Capital Gains Taxation – Key Concepts

Page Contents

Capital Gains Taxation – Key Concepts

- Applicability: Capital Gains Tax applies on the transfer of a capital asset.

- Types of Capital Assets: Long-Term Capital Asset (LTCA) & Short-Term Capital Asset (STCA)

Holding Period to Determine LTCG or STCG

| Category | Type of Capital Asset | Before 23/07/2024 | On/After 23/07/2024 |

| A | i) Listed securities, units of UTI, equity mutual funds, zero coupon bonds | ≤ 1 year – STCA > 1 year – LTCA |

Same as before |

| B | i) Unlisted shares ii) Immovable property |

≤ 2 years – STCA > 2 years – LTCA |

Same as before |

| C | Any other asset | ≤ 3 years – STCA > 3 years – LTCA |

≤ 2 years – STCA > 2 years – LTCA |

Update: For “Any other asset”, LTCG now starts after 2 years, not 3 years, effective 23/07/2024.

Tax Rates for Capital Assets

| Type of Asset | Type of Gain | Tax Rate Before 23/07/24 | Tax Rate On/After 23/07/24 |

| Listed Equity Shares / Equity Mutual Funds (STT paid) |

LTCG (Sec 112A) | 10% on gains > INR 1 Lakh | 12.5% on gains > INR 1.25 Lakh |

| STCG (Sec 111A) | 15% | 20% | |

| Immovable Property | LTCG | 20% with indexation | 20% with indexation or 12.5% without indexation (whichever is beneficial for Individual/HUF) Others: 12.5% without indexation |

| STCG | Normal slab rate | Normal slab rate | |

| Others | LTCG | 20% | 12.5% |

| STCG | Normal slab rate | Normal slab rate |

Tax Rates for Mutual Funds

| Type of Fund | Type of Gain | If Acquired On/Before 01/04/2023 | If Acquired After 01/04/2023 |

| Debt Fund | LTCG | 20% with indexation | Normal slab rate |

| STCG | Normal slab rate | Normal slab rate | |

| Equity Fund | LTCG | 10% on gains > INR1.25 lakh* | Same |

| STCG | 15% | 15% |

- Equity fund = more than 65% invested in equities.

- Debt mutual funds acquired after 1-Apr-2023 no longer get indexation and are taxed at slab rate.

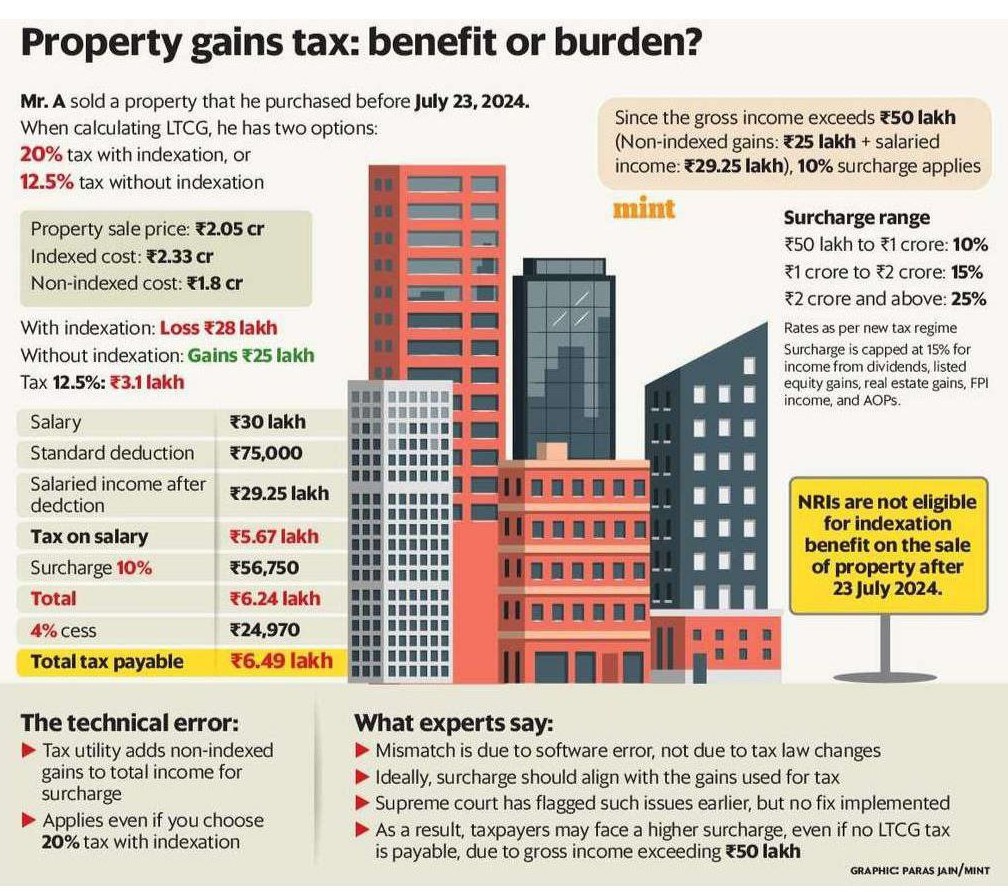

Important issue stemming from the new capital gains tax regime effective July 23, 2024.

