Taxation Comparison: Gold Coin vs Gold Jewellery

Page Contents

Taxation Comparison: Gold Coin vs Gold Jewellery

| Tax Aspect | Gold Coin | Gold Jewellery |

|---|---|---|

| ITR Reporting | Treated as a capital asset. Must be reported under “Capital Gains” if sold. | Same as gold coin – report in ITR under “Capital Gains” when sold. |

| Capital Gains Tax (CGT) | – Short-Term (STCG): If held ≤ 3 years → Taxed at slab rate. – Long-Term (LTCG): If held > 3 years → 20% with indexation. |

Same rule as coins (STCG if ≤ 3 years, LTCG if > 3 years with 20% + indexation). |

| GST on Purchase | 3% GST on value of gold coin. | 3% GST on gold value + 5% GST on making charges (higher impact due to design/labour). |

| GST on Sale by Dealer | Dealers must charge GST @3% if selling new coins. Individuals selling back to jeweller (for investment redemption) – GST not levied, only resale value paid. | Dealers/jewellers charge GST @3% on new jewellery + 5% on making charges. Individuals selling used jewellery → No GST, only resale value. |

| Resale Deduction Impact | Value usually closer to market price (minimal deductions). | Resale value reduced due to deduction of making charges, wastage, and purity adjustments. |

| TDS on Purchase | If purchase > ₹2 lakh in cash → PAN mandatory; if > ₹10 lakh in cash → TDS u/s 194Q may apply for business transactions. | Same rule applies. |

Tax Implications of Selling Inherited Gold

Nature of Inherited Gold : No tax is levied at the time of inheritance. Receiving gold through inheritance (from parents, grandparents, etc.) is not taxable in itself. It is exempt under Section 56(2)(x) of the Income Tax Act. Inherited gold is not treated as income under the Income Tax Act.

When Does Tax Arise?

- Tax is applicable only when you sell the inherited gold. When you sell inherited gold, the capital gains tax applies.

- The gain is calculated as Sale Price – Indexed Cost of Acquisition

- Capital Gains Tax is calculated based on:

- Original purchase price by the previous owner (e.g., parent/grandparent), or

- Fair Market Value (FMV) as on 1st April 2001 (if acquired before that date).

- Holding Period: Always treated as a Long-Term Capital Asset.

How Is Tax Calculated?

- Always treated as Long-Term Capital Gain (LTCG), regardless of how long you held it, because the holding period of the original owner is also counted.

- You can use Cost Inflation Index (CII) to adjust the original purchase price. If the gold was acquired before April 1, 2001, you can use the Fair Market Value (FMV) as on April 1, 2001 as the base. Use Indexed Cost of Acquisition (adjusted using the Cost Inflation Index).

- LTCG on gold is taxed at 20% with indexation under Section 112 of the Income Tax Act. & Surcharge and cess may apply additionally. Tax Rate is 20% LTCG tax + Surcharge + Health & Education Cess.

- Example:

LTCG = Sale Price – Indexed Cost of Acquisition

Tax Payable = 20% of LTCG + applicable surcharge/cess

- Exemptions & Savings Options

-

- Section 54F: Reinvest entire sale proceeds in a residential house (subject to conditions).

- under Section 54EC: Invest up to INR 30 lakh in Capital Gain Bonds (e.g., NHAI, REC) within 6 months of sale.

- Documentation to Keep

-

- Proof of inheritance (will, gift deed, legal heir certificate)

- Original purchase invoice (if available)

- Valuation certificate (especially if FMV as on 01.04.2001 is used)

Summary: Taxation Comparison: Gold Coin vs Gold Jewellery

-

Capital Gains Taxation : Same for both (coins & jewellery) under Income Tax Act.

-

GST Impact :Jewellery costs more due to GST on making charges, while coins are more tax-efficient.

-

Resale Taxation : No GST on resale by individuals, but jewellery loses value due to non-tax factors (making/wastage).

