Is Accounting Outsourcing Services Increase Profitability?

Page Contents

Is Accounting Outsourcing Services Increase Our Profitability?

- Use finance and outsourcing accounting services to save expenses, boost profits, and more effectively adhere to regulations.

- Using a third-party F&A service allows you to concentrate on managing your business while gaining the advantages of a higher return on investment (ROI).

- Outsourcing finance and accounting services is the fastest-growing business sector for CPA firms, which explains why these services are in such great demand.

- Businesses might gain from outsourcing accounting services in a number of ways:

Concentrate on growing your Company instead of learning to accounting

- The efficiencies offered by cutting-edge technology and a skilled accounting and finance team regularly persuade customers that it is advantageous to change their company model.

- Companies can concentrate on what they do best and spend less time on administrative activities because they have competent accounting and finance teams.

A proactive attitude

- Clients of accounting outsourcing firms may learn about organisational inefficiencies, switch from reactive to proactive account management, and have access to cutting-edge tools and extensive technical knowledge.

- Unlike to traditional accounting, which is often referred to as reactive account outsourcing, aggressive accounting can help you uncover cost-saving opportunities, build market confidence in your company, and create long-term value.

Real-time financial data

- Standard financial reporting does not improve efficiency for business organisations because it is not real-time. Yet, it is beneficial to have a current comprehension of its important business drivers.

- You might be able to swiftly identify the crucial factors that have contributed to the success of your firm with the aid of cloud-based, real-time technology from your account outsourcing supplier.

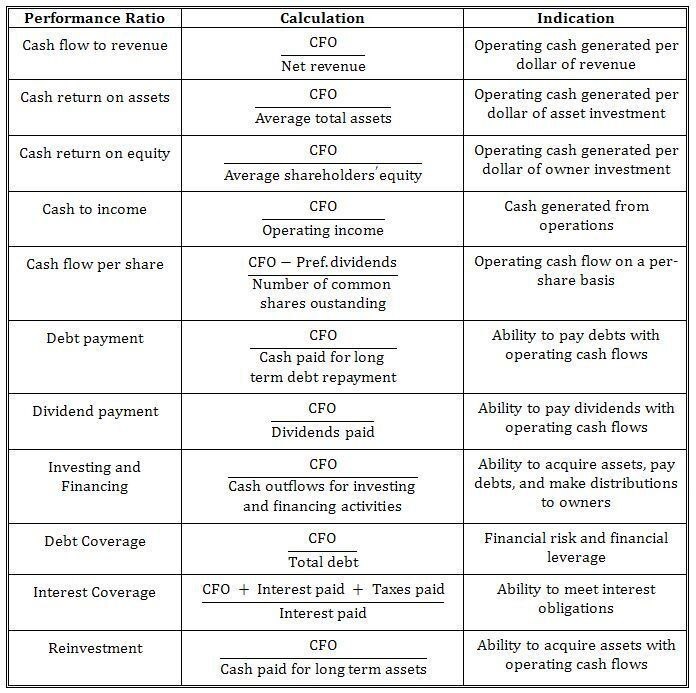

- Summarizing Performance Ratios related to cash flow analysis

Cash Flow to Revenue : Formula:

- CFO÷Net Revenue\text{CFO} \div \text{Net Revenue}

- Indication: Operating cash generated per dollar of revenue.

Cash Return on Assets : Formula:

- CFO÷Average Total Assets\text{CFO} \div \text{Average Total Assets}

- Indication: Operating cash generated per dollar of asset investment.

Cash Return on Equity : Formula

- CFO÷Average Shareholders’ Equity\text{CFO} \div \text{Average Shareholders’ Equity}

- Indication: Operating cash generated per dollar of owner investment.

Cash to Income : Formula:

- CFO÷Operating Income\text{CFO} \div \text{Operating Income}

- Indication: Cash generated from operations.

Cash Flow per Share : Formula:

- (CFO−Preferred Dividends)÷Number of Common Shares Outstanding(\text{CFO} – \text{Preferred Dividends}) \div \text{Number of Common Shares Outstanding}

- Indication: Operating cash flow on a per-share basis.

Debt Payment : Formula:

- CFO÷Cash Paid for Long-Term Debt Repayment\text{CFO} \div \text{Cash Paid for Long-Term Debt Repayment}

- Indication: Ability to pay debts with operating cash flows.

Dividend Payment : Formula:

- CFO÷Dividends Paid\text{CFO} \div \text{Dividends Paid}

- Indication: Ability to pay dividends with operating cash flows.

Investing and Financing : Formula:

- CFO÷Cash Outflows for Investing and Financing Activities\text{CFO} \div \text{Cash Outflows for Investing and Financing Activities}

- Indication: Ability to acquire assets, pay debts, and make distributions to owners.

Debt Coverage : Formula:

- CFO÷Total Debt\text{CFO} \div \text{Total Debt}

- Indication: Financial risk and leverage.

Interest Coverage : Formula:

- (CFO+Interest Paid+Taxes Paid)÷Interest Paid(\text{CFO} + \text{Interest Paid} + \text{Taxes Paid}) \div \text{Interest Paid}

- Indication: Ability to meet interest obligations.

Reinvestment : Formula:

- CFO÷Cash Paid for Long-Term Assets\text{CFO} \div \text{Cash Paid for Long-Term Assets}

- Indication: Ability to acquire assets with operating cash flows.

High degree of accuracy

- Teams of professional people who have been specifically trained to meet the needs of accounting outsourcing firms for your company make up outsourced finance and accounting teams.

- Upper management keeps an eye on the work to make sure the highest level of accuracy is attained.

- Business owners might not be familiar with all of the rules and regulations that make up the complicated field of accounting.

Keeping track of taxation compliance deadline

- A perfect record is essential when it comes to satisfying regulatory standards.

- Due to business owners’ and accounting outsourcing firms’ excessive workloads from day-to-day operations, deadlines are unfortunately regularly missed.

- All organisations must adhere to compliance requirements, but those with expansion or further investment on their radar should give these jobs top priority.

Administrative and financial flexibility

- You can pick and choose the services you need when you outsource bookkeeping and accounting for the finance department of your business.

- You can either hire a full-time crew or pay for assistance as you need it.

- Fixed costs could become variable ones, freeing up previously allotted resources for alternative uses.

- If your business can outsource, it can devote more resources to generating money.

Savings and security in the case of an emergency situations

- You can assign tasks to others without worrying about their access to private information if you deal with the right outsourcing accounting service and finance business.

- They can either transfer the files to a safe server in the cloud or remotely access your server (trying to prevent the need for your data to leave the office).

- Companies that outsource work to you frequently have strong disaster recovery plans across all of their locations and can back up your data on a number of highly secure servers.

- Your financing provider should make sure that you have internal procedures in place to safeguard confidential data and minimize risks.