- Rebate under Section 87A : Not available under New Tax Regime for Special Tax Rate incomes. And it is Available under Old Tax Regime.

- Basic Exemption Slabs : Still applicable on Special Tax Rate incomes under both regimes.

- Buyback of Shares : Before 01/10/2024: Exempt under Section 10(34A). and On or after 01/10/2024: Taxable as IFOS under Section 2(22)(f). Purchase consideration will be treated as current year capital loss.

Long-Term Capital Gains (LTCG) on Immovable Property :

- For property sold after 23/07/2024: LTCG tax to be paid at lower of 12.5% or 20% — applicable under both tax regimes.

- For property sold before 23/07/2024: LTCG tax to be paid at 20% with indexation — applicable under both regimes.

- LTCG income (for property sold after 23/07/2024) to be added to Gross Total Income (GTI) based on LTCG without indexation.

- Section 54 exemptions (for property sold after 23/07/2024) will be based on Amount calculated without indexation of LTCG — applies under both regimes.

- Cross-verify tax utility calculations, especially for LTCG and surcharge. & Consider both LTCG options (indexed and non-indexed) to choose the most tax-efficient route.

- Increased exemption limit on equity LTCG from INR 1 Lakh to INR 1.25 Lakh. & Introduction of 12.5% LTCG tax rate (without indexation) for certain capital assets.

- 20% STCG on listed equity shares (previously 15%) – a significant hike. &No indexation benefit on debt funds acquired after 01/04/2023.

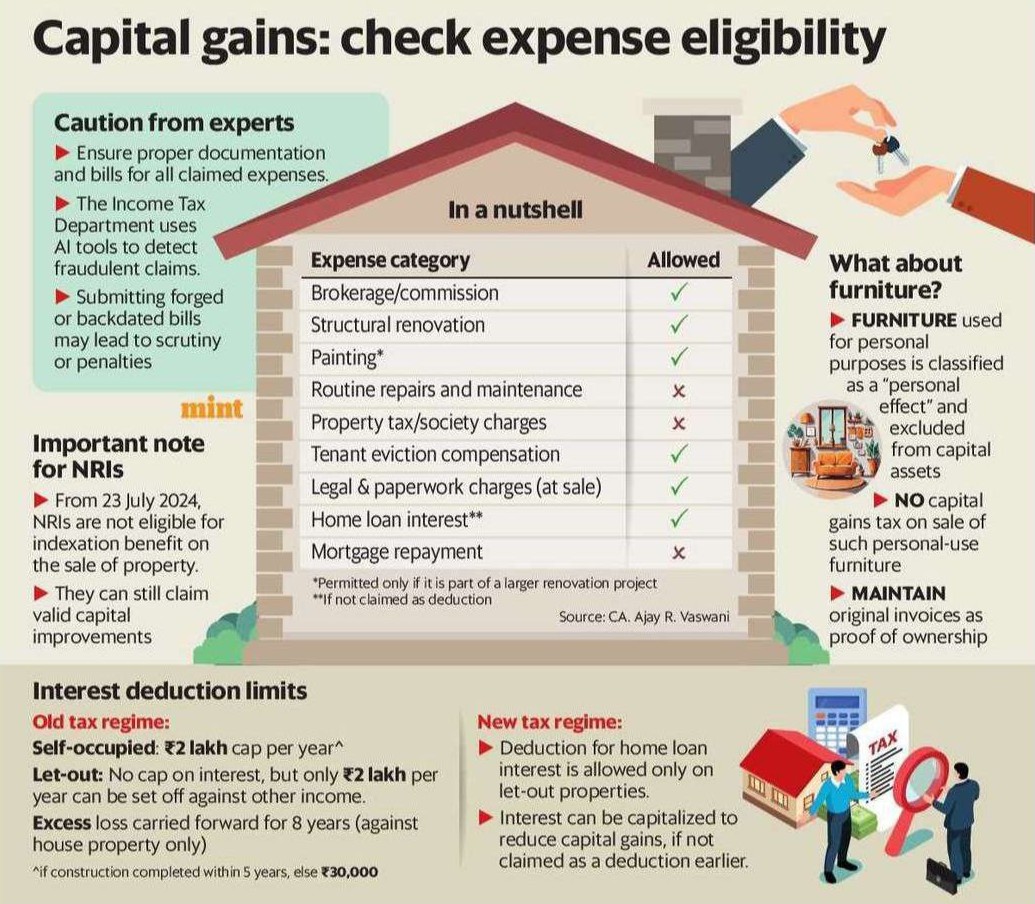

Interest Deduction Limits

- Old Tax Regime: Self-occupied: INR 2 lakh/year cap on interest deduction (if construction completed in 5 years; else INR 30,000) & Let-out: No cap on interest, but only INR 2 lakh can be set off annually and Excess loss carried forward for 8 years (house property only)

- New Tax Regime: Deduction for home loan interest allowed only on let-out properties & Interest can be capitalized to reduce capital gains (if not claimed earlier)

- we needed to Ensure valid invoices, bills, and supporting documentation & ITD uses AI tools to flag suspicious/fraudulent claims also Backdated/fake invoices may lead to scrutiny, penalties, or rejection

- NRIs must be cautious — they cannot claim indexation after 23 July 2024. And If overcharged due to surcharge misapplication, consider filing a grievance with the CPC or escalating through a rectification request.

