Top 5 Changes in Tax Audit Form 3CD for AY 2025-26

Page Contents

Top 5 Changes in Form 3CD (AY 2025-26)

Top 5 Changes in Income Tax Audit Form 3CD for AY 2025-26 (FY 2024-25) based on the CBDT notification and expert commentary are mentioned here under:

- what is change in MSME Payments – Clauses 22 & 26 : Clause 22 now requires disclosure of timely vs. delayed MSME payments. Clause 26 requires breakup of disallowed amounts under Section 43B(h) Paid during the year & remaining unpaid at year-end. Its Impact is to Strengthens compliance under MSMED Act, ensures better tracking of delayed payments, but may lead to duplication of reporting with MCA filings.

- Changes related Buyback of Shares – New Clause 36B : New clause introduced to report details of buyback Amount received on buyback & Cost of acquisition of shares. its impact to ensure compliance after buyback is reclassified as dividend (post Finance Act, 2025). Reporting is now at shareholder level, not company level.

- Impact of change on Settlement-related Expenditure – Clause 21: Now requires disclosure of expenses incurred to settle proceedings under laws like SEBI Act, SCRA, Depositories Act, Competition Act, etc. Covers even legal/professional fees linked to such settlements. Its Impact is to reinforces the principle that costs related to breach of law are not allowable deductions. Adds transparency in dispute/settlement reporting.

- Changes in Loans, Deposits & Advances – Clause 31: Coded reporting introduced (Codes A–L). Covers cash receipts/payments, non-account payee instruments, transfers, conversions, journal entries, etc. it Impact in tax audit is enhances analytics and prevents misuse of journal entries/book adjustments for fund movement. Greater scrutiny of loan/deposit transactions.

- Changes in Presumptive Income – Clause 12 : Clause 12 expanded to include Section 44BBC: Presumptive taxation for non-resident cruise ship operators. Its Impact is to Aligns Form 3CD with Finance Act, 2024 changes, ensures reporting of new presumptive regime.

