Eligible/ Ineligible expenses while calculating Capital Gain

Page Contents

Eligible & Ineligible expenses while calculating Capital Gain

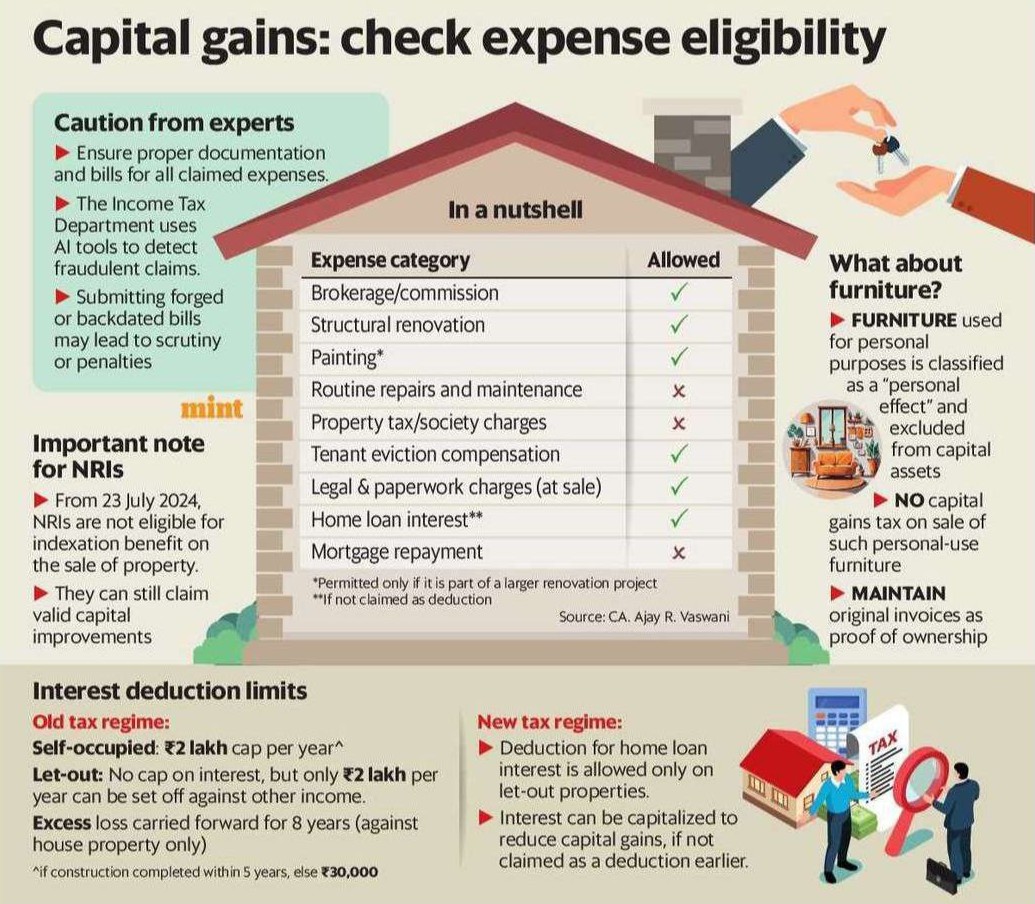

Overview of eligible and ineligible expenses while calculating Capital Gains on property sales and highlights specific rules for NRIs and under different tax regimes.

Eligible Expenses (Allowed for Capital Gains Calculation)

These can be added to the cost of acquisition/improvement:

-

Brokerage/Commission

-

Structural Renovation (if part of a larger project)

-

Painting (if part of a renovation project)

-

Legal & Paperwork Charges (at sale)

-

Home Loan Interest (if not already claimed as a deduction)

| Expense Category | Eligibility | Remarks |

|---|---|---|

| Brokerage/Commission | Allowed | Paid at the time of sale |

| Structural Renovation | Allowed | Permitted only if it is part of a larger renovation project |

| Painting | Allowed | Allowed only if part of major renovation |

| Legal & Paperwork Charges (at sale) | Allowed | Includes registration/legal fees at time of sale |

| Home Loan Interest | Allowed* | Only if not claimed earlier as a deduction (under Section 24) |

Ineligible Expenses (Not Allowable for Capital Gains Calculation)

These cannot be claimed for capital gains:

-

Routine repairs and maintenance

-

Property tax/society charges

-

Tenant eviction compensation

-

Mortgage repayment

These cannot be claimed to reduce capital gains

| Expense Category | Eligibility | Reason |

|---|---|---|

| Routine Repairs & Maintenance | Not Allowed | Considered revenue expense, not capital in nature |

| Property Tax/Society Charges | Not Allowed | Operational expense, not part of acquisition/improvement |

| Tenant Eviction Compensation | Not Allowed | Treated as personal or administrative |

| Mortgage Repayment (Principal) | Not Allowed | Only interest (if not deducted) may be allowed |

Important Note for NRIs (from 23 July 2024 onwards)

-

No Indexation Benefit on property sale.

-

But NRIs can still claim valid capital improvements with documentation.

Furniture: What to Note

-

Furniture used for personal purposes is a “personal effect”.

-

Excluded from capital assets.

-

No capital gains tax on such furniture.

-

However, maintain original invoices as proof of ownership.

Interest Deduction Rules

Old Tax Regime:

-

Self-occupied: ₹2 lakh cap/year on interest.

-

Let-out: No cap on interest, but only ₹2 lakh/year can be set off against other income.

-

Excess loss: Can be carried forward for 8 years (house property income only).

-

If construction not completed within 5 years → limit drops to ₹30,000.

New Tax Regime:

-

Interest deduction allowed only for let-out properties.

-

Home loan interest can be capitalized to reduce capital gains if not already claimed as a deduction.