- From 23 July 2024, NRIs are not eligible for indexation benefit on property sales. However, they can still claim: Valid capital improvement expenses & Brokerage, legal costs, home loan interest (if not previously deducted)

Capital gains: check expense eligibility : Eligible Capital Gains Expenses (In a Nutshell)

| Expense Category | Allowed |

| Brokerage/Commission | ✔️ |

| Structural Renovation (e.g., rebuilding) | ✔️ |

| Painting (if part of renovation) | ✔️* |

| Routine repairs and maintenance | ✘ |

| Property tax / society charges | ✘ |

| Tenant eviction compensation | ✘ |

| Legal & paperwork charges (at sale) | ✔️ |

| Home loan interest (if not claimed as deduction) | ✔️** |

| Mortgage repayment | ✘ |

* Only permitted if part of a larger renovation project

** Allowed only if not previously claimed as a deduction under Section 24(b)

What About Furniture: Furniture for personal use is a “personal effect” Not considered a capital asset; Hence, no capital gains tax applies on sale of such items & Maintain original invoices as proof of ownership

Property gains tax: benefit or burden

Situation : Mr. A sold property purchased before July 23, 2024

- Property Sale Price: INR 2.05 crore

- Indexed Cost (with indexation): INR 2.33 crore → Loss of INR 28 lakh

- Non-Indexed Cost (actual cost): INR 1.8 crore → Gain of INR 25 lakh

- Tax Options for LTCG (before July 23, 2024) : 20% with Indexation & Results in loss, hence no LTCG tax.

- 12.5% without Indexation : Gain: INR 25 lakh → Tax = INR 3.1 lakh

Salaried Income Impact

- Salary: INR 30 lakh Less: Standard Deduction INR 75,000 → INR 29.25 lakh and Income Tax on salary: INR 5.67 lakh, Surcharge @10%: INR 56,750, 4% Cess: INR 24,970, Total Tax Payable: INR 6.49 lakh

The Technical Glitch (Error in Tax Utility)

- Even if taxpayer chooses 20% with indexation (and shows loss),

→ the system still includes the non-indexed gain (INR 25 lakh) in gross income to check surcharge applicability. - This incorrectly increases gross income > INR 50 lakh, triggering 10% surcharge, even though actual taxable income is lower.

Surcharge Applicability as per New Tax Regime

| Gross Income Slab | Surcharge Rate |

| INR 50 lakh to INR 1 crore | 10% |

| INR 1 crore to INR 2 crore | 15% |

| Above INR 2 crore | 25% |

Capped at 15% for income from dividends, listed equity gains, real estate gains, FPI income, and AOPs.

Important for NRIs: NRIs are not eligible for indexation benefit on sale of property after July 23, 2024 & This makes their LTCG tax exposure significantly higher.

This issue arises from a software mismatch, not a legal amendment. Ideally, surcharge should apply on taxable gains, not notional or non-indexed ones. Supreme Court has flagged this earlier, but a fix is yet to be implemented.

Capital Gains on Sale of Ancestral Jewellery

-

Taxability : Jewellery, whether self-acquired or inherited, is a capital asset under section 2(14) of the Income-tax Act. Sale of inherited jewellery by a legal heir attracts Capital Gains Tax. Since it is inherited, the gain is always treated as Long-Term Capital Gain (LTCG) [section 49 read with section 2(42A)].

-

Cost of Acquisition : The cost is taken as the cost to the previous owner (ancestor). and Indexation benefit is available from the year the ancestor first acquired the jewellery.

-

Clarification on “500 grams exemption” : The CBDT circular (1994) provides a relaxation during income-tax search/seizure operations — officers shall not seize up to:

-

500 grams per married lady,

-

250 grams per unmarried lady,

-

100 grams per male.

-

This is only for seizure relief and does not provide any exemption from capital gains tax.

-

-

Exemptions Available : Section 54F: Invest net consideration in a residential house property (subject to conditions). & Section 54EC: Invest capital gains in specified bonds (NHAI/REC, etc.) within 6 months (max ₹50 lakhs). capital gains apply on sale of ancestral jewellery. No blanket exemption of 500 grams exists for taxation purposes.Full value of consideration minus indexed cost of acquisition = taxable LTCG.