) collections and Advance Tax collections for FY 2024-25 as on 12.01.2025 has been released.

Direct Tax Collections (FY26 up to Sept 17, 2025)

-

Net Direct Tax Revenue: INR 10.82 lakh crore (+9.18% YoY)

-

Gross Tax Collection: INR 12.43 lakh crore (+3.39% YoY)

-

Corporate Tax: INR 4.72 lakh crore

-

Non-Corporate Tax: INR 5.83 lakh crore

-

Securities Transaction Tax (STT): INR 26,000 crore

-

Other Taxes: INR 291 crore

-

-

Refunds:INR 1.60 lakh crore (-23.87% YoY)

Advance Tax (part of gross collections)

-

Total: INR 4.48 lakh crore (+2.90% YoY)

-

Corporate Tax: INR 3.52 lakh crore (+6.11%)

-

Non-Corporate Tax: INR 96,700 crore (-7.30%)

-

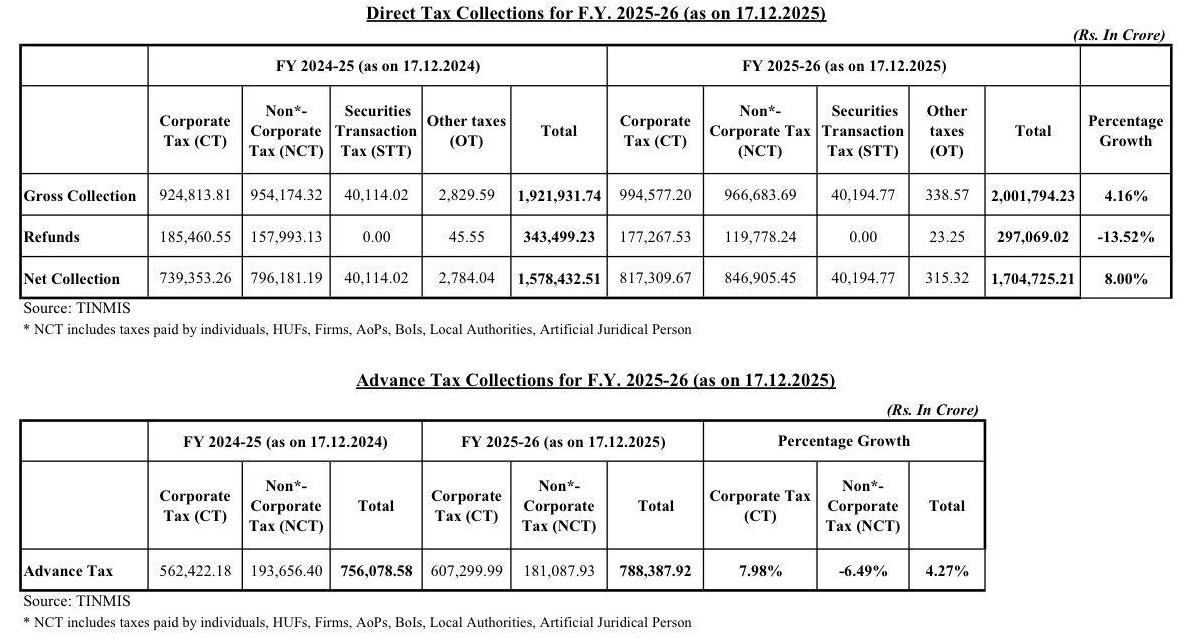

Data on Gross Direct Tax collections, Refunds, Net Direct Tax collections & Advance Tax collections for FY 2025-26 as on 17.12.2025 has been released.

Direct Tax Collections

| Category | FY 2024-25 | FY 2025-26 | % Growth |

|---|---|---|---|

| Gross Collection | INR 19,21,941.93 | INR 20,01,794.23 | 4.16% |

| Refunds | INR 3,43,499.23 | IN 2,97,069.42 | -13.52% |

| Net Collection | INR 15,78,442.71 | INR 17,04,725.21 | 8.00% |

Breakdown by Tax Type (FY 2025-26):

- Corporate Tax (CT): ₹9,94,587.92

- Non-Corporate Tax (NCT): ₹9,66,683.60

- Securities Transaction Tax (STT): ₹49,177.97

- Other Taxes (OT): ₹338.57

Advance Tax Collections

| Category | FY 2024-25 | FY 2025-26 | % Growth |

|---|---|---|---|

| Corporate Tax | INR 5,62,422.18 | INR 6,07,299.99 | 7.98% |

| Non-Corporate Tax | INR 1,93,656.40 | INR 1,81,087.93 | -6.49% |

| Total | INR 7,56,078.58 | INR 7,88,387.92 | 4.27% |

- Overall Direct Tax Growth: 4.16% in gross collections; net collections up by 8% due to lower refunds.

- Corporate Tax Driving Growth: Corporate advance tax is up 7.98%, while non-corporate advance tax declined 6.49%.

- Refunds Down: A significant drop in refunds (-13.52%) indicates tighter processing or fewer excess payments.

- Non-Corporate Segment Weakness: Despite overall growth, non-corporate advance tax fell, signaling stress among small businesses or professionals.

Summary of Direct Tax Collections (as on 17 December 2025 )

Gross Direct Tax Collection

| Category | FY 2024‑25 (₹ Cr) | FY 2025‑26 (₹ Cr) | Growth |

|---|---|---|---|

| Corporate Tax (CT) | 924,813.81 | 994,577.20 | +7.55% |

| Non‑Corporate Tax (NCT) | 954,174.32 | 966,683.69 | +1.31% |

| STT | 40,114.02 | 40,194.77 | +0.20% |

| Other Taxes | 2,829.59 | 338.57 | -88% |

| Total | 1,921,931.74 | 2,001,794.23 | +4.16% |

Gross direct tax collection increased 4.16%, mainly driven by corporate tax growth.

Refunds Issued

| Category | FY 2024‑25 (₹ Cr) | FY 2025‑26 (₹ Cr) | Growth |

|---|---|---|---|

| Total Refunds | 343,499.23 | 297,069.02 | –13.52% |

Refund outgo reduced significantly, which contributes to higher net collections.

Net Direct Tax Collection

| FY | Net Collection (₹ Cr) |

|---|---|

| FY 2024‑25 | 1,578,432.51 |

| FY 2025‑26 | 1,704,725.21 |

Net Direct Tax Growth: 8.00%

Net collections are rising faster than gross collections because refunds have decreased sharply.

Advance Tax Collections: Advance Tax Comparison

| Category | FY 2024‑25 (₹ Cr) | FY 2025‑26 (₹ Cr) | Growth |

|---|---|---|---|

| Corporate Tax (CT) | 562,422.18 | 607,299.99 | +7.98% |

| Non‑Corporate Tax (NCT) | 193,656.46 | 181,087.93 | –6.49% |

| Total | 756,078.58 | 788,387.92 | +4.27% |

Key Insight Corporate advance tax is growing strongly (~8%). & Non‑corporate advance tax fell (6.49% decline), possibly due to MSME stress or slower growth in individual business income. Following are Positive Indicators

- Strong corporate profitability is reflected in higher CT collections.

- Net direct tax collections show healthy 8% growth.

- Lower refunds indicate better processing or lower overpayment.

Areas of Concern : Non‑corporate taxpayers show almost no growth in gross taxes and declining advance tax, signalling pressure on small businesses or more efficient tax planning. The data shows the corporate sector is performing better than the non‑corporate sector, government tax revenue growth remains stable at 4–8% depending on the metric, & lower refunds boost the government’s cash position mid‑year.