Caution: Don’t Fall for Ultra-Cheap “INR 24 ITR Filing” Trap

Page Contents

JioFinance Launches INR 24 ITR Filing Service Convenience with Caveats

Reliance-owned Jio Financial Services has introduced a new, ultra-affordable Income Tax Return filing module on its JioFinance app, starting at just INR 24 for self-service filing. They made a platform that aims to make tax filing more accessible, especially for first-time filers, and offers two options:

-

Self-Service Filing – INR 24, a do-it-yourself process with guided steps.

-

Expert-Assisted Filing – Starting at INR 999, handled by tax professionals.

INR 24 ITR filing with integrated tax planning is definitely going to shake up the lower end of the tax filing market. It’s very similar to what happened in other industries when tech-driven, ultra-low-cost platforms entered:

-

Banking: UPI made basic transfers free, forcing banks to focus on wealth management & lending.

-

Travel : Online portals killed small-ticket booking fees but created opportunities in curated travel experiences.

The app also includes a Tax Planner for projecting future liabilities, maximising deductions, comparing old vs new tax regimes, and simplifying tax compliance. Post-filing, users can track return status, monitor refunds, and receive alerts for tax notices. Jio Financial Services could be a game changer for simple cases, but for anything beyond that, a professional review remains the safest investment.

Professional Caution on Ultra-Cheap ITR Filing Offers (INR 24 Cases)

As a Chartered Accountant, I strongly caution taxpayers against blindly trusting ultra-cheap “INR 24 Income Tax Return filing” offers. Filing an Income Tax Return is not just data entry. It requires correct interpretation of tax provisions, claiming all eligible deductions, choosing the right regime, reporting capital gains accurately, setting off losses, and avoiding compliance pitfalls. it requires accurate interpretation of provisions, correct claim of deductions, selection of the right tax regime, reporting of capital gains, setting off of losses, and avoiding compliance pitfalls.

CA’s Perspective:

While technology-led solutions like this can simplify filing for basic ITR-1 salaried cases, taxpayers should be cautious when income involves complexities such as capital gains, business/profession income, foreign assets, or carry-forward of losses.

A wrong or incomplete return can result in:

-

Notices and penalties

-

Missed deduction or exemption claims

-

Incorrect tax regime lock-in

-

Refund delays

Don’t Fall for Ultra-Cheap “INR 24 ITR Filing” Traps

Such ultra-low prices often mean limited scope, hidden upselling, or zero accountability. While apps and online platforms can assist, they cannot replace professional judgement especially for anything beyond a very basic ITR-1 salary case. These low-price packages often have limited scope, hidden upselling, or zero accountability. While mobile apps can be useful for basic ITR-1 salaried cases, they cannot replace professional judgement for cases involving:

- Capital gains

- Multiple sources of income

- Foreign income or assets

- Business/profession income

- Past losses or complex adjustments

A wrong or incomplete return can result in:

- Income Tax notices & penalties

- Loss of carry-forward benefits for past losses

- Wrong tax regime lock-in for future years

- Delayed or denied refunds

- Tax notices and penalties

- Loss of carry-forward benefits on past losses

- Unwanted tax regime lock-in for future years

- Delays or denials of refunds

Bottom line: For basic filing threat. For professionals willing to reposition towards advisory + tech integration huge opportunity.

Our Advice:

If your return involves any complexity, invest in a professional review. Saving a few hundred now could cost you thousands — and significant stress later. If your income involves capital gains, multiple sources, foreign income, business/profession, or past losses, get your return professionally reviewed. The few hundred you save today could cost you thousands and a lot of stress later.

