Crypto Taxation & ITR Reporting Guide for India

Page Contents

Crypto Taxation & ITR Reporting Guide

Tax on Profits from Crypto (Virtual Digital Assets)- Taxation U/s 115BBH

Applicability on Virtual Digital Assets :

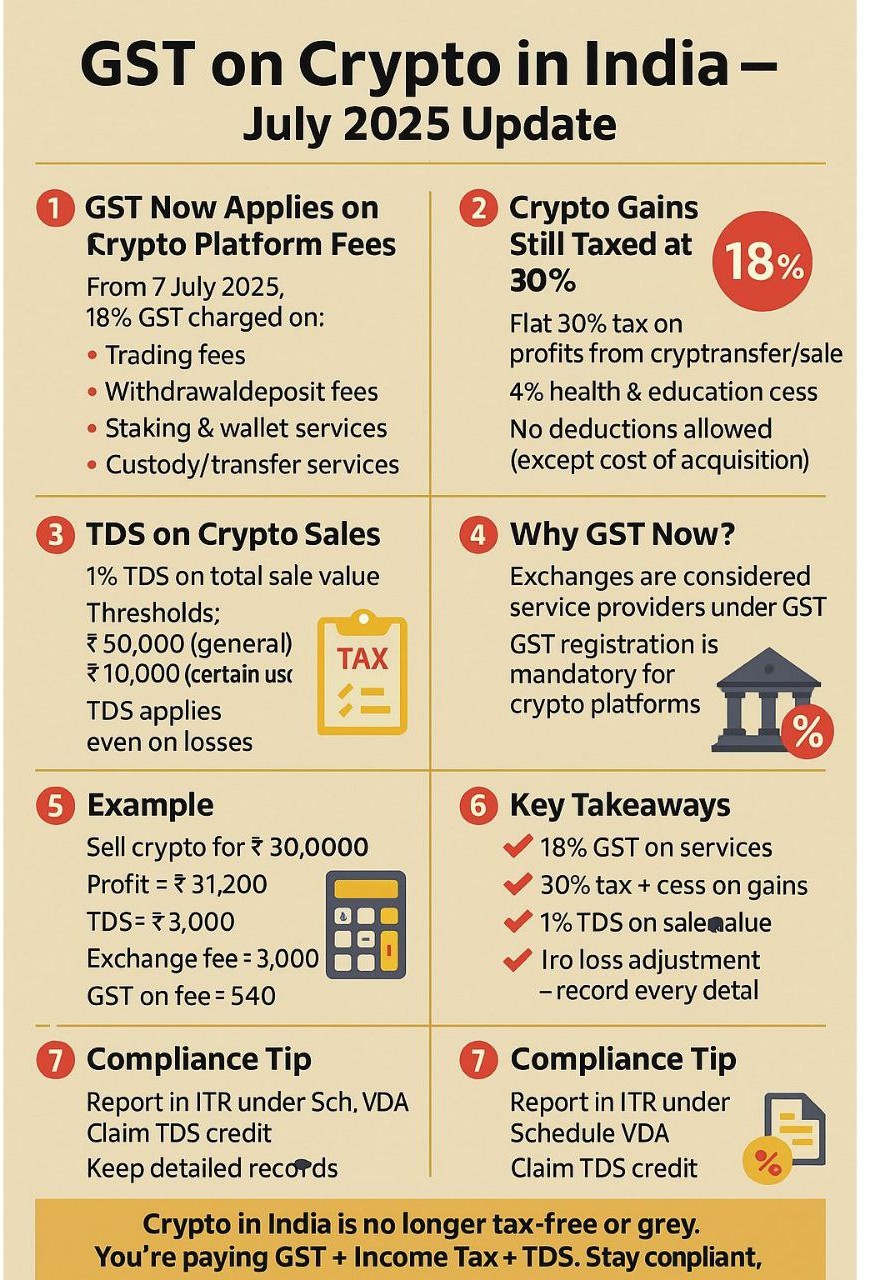

Legal Definition Virtual Digital Assets: Under Income Tax Act, cryptocurrencies, NFTs, and similar assets are classified as Virtual Digital Assets (Sec. 2(47A)). Special taxation rules apply from 1st April 2022 onwards. Effective from 1st April 2022 (AY 2023-24 onwards) & Covers Virtual Digital Assets such as cryptocurrencies, NFTs, and similar digital assets. Flat 30% tax on income from transfer of VDAs. Plus 4% health & education cess and surcharge (as applicable) & No slab benefit – rate applies irrespective of income level.

