12% & 28% GST rate Scrapped, leaving only 2 Slab of 5% & 18%

Page Contents

The existing 12% & 28% GST rates were Scrapped, which resulted in leaving only 2 FST slab of 5% & 18% rates.

- The Group of Ministers on GST rate rationalisation has accepted the Centre’s proposal to reduce the current four-slab structure to two, Bihar Deputy Chief Minister Samrat Choudhary said on Thursday.

- The Group of Ministers, chaired by Choudhary, endorsed the move to scrap the existing 12% and 28% rates, leaving just two standard slabs of 5% and 18%. “The GoM has decided to accept the 2 proposals of the Centre,” Choudhary said after the meeting, confirming that the panel had given its recommendations.

- Under the plan, 99% of items currently taxed at 12% will be shifted to the 5% slab, while 90% of those under the 28% bracket will move to 18%. A higher 40% levy is likely to be retained on 5–7 “sin goods”, including ultra-luxury items such as high-end cars.

- The 6-member GoM also includes Uttar Pradesh Finance Minister Suresh Kumar Khanna, Rajasthan Health Minister Gajendra Singh, West Bengal Finance Minister Chandrima Bhattacharya, Karnataka Revenue Minister Krishna Byre Gowda, and Kerala Finance Minister K. N. Balagopal.

- Khanna said all states had welcomed the proposal, calling it “in the interest of the common man.” He added that revenue loss from the new structure would be calculated, as some states demanded compensation to offset shortfalls.

- West Bengal’s Bhattacharya, while supporting pro-people rationalisation, cautioned that the Centre’s proposal did not account for revenue loss. “Ultimately, if a state suffers any loss, it boils down to the sufferance of the common man. The GST Council will discuss the rate proposal item by item,” she noted.

- The GoM has accepted the proposal, noting that rate rationalisation will simplify the indirect tax system while providing relief to households, farmers, the middle class, and MSMEs.”

FM Nirmala Sitharaman say GST reform would create transparent and growth-oriented

- The center has argued that rate rationalisation would simplify the indirect tax system while ensuring relief for households, farmers, the middle class, & MSMEs. FM Nirmala Sitharaman had told the Group of Ministers earlier this week that GST reform would create a “transparent and growth-oriented” GST regime.

- Telangana Deputy CM Mallu Bhatti Vikramarka also extended support to the reform but stressed the need for a robust compensation mechanism. The state suggested either retaining the current compensation cess system or raising GST on sin and luxury goods to ensure states are protected against revenue erosion.

- The rationalisation debate comes a day after another Group of Ministers meeting, where most states backed a proposal to exempt health and life insurance premiums for individuals from GST. While the move could result in an estimated annual revenue loss of INR 9,700 cr, states emphasised that mechanisms must be put in place to ensure the benefit is passed on to policyholders.

Note on Change in Rate of GST (Section 14)

- When the rate of GST changes, the Time of Supply (TOS) determines whether the old rate or new rate applies. The TOS is identified by considering three key events: Date of supply of goods/services , Date of invoice issued & Date of receipt of payment

Golden Rule on Change in Rate of GST

-

If two out of three events occur before the rate change : Old rate applies.

-

If two out of three events occur after the rate change : New rate applies.

Important Point on Payment

- For “receipt of payment,” if the amount is credited to the bank account more than 4 working days after the rate change, then the date of bank credit (not the books entry date) will be considered.

- Always check the sequence of Supply – Invoice – Payment. Whichever side (before or after rate change) has two events, that rate will govern the transaction.

GST Rate Change – Applicability Rule (Section 14, CGST Act)

When GST rates change, the “two out of three rule” under Section 14 determines whether the old rate or the new rate applies. Businesses must carefully track all three events around the date of GST rate change, with extra attention to how “date of payment” is determined, to ensure correct GST rate application. following are three trigger events:

-

Date of Supply (completion of supply)

-

Date of Invoice

-

Date of Receipt of Payment

Rule for Applying GST Rate

-

If any two of the above events occur before the rate change : Old GST rate applies.

-

If any two of the above events occur after the rate change : New GST rate applies.

Special Rule for Payment Date : For Section 14, date of receipt of payment is the earlier of Date payment is entered in supplier’s books of account, OR Date amount is credited to supplier’s bank account. An exception to this rule is If the amount is credited to the bank account more than 4 working days after the rate change, then the actual bank credit date will be considered. Illustration : Suppose GST rate changes on 22 September 2025:

-

Invoice issued on 20 Sept 2025, Payment on 21 Sept 2025, Supply on 23 Sept 2025 : Two events (invoice & payment) before rate change : Old rate applies.

-

Invoice on 23 Sept 2025, Supply on 25 Sept 2025, Payment on 24 Sept 2025 : Two events (invoice & supply) after rate change: New rate applies.

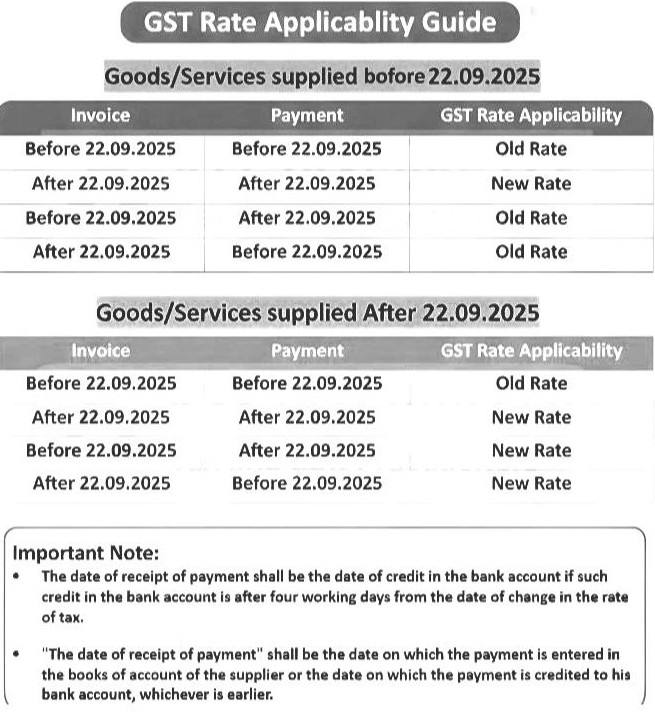

GST Rate Applicability Guide based on the date of supply, invoice, and payment, with a key cutoff date of 22.09.2025

For Goods/Services Supplied Before 22.09.2025

| Invoice Date | Payment Date | Applicable GST Rate |

|---|---|---|

| Before 22.09.2025 | Before 22.09.2025 | Old Rate |

| After 22.09.2025 | After 22.09.2025 | New Rate |

| Before 22.09.2025 | After 22.09.2025 | Old Rate |

| After 22.09.2025 | Before 22.09.2025 | Old Rate |

For Goods/Services Supplied After 22.09.2025

| Invoice Date | Payment Date | Applicable GST Rate |

|---|---|---|

| Before 22.09.2025 | Before 22.09.2025 | Old Rate |

| After 22.09.2025 | After 22.09.2025 | New Rate |

| Before 22.09.2025 | After 22.09.2025 | New Rate |

| After 22.09.2025 | Before 22.09.2025 | New Rate |

If payment is credited to the bank account after four working days from the date of rate change, then that date is considered the date of receipt of payment. Otherwise, the date of receipt of payment is the earlier of:

-

- The date entered in the supplier’s books of account.

- Date credited to the supplier’s bank account