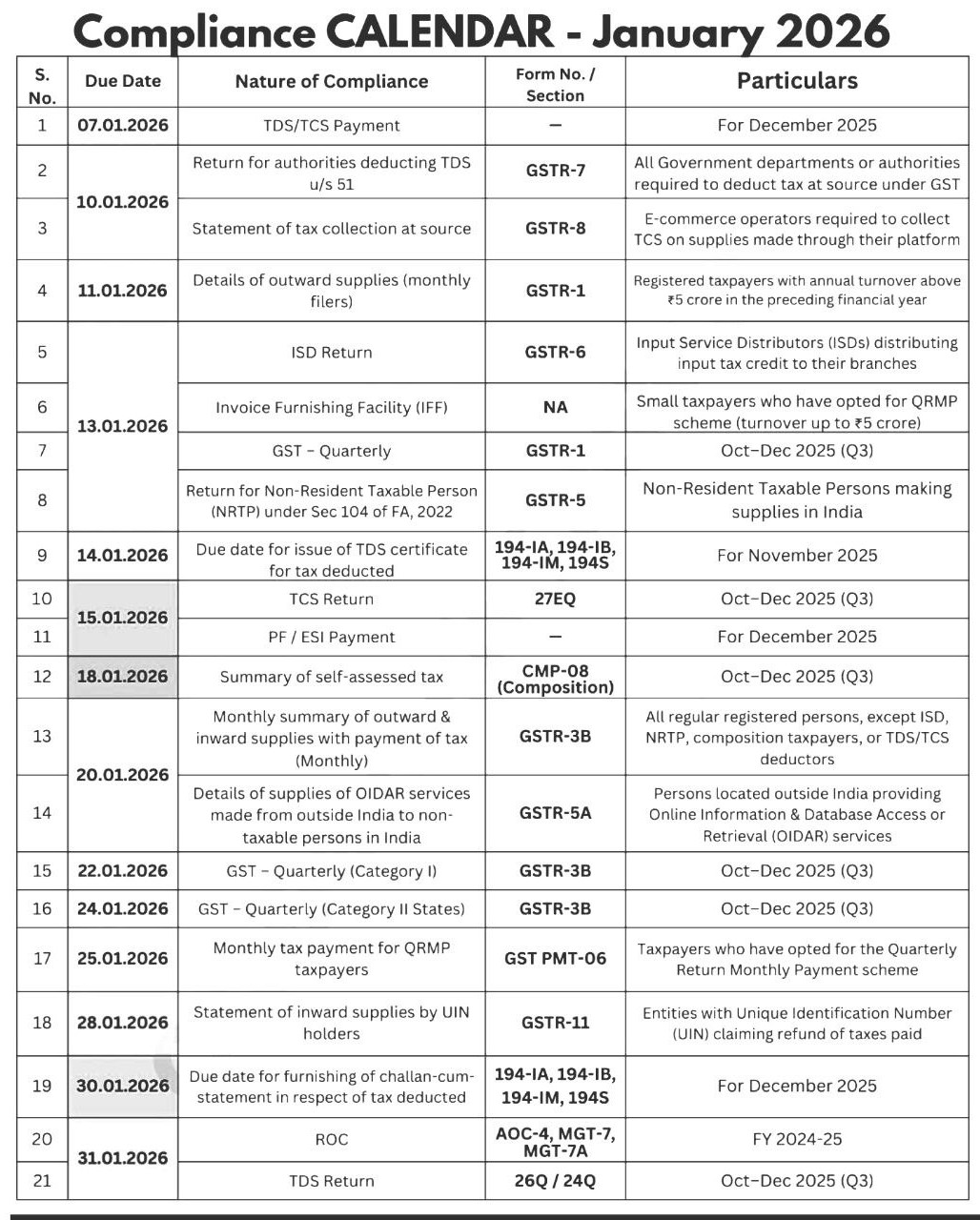

Compliance Due Dates Compliance Calendar January 2026

Page Contents

Key Compliance Due Dates—Compliance Calendar—January 2026

7 January 2026

-

TDS / TCS Payment – For December 2025

10 January 2026

-

GSTR-7 – Return by authorities deducting TDS u/s 51

-

GSTR-8 – TCS statement by e-commerce operators

11 January 2026

-

GSTR-1 (Monthly) – Taxpayers with turnover > ₹5 crore (preceding FY)

13 January 2026

-

GSTR-6 – ISD return

-

IFF – For QRMP taxpayers

-

GSTR-1 (Quarterly) – Oct–Dec 2025 (Q3)

-

GSTR-5 – Non-Resident Taxable Persons

14 January 2026

-

Issue of TDS Certificates -Sections 194-IA / 194-IB / 194-IM / 194S (For November 2025)

15 January 2026

-

TCS Return – Form 27EQ – Oct–Dec 2025 (Q3)

-

PF / ESI Payment – For December 2025

18 January 2026

-

CMP-08 – Composition tax payment (Q3)

20 January 2026

-

GSTR-3B (Monthly) – Regular taxpayers

22 January 2026

-

GSTR-3B (Quarterly – Category I States) – Q3

24 January 2026

-

GSTR-3B (Quarterly – Category II States) – Q3

25 January 2026

-

GST PMT-06 – Monthly tax payment for QRMP taxpayers

28 January 2026

-

GSTR-11 – Statement by UIN holders (refund claims)

30 January 2026

-

Challan-cum-Statement for TDS -Sections 194-IA / 194-IB / 194-IM / 194S (For December 2025)

31 January 2026

-

ROC Filings

-

AOC-4

-

MGT-7 / MGT-7A – FY 2024-25

-

-

TDS Return – 26Q / 24Q – Oct–Dec 2025 (Q3)