Taxation Rules for Crypto – Tax on Profits – Section 115BBH :

Deductions Allowed / Not Allowed

- Deductions Allowed: Only the cost of acquisition (purchase price) can be deducted.

- Deductions Not Allowed : Not Allowed: No deduction for expenses (like mining cost, transaction fee, electricity, consultancy), No deduction for cost of improvement & No exemption for reinvestment (like 54F, 54EC in capital gains).

- Rules for Crypto Losses : Loss from crypto cannot be set off against any other income (salary, business, capital gains, etc.). Loss from one crypto cannot be set off against another crypto. No carry forward of crypto losses to future years.

Example

-

- Buy Bitcoin = ₹3,00,000

- Sell Bitcoin = ₹4,50,000

- Profit = ₹1,50,000

- Tax = 30% of 1,50,000 = ₹45,000

- Cess @ 4% = ₹1,800

- Total Tax = ₹46,800

If sold at a loss, say ₹2,50,000 (loss of ₹50,000),

The loss is ignored (cannot be adjusted or carried forward) :

Even occasional investors are covered; it applies to both individuals and businesses. Gains are separately taxed; cannot be clubbed under normal slabs. Reporting in Schedule VDA of ITR is mandatory.

- Flat 30% tax on profits from transfer of VDAs.

- No deduction allowed except cost of acquisition.

- No set-off of crypto loss against any other income.

- No carry forward of crypto losses.

Example:

-

- Buy BTC @ ₹1,00,000 → Sell @ ₹1,50,000

- Profit = ₹50,000

- Tax = ₹15,000 (30% flat + surcharge + cess)

TDS – Section 194S

1% TDS on transfer of VDAs if Aggregate transaction value > ₹10,000 in a year (₹50,000 for specified persons like individuals with income < ₹50 lakh & no business income). Applies on payment made in cash, kind, or crypto-to-crypto trades. Exchanges generally deduct TDS on behalf of traders.

Gift of Crypto – Section 56(2)(x)

If you receive crypto as a gift, it is taxable as Income from Other Sources at market value (unless exempt under relatives/marriage/gift exemptions).

GST Impact (for Businesses/Exchanges)

As per GST law, crypto exchanges must charge 18% GST on transaction fees/commissions. GST is not levied on crypto transfer itself for investors, only on exchange services.

ITR Reporting of Crypto Income

For Individuals/Investors

Report crypto gains/losses under Schedule VDA in ITR forms (ITR-2 or ITR-3). Pay 30% tax separately on profits (not merged with normal slab income). Details required:

-

- Date of acquisition & transfer

- Cost of acquisition

- Sale consideration

- Income (profit) calculated

For Traders/Business Income

If frequent trading is your business activity, file under ITR-3 (PGBP). Still taxed u/s 115BBH (30%).

For NRIs

Same tax rules apply on VDAs purchased in India or through Indian exchanges. DTAA relief may not be available for VDA taxation.

