Various exemptions available in Capital Gains for FY 2025-26

Page Contents

Various exemptions available in respect of capital gains applicable for FY 2025-26 (AY 2026-27)

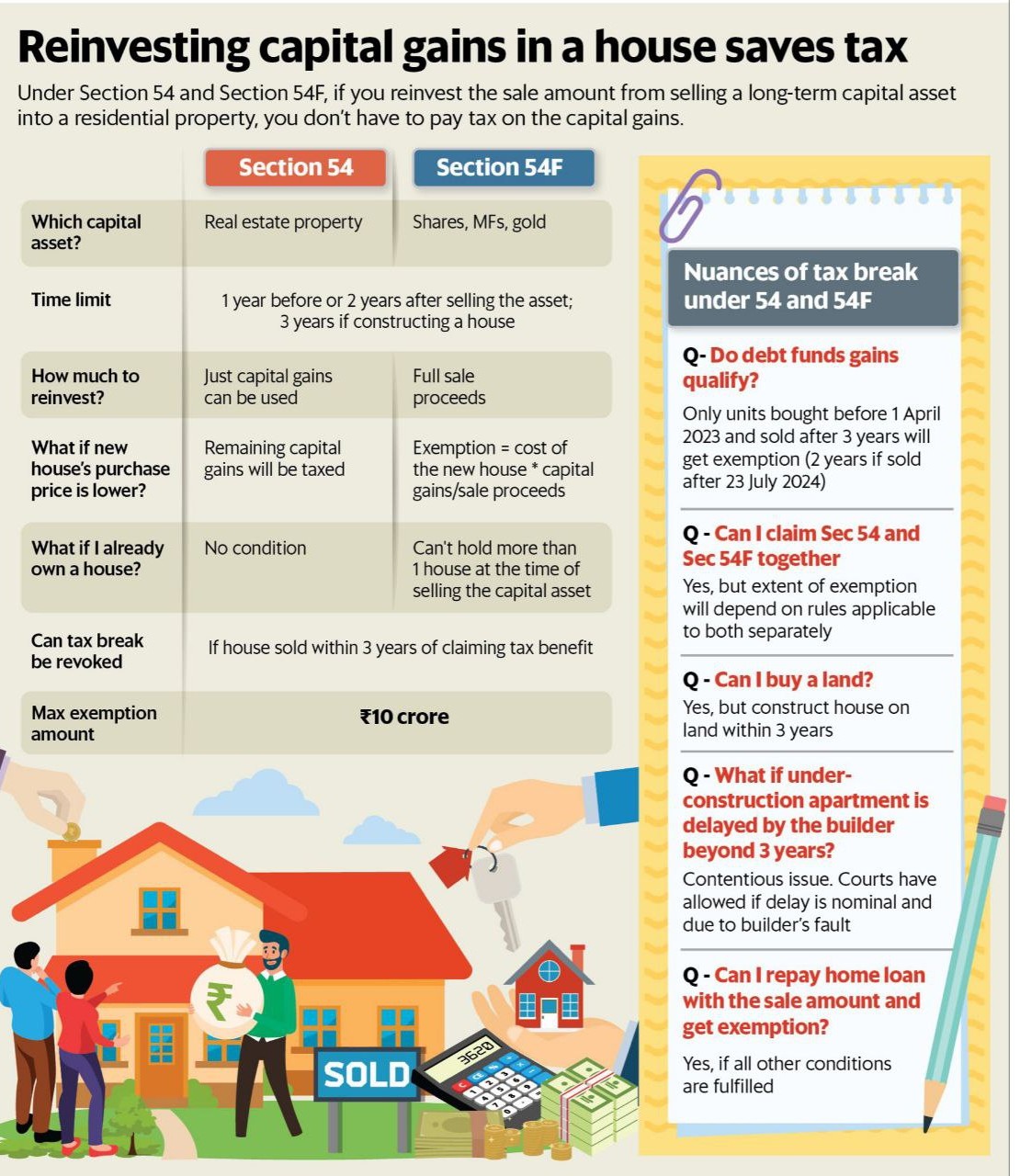

Income Tax Department chart showing various exemptions available in respect of Capital Gains under different sections of the Income Tax Act for FY 2025-26. These exemptions apply primarily to Long-Term Capital Gains when certain conditions are met. Short-term capital gains generally do not have exemptions under these sections unless specifically stated.

- Section 54 – Individual/HUF selling residential house property.

- Section 54B – Individual/HUF selling agricultural land.

- Section 54D – Any assessee selling land/building for industrial undertaking.

- Section 54EC – Any assessee investing in specified bonds.

- Section 54F – Individual/HUF selling any long-term capital asset (other than residential house).

- Section 54G – Industrial undertaking shifting from urban area.

- Section 54GA – Industrial undertaking shifting to SEZ.

- Section 54GB – Individual/HUF selling residential property and investing in eligible company.

Quick reference for exemptions on capital gains.

Section 54 — Exemption on Sale of Residential House

Who can claim: Individuals & HUFs

Asset sold: Long-term capital asset residential house

Condition: Reinvest capital gains in:

Another residential house in India, bought within 1 year before or 2 years after sale; Or construct within 3 years from sale.

Exemption amount: Lower of LTCG or cost of new house purchased/constructed.

Important cap: Exemption is limited to a maximum of ₹10 crore (even if investment exceeds this) — introduced by Finance Act changes applicable from recent years including FY 2025-26.

