Capital Gain Exemption- Investment in NHAI/REC/PFC/IRFC Bond

Page Contents

Investment in NHAI, REC, PFC, & IRFC Bonds For Capital Gain Exemption U/s 54EC

Section 54EC of the Income Tax Act allows income tax taxpayers to claim an exemption on long-term capital gains arising from the sale of land, buildings, or both by investing in specified 54EC Capital Gain Bonds. If a person has sold a capital asset in March 2025 and wants to claim exemption under Section 54EC, they do not need to deposit the amount in the Capital Gains Account Scheme by 31.03.2025. They can directly invest in 54EC bonds within six months from the date of transfer of the capital asset. Here are key features of Capital Gain investment in NHAI, REC, PFC, or IRFC u/s 54EC bonds investment:

U/s 54EC bonds investment Eligibility:

Capital Gain Exemption u/s 54EC Available to individuals, Hindu Undivided Families (HUFs), companies, and other taxpayers who have sold a long-term capital asset (land/building). The taxpayer must invest the capital gains (not the entire sale proceeds). Eligible Issuers under Capital Gain Exemption u/s 54EC

-

- NHAI (National Highways Authority of India)

- REC (Rural Electrification Corporation)

- PFC (Power Finance Corporation)

- IRFC (Indian Railway Finance Corporation)

Investment Deadline: Capital Gain Exemption u/s 54EC can be made within 6 months from the date of sale of the capital asset. The investment must be made within six months from the date of transfer of the long-term capital asset

Maximum Investment Limit: INR 50 lakh per FY. The exemption is available for up to INR 50 lakh in a financial year.

Taxability of Interest: Interest earned (typically 5.25% per annum) is taxable under “Income from Other Sources”. No TDS deducted, but tax liability exists based on the investor’s tax slab.

No Requirement to Use CGAS: Unlike Sections 54 and 54F, where CGAS is required if reinvestment is not done before the due date of filing ITR, Section 54EC does not require a CGAS deposit.

Lock-in Period: 5 years (Previously 3 years, but extended to 5 years from FY 2018-19). The investment in NHAI, REC, PFC, or IRFC 54EC bonds must be held for five years to retain the exemption. Example: If a person sells a property on 15th March 2025, they have time until 14th September 2025 to invest in 54EC bonds. No need to deposit in Capital Gains Account Scheme by 31st March 2025.

Who Should Invest in 54EC Bonds?

Investors with long-term capital gains from land/buildings who do not want to reinvest in another property.

-

- Those looking for a safe, government-backed investment with steady interest (but lower returns compared to real estate).

- Taxpayers nearing the due date for capital gains investment who want a hassle-free alternative to real estate purchases.

Premature Withdrawal: Not allowed before 5 years. If sold before 5 years, capital gains exemption is revoked, and gains become taxable in the year of sale.

Exemption Calculation: Exemption = Investment in 54EC Bonds (up to ₹50 lakh) or Capital Gains, whichever is lower.

Question: If someone sells a capital asset in March 2025 and wishes to invest in 54EC bonds, do they need to deposit the amount in the Capital Gains Account Scheme (CGAS) by 31.03.2025, or can they directly invest in 54EC bonds within six months?

Answer: No, they do not need to deposit the capital gains into the Capital Gains Account Scheme (CGAS) if they are opting for exemption u/s 54EC. Section 54EC is distinct and independent from Sections 54 & 54F, which require investment in residential property and may need CGAS if the reinvestment is not immediate.

U/s 54EC, the entire capital gain (up to INR 50 lakhs) must be invested in specified bonds (e.g., REC, PFC, IRFC, NHAI). The investment must be made within 6 months from the date of transfer of the capital asset. There is no requirement to park the capital gains in the CGAS before investing. Example: If the asset was sold on 15th March 2025, the investment in 54EC bonds can be made anytime up to 14th September 2025, directly, without using the CGAS route.

Comparison of Section 54 vs. Section 54F vs. Section 54EC

| Criteria | Section 54 | Section 54F | Section 54EC |

| Applicable to | Sale of a residential house property | Sale of any capital asset other than a residential house (e.g., land, commercial property, shares) | Sale of any long-term capital asset (land, building, or both) |

| Type of Exemption | Exemption on capital gains | Exemption on net sale consideration | Exemption on capital gains |

| Reinvestment Required | Purchase or construction of a new residential house | Purchase or construction of a new residential house | Investment in 54EC bonds issued by NHAI, REC, PFC, or IRFC |

Time Limit for Investment |

Purchase: Within 1 year before or 2 years after the sale date. Construction: Within 3 years after the sale |

Purchase: Within 1 year before or 2 years after the sale date. Construction: Within 3 years after the sale |

