How income from house property is taxed in India

Page Contents

How income from house property is taxed in India under the Income Tax Act.

Income from House Property – Section 22 to 27 (Overview)

Basic Conditions to Qualify as Income from House Property:

Income is taxable under “Income from House Property” if you are the owner (legal or deemed) of the property. The property includes buildings or land appurtenant thereto, not vacant land alone. & The property is not used by you for your own business/profession. Conditions for Taxability are mention here under :

- Income must be rental/lease-based (lumpsum or periodic).

- Must relate to a building (residential/commercial) — not just land.

- Ownership of the property is essential (including deemed ownership).

- Property must not be used for business (if renting is your business, it’s business income).

- Property can be self-occupied or let out — both are covered.

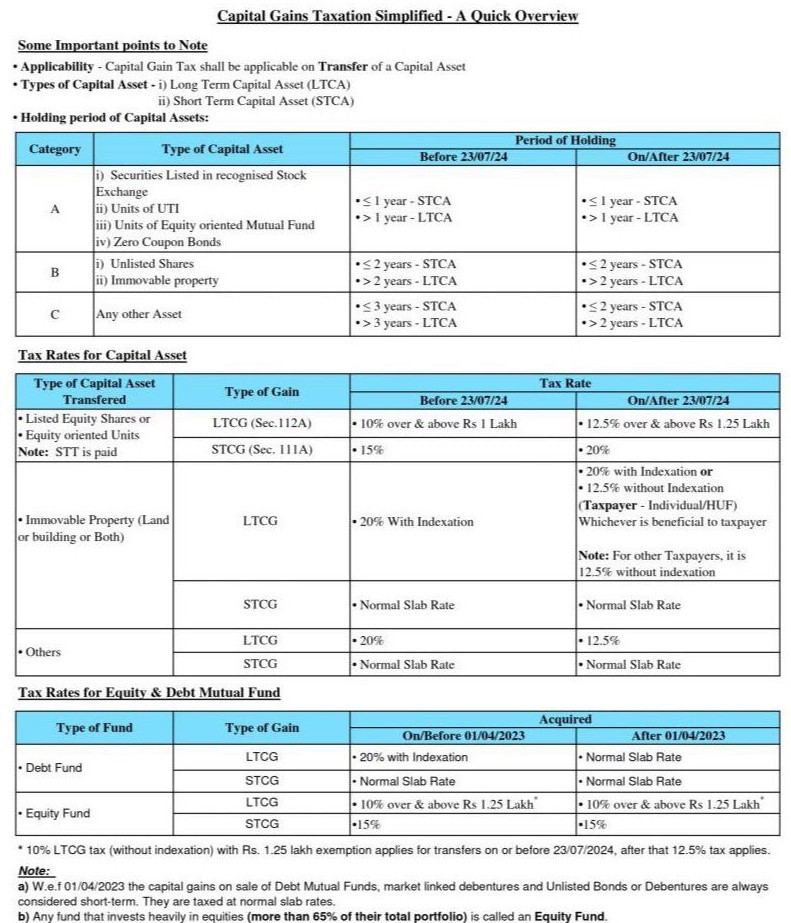

Types of House Property & Tax Treatment

| Property Type | Taxability |

| Self-Occupied | GAV = Nil (Max 2 properties allowed as self-occupied) |

| Let-Out | GAV = Actual Rent or Expected Rent, whichever is higher |

| Deemed Let-Out | Applies when more than 2 properties are self-occupied |

| Income from vacant land | Income from vacant land is taxed under “Income from Other Sources |

Classification of House Property

| Type | Description | Tax Treatment | |||

| Self-Occupied | Used by owner/family or vacant | GAV = Nil (max 2 allowed) | |||

| Let Out | Rented wholly or partly | GAV = Actual Rent Received | |||

| Deemed Let Out | More than 2 properties, even if vacant | GAV = Expected Rent | |||

| Used for Business | Not taxed under this head | ||||

Deemed Ownership – Section 27

You are treated as the deemed owner if:

- The owner of the property transferred the property to a spouse/minor child (other than for adequate consideration).

- Txapaer hold property which can’t be divided.

- The owner are an allottee under a co-op society.

- owner possess a property under Section 53A of the Transfer of Property Act.

- Txapaer have a leasehold interest for over 12 years.

