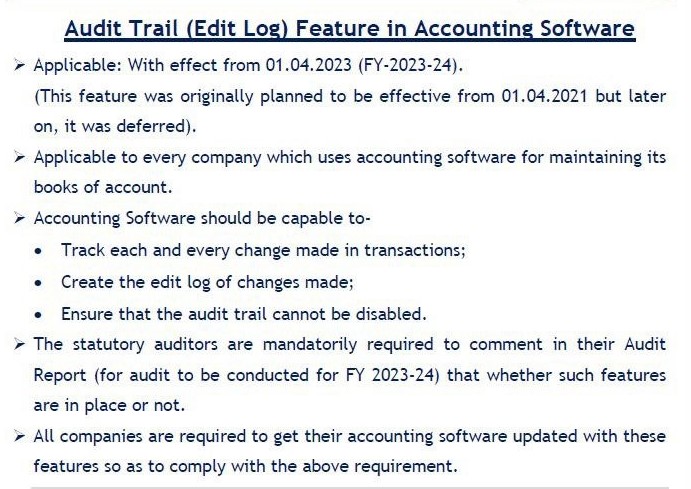

Penalties : MCA Notification on Audit Trail w.e.f 1-04-2023

Page Contents

What is Penalties for Non-compliance of MCA Notification on Audit Trail (Edit Log) w.e.f 1st April 2023

The penalties for non-adherence to the MCA Notification on Audit Trail (Edit Log), effective from April 1, 2023, are stringent and cover companies, their officers, and auditors.

For Companies:

- Penalty for Non-Compliance (Section 128(5)): A company failing to comply with audit trail requirements may face fines ranging from ₹50,000 to ₹5,00,000. Further Penalties: Continued non-compliance may lead to additional penalties as per the Companies Act, 2013, particularly for issues like tampering with financial records or inaccurate reporting.

For Directors/CFO/Authorized Personnel:

- Responsible officers, including the Managing Director and CFO, may face fines from ₹50,000 to ₹5,00,000 for non-compliance. In severe, willful cases, officers could also face imprisonment of up to 1 year alongside financial penalties.

For Auditors:

- Penalty for Non-Compliance (Section 147(2)): If an auditor fails to report non-compliance or certifies inaccurate financial statements, they may face fines ranging from ₹25,000 to ₹5,00,000 or four times their remuneration, whichever is less. Persistent non-compliance may result in disciplinary action by ICAI, potentially leading to suspension of the auditor’s license to practice.

Conclusion:

Non-compliance with the MCA’s audit trail notification poses serious consequences, including significant fines, personal liabilities, imprisonment, or professional disqualification. Companies must ensure their accounting software complies with these requirements to avoid such penalties.

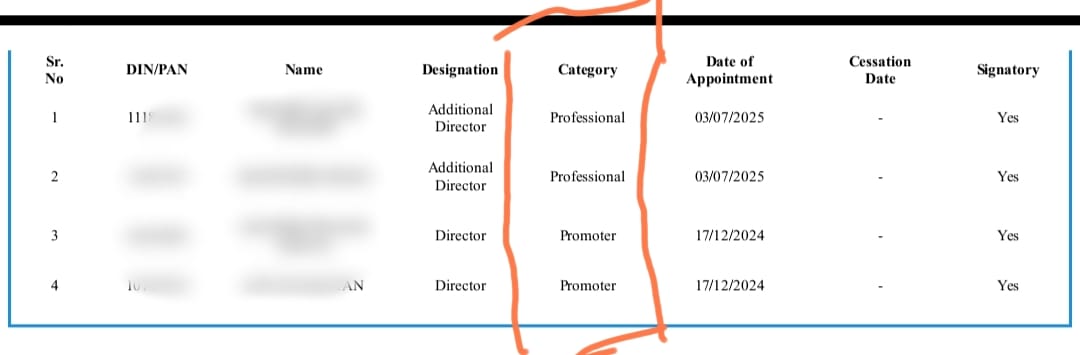

MCA Update: Director Category Now Visible in Signatory Details

- The Ministry of Corporate Affairs (MCA) has introduced a useful enhancement on its portal. Now, under the “Signatory Details” section for companies, users can view the designation/category of directors (such as Managing Director, Whole-Time Director, Nominee Director, etc.).

- Key Benefit: This update brings greater transparency and clarity in identifying the roles of directors in a company, aiding stakeholders, professionals, and regulators. Log in to the MCA portal, search for any company’s Master Data, and scroll to the Signatory Details section — the director category is now explicitly displayed alongside their names and DINs.