The Bombay High Court, in the case of 87A Rebate

Page Contents

The Bombay High Court, in the case of 87A Rebate

In a recent judgment, the Bombay High Court addressed issues concerning the Section 87A rebate under the Income Tax Act, 1961. The case arose when taxpayers reported difficulties claiming the rebate due to updates in the tax filing utility after July 5, 2024. These updates prevented the rebate for individuals with incomes below INR 7 lakh that included components taxed at special rates, such as short-term capital gains.

This decision underscores the judiciary’s role in upholding taxpayer rights and ensuring that administrative procedures do not impede lawful claims.

The PIL challenged the modifications made to the online tax filing utility by the Income Tax Department, which restricted taxpayers from claiming the Section 87A rebate for the assessment year 2024-25.

Chamber of Tax Consultants filed a Public Interest Litigation challenging this modification, arguing that Section 87A does not impose conditions based on income composition. The court ruled in favor of the petitioners, emphasizing that procedural changes in the tax filing system should not override statutory entitlements. Consequently, the CBDT was directed to extend the deadline for filing belated and revised returns to January 15, 2025, allowing eligible taxpayers to claim the rebate.

Eligibility of claims under Section 87A

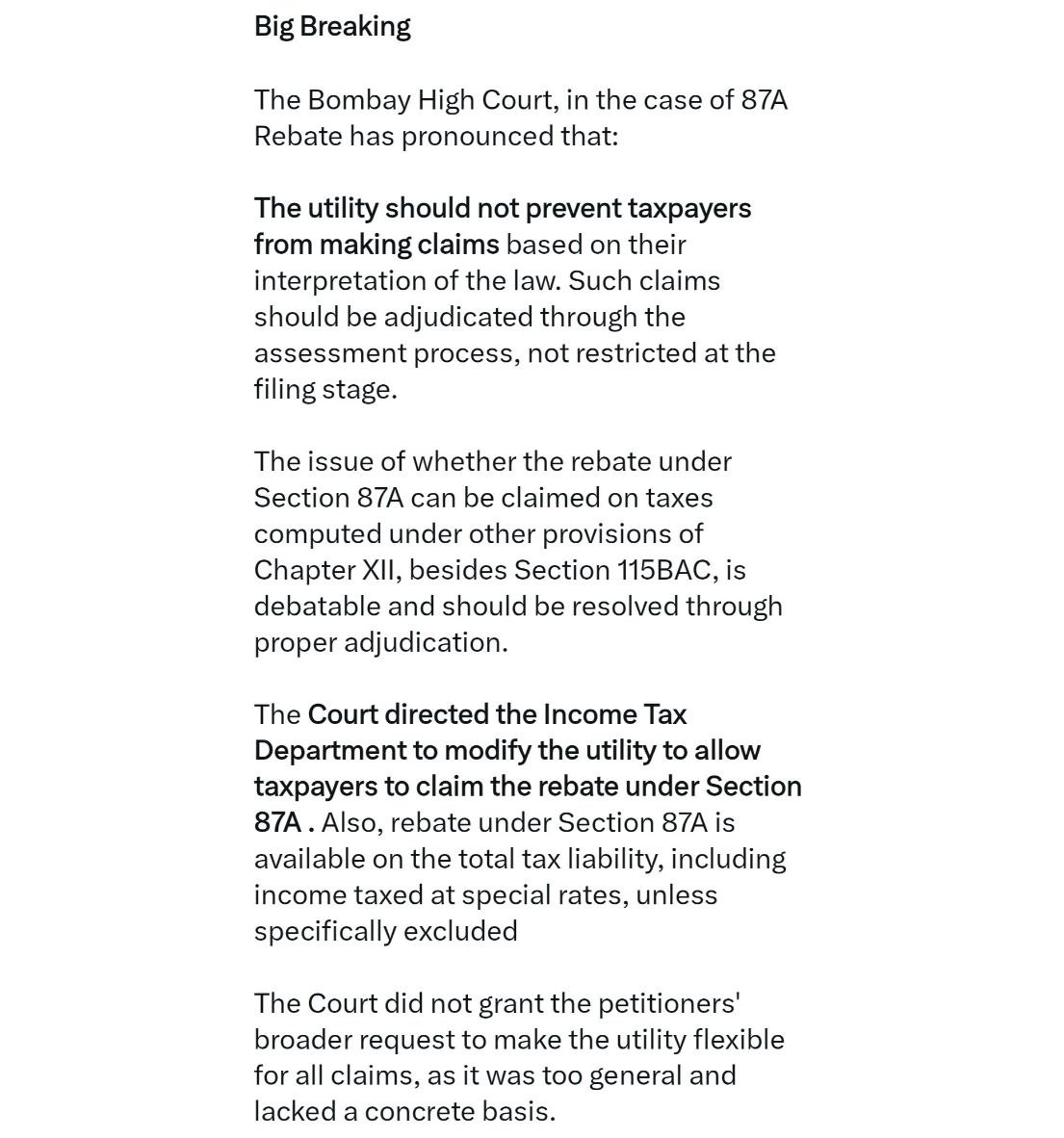

The court stated that the eligibility of claims under Section 87A should be assessed by the Income Tax authorities during the processing of returns under Sections 143(1) or 143(3), and not blocked outright by the online utility.

Prohibition of Claims through Utility:

The bench criticized the department’s modification to the utility that prohibited taxpayers from claiming a rebate at the threshold level itself. It emphasized that such claims, even if debatable, must be allowed to be filed and then assessed during scrutiny or return processing.

While recognizing the seriousness of the issue, the bench refrained from deciding on the correctness of the claims made by either party, as it believed such matters should first be addressed by quasi-judicial authorities under the Income Tax Act. The court highlighted that Articles 265 (no tax to be levied without authority of law) and 300A (right to property) of the Constitution must guide the actions of the department, and laudable ends cannot justify restrictive means.

Conclusion:

The Public Interest Litigation was disposed of with the court directing that the department cannot bar assessees from filing claims u/s 87A via modifications to the utility. Tax Dept. is free to examine the validity of such claims during the return processing or scrutiny stages, as per the provisions of the Act. Both the department and taxpayers retain remedies under the Act to address disputes.