TDS Rules on VDAs u/s 194S of the Income Tax Act, 1961

Page Contents

TDS Rules on Virtual Digital Assets (VDAs) u/s 194S of the Income Tax Act, 1961,

Crypto & Income Tax in India (Post July 1, 2022) :

TDS is Advance tax collected by exchanges like ZebPay on behalf of the Government. TDS deducted on On every sale or transfer of Virtual Digital Assets (VDAs) from July 1, 2022. & TDS Rate: 1% of transaction value (Section 194S, IT Act). TDS on crypto transactions is mandatory as per Income Tax Act. For Example:

Sell 1 BTC = INR 20,00,000

Fees (0.5%) = INR 10,000

Net value = INR 19,90,000

TDS (1%) = INR 19,000

Final amount = INR 19,71,000

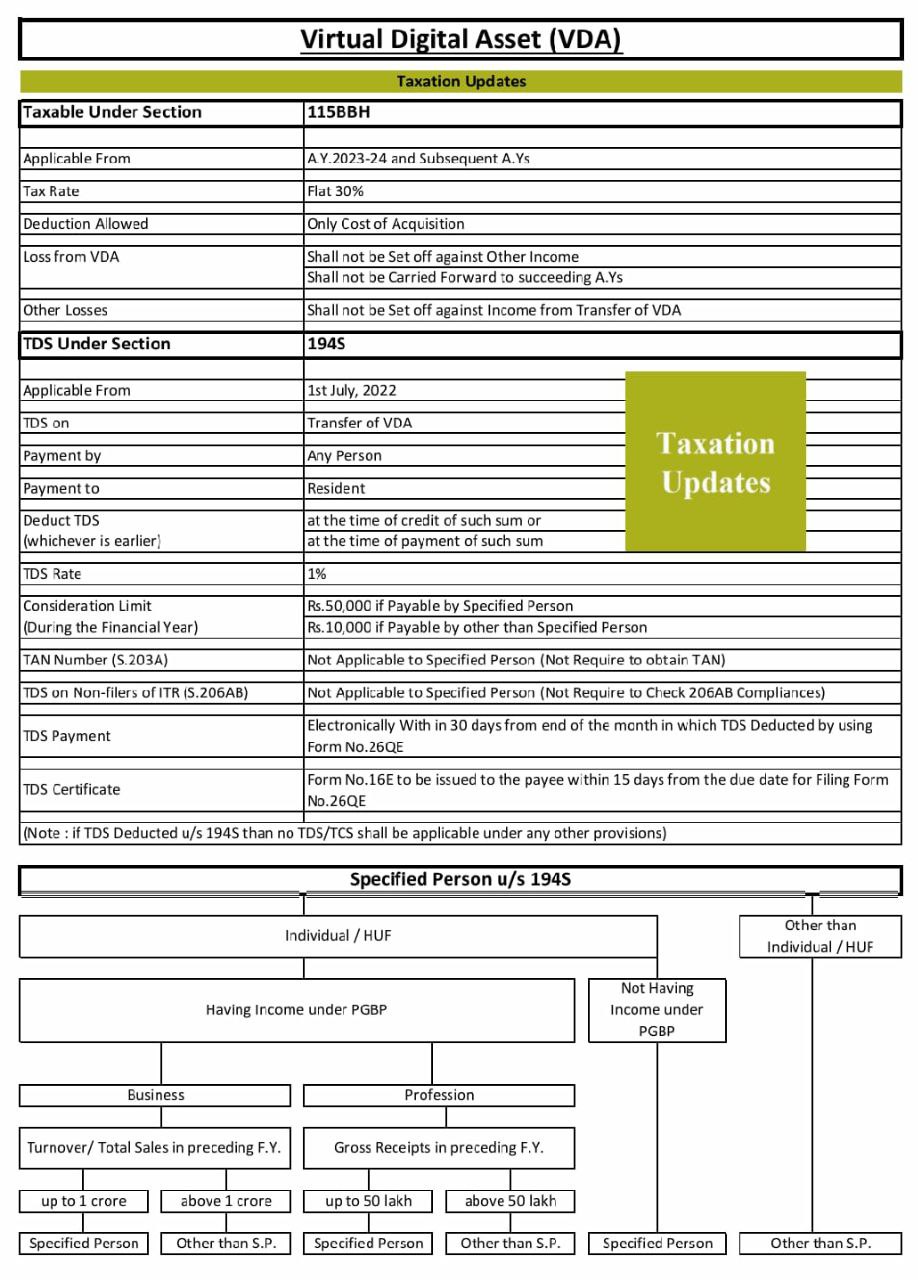

Applicability of Section 194S :