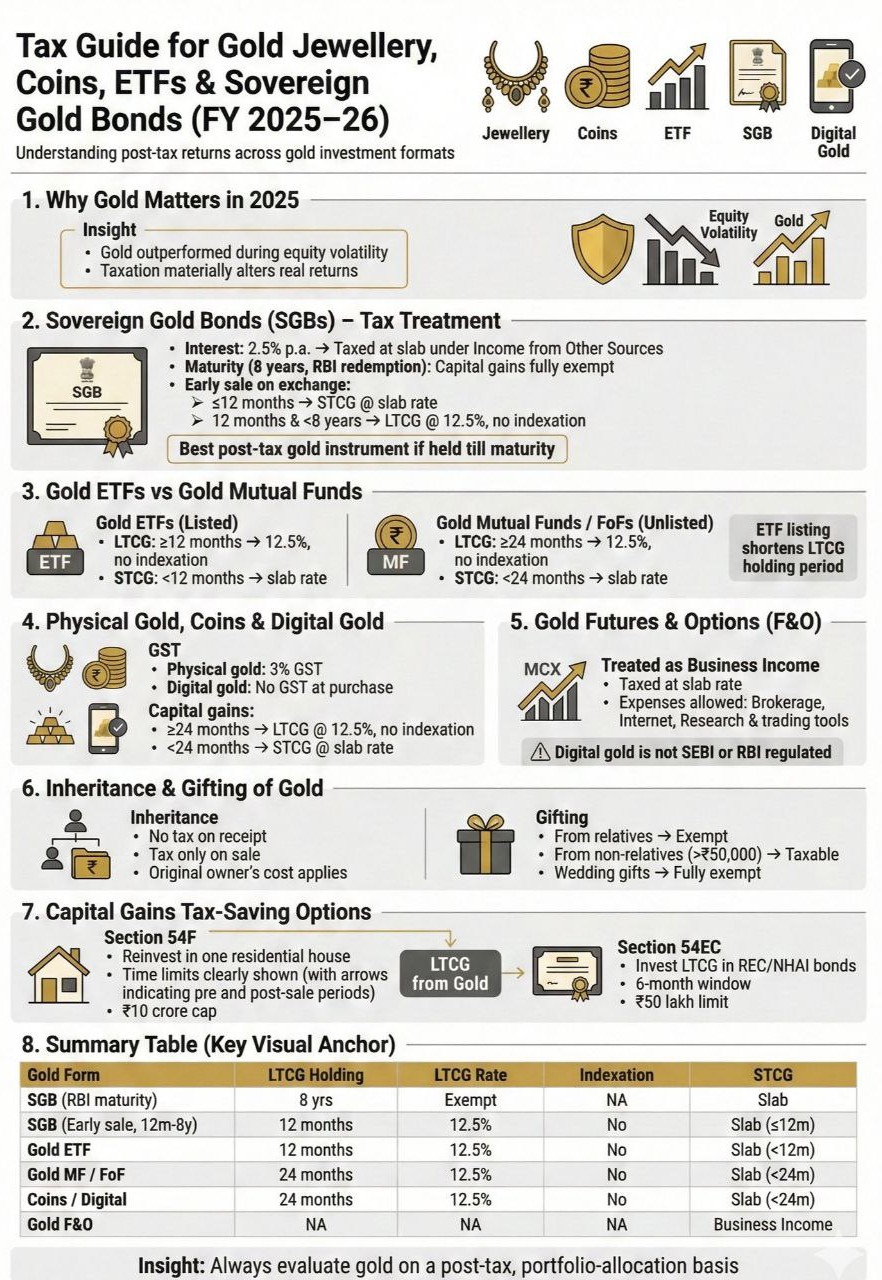

Tax Guide for Gold (FY 2025–26) – Jewellery | Coins | ETF | SGB | Digital Gold

Why Gold Matters in 2025

- Gold has historically outperformed during periods of inflation and geo‑political uncertainty. Gold outperformed during volatility

- Post‑tax returns vary significantly across gold investment options—understanding taxation is essential for better portfolio decisions. Taxation materially affects post‑tax returns

Sovereign Gold Bonds (SGBs)—Tax Treatment

Interest

- 2.5% interest taxable under “Income from Other Sources”

Capital Gains (Sale on Exchange)

- Sold before maturity

- < 12 months → STCG (taxed at slab rate)

- ≥ 12 months → LTCG @ 12.5% (no indexation)

under Capital Gains (On Redemption After 8 Years)

- Completely Tax‑Free

- Best post‑tax gold instrument if held till maturity

Gold ETFs vs. Gold Mutual Funds

Gold ETFs

- LTCG: ≥ 12 months → 12.5%, no indexation

- STCG: slab rate

Gold Mutual Funds / FoFs

- Same taxation as ETFs

- ETF listing performance impacts FoFs indirectly

Physical Gold, Coins & Digital Gold

Physical Gold

- 3% GST on purchase

- Making charges also taxed

- On sale:

- STCG (< 12 months): slab rate

- LTCG (≥ 12 months): 12.5%, no indexation

Digital Gold

- Same capital gains rules

- Not SEBI/RBI regulated (buyer beware)

Gold Futures & Options (F&O)

- Taxed as Business Income

- Can claim expenses: brokerage, interest, research, trading tools

- Losses can be set off as per business loss rules

Inheritance & Gifting

Inheritance

- Fully Tax‑Free for the recipient

- Capital gains only when sold (cost = previous owner’s cost)

Gifts

- From relatives: tax‑free

- From non‑relatives:

- Value > ₹50,000 → Taxable as Income

Capital Gains Saving Options

Applies only to sale of physical gold (not ETFs/SGBs):

Section 54F

- Invest in residential house

- Full exemption if entire sale consideration reinvested

- One house property limit

Section 54EC

- Invest in REC/NHAI Bonds

- ₹50 lakh annual limit

- 5‑year lock‑in

Summary Table (Quick View)

| Gold Form | LTCG Holding | LTCG Rate | Indexation | STCG |

|---|---|---|---|---|

| SGB (RBI maturity) | 8 years | Tax-Free | NA | NA |

| SGB (Premature, Exchange) | ≥12m | 12.5% | No | Slab |

| Gold ETF / MF | ≥12m | 12.5% | No | Slab |

| Physical Gold / Jewellery / Coins | ≥12m | 12.5% | No | Slab |

| Digital Gold | ≥12m | 12.5% | No | Slab |

Always evaluate gold on a post‑tax and portfolio‑allocation basis, not just pre‑tax return.