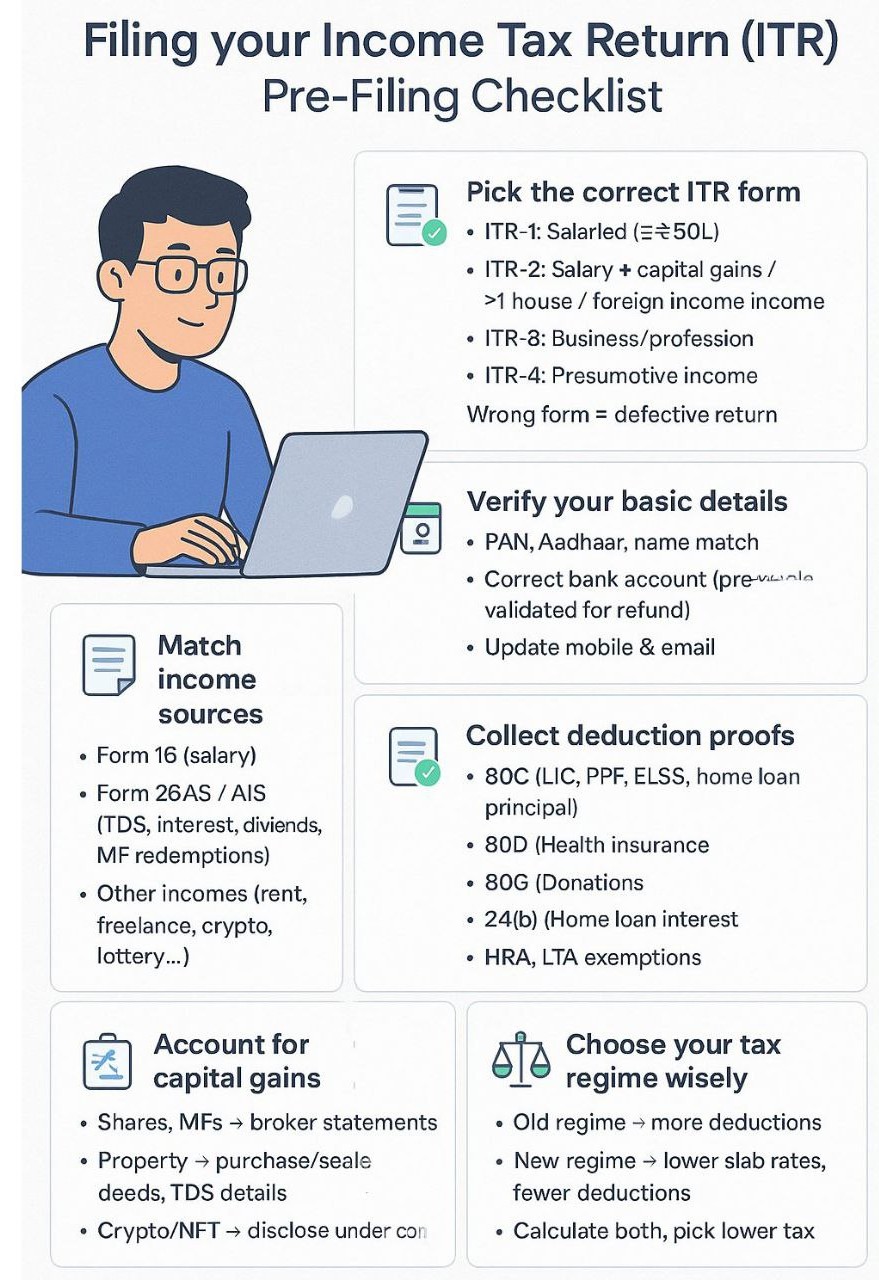

Filing your Income Tax Return (ITR) : Pre-Filing Checklist

Pick the correct ITR form

-

ITR-1: Salaried (income ≤ ₹50L)

-

ITR-2: Salary + capital gains / >1 house / foreign income

-

ITR-3: Business / profession

-

ITR-4: Presumptive income –

-

Wrong form = defective return

Verify your basic details

-

PAN, Aadhaar, name match

-

Correct bank account (pre-validated for refund)

-

Update mobile & email

Match income sources

-

Form 16 (salary)

-

Form 26AS / AIS (TDS, interest, dividends, MF redemptions)

-

Other incomes: rent, freelance, crypto, lottery, etc.

Collect deduction proofs

-

80C: LIC, PPF, ELSS, home loan principal

-

80D: Health insurance

-

80G: Donations

-

24(b): Home loan interest

-

HRA, LTA exemptions

Account for capital gains

-

Shares / MFs : broker statements

-

Property : purchase/sale deeds, TDS details

-

Crypto / NFT : disclose under correct head

Choose your tax regime wisely

-

Old Regime: More deductions, exemptions

-

New Regime: Lower slab rates, fewer deductions

-

Taxpayer Calculate both, pick whichever gives lower tax