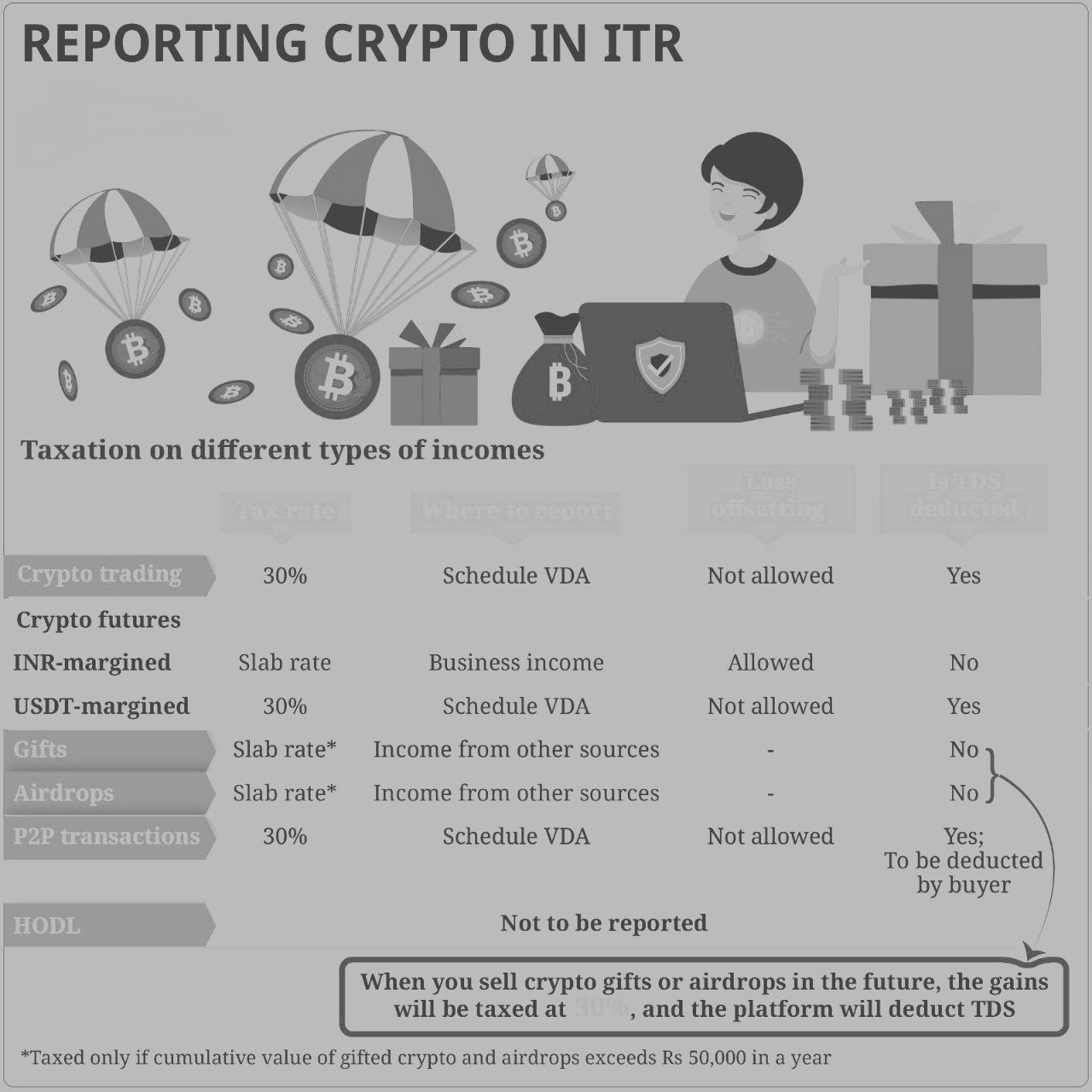

How different types of crypto-related incomes are taxed and reported in India.

| Type of Crypto Income | Tax Rate | Where to Report in ITR | Loss Offsetting | TDS Deducted |

| Crypto Trading | 30% | Schedule VDA | Not allowed | Yes |

| Crypto Futures | Slab Rate | Business Income | Allowed | No |

| INR-Margined Futures | Slab Rate | Business Income | Allowed | No |

| USDT-Margined Futures | 30% | Schedule VDA | Not allowed | Yes |

| Gifts (Crypto/Airdrops) | Slab Rate (if > ₹50,000/year) | Income from Other Sources | Allowed | No |

| Airdrops | Slab Rate | Income from Other Sources | Allowed | No |

| P2P Transactions | 30% | Schedule VDA | Not allowed | Buyer deducts |

| HODL (Holding Crypto) | Not taxable until sold | Not reported | Not applicable | No |

Penalties for Non-Compliance : Non-disclosure of crypto assets = penalty & prosecution under Black Money Act / Benami Law (if foreign or undisclosed). Wrong reporting may lead to scrutiny & demand notices.

Important Notes- Crypto Taxation & ITR Reporting Guide

Section 115BBH imposes a harsh flat tax regime on crypto profits 30% tax, No expense deduction (except purchase cost) & No set-off / carry forward of losses. Crypto is taxed at a flat 30% with 1% TDS on transfers. Losses can’t be adjusted. Proper disclosure in Schedule VDA of ITR is mandatory to avoid scrutiny.

