Taxability Under GST for E-Commerce Sale of Services

Page Contents

Taxability Under GST for E-Commerce Sale of Services

Definition & Models of E-Commerce

- Electronic Commerce (Section 2(44)): Supply of goods/services over digital networks.

- E-Commerce Operator (Section 2(45)): Any person managing a digital platform for e-commerce.

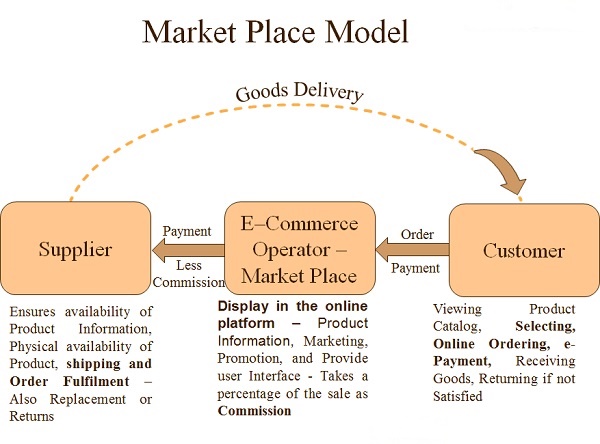

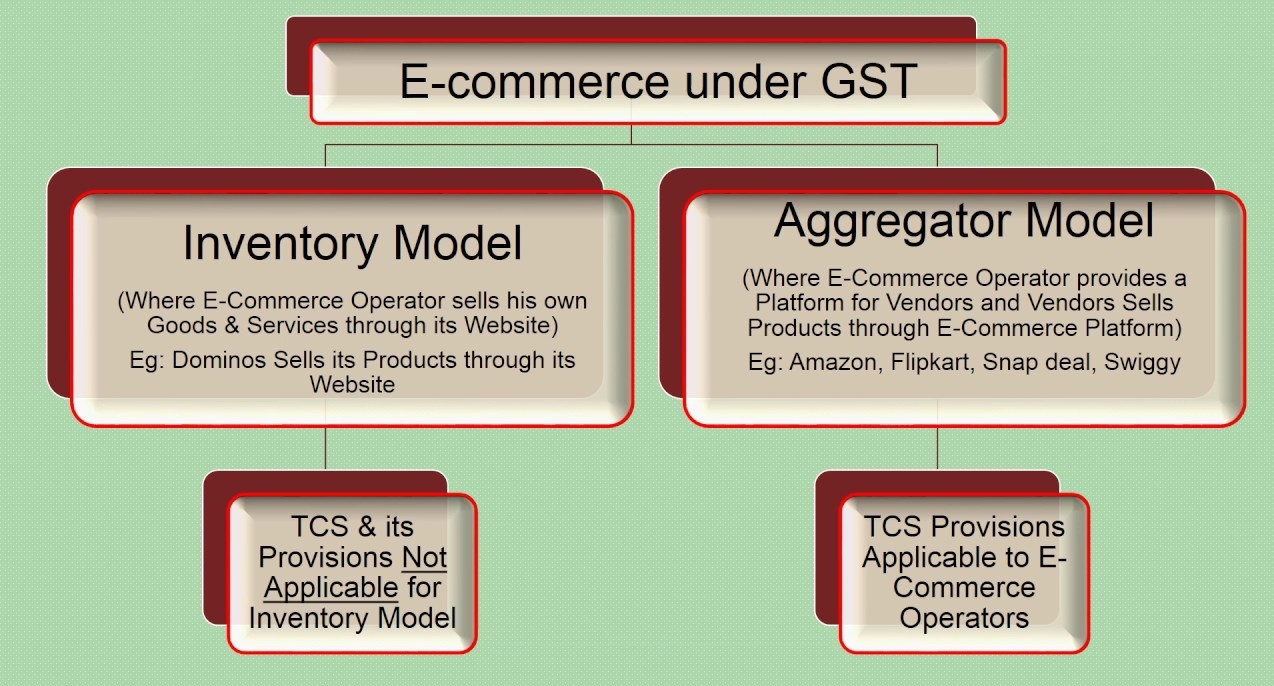

- Business Models:

- Marketplace Model: Amazon, Flipkart.