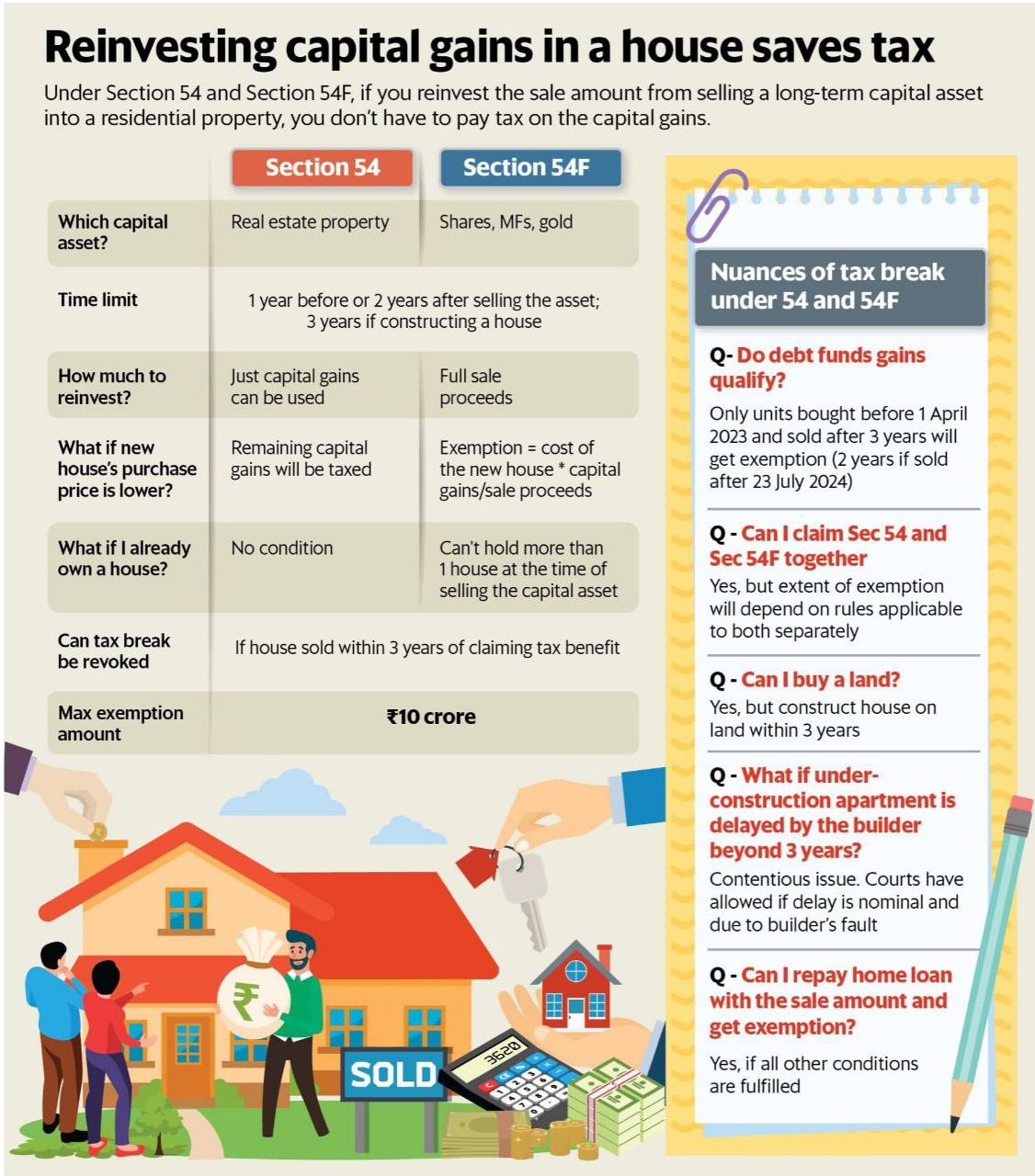

How reinvesting capital gains in a house can save tax u/s 54 & 54F of the Income Tax Act.

Section 54 vs Section 54F

| Aspect | Section 54 | Section 54F |

|---|---|---|

| Applicable to | Sale of real estate property | Sale of shares, mutual funds, gold, etc. |

| Time Limit | 1 year before or 2 years after selling the asset; 3 years if constructing a house | Same |

| Amount to Reinvest | Only capital gains | Full sale proceeds |

| If new house price is lower | Remaining capital gains taxed | Exemption = cost of new house × capital gains ÷ sale proceeds |

| Condition on owning house | No restriction | Cannot hold more than one house at time of sale |

| Revocation | If house sold within 3 years of claiming benefit | Same |

| Max exemption | INR 10 crore | INR 10 crore |

FAQs related to reinvesting capital gains in a house can save tax u/s 54 & 54F

Q.1: Do debt funds qualify?

Yes, if bought after April 1, 2023 and sold after 3 years (or 2 years if sold after July 23, 2024).

Q.2: Can I claim both Sec 54 & 54F?

Yes, but subject to conditions.

Q.3: Can I buy land?

Yes, but must construct house within 3 years.

Q.4: Under-construction delay beyond 3 years?

Courts allow if delay is builder’s fault.

Q.5: Can I repay home loan with sale amount?

Yes, if other conditions are met.

Q.6: How This Links to Your LTCG Strategy

If you have a large LTCG from mutual funds, instead of paying 12.5% tax, you can invest full sale proceeds in a residential property under Section 54F. This is especially useful if gains exceed the INR 1.25 lakh exemption limit. and You plan to buy or construct a house anyway. Taxpayer must follow the caution as mentioned below:

-

- You must invest entire sale proceeds, not just gains, for Section 54F.

- Lock-in: Cannot sell the new house within 3 years.

- If you already own more than one house, Section 54F benefit is not available.