Rules & Forms for Direct Tax Vivad Se Vishwas Scheme 2024

Page Contents

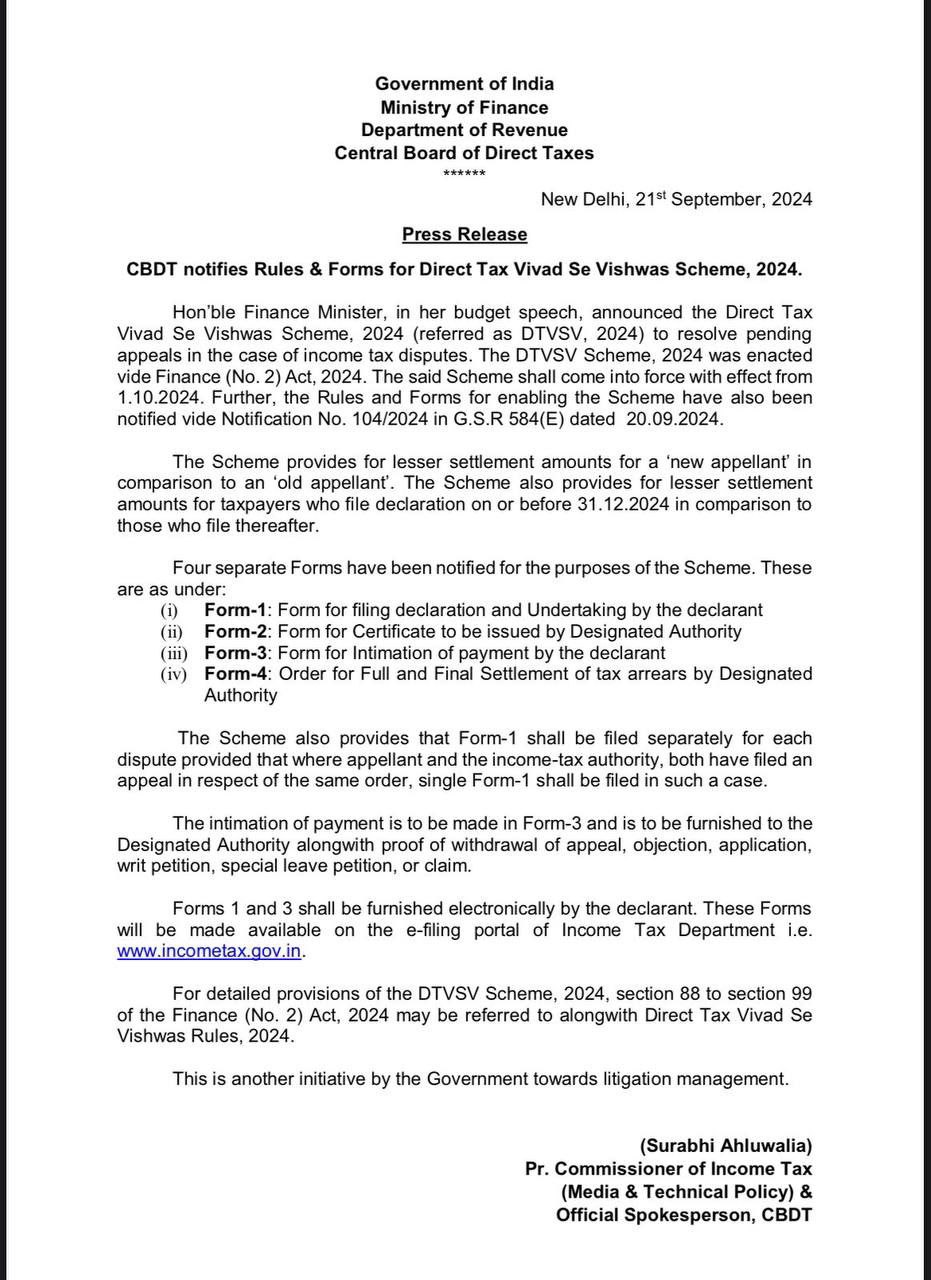

CBDT notifies Rules & Forms for Direct Tax Vivad Se Vishwas Scheme, 2024 (DTVSV, 2024).

The Central Board of Direct Taxes (CBDT) has officially notified the rules and forms for the Direct Tax Vivad Se Vishwas Scheme, 2024 (DTVSV, 2024). This scheme, first introduced by the Hon’ble Finance Minister during the Union Budget 2024, is aimed at reducing income tax litigation by offering a mechanism for settling pending disputes. The DTVSV, 2024, will come into force from 1st October 2024. Notification: The rules and forms have been notified via Notification No. 104/2024 in G.S.R 584(E) dated 20th September 2024.

There is a provision for a reduced settlement amount for ‘new appellants’ (those filing fresh appeals). These appellants must file their declaration under the scheme on or before 31st December 2024 to benefit from this concession. The scheme is designed to resolve pending appeals related to income tax disputes, offering taxpayers an opportunity to settle these cases by paying a specified percentage of the disputed tax amount, thus avoiding prolonged litigation. The scheme is part of the government’s broader initiative to streamline tax-related litigation and foster a more efficient resolution process for taxpayers and authorities alike.

Forms for Filing and Payment: Specific forms are prescribed for taxpayers to:

- File their declaration under the scheme.

- Waive the right to appeal.

- Provide intimation of payment to the tax authorities.

VSV Rules 2.0 detail how to compute losses, unabsorbed depreciation, and Minimum Alternate Tax (MAT)/Alternative Minimum Tax (AMT) credits that can be carried forward when disputes related to these items are settled under the scheme. The rules also specify how to calculate the disputed tax for issues that have been previously resolved in favor of the taxpayer.

Forms for Designated Authority (DA):

The rules also include forms that the Designated Authority (DA) will use to Issue the certificate acknowledging the settlement & Provide the final order related to the dispute resolution.

Taxpayers who file their declaration under the DTVSV Scheme on or before 31st December 2024 will be eligible for a reduced settlement amount. After this deadline, a higher amount will be required for settlement. For detailed information, refer to sections 88 to 99 of the Finance (No. 2) Act, 2024, and the Direct Tax Vivad Se Vishwas Rules, 2024. These provisions outline the process, benefits, and obligations under the DTVSV Scheme, 2024.

CBDT Notified Forms Under the DTVSV Scheme, 2024

- Form-1: This is the form for filing a declaration and undertaking by the declarant. A separate Form-1 must be filed for each tax dispute. Exception: If both the appellant and the Income Tax Authority have filed appeals regarding the same order, only one Form-1 needs to be submitted.

- Form-2: A certificate issued by the Designated Authority certifying the terms of settlement under the scheme.

- Form-3: This form is used for the intimation of payment by the declarant. It must be furnished to the Designated Authority along with proof of withdrawal of the corresponding appeal, writ petition, or other legal claims.

- Form-4: The order issued by the Designated Authority for the full and final settlement of the tax arrears.

File Form-1 for each dispute or a single form if there is a common appeal. After receiving the certificate (Form-2) from the Designated Authority, make the required tax payment. Intimate the payment through Form-3 and furnish proof of withdrawal of any associated appeal or legal action. The Designated Authority will issue a final settlement order in Form-4. Forms 1 and 3 must be submitted electronically through the Income Tax Department’s e-filing portal at www.incometax.gov.in.