- Inventory Model: Tata Cliq, Pantaloons.

- Aggregator Model: Uber, Swiggy, Urban Company.

GST Registration Requirements- Compulsory Registration for E-Commerce Operator’s

- Section 24(ix): Mandatory registration for suppliers through ECOs collecting TCS under Section 52, regardless of turnover. As per Section 24 of CGST Act, every E-Commerce Operator must register under GST, irrespective of turnover. Suppliers supplying through E-Commerce Operator’s also require registration except in certain notified services U/s 9(5).

- Relaxation via Notification 65/2017: Service suppliers through ECOs exempt if turnover < INR 20 lakhs (INR 10 lakhs for special category states).

- Notification 34/2023: Goods suppliers through ECOs liable for registration only if turnover exceeds INR 40 lakhs (INR 20 lakhs for special category states). For notified services (like taxi, restaurant, accommodation, housekeeping): ECO pays GST, suppliers enjoy threshold exemption.

- For other services:

- E-Commerce Operator has compulsory registration & collects Tax Collected at Source.

- Suppliers can claim TCS credit while paying GST.

Section 9(5) – E-Commerce Operator Liable to Pay GST (Notified Services) : ECO as Deemed Supplier

In these cases, E-Commerce Operator pays GST as if they were the supplier:

- Passenger transport by radio-taxi, motor cab, maxi cab, motorbike (and from Jan 2022, omnibus & other motor vehicles).

- Hotel/Accommodation services (inns, guest houses, clubs, campsites, etc.) unless supplier is liable for registration.

- Housekeeping services (plumbing, carpentry, etc.) unless supplier is liable for registration.

- Restaurant services (except those in hotels with tariff > INR 7,500 per unit/day). Here, actual suppliers may not need GST registration if below threshold.

- Threshold Exemption (INR 20L/INR 10L) applies to service suppliers (except when mandatory registration is triggered).

- Section 9(5) – Notified Services → ECO pays GST, suppliers may be exempt if below threshold, no TCS. Passenger transport, hotel accommodation, housekeeping, restaurant/cloud kitchen.

- ECOs are liable to pay GST on certain services supplied through them:

| Service | Supplier | GST Liability |

| Radio taxi, motor cab, bike | Any person | ECO |

| Hotel accommodation | Registered supplier | Supplier |

| Hotel accommodation | Unregistered supplier | ECO |

| Housekeeping (plumbing, carpentry) | Unregistered | ECO |

| Restaurant services (excluding INR 7500+ hotel premises) | Any person | ECO |

Food Delivery Apps (Zomato, Swiggy)

- From Jan 1, 2022, ECOs collect 5% GST directly from customers. Circular 167/2021: ECOs issue invoices and are not required to file GSTR-8 for restaurant services.

Section 52 –Tax Collected at Source applicability on E-Commerce Operator

- ECOs must collect up to 1% TCS on net taxable supplies. Recent Update (Notification 15/2024): TCS rate revised to 0.5% IGST from July 10, 2024.

Net Value = Total taxable supplies – Returns.

- E-Commerce Operator must collect Tax Collected at Source @ 1% (0.5% CGST + 0.5% SGST) on net taxable supplies made through it by other suppliers.

- TCS: For all other supplies via ECO, supplier pays GST but ECO collects TCS (0.5% CGST + 0.5% SGST) on net value. Food Delivery Apps (Swiggy, Zomato) since 1 Jan 2022: ECO collects 5% GST from customer, restaurants still need registration.

- TCS deposited by 10th of the following month.

- E-Commerce Operator files GSTR-8 monthly.

- Supplier can claim Tax Collected at Source credit in electronic cash ledger via GSTR-2A.

- TCS is not applicable on exempt/zero-rated supplies,

- Selling own products via own website ≠ TCS liability,

- ECO collecting payment = liable for TCS.

- Multiple ECOs: the one making payment to supplier deducts TCS.

Special Cases

- From Jan 2022, food delivery apps (Zomato, Swiggy) directly collect and pay 5% GST on restaurant services.

- Suppliers of exempt or zero-rated goods/services (e.g., books) → No Tax Collected at Source .

- If supplier sells own goods via own website → Not required to collect TCS (but must pay GST on sales).

