Reasons for Income Tax Scrutiny Triggers/Tax Notices in 2025

Page Contents

Reasons for Income Tax Scrutiny Triggers / Tax Notices in 2025

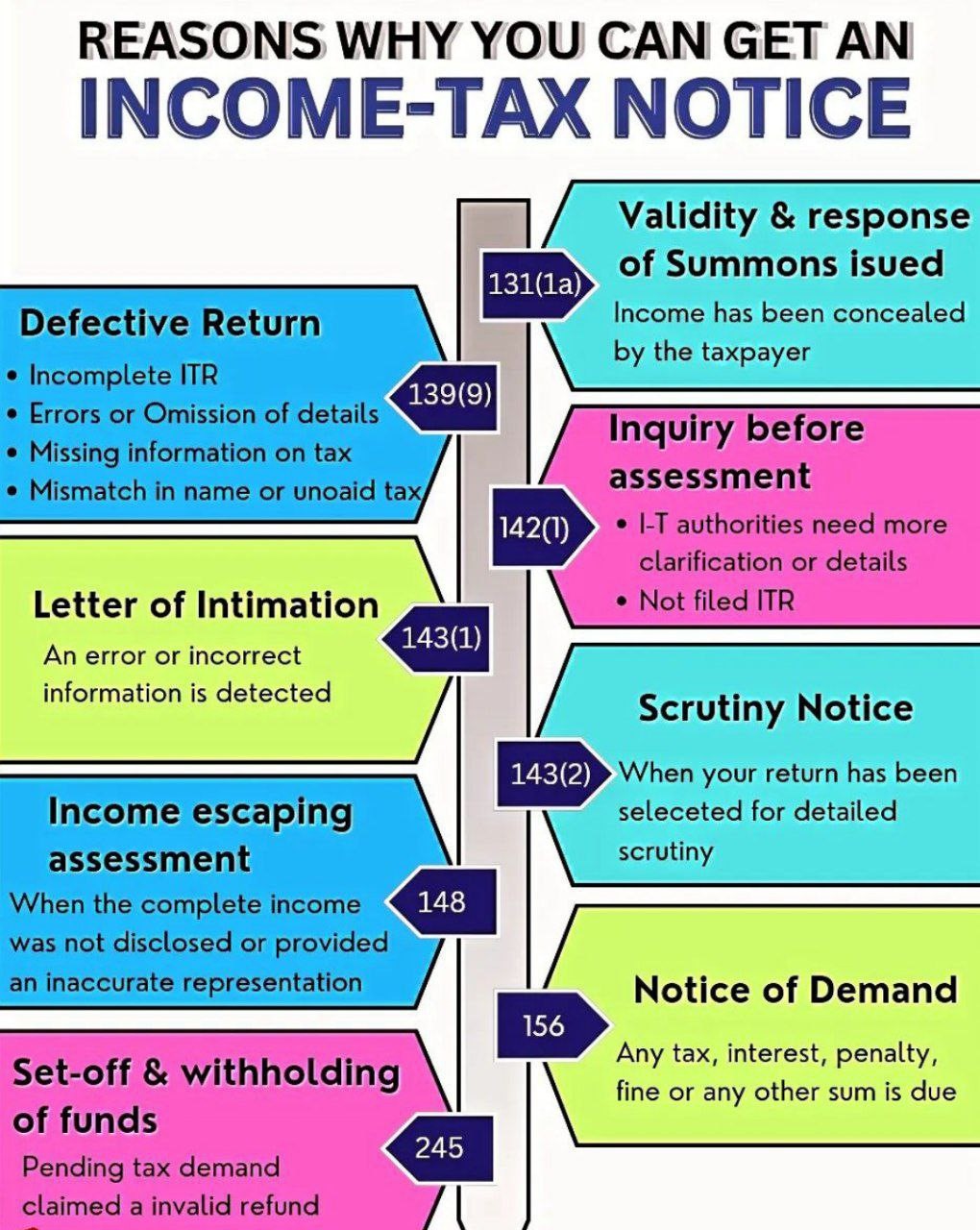

Every year, 1000 of taxpayers in India receive Tax Notices due to mismatches, omissions, or non-compliance in their tax filings. With the Tax Dept now deploying advanced AI-driven monitoring systems, scrutiny in 2025 is expected to be more stringent than ever. To avoid penalties, stress, and time-consuming litigation, it is crucial to understand why notices are issued and how to prevent them.