Computation of Income from House Property :

Step-by-Step Calculation:

- Compute Gross Annual Value (GAV)

- Higher of (Fair Rent vs Municipal Rent), subject to Standard Rent

- Compare Expected Rent with Actual Rent → GAV is higher of the two

- Deduct Municipal Taxes (if paid by owner) : Net Annual Value (NAV) = GAV – Municipal Taxes

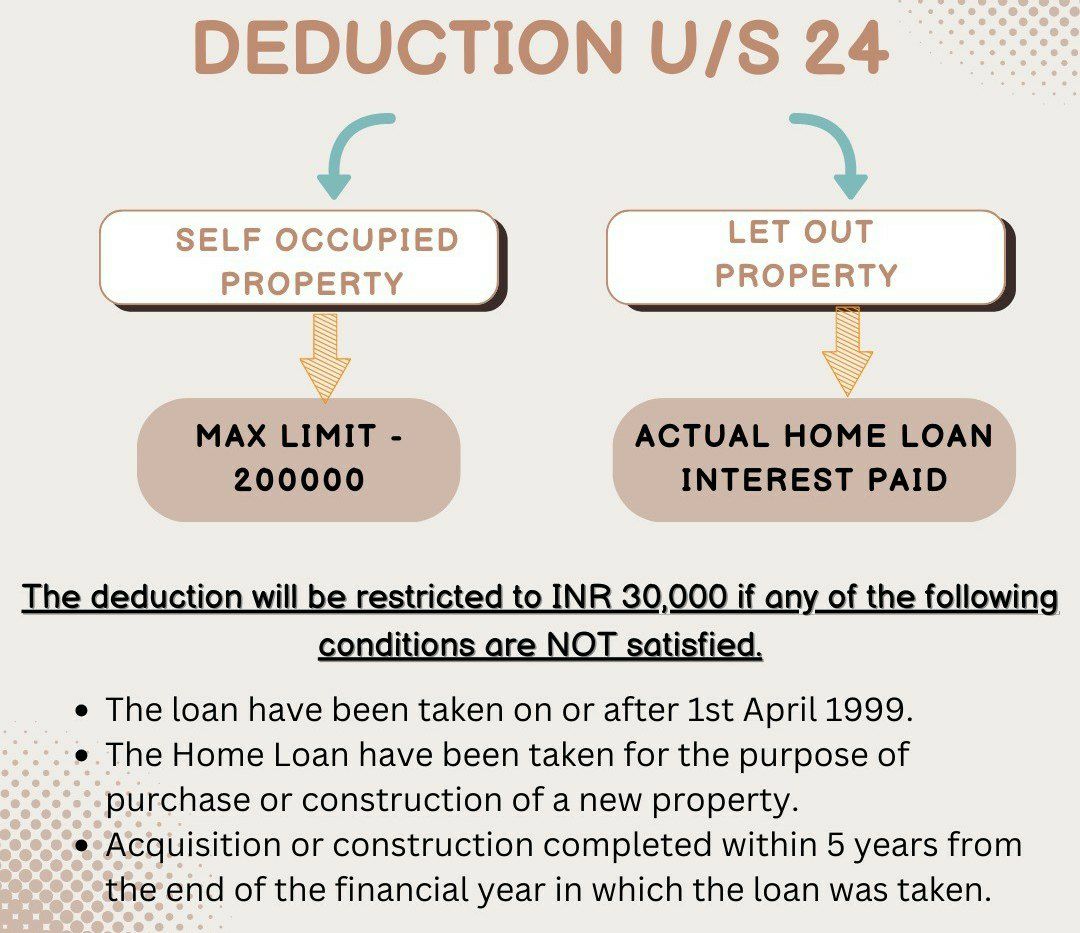

- Apply Standard Deduction (30% of NAV) : Deduction under Sec 24(a) = 30% of NAV

- Deduct Interest on Home Loan [Sec 24(b)] : Max INR 2,00,000 (Self-occupied, subject to conditions)

- No limit (Let-out property)

- Income from House Property = NAV – 30% – Interest

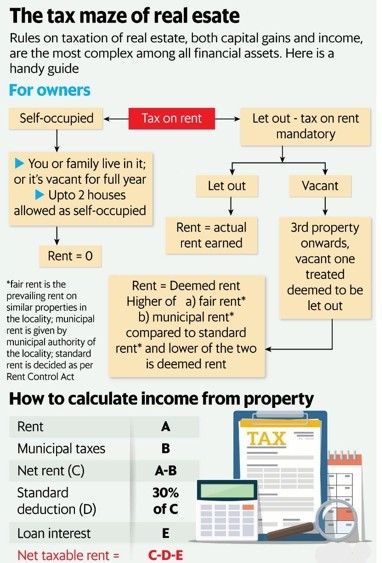

For Owners: Property usage determines taxability

Self-Occupied Properties : Definition: You or your family live in the house, or it’s vacant for the entire year. The following tax treatments are mentioned here:

-

- Up to 2 properties can be treated as self-occupied.

- Annual value (rent) = INR 0 → No tax on notional rent.

Let Out Properties : Tax on rent is mandatory & Rent = Actual rent received or receivable.

Vacant Properties : If you own more than 2 houses, the 3rd property onwards, even if vacant, is deemed to be let out.

Deemed Rent Calculation: If a house is not actually let out but is considered as let out (like the 3rd house), then Deemed Rent = Lower of Standard Rent (as per Rent Control Act) and Higher of Fair Rent (prevailing rent in locality) & Municipal Rent (decided by municipal authority)

Key Points

- Only two houses can be treated as self-occupied.