From July 1, 2022, Cryptocurrencies, NFTs, and other digital assets notified by the government and Rate of TDS on Virtual Digital Assets :

-

- 1% of the transaction value

- 20% if PAN is not furnished

- No TDS before 1 July 2022. But 30% tax applies on profits from 1 April 2022. Who deposits TDS i.e. Exchange (e.g., ZebPay) deposits to Government of India. & same is Reflected in Form 26AS., TDS certificates provided by exchange.

- Why 5% TDS instead of 1% : If you haven’t filed ITR for last 2 FYs → you fall under Section 206AB → TDS @ 5%.

- How to check TDS bracket (1% or 5%) : Verify your status on the Income Tax e-filing portal. Where is 1% TDS applicable?

-

- Sell Crypto-INR pairs

- Crypto-Crypto trades (since one coin is sold to buy another)

- Withdrawals to third-party accounts

- Not on buying Crypto-INR or INR deposits/withdrawals

Threshold Limits for TDS on Virtual Digital Assets : Threshold for TDS is

- INR 10,000 per year (normal users)

- 50,000 per year (specified persons, like individuals with turnover below tax audit limit) However, exchanges deduct TDS on every trade. Refund/adjustment possible in ITR.

- Specified Persons: TDS applies if aggregate value of transactions exceeds INR 50,000 in a financial year & Others: TDS applies if aggregate value exceeds INR 10,000

Specified Person includes:

- Individuals/HUFs with no business/professional income

- In case Individuals/HUFs with business turnover ≤ INR 1 crore

- Individuals/HUFs with professional receipts ≤ INR 50 lakh

Difference between TDS & 30% tax on gains :

- TDS (1%) → Deducted on each sale/transfer. It’s adjustable against final tax liability.

- Tax on gains (30% + surcharge + cess) → Payable on net profits at the time of filing ITR.

When and Who Deducts TDS on Virtual Digital Assets

- TDS must be deducted at the time of payment or credit, whichever is earlier

- Buyer is responsible for deducting TDS in peer-to-peer transactions

- Exchange deducts TDS if transaction is routed through it

- In case of brokers, responsibility may be shared or delegated via agreement

Special Cases in case of Virtual Digital Assets

- Crypto-to-Crypto Trades: TDS applies on both legs of the transaction

- Transfers in Kind: TDS must be deducted and paid before releasing consideration

- No TAN Required: Specified persons are exempt from needing a TAN

- TDS on special cases

-

- Crypto Earn products: No TDS

- Airdrops: TDS applied only when sold

- Pending orders before July 1, 2022: Cancelled and need re-placement

- Can TDS be avoided or reduced?

-

- No exemptions under Section 194S.

- Lower deduction certificates not valid here.

- Only exemption: if yearly transactions < INR 10,000 (normal) / INR 50,000 (specified).

- Refund can be claimed while filing ITR.

- How to claim TDS refund/credit? : By Adjust against total tax liability or claim refund in ITR filing. Shown in Form 26AS.

