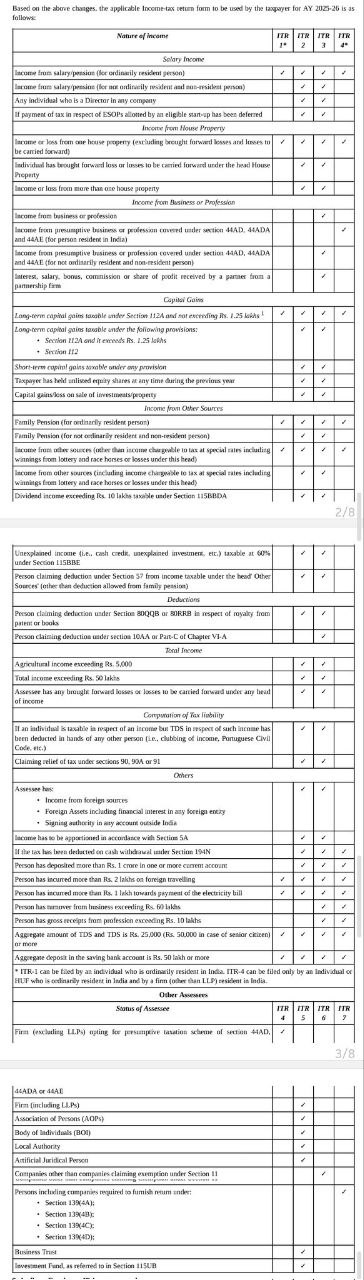

Comparison chart of ITR-5, ITR-3, & ITR-4 for AY 2025-26

Page Contents

ITR-5 filing eligibility and requirements in India for AY 2024-25 / FY 2023-24

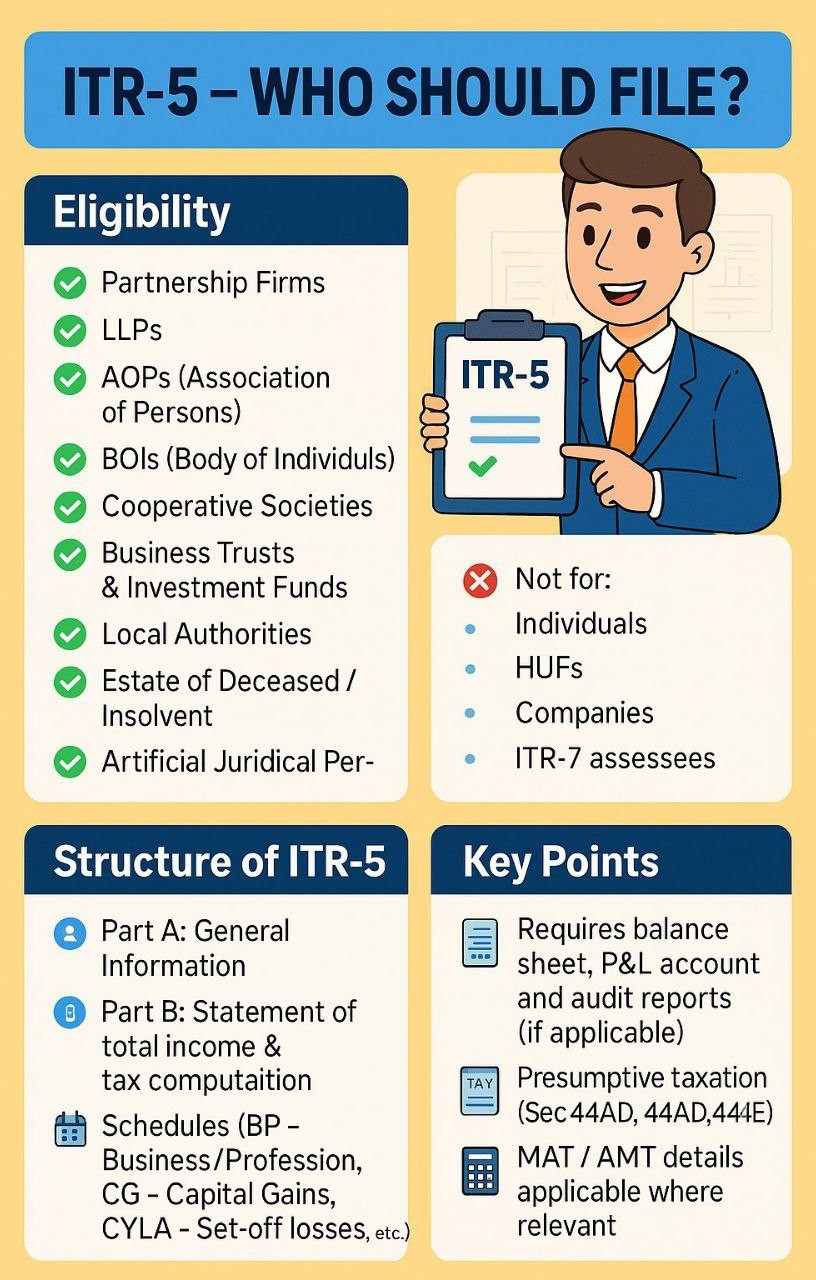

Who Can File ITR-5 : Eligibility Who Can File ITR-5

ITR-5 is meant for entities other than individuals and HUFs, specifically:

- Firms (including LLPs)

- AOPs (Association of Persons)

- BOIs (Body of Individuals)

- Artificial Juridical Persons (AJP)

- Co-operative Societies

- Local Authorities

- Private Discretionary Trusts

- Estate of deceased or insolvent person under certain circumstances

- Business trusts and Investment funds referred in section 115UB

- Estate of Deceased / Insolvent persons

- Business Trusts & Investment Funds

- Artificial Juridical Persons

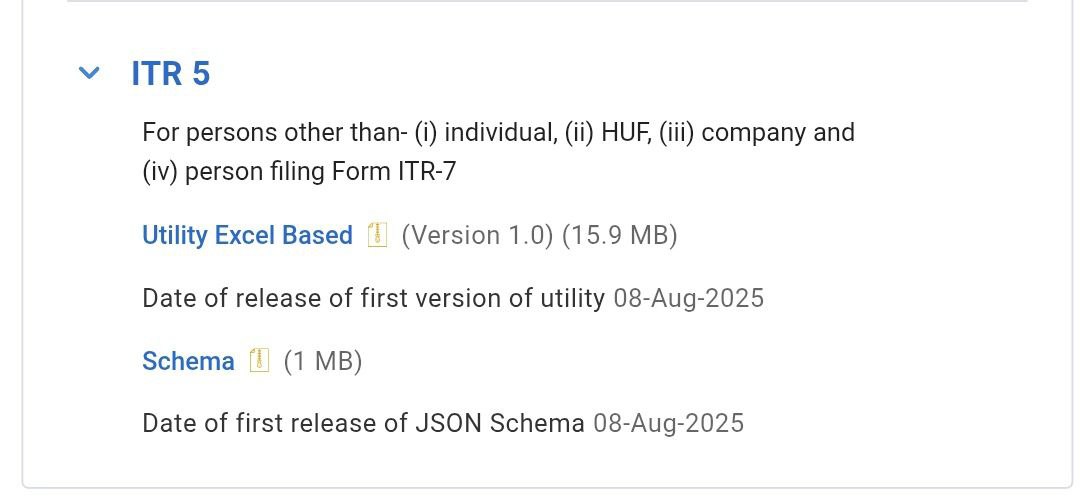

ITR-5 filing eligibility and requirements in India. ITR-5 utility release information for AY 2025-26, ITR-5 filing Applicable to Persons other than Individual, HUF, Company, Person filing Form ITR-7. This means the Excel-based ITR-5 filing tool and its JSON schema became available from 8 August 2025, allowing entities like partnerships, LLPs, AOPs, BOIs, etc., to start preparing and filing their returns for FY 2024-25. ITR-5 Available Utility:

-

- Utility Excel Based – Version 1.0 (15.9 MB)

- Date of first release: 08-Aug-2025

- Schema File Size: 1 MB

Who Cannot File ITR-5

- Individuals and HUFs (they file ITR-1, 2, 3, or 4 depending on income sources)

- Companies (except LLPs) must file ITR-6 or ITR-7 depending on exemptions

- Persons claiming exemption under section 11 (Income from property held for charitable/religious purposes) use ITR-7

- ITR 5 Not for Individuals, HUFs (Hindu Undivided Families), Companies, ITR-7 assessees

Structure of ITR-5:

-

- Part A: General Information

- Part-B: Statement of total income & tax computation

- Schedules:

- BP – Business/Profession

- CG – Capital Gains

- CYLA – Set-off of losses, etc.

