When Does a Tax Audit Become Mandatory?

Page Contents

When Does a Tax Audit Become Mandatory?

Not every taxpayer needs a tax audit. But once your turnover or income crosses certain limits, it becomes compulsory under the Income Tax Act. A tax audit ensures accuracy, transparency, and compliance. Maintain your books properly, stay digital to enjoy higher limits, and file your audit reports on time to avoid penalties.

Objectives of Tax Audit

-

Ensure proper maintenance and accuracy of books of account.

-

Report discrepancies and compliance issues observed during examination.

-

Provide prescribed information such as depreciation, disallowances, etc.

-

Facilitate accurate computation of taxable income and deductions.

-

Enable tax authorities to verify correctness of ITRs filed.

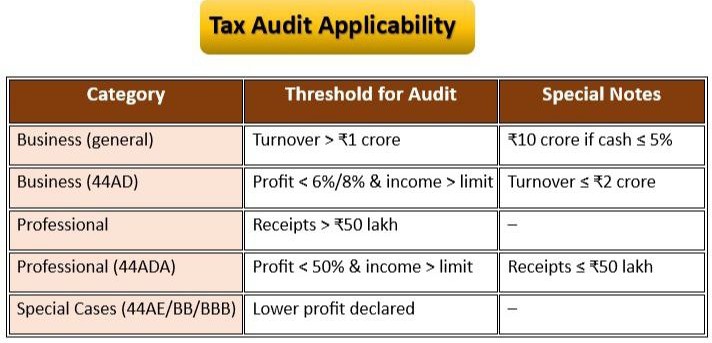

Section 44AB – The Tax Audit Section : Tax Audit Limits & Conditions

A Tax Audit means your books of account are examined by a Chartered Accountant (CA) to verify:

-

Correctness of income & deductions

-

Proper compliance with tax laws

It applies to Businesses, Professionals, and Presumptive taxpayers.

| Category | Limit | Section | Audit Required When |

|---|---|---|---|

| Business | INR 1 Cr (₹10 Cr if digital transactions) | 44AB(a) | Turnover > limit |

| Profession | INR 50 Lakh | 44AB(b) | Receipts > limit |

| 44AD | INR 2 Cr | 44AB(d) | Profit < 6% (digital) / 8% (cash) |

| 44ADA | INR 50 Lakh | 44AB(d) | Profit < 50% |

| 44AE | — | 44AB(e) | Profit < presumptive |

For Businesses (Section 44AB(a))

Businesses – Section 44AB(a) : Mandatory if turnover exceeds ₹1 crore. Limit increases to ₹10 crore if: Cash receipts ≤ 5% of total receipts, and Cash payments ≤ 5% of total payments. Digital transactions help you enjoy the higher limit. But the limit increases to ₹10 crore if:

-

Cash receipts ≤ 5% of total receipts, and

-

Cash payments ≤ 5% of total payments

Essentially, if you run your business almost entirely in digital mode, you enjoy a higher audit threshold.

For Professionals (Section 44AB(b))

If gross receipts exceed INR 50 lakh in a financial year : Audit required if gross receipts exceed INR 50 lakh in a financial year. Tax audits become mandatory

Presumptive Taxation (Sections 44AD, 44ADA, 44AE)

Under Section 44AD : Business: If you declare profit < 6% (digital) or < 8% (cash) of turnover and your income > basic exemption limit : Audit required

Section 44ADA : Professionals: If profit declared < 50% of receipts and income > exemption limit : Audit mandatory

Under Section 44AE : Transporters: If you own ≤ 10 goods vehicles : presumptive profit = INR 1,000 per ton per month. If you declare less :Audit applies

Loss or Low-Profit Cases

Even if turnover is below limits, but You report a loss or Declare profit below presumptive rate, and Your income exceeds the basic exemption limit Then Tax Audit is required

Digital transactions threshold: For businesses with 95% or more receipts/payments digitally, audit limit increases from INR 1 Cr to INR 10 Cr.

Presumptive schemes:

-

- 44AD: For small businesses; audit if declared profit is less than presumptive rate (6%/8%).

- Section 44ADA: For professionals; audit if profit < 50% of gross receipts.

- 44AE: For transporters; audit if profit < presumptive amount per vehicle.

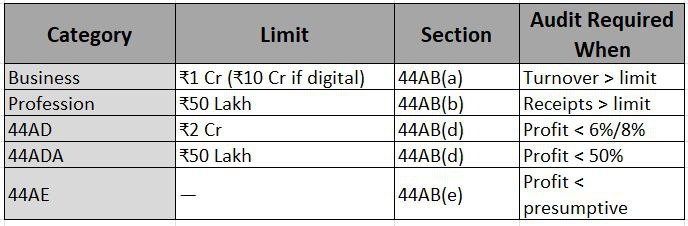

Tax Audit Mandatoryunder Section 44AB:

| Category of Taxpayer | Condition / Threshold for Tax Audit |

|---|---|

| Business (Non-presumptive) | Turnover > INR 1 crore, or INR 10 crore if cash transactions ≤ 5% of total receipts/payments |

| Professionals | Gross receipts > INR 50 lakh |

| Business under Presumptive Scheme (Sec 44AD) | Declares profit < 6% (digital) / 8% (cash) and income > basic exemption limit |

| Professionals under Presumptive Scheme (Sec 44ADA) | Profit < 50% of receipts and income > basic exemption limit |

| Transporters (Sec 44AE, 44BB, 44BBB) | Declares profit below prescribed presumptive limit |

| Business Loss Cases | Turnover > INR 1 crore and loss or low profit declared beyond exemption limit |

| Other Audits (Companies, Co-ops, etc.) | If audited under any other law → same report may be used for Income Tax purposes |

Normaly Due Date for Tax Audit Report (FY 2024–25)

The CA uploads the report on the Income Tax portal, and the taxpayer must accept it in their login. following are last date :

-

31st October 2025 – Extended due date for filing Tax Audit Report (Form 3CA/3CB–3CD).

-

31st October 2025 – For assessees with transfer pricing (Sec 92E) requirements.

Audit Report Forms

| Form No. | Applicable When |

|---|---|

| Income tax Form 3CA | Accounts already audited under another law (e.g. Companies Act) |

| Income tax Form 3CB | Accounts not audited under any other law |

| Income tax Form 3CD | Statement of prescribed particulars (annexure to 3CA/3CB) |

| Income tax Form 3CE | Applicable for non-residents/foreign companies receiving royalty or FTS from India |

Penalty for Non-Compliance (Section 271B)

Failure to get your accounts audited = Penalty of 0.5% of turnover or INR 1,50,000, whichever is lower. However, no penalty applies if there is a reasonable cause, such as Natural calamities, Resignation of CA or key staff, Labour unrest or strikes, Loss of records due to factors beyond control, Death or incapacity of partner in charge of accounts