Quick Guide on GST Marginal Scheme

Page Contents

Quick Guide on GST Marginal Scheme

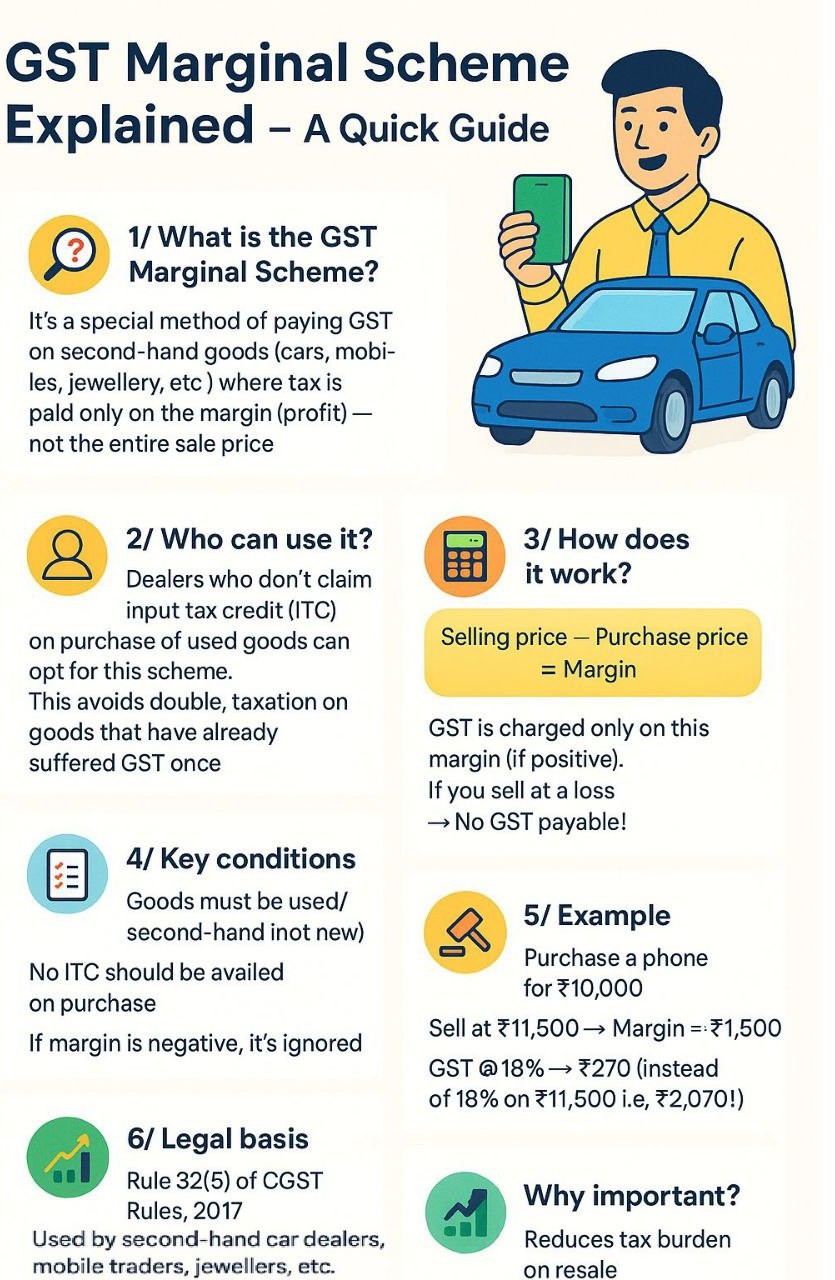

What is GST Marginal Scheme Meaning :

The GST Margin Scheme is applicable primarily to second-hand goods.

- Under this scheme, GST is levied only on the margin (difference between selling price and purchase price), not the full sale value.

- Purpose: Avoid double taxation on goods that have already been taxed earlier.

The GST Marginal Scheme is a special method of GST calculation applicable to second-hand goods (e.g., cars, mobiles, jewellery). Under this scheme, GST is charged only on the margin (profit), not on the full sale price. Prevents double taxation on goods that were already taxed earlier. As per the Rule 32(5), CGST Rules, 2017 – Commonly used by second-hand car dealers, mobile traders, jewellers, etc. Reduces the tax burden on resale transactions. & Encourages reuse and recycling of goods.

GSTN Exemption Notification : Notification No. 10/2017-Central Tax (Rate) dated 28.06.2017:

- Exempts intra-State purchases of second-hand goods from unregistered persons by dealers using the margin scheme.

- Similar exemptions exist under SGST Acts.

Who Can Use GST Marginal Scheme :

Dealers of used/second-hand goods. & Dealers who do not claim Input Tax Credit (ITC) on their purchases. Key Conditions of GST Marginal Scheme is Goods must be used/second-hand., No ITC should be claimed on the purchase of the goods., Negative margin is ignored. Following the basic Conditions to Avail Margin Scheme

- Supplier must be a second-hand goods dealer.

- Goods must not have ITC claimed.

- Any further processing should not change the nature of the goods.

- The transaction must be a taxable supply.

- GST is payable only if the margin is positive.

- If the value is negative, GST is not applicable.

- Input Tax Credit (ITC) cannot be claimed when opting for this scheme. No GST if the goods are sold at a loss.

How Does GST Marginal Scheme Work?

Scope and Valuation of GST Marginal Scheme :

- Margin = Selling Price – Purchase Price

- Value of supply = Selling Price – Purchase Price

- Applicable for used goods or goods with minor processing that does not change the nature of goods.

Illustrative Example

- Dealer: M/s Zenit Enterprises Ltd (second-hand two-wheelers)

- Purchase: Honda Activa for ₹42,000 from an unregistered person (original price ₹77,000)

- Sale: ₹55,000 after minor refurbishing

- Margin = ₹55,000 – ₹42,000 = ₹13,000

- GST is levied only on ₹13,000, and no ITC can be claimed

Key Takeaways GST Marginal Scheme

- Reduces tax burden on resale of used goods

- Encourages reuse and recycling

- Commonly used by vehicle dealers, mobile traders, and jewellers

- Seller (unregistered) does not issue a taxable invoice

- Buyer (registered dealer) cannot claim ITC

- Margin scheme must be opted for explicitly

- margin-scheme-under-gst