Income Tax Scrutiny Triggers: Red Flags You Should Avoid

Most common reason for receiving a notice is Mismatch between ITR data and Form 26AS/AIS. Even minor discrepancies must be addressed to avoid penalties. Simple issues may be resolved online within weeks; complex matters may take longer. We reply to a notice without a CA but expert assistance reduces errors and further scrutiny. By filing accurately, reporting all income, and ensuring no mismatches with AIS/26AS.

- High-Value Transactions Not Matching ITR: -If your Bank deposits, Credit card spends, or Property investments. don’t match your declared income. it’s a major trigger. All such data is captured in your AIS & 26AS.

- Real Estate Deals: –Buying or selling property above INR 50 lakh? Reported via TDS (Form 26QB). If property transaction values don’t reflect in your ITR scrutiny is likely. Always match sale/purchase details with your ITR disclosures.

- Delay or Non-Filing of ITR : Late filing or non-filing despite having taxable income automatically triggers notices under Section 139(9). Taxpayer can Avoid it via File ITR before the due date & Even if income is below taxable limits, file ITR if you have high-value transactions.

- Heavy Cash Deposits or Withdrawals: – Large cash deposits (esp. post-demonetisation) or high withdrawals can trigger red flags. Large cash deposits/withdrawals exceeding prescribed limits can result in scrutiny. Taxpayer can Avoid it by Use digital modes (NEFT/RTGS/UPI) for high-value payments & Avoid splitting transactions AI systems detect patterns easily. Thresholds is as follow :

- Deposit INR 10L+ in savings a/c

- Deposit INR 50L+ in current a/c

- Cash expenses >INR 2L per transaction

- Tax payer needed to ensure proper trail for all cash dealings.

- Luxury Lifestyle vs Declared Income: – Owning luxury cars, foreign trips, or big investments but showing low income?. That’s a mismatch The Department uses AI-based tools to detect such lifestyle-income gaps.

- High Share / Crypto / Derivative Trades: – Frequent or high-volume trades reported to exchanges trigger automated scrutiny. Particularly when Losses claimed are large, Turnover mismatch in 44AD/44AB. Keep proper broker statements & contract notes ready.

- Non-Disclosure of Foreign Assets or Income (Foreign Income or Assets): – Non-disclosure of Foreign property, Foreign bank account, Investment abroad & under the Black Money (Undisclosed Foreign Income & Assets) Act = serious scrutiny risk. Non-reporting of foreign bank A/c, property, or financial interests is treated as a serious offence under the Black Money Act. Taxpayer to Avoid Disclose all foreign assets/income under Schedule FA & Ensure compliance with FEMA and RBI reporting norms.

- Mismatch Between Tax return & Form AIS / TIS/26AS : Taxpayer TDS, interest income, dividend, etc. in 26AS/AIS must match your ITR.Even a small mismatch (like missed FD interest) can trigger a notice. A mismatch between the income or TDS reported in your ITR and the data captured in Form 26AS, AIS, or TIS is the most common trigger for notices. Example: TDS deducted by your employer or bank not appearing correctly in your ITR. Taxpayer can avoid it by Always verify income and TDS with 26AS, AIS, and TIS before filing & Report all sources of income including bank interest, capital gains, and dividends.

- Frequent Cash Business Expenses: – Heavy cash payments to vendors or employees often lead to suspicion. Section 40A(3): Cash expense >INR 10,000 per day per person = disallowed. & Stick to banking channels

- Repeated Refund Claims / Loss Returns: – If you continuously file refund/loss returns, the system may flag your ITR for detailed verification. Keep documentary proof for all deductions & losses claimed.

- Non-Filing of Return Despite High TDS or AIS Data : If there’s substantial TDS in your PAN or high-value AIS entries, but you haven’t filed an ITR scrutiny is auto-triggered.

- Incorrect PAN–Aadhaar Linking or TDS Errors : Mismatches due to unlinked PAN–Aadhaar or non-deposit of TDS by deductors often result in notices. Taxpayer to Avoid it must Ensure PAN and Aadhaar are linked before filing. & Confirm with employers/banks/tenants that TDS has been deposited correctly and on time.