- For ITR 5 requires balance sheet, profit & loss account, and audit reports (if applicable). and Presumptive taxation available u/s 44AD, 44ADA, 44AE also MAT (Minimum Alternate Tax) / AMT (Alternate Minimum Tax) details applicable where relevant

ITR Filing Method

- Only online via the Income Tax e-Filing portal:

- Using Digital Signature Certificate (DSC) (mandatory for firms, LLPs, and certain other entities)

- Through Electronic Verification Code (EVC) (only for those not mandatorily required to use DSC)

Key Income Sources Allowed in ITR-5

- Income from business or profession

- Capital gains

- House property income

- Other sources (interest, dividends, etc.)

- Income from speculative business (e.g., F&O trading)

- Presumptive income u/s 44AD, 44ADA, 44AE (for eligible entities)

Mandatory Disclosures in ITR-5

- Balance Sheet and Profit & Loss Account (as per Schedule BP, P&L, BS)

- Partner/Member details in case of firm/AOP/BOI

- Audit information if applicable under:

- Section 44AB (Tax Audit)

- under Section 92E (Transfer Pricing Report)

- Details of foreign assets & income (if applicable)

- GST details & turnover reconciliation (if applicable)

Due Dates of ITR-5 For AY 2024-25:

- 31st July 2024 – If no audit is required

- 30th September 2024 – If audit is required u/s 44AB

- 31st October 2024 – If Transfer Pricing report required under Section 92E

Penalties for Late Filing

- INR5,000 if filed after due date but before 31 Dec

- INR 1,000 if total income ≤ INR5 lakh

- Interest u/s 234A, 234B, and 234C may also apply

- Losses (except house property loss) cannot be carried forward if return filed late

Comparison chart of ITR-5, ITR-3, and ITR-4 for AY 2025-26 (FY 2024-25):

| Particulars | ITR-3 | ITR-4 (Sugam) | ITR-5 |

| Who can file | Individuals and HUFs having income from profits & gains of business or profession (other than ITR-4 presumptive scheme), along with other incomes | Individuals, HUFs, and Firms (other than LLP) resident in India with total income up to INR50 lakh, having income from business/profession computed under presumptive taxation (Sections 44AD, 44ADA, 44AE) | Firms, LLPs, AOPs, BOIs, artificial juridical persons, cooperative societies, local authorities, and other entities (except those who are required to file ITR-7) |

| Type of Assessee | Individual / HUF | Individual / HUF / Firm (Non-LLP) | Partnership Firms, LLPs, AOPs, BOIs, etc. |

| Residential Status | Resident or Non-Resident | Resident only | Resident or Non-Resident |

| Income Sources Covered | Salary, House Property, Capital Gains, Business or Profession, Other Sources, Foreign Assets, and income from outside India | Salary, One House Property, Other Sources, and Business/Profession income under presumptive scheme only | Income from Business/Profession, Capital Gains, House Property, Other Sources |

| Turnover / Income Limit | No limit | Total income ≤ INR50 lakh; turnover/gross receipts limit for presumptive scheme applies | No limit |

| Presumptive Taxation | Not applicable (normal books required) | Applicable (44AD, 44ADA, 44AE) | Not applicable (normal books required) |

| Foreign Assets / Income | Allowed, Schedule FA to be filled | Not allowed | Allowed |

| Audit Requirement | If turnover/profit conditions under Section 44AB apply | Only if not following presumptive scheme or conditions violated | If turnover/profit conditions under Section 44AB apply |

| Filing Method | Online or Offline | Online or Offline | Online only |

| Typical Use Case | Individual consultant, trader, professional, or business owner with regular accounting | Small shop owner, small trader, small professional opting for presumptive taxation | LLP, partnership firm, AOP, BOI with any income source except political/religious trust (ITR-7) |

ITR forms (ITR-1, ITR-2, ITR-3, ITR-4) apply for different income types and taxpayer situations for AY 2025-26.

- ITR-1 is for simple resident salaried cases (no foreign income/assets, capital gains, or complex deductions).

- ITR-4 is for presumptive income u/s 44AD, 44ADA, 44AE (resident individuals, HUFs, and firms excluding LLPs) with total income ≤ INR50 lakh, but not for those with foreign assets/income.

- ITR-3 covers individuals/HUFs with business or profession income (non-presumptive).

- ITR-2 is for individuals/HUFs without business income but with more complex scenarios (capital gains, foreign assets, multiple properties, etc.).

