Comparison of New Vs. Old tax regime for FY 2025-26

Page Contents

Comparison of the new tax regime vs. the old tax regime for FY 2025-26

Comparison of the new tax regime vs. the old tax regime for FY 2025-26, including income slabs, tax rates, and allowed deductions/exemptions.

Income Tax Slab Rates (FY 2025-26)

Slabs under Old Tax Regime

-

Up to INR 2,50,000 – Nil

-

INR 2,50,001 – INR 5,00,000 – 5%

-

INR 5,00,001 – INR 10,00,000 – 20%

-

Above INR 10,00,000 – 30%

Standard deductions & exemptions apply here

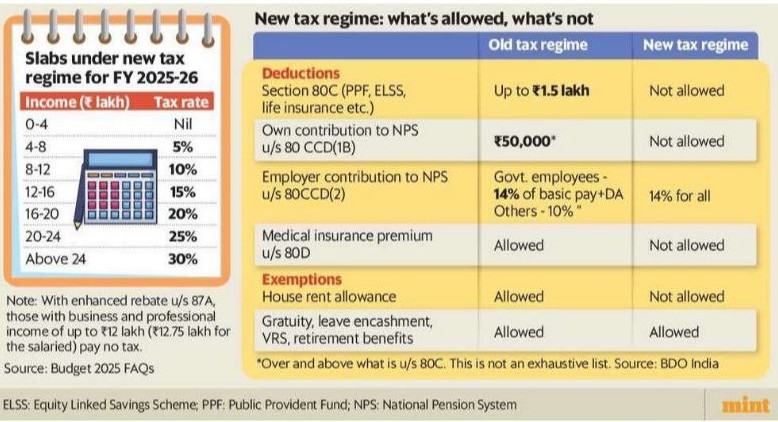

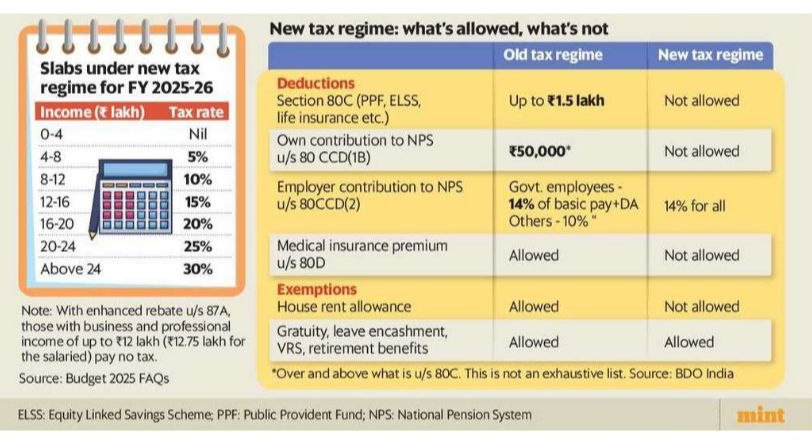

Slabs under New Tax Regime (Revised for FY 2025-26)

| Income (INR lakh) | Tax Rate |

|---|---|

| 0 – 4 | Nil |

| 4 – 8 | 5% |

| 8 – 12 | 10% |

| 12 – 16 | 15% |

| 16 – 20 | 20% |

| 20 – 24 | 25% |

| Above 24 | 30% |

Note: Enhanced rebate under Section 87A: For individuals with business and professional income up to INR 12 lakh (INR 12.75 lakh for salaried), no tax payable. (Source: Budget 2025 FAQs.). Structured to be more gradual and beneficial for middle-income taxpayers

Standard Deduction & Rebate

Standard Deduction

-

Old Regime: INR 50,000 (for salaried/pensioners)

-

New Regime: INR 75,000 (enhanced from FY 2025-26)

Section 87A Rebate

-

Old Regime: Rebate up to INR 12,500 available if taxable income ≤ INR 5 lakh

-

New Regime: Rebate up to INR 60,000 available if taxable income ≤ INR 12 lakh, effectively zero tax up to INR 12 lakh for many taxpayers

Deductions & Exemptions: What’s Allowed?

Old Tax Regime (Rich in Deductions)

Allows numerous popular deductions that help reduce taxable income Section 80C (up to INR 1.5 lakh)—ELSS, PPF, EPF, life insurance, etc. Section 80D—Health insurance premiums, HRA exemption, LTA (Leave Travel Allowance), Home loan interest deduction (Section 24), other Chapter VI-A deductions (80E, 80G, etc.). Standard deduction: INR 50,000/-. These can significantly lower gross taxable income.

New Tax Regime (Few Deductions)

Most exemptions/deductions are not allowed, such as HRA, LTA, Sections 80C & 80D, and home loan interest (except in certain cases). The main available benefits are the standard deduction of INR 75,000 and the employer’s NPS contribution (80CCD(2)), etc. The new regime trades deductions for simpler slabs and lower rates.

The new regime offers lower tax rates but removes most deductions and exemptions, except employer NPS contributions and retirement benefits. The old regime retains deductions under 80C and 80D and exemptions like HRA, making it beneficial for taxpayers with significant investments and insurance.