- Non-Disclosure of Foreign Assets or Income : Non-reporting of foreign bank accounts, property, or financial interests is treated as a serious offence under the Black Money Act. Taxpayer to Avoid it by Disclose all foreign assets/income under Schedule FA & Ensure compliance with FEMA and RBI reporting norms.

- Claiming Incorrect Deductions or Exemptions : Claiming ineligible or inflated deductions under 80C, 80D, HRA, etc., frequently attracts notices for under-reporting. Taxpyer can Avoid it via Claim only genuine, eligible deduction, Keep proofs such as investment receipts, medical bills, and rent agreements & Avoid last-minute tax-saving mistakes.

- Non-Disclosure of High-Value Transactions : The department tracks high-value transactions such as:

-

- Cash deposits > INR 10 lakh in savings accounts

- Credit card payments > INR 1 lakh (cash) or > INR 10 lakh (non-cash)

- Large investments in mutual funds, shares, or bonds

- Property purchases/sales ≥ INR 30 lakh

Taxpayer can Avoid it via Report all high-value transactions in your ITR & Maintain proper documentation like bank statements, investment proofs, property papers, etc.

- Not Reporting Income from All Sources : Secondary incomes are often overlooked, including Freelancing/consultancy income, Rental income, FD/RD interest, Capital gains from equity, mutual funds, or cryptocurrency, Taxpayer can avoid it by Report all sources of income even if TDS is already deducted & Use AIS and 26AS to identify missing entries.

Other Top Audit Triggers for Income Tax Scrutiny that can cause income tax scrutiny

- Tax Audit Applicability Breach: Turnover/professional receipts exceed limits (INR 1 crore for business, INR 50 lakh for profession) but no audit done.

- Defects in Audit Report or ITR: Missing signatures, incomplete disclosures, wrong clauses in Form 3CD, or late submission.

- Non-Compliance with Accounting Standards (AS/Ind AS) : Deviations in income recognition, valuation, or presentation flagged by auditor.

- Qualified/Adverse/Disclaimer Opinions : Auditor expresses doubt or inability to verify financials.

- Auditor’s Report Qualifications : Notes like “subject to” or “except for” indicate non-compliance or weak internal controls.

- High-Priority Disclosures in Form 3CD : Clauses 21, 34, 40, 44 left blank or showing anomalies (e.g., TDS defaults, GST mismatch).

- Specific Tax-Related Disclosures : Related party payments, cash transactions, foreign remittances, unverifiable donations.

- Mismatch of Audit Financials vs Tax return : Differences in revenue, expenses, or profits between audited accounts and tax return.

- Abnormal Financial Ratios : Negative current ratio, very low margins, or unusually high debtor days.

- Transactional Red Flags : High cash payments, unsecured loans without agreements, frequent related-party dealings.

- Profitability Variations : Sudden profit drops or spikes without valid business reasons.

- Revenue and Sales Fluctuations : Big jumps or declines in turnover without matching cost changes.

- Expense & Deduction Triggers : Excessive salaries, high consultancy/advertising costs, frequent donations under 80C/80G.

- Cash Flow Statement Anomalies : Large cash flows despite accounting losses or excessive cash purchases/sales.

How to Respond to an Income Tax Notice

We should not panic most notices are for clarification. Log in to the Income Tax e-Filing Portal and check the notice details. Respond within the stipulated timeline with supporting documents & timely accurate and timely compliance. taxpayer should Avoid These Red Flags :

With enhanced digitization and AI-driven monitoring, compliance in 2025 requires greater accuracy and transparency. Most notices arise due to mismatches, non-disclosure, or incorrect reporting. By maintaining proper documentation, filing correctly, and seeking expert guidance, taxpayers can easily avoid unnecessary notices and penalties.

Mismatch in Tax return & AIS/26AS, High cash transactions, Property, luxury assets without declared income, Undisclosed foreign income, Frequent loss/refund returns, Stay transparent. File accurate returns. Keep records. At Rajput Jain & Associates, Expert CA assist with Tax return filing, tax planning, compliance, AIS/26AS reconciliation, and responding to tax notices ensuring 100% accuracy and timely submissions so you can stay worry-free & focus on your financial growth.