Within 6 months from the date of sale |

| Utilization of Capital Gains Account Scheme if investment not made before ITR filing deadline? | Required if new house is not purchased/constructed before ITR filing due date | Required if new house is not purchased/constructed before ITR filing due date | Not Required |

| Holding Period of New Asset | 3 years | 3 years | 5 years |

Exemption Amount |

Capital Gain Amount is exempt to the extent of investment in a new house | Entire capital gain exempt only if 100% of sale proceeds are reinvested in a new house. Otherwise, proportionate exemption is allowed. | Exemption is limited to ₹50 lakh per financial year |

| Consequences of Selling New Asset Before Holding Period | Exemption is revoked, and the capital gains become taxable | Exemption is revoked, and the capital gains become taxable | Exemption is revoked if bonds are sold before 5 years |

| Reinvestment Allowed in Multiple Assets? | Allowed (subject to conditions) | Allowed (only one residential house in India) | Not applicable (only 54EC bonds) |

| Who Should Opt for This? | Best for homeowners reinvesting in a new house | Best for non-homeowners selling other assets and buying a house | Best for those wanting fixed returns without buying property |

Section 54F exemption withdrawal scenario due to violation of the 3-year holding condition. :

Issue 1: What should be the “Date of Accrual?

- When Section 54F exemption is withdrawn due to the transfer of the new asset within 3 years, the capital gain becomes “deemed to be long-term capital gain” of the year in which the new asset is transferred.

- Therefore, the date of Accrual = Date of transfer of the new asset (i.e., residential house property sold before 3 years) & Not the date of transfer of the original asset (unlisted shares)

- Why? Because the gain is deemed to arise in the year of violation (i.e., sale of new asset), not when the original asset was sold.

Issue 2: What should be the type of capital gain?

- In your case The original asset was unlisted equity shares (sold in FY 2022–23), LTCG was earlier exempt under Section 54F. Now that the new house is sold before 3 years, the exemption is revoked, and the previous LTCG becomes taxable in the year of violation (FY 2024–25 / AY 2025–26).

- Taxability : As per Budget 2024 changes (if applicable for this AY), the LTCG on unlisted shares may be taxable at 12.5% (instead of 20%) if held > 24 months, and only for residents. But since this is a deemed LTCG, arising due to Section 54F violation, it retains its original nature (i.e., LTCG on unlisted shares).

- In ITR Utility: Report this under “Long-Term Capital Gain for Unlisted Equity Shares., Choose an appropriate schedule—typically Schedule CG > B4, and the rate should be updated as per AY 2025–26 utility. If utility offers a 12.5% option, select it. Else, go with 20%, and revise later if clarification emerges

Where to Report in the ITR Utility?