E-Commerce Operator GST Return Filing & Compliance – GSTR-1, GSTR-3B

- GSTR Filing:

- ECO: GSTR-8 (TCS) + report 9(5) supplies in Table 15 of GSTR-1.

- Supplier: Report in Table 14 of GSTR-1 for TCS-covered services.

- GSTR-3B Table 3.1.1:

- ECO reports and pays GST in cash (no ITC allowed).

- Registered suppliers report in 3.1.1(ii) (no tax liability).

- Table 14: Supplier reports supplies through ECO under Section 52 (TCS).

- Table 15: ECO reports supplies under Section 9(5).

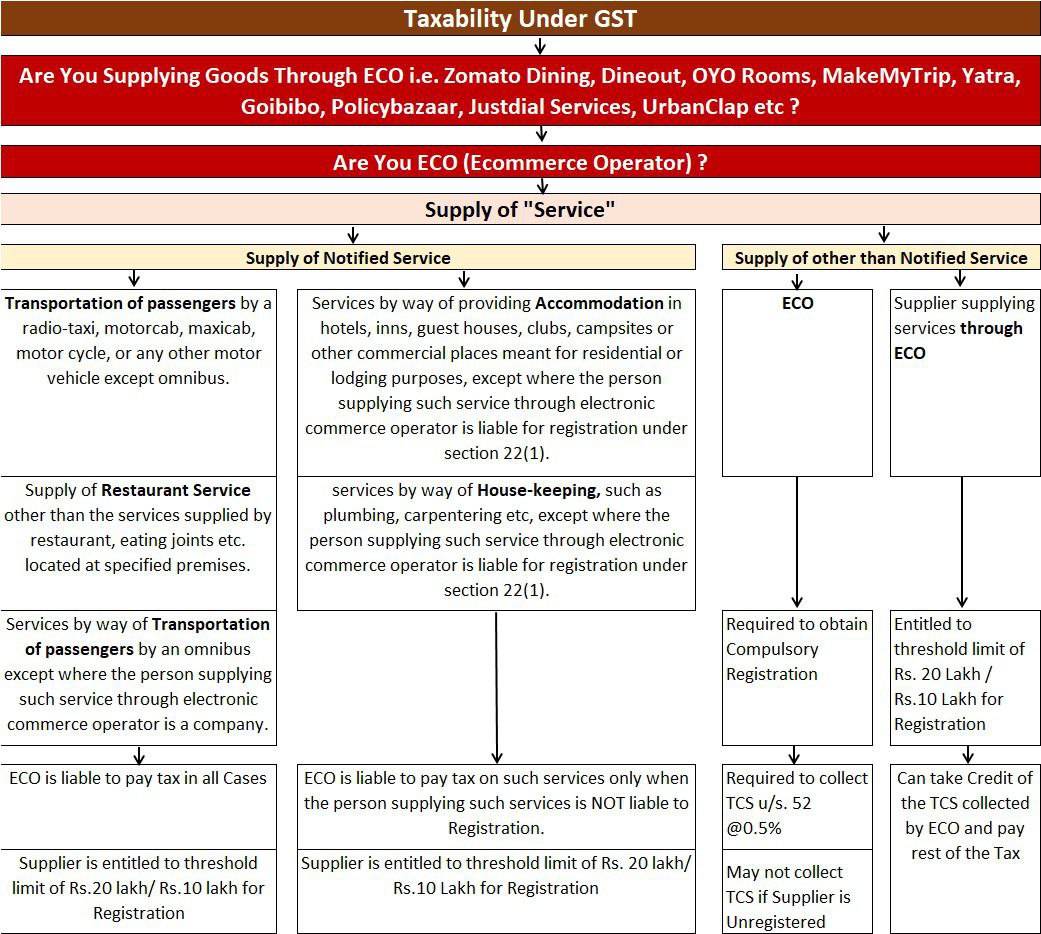

Taxability Under GST for E-Commerce Sale of Services

Step 1: Are You Supplying Goods/Services Through E-Commerce Operator ?

Examples: Zomato Dining, Dineout, OYO Rooms, MakeMyTrip, Yatra, Goibibo, Policybazaar, UrbanClap, etc.