Section 54F : Exemption on Sale of Any Long-Term Capital Asset (Except Residential House)

Who can claim: Individuals & HUFs

Asset sold: Long-term capital asset other than a residential house

Condition: Reinvest the net sale proceeds (not just capital gain) in a residential house in India: following are basic condition

-

Purchase within 1 year before or 2 years after sale;

-

Construct within 3 years from sale.

Exemption amount: The amount of LTCG × (investment in new house ÷ net sale proceeds).

Key restriction: Exemption capped at ₹10 crore of reinvestment amount. -

To be eligible:

-

-

On the date of transfer, the assessee should not own more than one residential house (excluding the new one being purchased).

-

Deposit unutilised funds in Capital Gains Account Scheme (CGAS) if not invested by the due date of filing the return to claim exemption.

-

Section 54B — Exemption on Transfer of Agricultural Land

Who can claim: Individuals & HUFs

Asset sold: Agricultural land used for agricultural purposes for at least 2 years before sale

Condition: Reinvest gains into agricultural land within 2 years from the date of transfer.

Exemption amount: Lower of capital gain or cost of new land.

Special: Must continue using the new land for agriculture.

Section 54D — Exemption on Compulsory Acquisition of Industrial Land/Building

Who can claim: Any assessee

Asset sold: Land/building forming part of an industrial undertaking compulsorily acquired

Condition: Purchase replacement land/building within 3 years to shift or re-establish the undertaking.

Exemption: LTCG exempt to the extent of cost of new asset or gain, whichever is lower.

Section 54EC : Investment in Specified Bonds

Who can claim: Any assessee

Asset sold: Long-term capital asset (land or building)

Condition: Invest LTCG in specified bonds within 6 months from sale.

Eligible bonds: NHAI, REC, HUDCO bonds (must be held for 5 years — longer lock-in)

Maximum limit: INR 50 lakh in aggregate in a financial year.

Important: If bonds are transferred or converted into cash within 5 years, the exemption is withdrawn and previous gains get taxed.

Section 54EE: Investment in Specified Funds (e.g., Startup Funds)

Who can claim: Any assessee

Asset sold: Long-term capital asset

Condition: Invest gains in notified long-term specified funds within 6 months from sale.

Maximum limit: INR 50 lakh in a year (inclusive of FY of sale and next).

Important: Must hold the investment for the prescribed lock-in period (typically 3 years).

If the specified asset is sold or converted into money earlier, exemption is withdrawn.

Section 54G & 54GA: Shifting of Industrial Undertaking / SEZ Reinvestment

These provisions provide exemptions where gains arise from the transfer of assets used for industrial undertakings and are reinvested to set up similar activities in Rural areas (Sec 54G) & Special Economic Zones (Sec 54GA). Key conditions is are mentioned here under :

-

Reinvestment in new assets within 1 year before or 3 years after transfer.

-

Exemption amount is the lower of gain or cost of the new asset.

Important Notes for FY 2025-26

- LTCG on Equity / Mutual Funds : LTCG from listed equity shares and equity-oriented mutual funds exceeding ₹1 lakh in a financial year is taxed at 10% without indexation. The specific exemption threshold of ₹1 lakh exists for equity LTCG under Section 112A (not a reinvestment exemption but a basic exemption limit for taxing).

- STCG Rules : Short-term capital gains (STCG) generally do not qualify for the above exemptions (e.g., Sections 54, 54F, 54EC, etc., apply only to LTCG). Section 87A rebate (for reducing tax payable) typically does not apply to special rate incomes like STCG (clarified for FY 2025-26), though judicial decisions may affect this in specific cases.

Quick Summary Table : exemptions on capital gains.

| Section | Applicable Asset Sale | Reinvestment Asset | Time Limit | Max Exemption |

|---|---|---|---|---|

| 54 | Residential house | New residential house | 1 yr before / 2 yr after / 3 yr for construction | LTCG or investment (capped at ₹10 Cr) |

| 54F | Any LT asset except residential house | Residential house | Same as Sec 54 | LTCG × (invest / net sale) (capped at ₹10 Cr) |

| 54B | Agricultural land | Agricultural land | Within 2 yrs | Lower of gain or investment |

| 54D | Industrial land/building (acquired) | Same | Within 3 yrs | Lower of gain or investment |

| 54EC | Land/building | Specified bonds | Within 6 mo | ₹50 lakh |

| 54EE | Any LT asset | Specified funds | Within 6 mo | ₹50 lakh |

| 54G / 54GA | Industrial assets for rural/SEZ | Similar assets | 1 yr before / 3 yrs after | Lower of gain or investment |

Each section specifies exemptions on capital gains.

- Eligible Assessee (Individual, HUF, or any assessee)

- Nature of Asset Transferred (Residential property, agricultural land, industrial land/building, etc.)

- Type of Capital Gain (Long-term or short-term)

- New Asset Required for Exemption (Residential house, agricultural land, bonds, etc.)

- Maximum Exemption Allowed (e.g., INR 50 lakh for 54EC bonds)

- Time Limit for Purchase/Investment (e.g., within 2 years, 3 years, or 6 months)

- Conditions (e.g., deposit in Capital Gains Account Scheme if not utilized before filing return)

- Bonds under Section 54EC are redeemable after 5 years (Housing and Urban Development Corporation Ltd or NHAI). The Capital Gains Account Scheme applies if the investment is not made before the return filing. Amendments as per the Finance Act, 2025 are included.