- Gifts & Airdrops: Taxed only if cumulative value > ₹50,000/year.

- Future Sale of Gifts/Airdrops: Gains taxed at 30%, and TDS will be deducted by the platform.

- Losses from crypto trading cannot be offset against other income.

- Schedule VDA is the dedicated section in ITR for reporting crypto assets.

- Compliance Checklist – Tax on Profits from Crypto (Virtual Digital Assets)

-

- Maintain records of all crypto trades, wallets, and exchange statements.

- Ensure TDS (1%) is correctly deducted and reflected in Form 26AS / AIS.

- Report all crypto income, even if held abroad (ROR status only).

- Disclose gifts/airdrops/mining rewards as taxable income.

- File ITR-2 / ITR-3 with Schedule VDA filled correctly.

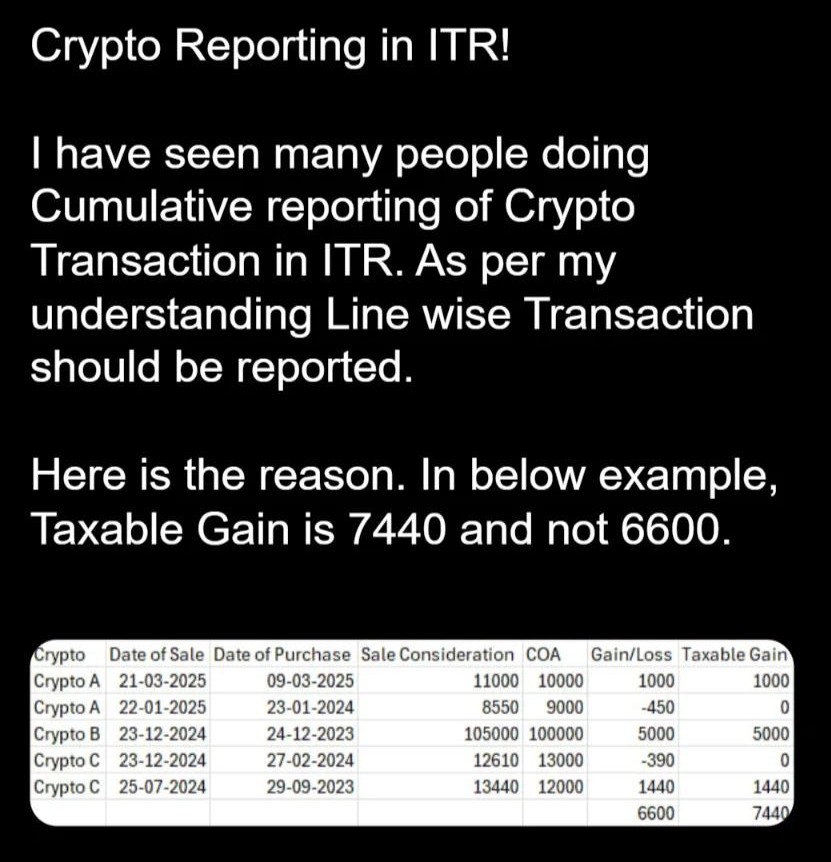

Common Mistakes to Avoid When Filing ITRs

- Not E-Verifying the Return : Submitting the ITR is only half the process. If you don’t e-verify it within 30 days, it’s considered invalid.

- Ignoring AIS & TIS Mismatch : Always cross-check your ITR with the Annual Information Statement & Taxpayer Information Summary to avoid discrepancies and notices.

- Skipping Capital Gains Reporting : Gains from shares, mutual funds, crypto, or property must be reported—even if reinvested or exempt.

- Not Filing When Mandatory : Even if your income is below the taxable limit, filing may be mandatory due to Foreign assets, TDS deductions, High-value transactions.

- Omitting Bank Account Details : All active bank accounts (except dormant ones) must be disclosed in the ITR.

- Not Comparing Old vs New Tax Regime : Use online calculators or consult a tax expert to determine which regime gives you better tax savings.

- Unvalidated Bank Account for Refund : If your bank account isn’t validated on the income tax portal, your refund may be delayed or rejected