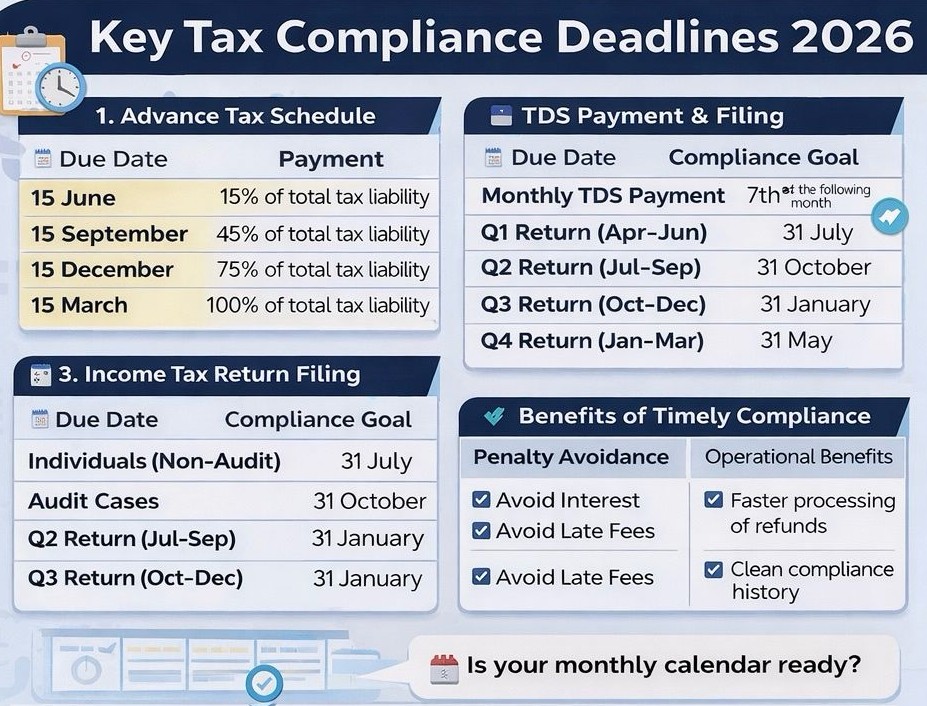

Tax planning is incomplete without timely compliance. :

Even the best tax strategy fails if deadlines are missed leading to interest, late fees, cash-flow strain, notices, and blocked credits. Save this quick due-date reference to stay on track

Advance Tax Due Dates

-

15 June — 15% of total tax liability

-

15 September — 45% of total tax liability

-

15 December — 75% of total tax liability

-

15 March — 100% of total tax liability

TDS (Tax Deducted at Source) Timeline

-

Monthly TDS payment — 7th of the following month

-

Quarterly TDS Returns:

-

-

Q1 (Apr–Jun) — 31 July

-

Q2 (Jul–Sep) — 31 October

-

Q3 (Oct–Dec) — 31 January

-

Q4 (Jan–Mar) — 31 May

-

Income Tax Return (ITR) Due Dates

-

Individuals (Non-Audit cases) — 31 July

-

Audit cases — 31 October

-

Belated / Revised Return — 31 December of the Assessment Year

Why Timely Compliance Matters

- Avoid interest (Sections 234A / 234B / 234C)

- Avoid late filing fee (Section 234F)

- Faster refund processing

- Clean compliance track record

- Fewer notices, lower stress

Summary of Compliance Due Dates – January 2026

| Date | Compliance | Form / Section | Period / Details |

|---|---|---|---|

| 07 Jan 2026 | TDS/TCS Payment | — | For Dec 2025 |

| 10 Jan 2026 | TDS return for authorities u/s 51 | GSTR‑7 | TDS under GST |

| 10 Jan 2026 | TCS return | GSTR‑8 | E‑commerce TCS |

| 11 Jan 2026 | Monthly GSTR‑1 (Turnover > ₹5 Cr) | GSTR‑1 | Dec 2025 |

| 13 Jan 2026 | IFF (QRMP – Monthly Invoice Upload) | IFF | For Dec 2025 |

| 13 Jan 2026 | Quarterly GSTR‑1 | GSTR‑1 | Q3 (Oct–Dec 2025) |

| 14 Jan 2026 | TDS Certificate Issue | 194‑IA/IB, 194M, 194S | For Nov 2025 |

| 15 Jan 2026 | TCS Return | 27EQ | Q3 (Oct–Dec 2025) |

| 15 Jan 2026 | PF / ESI Payment | — | For Dec 2025 |

| 18 Jan 2026 | CMP‑08 (Composition Statement) | CMP‑08 | Q3 (Oct–Dec 2025) |

| 20 Jan 2026 | GSTR‑5A (OIDAR Services) | GSTR‑5A | Dec 2025 |

| 20 Jan 2026 | GSTR‑3B Monthly | GSTR‑3B | Dec 2025 |

| 22 Jan 2026 | GSTR‑3B – Quarterly (Category II States) | GSTR‑3B | Q3 |

| 24 Jan 2026 | GSTR‑3B – Quarterly (Other States) | GSTR‑3B | Q3 |

| 25 Jan 2026 | QRMP Monthly Tax Payment | PMT‑06 | For Dec 2025 |

| 28 Jan 2026 | GSTR‑11 (UIN holders) | GSTR‑11 | Dec 2025 |

| 30 Jan 2026 | Challan‑cum‑Statement for TDS | 194‑IA/IB/M/S | For Dec 2025 |

| 30 Jan 2026 | ROC Filings | AOC‑4, MGT‑7, MGT‑7A | FY 2024‑25 |

| 31 Jan 2026 | TDS Return | 24Q/26Q | Q3 (Oct–Dec 2025) |