Key Differences & Practical Points Old Tax Regime & New Tax Regime

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax slab structure | 3 slabs | 7 slabs (more gradual) |

| Standard deduction | INR 50,000 | INR 75,000 |

| Section 87A rebate | ≤ INR 5 lakh | ≤ INR 12 lakh |

| Major deductions/exemptions | Allowed | Largely not allowed |

| Ease of compliance | Moderate | High (simpler filing) |

| Best for | High deduction claimants | Salaried / middle class with fewer deductions |

Age & Other Considerations

In the old regime, senior/super senior citizens have higher basic exemption limits (e.g., INR 3 lakh and INR 5 lakh) whereas the new regime treats all ages uniformly with nil tax up to INR 4 lakh

Choosing Between the Two—Practical Rules of Thumb

- New Tax Regime May Be Better If the taxpayer does not have substantial deductions/exemptions, and the taxpayer’s taxable income is ≤ ₹12 lakh (zero tax after rebate), and the taxpayer prefers simplicity over tracking multiple proofs

- The old tax regime may be better if the taxpayer has large deductions (80C, 80D, HRA, home loan interest, etc.). Taxpayer total deductions > break-even point where old regime tax becomes lower even with higher slabs & taxpayers are strategic with long-term tax planning. Analysts often compute the “break-even deduction limit” to decide which regime saves more tax.

- The new tax regime (with enhanced slabs, higher standard deduction, and bigger rebate) is more attractive for middle-income taxpayers with fewer deductions. The old tax regime still shines for taxpayers with substantial deductions/exemptions, particularly through investment and housing benefits.

- The new regime may be better if the taxpayer has few deductions/exemptions., Taxable income ≤ INR 12 lakh (zero tax after rebate). Prefers simplicity over tracking proofs.

- Old regime may be better if the taxpayer has large deductions (80C, 80D, HRA, home loan interest). & Total deductions exceed the break-even point where the old regime tax becomes lower.

- New regime: Attractive for middle-income taxpayers with fewer deductions (simpler, higher rebate, enhanced standard deduction). Old regime: Best for taxpayers with significant deductions and housing benefits.

New Tax Regime: What’s Allowed vs. What’s Not

| Category | Old Regime | New Regime |

|---|---|---|

| Deductions | ||

| Section 80C (PPF, ELSS, life insurance, etc.) | Up to ₹1.5 lakh | Not allowed |

| Own contribution to NPS u/s 80CCD(1B) | INR 50,000* | Not allowed |

| Employer contribution to NPS u/s 80CCD(2) | Govt employees – 14% of basic pay + DA; Others – 10% | 14% for all |

| Medical insurance premium u/s 80D | Allowed | Not allowed |

| Exemptions | ||

| House rent allowance | Allowed | Not allowed |

| Gratuity, leave encashment, VRS, retirement benefits | Allowed | Allowed |

Note: Over and above what is u/s 80C. This is not an exhaustive list. Source: BDO India.

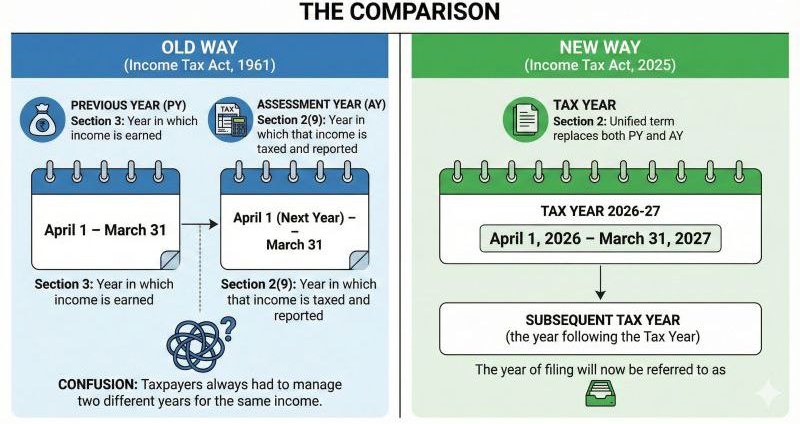

Goodbye, Assessment Year. Welcome, tax year.

Effective 1 April 2026, India turns the page on the Income-tax Act, 1961 and ushers in the Income-tax Act, 2025—the most significant overhaul of direct tax law in six decades.

New Tax Regime (FY 2025-26): Lower Rates, Fewer Deductions

🔹 Slabs under the New Regime

-

₹0–4 lakh → Nil

-

₹4–8 lakh → 5%

-

₹8–12 lakh → 10%

-

₹12–16 lakh → 15%

-

₹16–20 lakh → 20%

-

₹20–24 lakh → 25%

-

Above ₹24 lakh → 30%

With the enhanced rebate u/s 87A, tax payable becomes nil up to ₹12 lakh (₹12.75 lakh for salaried taxpayers due to standard deduction).

What You Give Up in the New Regime

- Section 80C deductions (PF, ELSS, LIC, etc.)

- Own contribution to NPS u/s 80CCD(1B)

- Medical insurance deduction u/s 80D

- House Rent Allowance (HRA)

- Most exemptions and allowances

What Still Continues

- Employer’s contribution to NPS u/s 80CCD(2) (14% of basic + DA for all employees)

- Gratuity, leave encashment, VRS & retirement benefits

- Standard deduction (for salaried taxpayers)

The Real Question Isn’t “Which Is Better?”

- It’s “How much deduction do you actually use?” Low deductions / simple salary → New regime often wins & High HRA, 80C, 80D, home loan interest → Old regime still relevant

- The new regime is not anti-savings—it’s anti-complexity. But choosing blindly can cost money. A regime comparison is no longer optional—it’s essential.