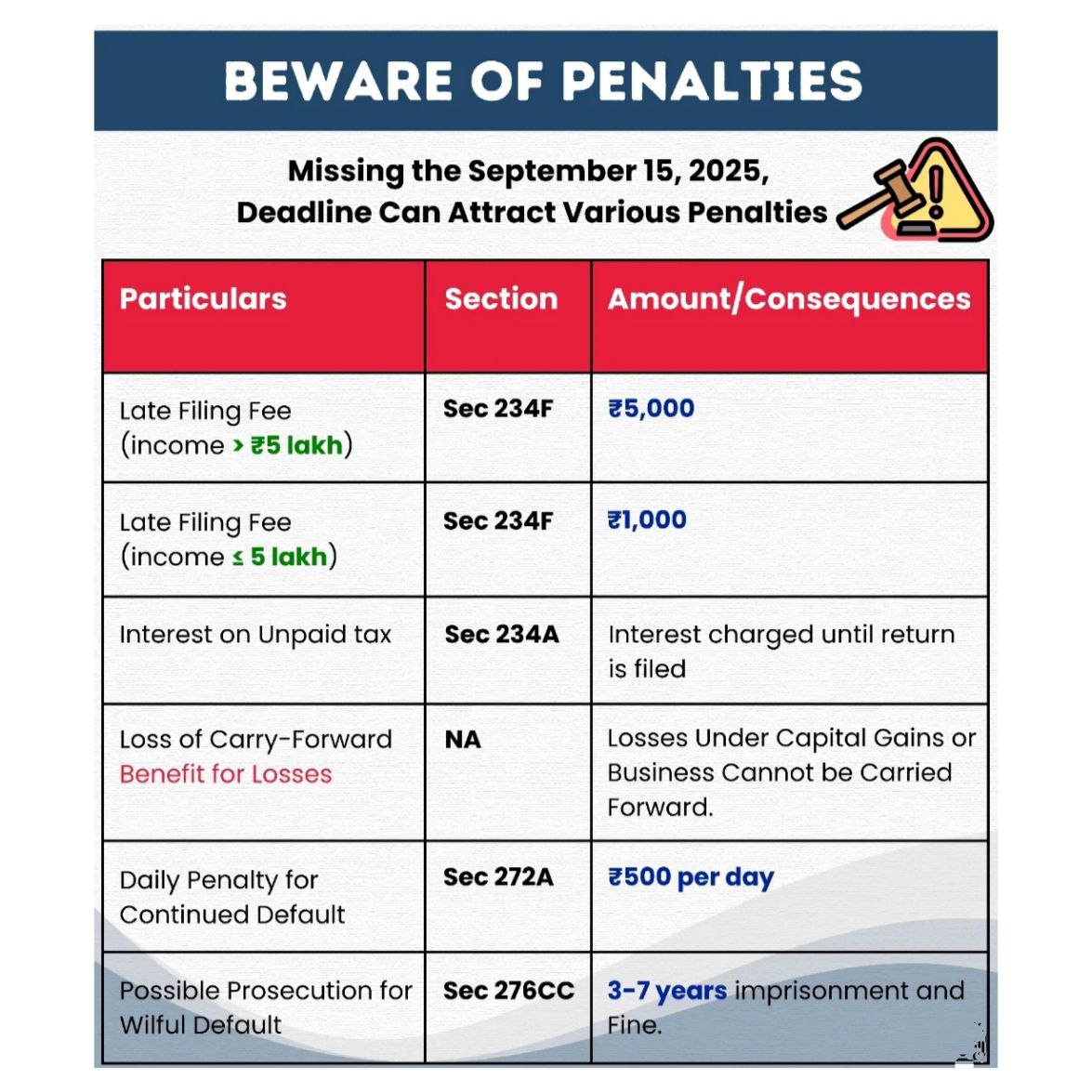

In case we miss the September 15, 2025 filing deadline

Here’s the breakdown:

| Particulars | Section | Amount / Consequences |

|---|---|---|

| Late Filing Fee (income > ₹5 lakh) | Sec 234F | ₹5,000 |

| Late Filing Fee (income ≤ ₹5 lakh) | Sec 234F | ₹1,000 |

| Interest on Unpaid Tax | Sec 234A | Interest charged until return is filed |

| Loss of Carry-Forward Benefit for Losses | NA | Losses under capital gains or business cannot be carried forward |

| Daily Penalty for Continued Default | Sec 272A | ₹500 per day |

| Possible Prosecution for Wilful Default | Sec 276CC | 3–7 years imprisonment and fine |

This table makes it clear that missing the deadline can result in monetary penalties, loss of tax benefits, daily fines, and even jail time in extreme cases.

