Registrar of Companies Timeline Compliance Calendar

Page Contents

Registrar of Companies Timeline Compliance Calendar Financial Year

Following is the Registrar of Companies Compliance Calendar for Financial Year 2023-24.

| Form | Compliance | Period | Due Date

|

| MSME-01 | Form for furnishing half yearly return with the registrar in respect of outstanding payments to Micro or Small Enterprises | 1st October 2023 to 31st March 2024 | 30th April

|

| Form-11 | Annual Return of Limited Liability Partnership (LLP) | Financial Year | 30th May

|

| PAS-06 | Reconciliation of Share Capital Audit Report (Half-yearly) | 1st October 20X1 to 31st March 20X2 | 30th May

|

| DPT-03 | Form DPT-3 shall be used for filing return of deposit or particulars of transaction not considered as deposit or both by every company other than Government company. | Financial Year | 30th June

|

| DIR-03 | KYC Form No. DIR-3-KYC is used for filing application for KYC of directors. | Financial Year | 30th Sept

|

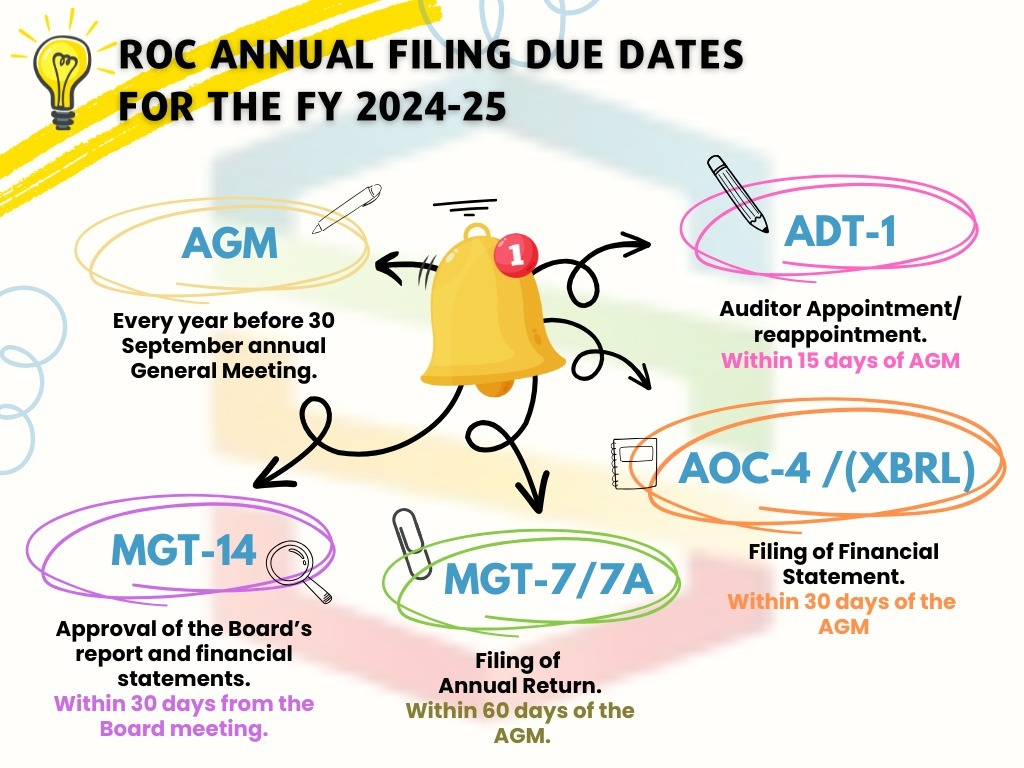

ADT-01 |

Form-ADT-01 is filed for informing Registrar of Companies about Appointment of Auditor. To be filed in 15 days from the conclusion of Annual General Meeting.

|

Annual General Meeting – For Financial Year 2023-24 can be done upto 30th Sept 2024 |

30th Sept |

| Form-08 | Statement of Account & Solvency and Charge filing | Financial Year | 30th October

|

| AOC-04 | Form for filing financial statement and other documents with the Registrar.

To be filed in 30 days from the conclusion of Annual General Meeting. Annual General Meeting for FY can be done upto 30th Sept |

Financial Year | 30th October |

| MSME-01 | Form for furnishing half yearly return with the registrar in respect of outstanding payments to Micro or Small Enterprises. | 1st April to 30th Sept | 31st Oct |

| MGT-14 | Form for filling resolutions (Including resolutions for Adoption of Accounts) and/or agreements within 30 days after being passed at the meeting of the Board/Shareholders of the company or of the making of the agreement. Annual General Meeting for Financial Year 2023-24 can be done upto 30th Sept 2024.

|

Financial Year

|

31st Oct

|

| PAS-06 | Reconciliation of Share Capital Audit Report (Half-yearly) | 1st April to 30th Sept | 29th Nov |

| MGT-07 | Form for Filling Annual Return for companies other than One Person Companies and Small Companies. To be filed in Sixty days from the conclusion of annual general meeting.- Annual General Meeting for Financial Year can be done upto 30th Sept

|

FY | 29th Nov

|

| MGT-07A | Form for Filling Abridged Annual Return for One Person Companies and Small Companies. To be filed in Sixty days from the conclusion of Annual General Meeting.- Annual General Meeting for Financial Year 2023-24 can be done upto 30th Sept 2024 | Financial Year 2023-24 | 29th November 2024

|

These Timeline dates are subject to change if extended by the Registrar of Companies.

Timeline Date for conducting Annual General Meeting

The Annual General Meeting of every company, with the exception of OPCs, must be held no later than 6th months following conclusion of the financial year. Every year, Company must hold an annual general meeting before Sept 30 if its FY ends in March. A first annual general meeting, but may be held by the firm in fewer than Nine months following conclusion of the 1st Financial year. A company’s Annual General Meetings should be separated by no more than Fifteen months.

MCA FORM ADT-3

Question : If the tenure of the previous auditor of five years has been completed on 31.3.2023 as ADT-1, then in my appointment, will I now have to take the SRN of ADT-3 from him or is only his resignation letter sufficient?

Ans : If ADT-3 is not filed by the previous auditor, then you can go with ADT-1 SRN along with resignation letter and if ADT-3 is filed, then you can fetch the details from MCA site. ADT-3 is not required when tenure of auditor is completed and auditor is appointed in AGM

Various types of meetings requirements as per Company Law

Compliance with Rule 9B of the Companies (Prospectus and Allotment of Securities) Rules, 2014 — Dematerialisation of Existing Securities and ISIN Allocation

Professional and copany Owner has to make mandatory compliance requirement under Rule 9B of the Companies (Prospectus and Allotment of Securities) Rules, 2014, as amended.

In accordance with the said rule: “No further issue or allotment of securities shall be made by a public company unless all its existing securities have been dematerialised.” And accordingly, you are requested to take the following actions:

-

Dematerialise all existing securities of the company through a depository (NSDL/CDSL) before proceeding with any further issuance or allotment of securities, including rights issue, bonus issues, private placements, preferential allotments, etc.

-

Obtain separate ISINs (International Securities Identification Numbers) for each class of security such as Preference shares, Debentures, Bonds, Any other security as defined under Section 2(h) of the Securities Contracts (Regulation) Act, 1956

above steps are duly complied with to maintain regulatory compliance and avoid any future non-compliance consequences under the Companies Act, 2013 and related SEBI regulations.