Virtual Digital Assets -Reporting & Compliance

- Form 26Q: For general reporting

- Income tax Form 26QE: For specified persons

- Form 26QF: For exchanges reporting quarterly transactions

- Income Tax Form 16A: TDS certificate issued to deductee

Non-Compliance Penalties in case Virtual Digital Assets non compliance

- Penalty under Section 271C: Equal to the amount of tax not deducted

- Prosecution under Section 276B: Possible imprisonment and/or fine

Recent Updates (FY 2025–26) on Virtual Digital Assets

- Schedule VDA introduced in ITR forms for crypto reporting

- Exchanges must submit detailed reports to ensure compliance

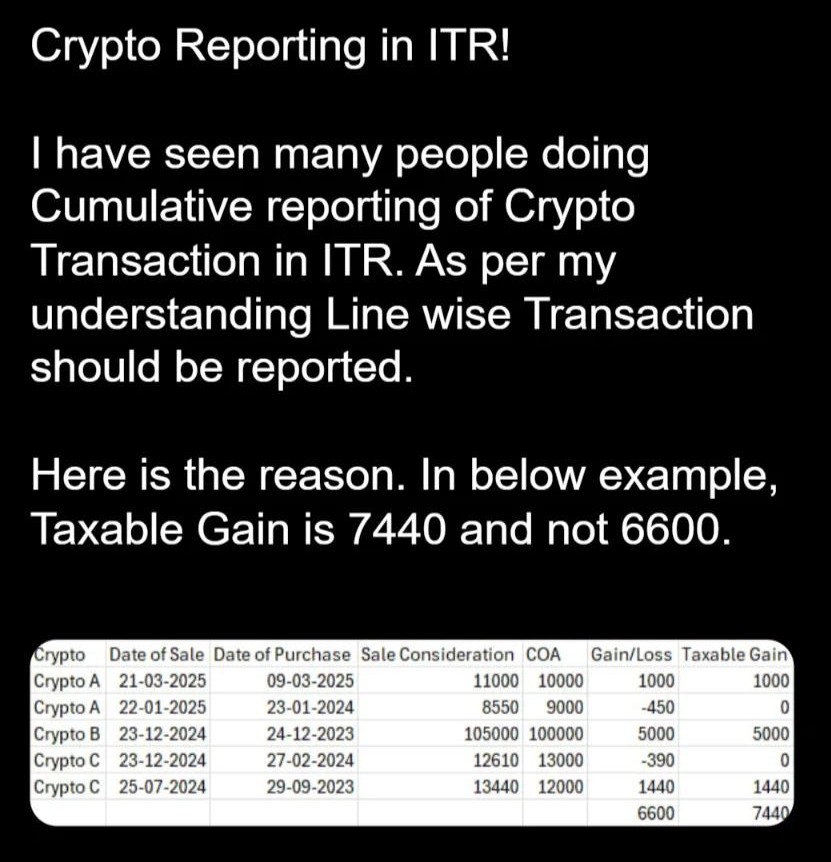

Crypto transactions and ITR returns: Line-wise reporting of crypto transactions in ITR rather than cumulative reporting

Importance of line-wise reporting of crypto transactions in Income Tax Returns (ITR) rather than cumulative reporting. Why Line-Wise Reporting Matters- Line-wise reporting of crypto transactions in ITR : Many taxpayers report crypto transactions cumulatively, which can lead to incorrect tax calculations. The infographic shows that each transaction should be reported individually to accurately compute the taxable gain or loss. Example Breakdown- Line-wise reporting of crypto transactions in ITR

| Crypto | Date of Sale | Date of Purchase | Sale Consideration | Cost of Acquisition (COA) | Gain/Loss | Taxable Gain |

| A | 21-03-2025 | 09-03-2025 | INR 11,000 | INR 10,000 | INR 1,000 | INR 1,000 |

| B | 23-12-2024 | 25-01-2023 | INR 8,550 | INR 9,000 | -INR 450 | -INR 450 |

| C | 23-12-2024 | 24-12-2023 | -INR 105,000 | -INR 100,000 | -INR 5,000 | -INR 5,000 |

| D | 25-07-2024 | 27-01-2018 | INR 12,600 | INR 12,000 | INR 600 | INR 600 |

Correct Taxable Gain Calculation- Line-wise reporting of crypto transactions in ITR

- Cumulative Gain (incorrect method): INR 1,000 – INR 450 – INR 5,000 + INR 600 = INR 6600

- Actual Taxable Gain (line-wise method): INR 1,000 + (-INR 450) + (-INR 5,000) + INR 600 = INR 7440

This discrepancy arises because losses and gains must be treated individually, especially when considering short-term vs long-term capital gains, and set-off rules under the Income Tax Act.

ITR Reporting Tips for crypto transactions in ITR

- Taxpayer must Report each transaction separately with Date of purchase and sale, Sale consideration, Cost of acquisition, Gain or loss

- Use appropriate ITR forms (usually ITR-2 or ITR-3 depending on your income sources).

- Maintain detailed records of all crypto trades.

- Classify gains correctly:

- Short-term if held < 36 months

- Long-term if held ≥ 36 months (though crypto is usually treated as short-term unless notified otherwise)

- Legal obligation- Bottom Line is crypto transactions reporting

-

- All Indian residents must comply → evading TDS is unlawful.

- Crypto decentralization ≠ exemption from Indian tax laws.

- Every crypto sale/transfer = 1% (or 5%) TDS.

- All profits = 30% tax (plus surcharge & cess).

- File ITR to claim credit/refund of deducted TDS.