Important tax rules for Futures & Options & Intraday Trading

Page Contents

Important tax rules for F&O (Futures & Options) and Intraday Trading

Why Must Gains or Losses from F&O Be Reported in ITR?

- Mandatory Compliance: Income tax authorities have full access to trading data through exchanges. Non-disclosure may trigger notices and penalties.

- Tax Optimization: Reporting losses allows you to set them off against other incomes and carry forward for future tax benefits.

- F&O income falls under non-speculative business income, per Section 43(5) of the Income Tax Act.

Which ITR Form to File for F&O Income?

| Situation | Applicable ITR |

| Regular reporting (with books) | ITR-3 |

| Opting for presumptive taxation (Sec 44AD) | ITR-4 |

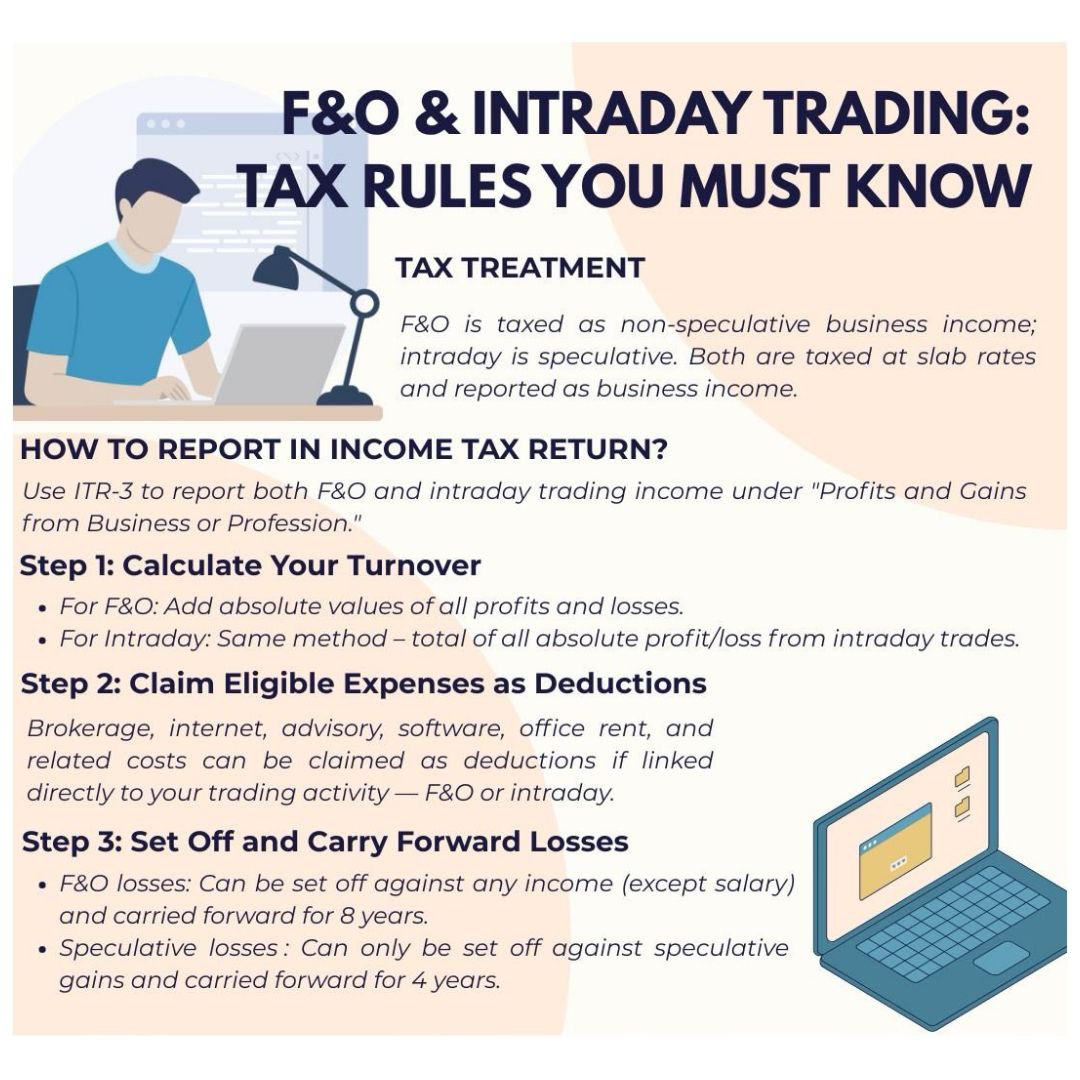

Tax Treatment in case of F&O (Futures & Options) and Intraday Trading

- F&O Trading: Treated as non-speculative business income.

- Intraday Trading: Treated as speculative business income.

- Taxed at applicable slab rates.

- Reported under “Profits and Gains from Business or Profession” in ITR-3. Use ITR-3 if you have F&O or Intraday income.

How to Report F&O (Futures & Options) and Intraday Trading in ITR?

Step 1: Calculate Turnover

- Turnover = Absolute Profit/Loss (sum of all positive & negative trade results).

- For options: Ignore premium for turnover post AY 2022-23 as per revised guidance.

Step 2: Claim Business Expenses (If not using presumptive)

- Brokerage, internet, advisory fees, trading software, rent, telephone, etc.

- Cash expenses > INR 10,000 are disallowed.

- Maintain receipts & digital proofs.

- Condition: Must be reasonable, well-documented, and exclusively related to trading.

Step 3: Set Off and Carry Forward Losses

| Type of Loss | Set Off Against | Carry Forward Period |

| F&O Losses (Non-Speculative) | Any income except salary | 8 years |

| Intraday Losses (Speculative) | Only against speculative income | 4 years |

Tax Audit Applicability for F&O Traders

Under Section 44AB:

| Criteria | Audit Requirement |

| Turnover > INR 10 crore | Audit mandatory |

| Turnover between INR 1 crore – INR 10 crore and cash transactions >5% | Audit mandatory |

| Turnover ≤ INR 2 crore, profit <6%, opted out of 44AD in last 5 yrs, total income > exemption limit | Audit mandatory |