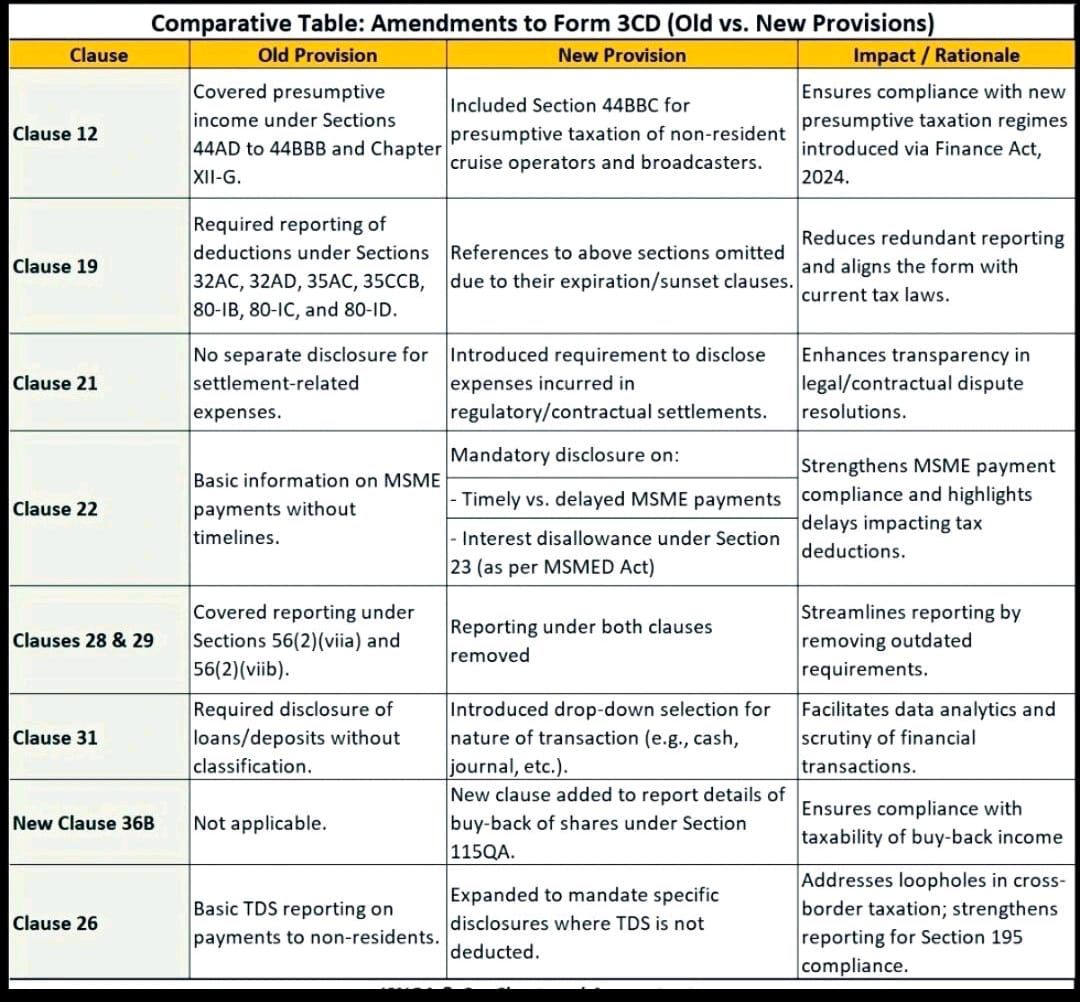

Amendments to Form 3 C D change in Old vs. New Provisions of Tax audit report

Overall Objective in the change in tax audit reporting is Simplification (removal of expired provisions), Better compliance (new presumptive, buy-back, cross-border taxation), Enhanced transparency (settlement expenses, MSME timelines) & Tightened compliance (esp. MSME & settlements), Improved analytics & reporting (dropdowns , structured data), New disclosures for modern transactions (buybacks, journal entries) & Alignment with Finance Act changes (44BBC). Increased reporting burden for taxpayers, but improves transparency and aids data-driven scrutiny by the Income Tax Department.

Comparative Table Amendments to Form 3 CD (Old vs. New Provisions)

It summarizes recent changes to the tax audit report requirements under Form 3CD. Key Amendments to Form 3CD :

| Clause | Old Provision | New Provision | Impact / Rationale |

| Clause 12 | Covered presumptive income under Sections 44AD to 44BBB and Chapter XII-G. | Included Section 44BBC for presumptive taxation of non-resident cruise operators and broadcasters. | Ensures compliance with new presumptive regimes introduced via Finance Act, 2024. |

| Clause 19 | Required reporting of deductions under Sections 32AC, 32AD, 35AC, 35CCB, 80-IB, 80-IC, 80-ID. | References omitted due to expiration/sunset clauses. | Reduces redundant reporting, aligns with current tax laws. |

| Clause 21 | No disclosure for settlement-related expenses. | Disclosure of expenses in regulatory/contractual settlements required. | Enhances transparency in dispute resolutions. |

| Clause 22 | Only basic MSME payment info, no timelines. | Mandatory disclosure on: (a) Timely vs delayed MSME payments, (b) Interest disallowance u/s 23 (MSMED Act). | Strengthens MSME compliance, highlights delays affecting tax deductions. |

| Clauses 28 & 29 | Reporting under Sections 56(2)(viia) and 56(2)(viib). | Reporting under both removed. | Streamlines reporting, removes outdated requirements. |

| Clause 31 | Disclosure of loans/deposits without classification. | Drop-down selection for transaction type (cash, journal, etc.). | Improves analytics & scrutiny of financial transactions. |

| New Clause 36B | Not applicable earlier. | New clause for reporting details of buy-back of shares u/s 115QA. | Ensures compliance with buy-back taxability. |

| Clause 26 | Basic TDS reporting on payments to non-residents. | Expanded to mandate disclosure where TDS not deducted. | Addresses loopholes in cross-border taxation; strengthens Section 195 compliance. |