If YES, move to Step 2.

Step 2: Are You an E-Commerce Operator (ECO)?

- Yes → E-Commerce Operator liable in certain cases.

- No → Supplier liable, but rules differ for notified vs. non-notified services.

Step 3: Nature of Service Supplied

Supply of Notified Services

- Transportation of passengers by radio-taxi, motorcab, maxicab, motorcycle (except omnibus).

- Restaurant services (other than those in specified premises).

- Accommodation services (hotels, guest houses, inns, clubs, etc.).

- Housekeeping services (plumbing, carpentry, etc.).

Tax Liability:

- E-Commerce Operator is liable to pay tax in most cases.

- Supplier enjoys threshold exemption (INR 20 lakh / INR 10 lakh).

Supply of Other than Notified Services

- If E-Commerce Operator itself supplies service → E-Commerce Operator must obtain compulsory registration, collect TCS @0.5% u/s 52.

- If supplier supplies through E-Commerce Operator → Supplier entitled to threshold exemption (INR 20 lakh / INR 10 lakh).

Tax Credit:

- Supplier can take credit of Tax Collected at Source collected by E-Commerce Operator and pay balance GST liability.

- If supplier is unregistered, E-Commerce Operator may not collect Tax Collected at Source.

Comparison: Section 52 vs Section 9(5)

| Aspect | Section 52 (TCS) | Section 9(5) (Deemed Supplier) |

| Tax Liability | TCS on net value by ECO | Full GST liability by ECO |

| Registration | Mandatory for ECO & supplier | ECO mandatory; supplier optional |

| Threshold | Not applicable | Applicable to supplier |

| Compliance | GSTR-8 | GSTR-3B (Table 3.1.1) |

| Reverse Charge | Not applicable | Applicable |

GST on E-Commerce Sale of Services

| Type of Service | Who Pays Tax? | Supplier Registration Required? | Threshold Applicability | TCS @1% (Sec. 52) |

| Passenger Transport (Ola, Uber, Rapido, etc.) | ECO | Not required (supplier exempt) | Applicable | No TCS (covered under 9(5)) |

| Hotel/Accommodation (OYO, MMT, Goibibo, etc.) | ECO (if supplier turnover < threshold) | Yes, if turnover > INR 20L/10L | Applicable | No TCS (covered under 9(5)) |

| Housekeeping (UrbanClap/TaskRabbit – plumbing, carpentry, etc.) | ECO (if supplier turnover < threshold) | Yes, if turnover > INR 20L/10L | Applicable | No TCS (covered under 9(5)) |

| Restaurant Services (Zomato, Swiggy – except hotels with tariff > INR 7,500) | ECO | Not required (supplier exempt) | Applicable | No TCS (covered under 9(5)) |

| Other Services via ECO (e.g., Online tuition, freelancing, consultancy, legal, IT, etc.) | Supplier | Yes, if turnover > INR 20L/10L | Applicable | Yes (ECO collects TCS & supplier claims credit) |

| Supplier selling own services via own website (not marketplace) | Supplier | Yes, if turnover > INR 20L/10L | Applicable | Not applicable (no third-party ECO) |

Quick Rules to Remember:

- Notified Services (Sec. 9(5)) → ECO pays GST directly, supplier may be exempt if below threshold, no TCS.

- Other Services via ECO → Supplier pays GST, ECO collects TCS @1%.

- Supplier’s own website → Normal GST liability, no TCS.

- Threshold exemption (INR 20L / INR 10L) applies to suppliers except when mandatory registration is triggered.

OIDAR Services (Online Info & Database Access/Retrieval) : Includes cloud services, digital content, online ads. Overseas providers must register via Form GST REG-10.

GST under Penalties on E-Commerce Sale of Services (Finance Act 2023)

Section 271H: INR 10,000 to INR 1,00,000 for incorrect TCS returns.

53rd GST Council Decision: E-Commerce Operator’s face penalty INR 10,000 or tax amount (whichever is higher) if they:

- Allowing supply by unregistered persons , Allow unregistered sellers (except exempt).

- Allowing ineligible inter-state supply or Allow sellers to supply outside registered states.

- Furnishing incorrect outward supply details. or Fail to file accurate GSTR-8.