Generated E-invoice, Applicability, Exception

Page Contents

Generated E-invoice and applicability with Exception of E-invoicing

Compulsory E-invoicing generation limit further reduces from Rs. 100 Cr to 50 Cr

You needed to aware the E-invoicing is mandatorily applicable from April 1st, 2021. CBIC reduced the mandatory e-invoicing threshold from 100 crores to 50 crores in a notification dated March 8, 2021. From April 1, 2021, taxpayers with an aggregate turnover of 50 crores or more (during any of the previous four years) will be required to use e-invoice. Ultimately, the govt aims to explore all GST assessees.

With effect from FY 2017-18 onwards, all businesses with a revenue of more than Rs 50 crores in any previous Financial Year will be subject to the E-invoicing system & We needed to compulsory apply generation of E-invoices!

But E-Invoicing System has few exceptions which are mention below categories:

But E-Invoicing System has few exceptions which are mention below categories:

- SEZ Unit;

- A GST registered person supplying services by way of admission to an exhibition of cinematograph films in multiplex screens i,e Supplying Services by way of admission to an exhibition of cinematograph films in multiplex screens

- GST Supplier of taxable service is a goods transport agency supplying services in relation to transportation of goods by road in a goods carriage; i.e Goods Transport Agency

- GST Supplier of taxable service is supplying passenger transportation service i.e Passenger Transport Service

- GST Supplier of taxable service is an insurer or a banking company or a financial institution, including a Non-Banking Financial Company i.e An insurer or a banking company or a financial institution, including a non-banking financial company

You may read the complete Notification 05/2021 – Central Tax

GST Rule 48(4):

The invoice shall be maintained by such class of registered persons as the Govt may notify, based on the Council’s guidelines, by including such particulars contained in FORM GST INV-01 after acquiring an Invoice Reference Number and uploading data found to contain therein on the Important Goods and Services Tax Electronic Portal in such fashion and subject to such conditions.

(Refer to Notification No.05/2021-Central Tax, dated March 8, 2021.)

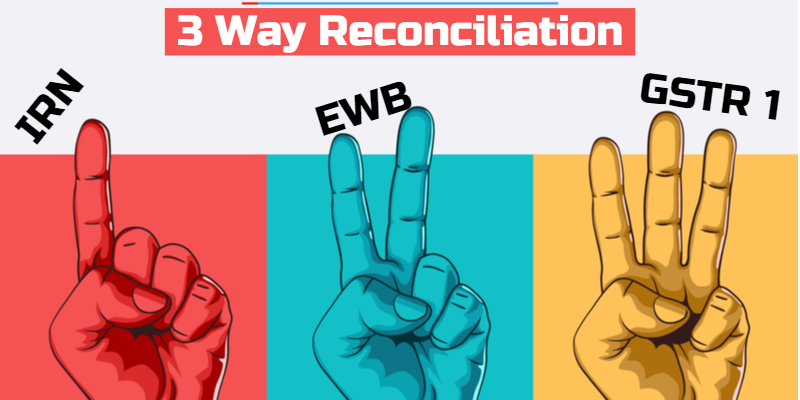

What is the Three Kind/Way Reconciliation concept?

- After creating the E-invoice and E-way Bill based on the IRN, your job is not completed.

- In the future, the Dept will also request reconciliations from businesses for all GST returns. In the future, the GST Dept may request 3 Kind/way reconciliation between E-Way Bill, IRN, & GSTR! It can also request Reconciliation with other pieces of information and documents in real-time.

- As a result, it is critical to have a proper system that automatically generates and saves all of your GST documents, including E-way Bills, E-invoices, IRNs, & other relevant information.

- A lot of the issues highlighted above is not even saved on the govt’s portal, making retrieving it after a few months or years nearly impossible. However, it is fairly common for GST Officers to request such information during investigations/audits.

- A lot of the information discussed above is not even saved on the government’s portal, making retrieving it after a few months or years nearly impossible. However, it is fairly common for GST Officers to request such information during investigations/audits.

Other GST UPDATE

- CBIC said despite the electronic way or E-way bill mechanism there has been rampant evasion and there is a need to increase compliance from April-November we have detected Rs 12,000 Crore of GST evasion.