-

Schedule CG (Capital Gains) → Long-Term Capital Gains (item B4),

-

Fill: Original Date of Transfer: Transfer date of unlisted shares

-

Deemed Date of Accrual: Transfer date of new house

-

Cost of Acquisition / Sale: As per original computation

-

Exemption Claimed Earlier: Show as withdrawn now

-

Net LTCG: Amount previously exempt now deemed taxable

-

| Particulars | Value / Response |

|---|---|

| Date of Accrual | Date of sale of new residential asset |

| Nature of Capital Gain | Long-Term Capital Gain |

| Type of Asset | Unlisted Equity Shares |

| Tax Rate | 12.5% or 20% (check utility) |

| Schedule in ITR | Schedule CG – Item B4 or B8 |

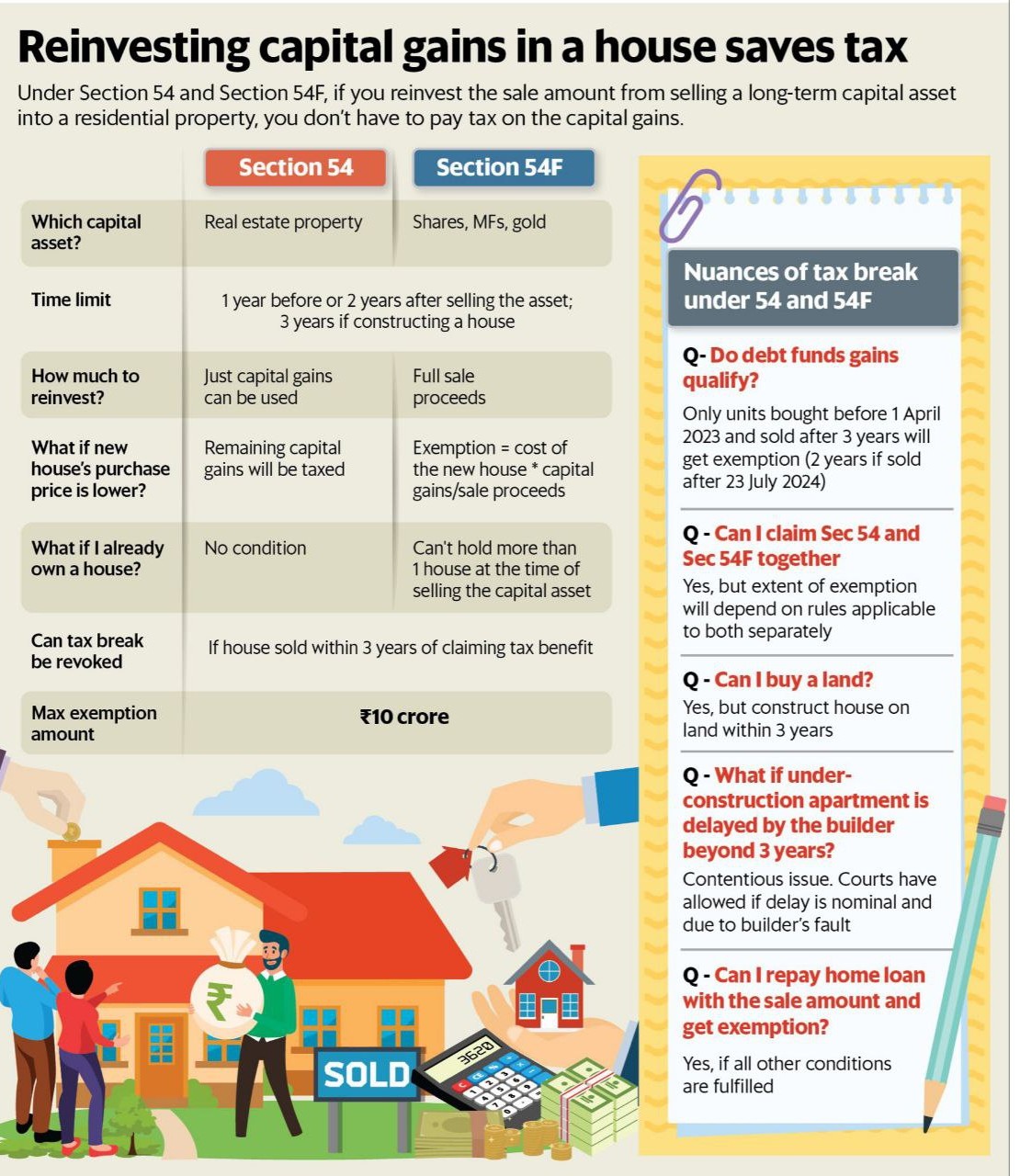

How reinvesting capital gains in a house can help save tax under Section 54 & 54F

Section 54: Applies when you sell real estate property. & Section 54F: Applies when you sell shares, mutual funds, gold, or other long-term capital assets. If you sell a long-term asset and reinvest in a residential property within the specified time frame, you can avoid paying tax on capital gains. However:

- Ensure compliance with ownership restrictions under Sec 54F.

- Keep track of timelines (1 year before, 2 years after, or 3 years for construction).

- Maximum exemption is INR 10 crore.

Following Conditions & Limits are mention here under :

| Aspect | Section 54 | Section 54F |

|---|---|---|

| Which capital asset? | Real estate property | Shares, MFs, gold |

| Time limit | 1 year before or 2 years after selling the asset; 3 years if constructing a house | Same |

| How much to reinvest? | Just capital gains | Full sale proceeds |

| If new house price is lower? | Remaining capital gains taxed | Exemption = cost of new house × capital gains ÷ sale proceeds |

| Already own a house? | No restriction | Cannot own more than 1 house at time of sale |

| Can tax break be revoked? | Yes, if house sold within 3 years | Same |

| Max exemption | INR 10 crore | INR 10 crore |

Summary of Key Differences 54 vs. 54F vs. 54EC

- Section 54 applies only to sellers of residential houses.

- Under Section 54F applies to sellers of any other asset who reinvest in a residential house.

- Section 54EC applies to any long-term capital asset but requires investment in specified bonds instead of property

FAQ related to 54 vs. 54F vs. 54EC & Nuances of Tax Break

Q.1: Debt fund gains qualify?

Ans. Yes, if bought before April 1, 2023 and sold after 3 years (with exemption till July 23, 2024).

Q.2: Can claim both Sec 54 & Sec 54F together?

Ans. Yes, but each exemption applies to its respective asset.

Q.3: Can buy land?

Ans. Yes, but must construct a house within 3 years.

Q.4: If under-construction apartment delayed beyond 3 years?

Ans . Courts allow relief if delay is beyond your control.

Q.5: Can repay home loan with sale amount and get exemption?

Ans. Yes, if all other conditions are met.