- Vacant 3rd house onwards → Deemed let out → Taxed on notional rent.

- You can claim interest deduction even on deemed let out property.

- Standard deduction of 30% is automatic—no bills required.

How to Calculate Taxable Income from House Property

| Component | Symbol | Description |

| Actual Rent/Deemed Rent | A | Total rent earned (or notional for deemed let out) |

| Municipal Taxes Paid | B | Allowed as deduction (only if paid by owner) |

| Net Rent | C | A – B |

| Standard Deduction (30%) | D | 30% of C |

| Interest on Home Loan | E | Interest paid on borrowed capital |

| Net Taxable Income | C – D – E |

Example : Let’s say:

- Rent received = INR 6,00,000 (A)

- Municipal taxes = INR 50,000 (B)

- Loan interest = INR 2,00,000 (E)

Then:

- Net Rent (C) = 6,00,000 – 50,000 = INR 5,50,000

- Standard Deduction (D) = 30% of 5,50,000 = INR 1,65,000

- Net Taxable = 5,50,000 – 1,65,000 – 2,00,000 = INR 1,85,000

Deductions for Home Loans

| Deduction | Section | Limit | Applicable On |

| Interest on Loan | 24(b) | INR 2 lakh (SO) / Full (LO) | Post & pre-construction |

| Principal Repayment | 80C | INR 1.5 lakh | Self-occupied only |

| Stamp Duty/Registration | 80C | INR 1.5 lakh | Same FY as payment |

| Additional Interest | 80EEA | INR 1.5 lakh | For property ≤ INR 45 lakh (conditions apply) |

| First-Time Buyer | 80EE | INR 50,000 | For loans sanctioned before 31.03.2017 |

Deductions Under Old vs New Tax Regime

| Regime | Self-Occupied | Let-Out |

| Old Regime | Interest up to INR 2 lakh + 80C benefits | Interest allowed (no limit) |

| New Regime (115BAC) | No interest or 80C deductions | Interest allowed only for let-out |

Loss from House Property

- Max set-off against other income: INR 2 lakhs (Old regime only)

- Carry Forward: Allowed up to 8 years (only under “House Property” head)

- New Regime: No set-off or carry forward allowed.

Tax Planning Special Cases on Income from House Property

- Mixed Use Property (e.g. Residence + Office) : Split the property proportionately and calculate income accordingly.

- Pre-construction Interest : Interest during construction can be claimed in 5 equal instalments starting from year of completion.

- Let out vacant houses to avoid deemed rental income.

- Structure ownership of multiple properties to optimize self-occupied status.

- Claim both HRA and loan deductions if residing in rented home while owning a separate property.

- Joint Ownership: Each co-owner can claim then Interest deduction: up to INR 2 lakh & 80C principal + stamp duty/registration: up to INR 1.5 lakh (in proportion to ownership & payment made). It is to be noted that Joint ownership reduces taxable income burden. Following are Joint Owners – Tax Benefits

| Scenario | Deduction Allowed |

| Both co-owners & co-borrowers | Both can claim up to INR 2 lakh (interest) + INR 1.5 lakh (80C) in their ownership ratio |

| Co-borrowers but not owners | Not eligible for any deduction |

| the Co-owners but not co-borrowers | No interest deduction; only 80C proportionally |

| Neither | Only owner who pays can claim, subject to actual payment |

Summarized FAQs on Income from House Propert

Q.1. Can sub-letting income be treated as house property income?

Ans. No. It is taxed under “Income from Other Sources”.

Q.2 Can I claim deduction on interest from friend/relative loans?

Ans. Yes, if the loan is for purchase/construction and proof exists.

Q.3 Paid municipal tax in April 2025 for FY 2024–25?

Ans. Allowed, since paid within the relevant financial year.

Q.4. 6 properties let out?

Ams. Compute income individually for each, then aggregate.

Q.5. Can I claim both HRA and home loan deduction?

Ans. Yes, under certain conditions.

Q.6. Is rent from property taxable?

Ans. Yes, under “Income from House Property”. Taxable if GAV > ₹2.5 lakh (basic exemption limit).

Q.7. Can income be negative?

Ans. Yes, due to interest deductions, especially for self-occupied properties.

Q8: Is HRA + Home Loan deduction both allowed?

Ans. Yes, if you stay in rented house and own another elsewhere.

Q.9. Can I claim deduction for under-construction property?

Ans. Yes, interest during construction is claimable post-completion in 5 equal installments.

Q.10. What is the interest limit under Section 24?

Ans. INR 2 lakh (Self-occupied) & No limit (Let-out) also ₹30,000 (Loan for repairs)

Important Terms in on Income from House Property above

| Term | Meaning |

| Municipal Value | Valuation for municipal tax purposes |

| Fair Rent | Rent of similar property in area |

| Standard Rent | Rent fixed under Rent Control Act |

| GAV | Higher of expected/actual rent (with standard rent cap) |

| NAV | GAV – Municipal taxes paid |

| Standard Deduction | 30% of NAV |