7 new disclosure requirements for ITR-1 and ITR-4 (AY 2025-26, Old Regime taxpayers):

| Sl. No. | Section / Claim | New Additional Details Required |

| 1 | HRA Exemption – Sec 10(13A) | Place of Work; Actual HRA Received; Actual Rent Paid; Basic Salary + DA; % of Basic Salary (50% for metro / 40% for non-metro). |

| 2 | 80C – PPF, Life Insurance, etc. | Document/Receipt No.; PPF A/c No.; Insurance Policy No. |

| 3 | 80D – Health Insurance | Name of Insurance Company; Policy/Document No. |

| 4 | 80E – Education Loan Interest | Lender Name; Bank Name; Loan A/c No.; Loan Sanction Date; Total Loan Amt; Loan Outstanding as on 31 Mar. |

| 5 | 80EE / 80EEA – Interest on Home Loan | the Lender Name; Bank Name; Loan A/c No.; Loan Sanction Date; Total Loan Amt; Loan Outstanding as on 31 Mar. |

| 6 | 80EEB – Interest on Electric Vehicle Loan | Lender Name; Bank Name; Loan A/c No.; Loan Sanction Date; Total Loan Amt; Loan Outstanding as on 31 Mar. |

| 7 | 80DDB – Specified Diseases | Name of the specified disease. |

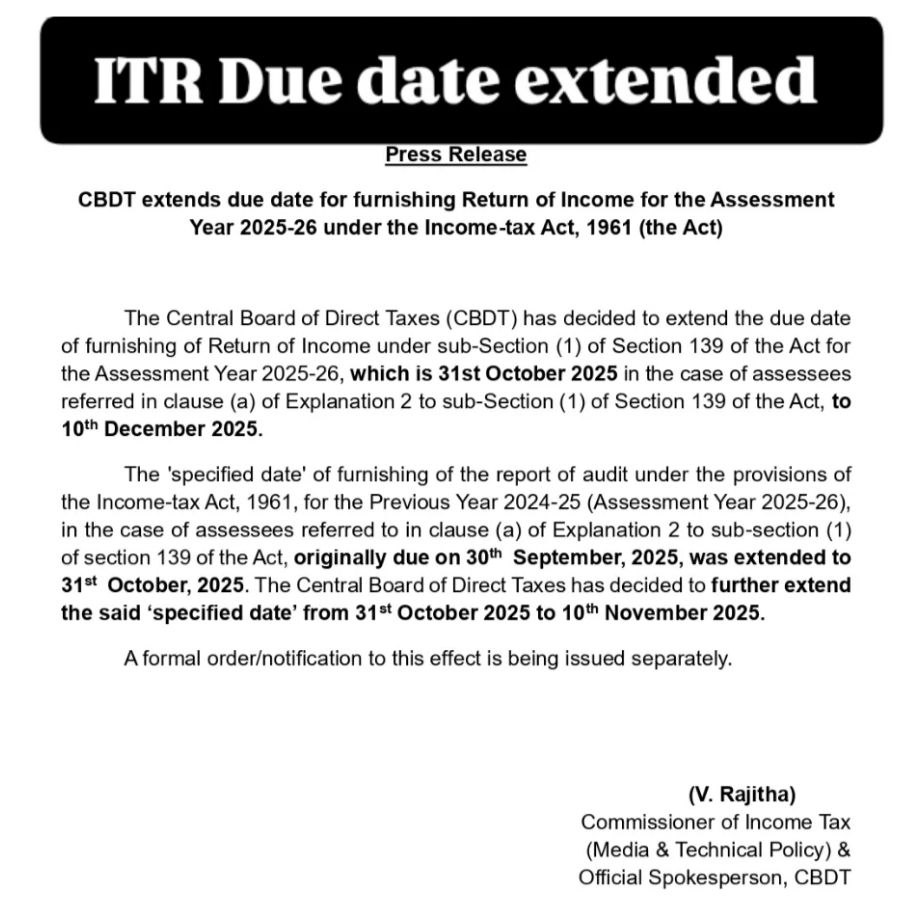

CBDT announcing an extension of due dates for filing ITR and audit reports for AY 2025-26

New press release from the Central Board of Direct Taxes announcing an extension of due dates for filing Income Tax Returns (ITR) and audit reports for Assessment Year 2025-26 under the Income-tax Act, 1961. Here are the key details:

✅ ITR Filing Due Date Extended

- Original Due Date: 31st October 2025

- Extended Due Date: 10th December 2025

- Applies to assessees covered under Section 139(1) and clause (a) of Explanation 2 to sub-Section (1) of Section 139.

✅ Audit Report Filing Due Date Extended

- Original Due Date: 30th September 2025

- First Extension: 31st October 2025

- Further Extended To: 10th November 2025

- Applies to assessees under provisions of Section 139 for Previous Year 2024-25 (AY 2025-26).