| Declaring ≥6% profit digitally under Sec 44AD | No audit required |

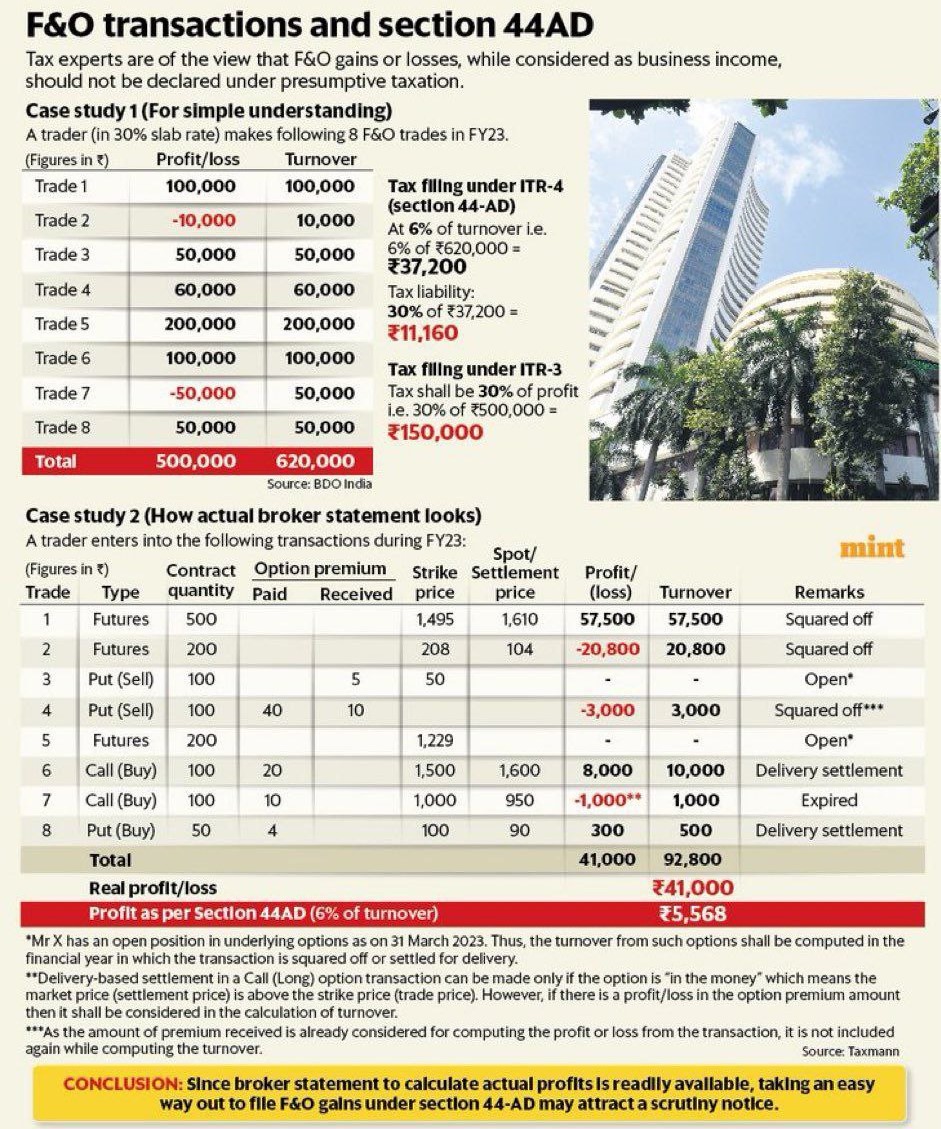

Presumptive Tax Scheme (Section 44AD)in case F&O (Futures & Options) and Intraday Trading

- Declare 6% of turnover as income if mostly digital.

- No need to maintain books or audit.

- If opted out after using, can’t re-enter for 5 years (Sec 44AD(4)).

Advance Tax Liability in case of F&O (Futures & Options) and Intraday Trading :

Yes, F&O traders must pay advance tax if their total tax liability exceeds INR 10,000 in a financial year, in four installments (15 June, 15 Sept, 15 Dec, 15 Mar). Taxpayer required to maintain books of accounts. Consider auditing requirements (if turnover > INR 10 crores or profit < 6%/8%). Use Form 3CD + 3CB or 3CA if audit is applicable.

Books of Accounts (If not under 44AD) applicable in case of F&O (Futures & Options) and Intraday Trading

Maintain:

- Trading account statements

- P&L statement

- Expense vouchers

- Bank statements

- Broker contract notes

New vs Old Tax Regime for F&O Traders

| Criteria | Old Regime | New Regime |

| Business expense deduction | Yes | No |

| 80C/80D deductions | Yes | No |

| Reversal | Can revert anytime | Can switch back only once in lifetime (Form 10-IEA) |

Budget 2024: STT on F&O Increased

- Futures STT: Now 0.02%

- Options STT: Now 0.1%

Frequently Asked Questions on F&O (Futures & Options) and Intraday Trading

| Question | Answer |

| Do I have to file ITR for F&O even if in loss? | Yes, especially to carry forward losses |

| Is Tax Audit mandatory? | Depends on turnover, profit %, and mode of transactions |

| Can F&O losses be carried forward under new regime? | Yes, only if ITR is filed on time |

| Which business code to use? | Use Code 09001 – Trading in derivatives (F&O) |

| Can F&O traders use presumptive taxation? | Yes, if turnover ≤ INR 2 crore and opting for Sec 44AD |