New PAN Aadhaar Linking: 31st Dec 2025 Deadline

Page Contents

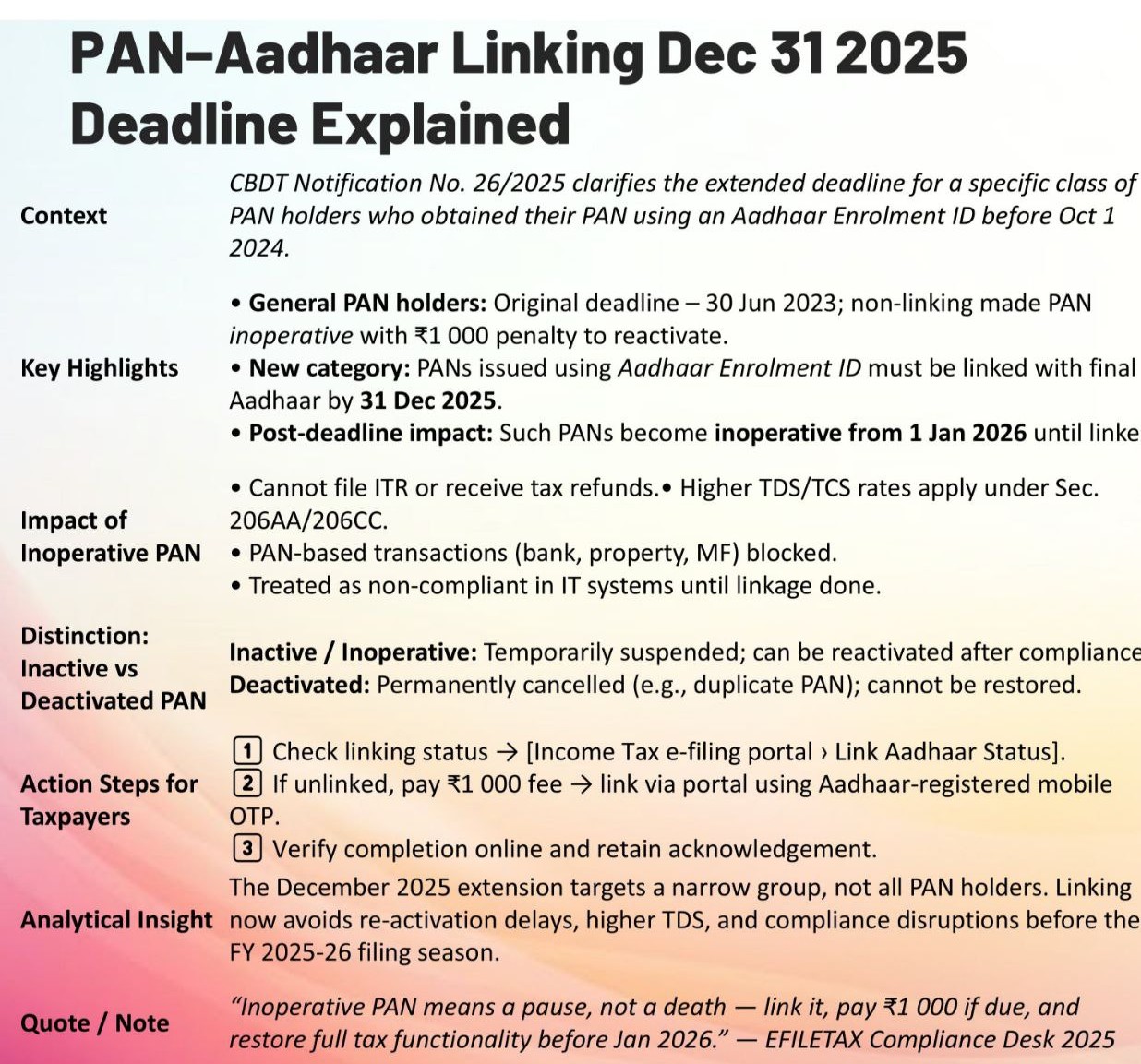

New PAN–Aadhaar Linking: 31 December 2025 Deadline

CBDT Notification No. 26/2025:

Extended deadline for PAN holders who obtained PAN using Aadhaar Enrolment ID before Oct 1, 2024. However The Income Tax Department has set 31 December 2025 as the last date to link PAN with Aadhaar for all individuals who have been allotted a PAN but have not yet linked it. After this date, your PAN will become inoperative until linked.

- General PAN holders: original deadline was 30 June 2023; non-linking made the PAN inoperative with a INR1,000 penalty to reactivate.

- New category: PANs issued using Aadhaar Enrolment ID must be linked with final Aadhaar by 31 Dec 2025.

Post-deadline impact:

Such PANs become inoperative from 1 Jan 2026 until linked. Linking now avoids reactivation delays, higher TDS, and compliance issues before FY 2025-26 filing season. Following are Impact of Inoperative PAN

- Cannot file ITR or receive tax refunds.

- Higher TDS/TCS rates under Sec. 206AA/206CC.

- PAN-based transactions (bank, property, MF) blocked.

- Treated as non-compliant in IT systems until linkage.

Why is the New PAN–Aadhaar linking mandatory?

Linking PAN with Aadhaar helps the Income Tax Department eliminate duplicate PANs, Prevent tax evasion, Strengthen identity verification, and enable smooth processing of returns, refunds, and compliance. The requirement comes under Section 139AA of the Income Tax Act.

What Happens If You Do NOT Link by 31 December 2025?

If taxpayer PAN becomes inoperative, which leads to ITR cannot be processed, Pending refunds cannot be issued. Higher TDS/TCS rates will apply (up to 20%), Taxpayer cannot file updated returns (ITR-U), PAN cannot be quoted for high-value transactions (e.g., bank account opening, mutual funds, property purchase). PAN becomes operative again only after linking (usually within 30 days of linking). Following are action Steps for Taxpayers

- Check linking status → [Income Tax e-filing portal] → Link Aadhaar Status.

- If unlinked, pay INR1,000 fee → link via portal using Aadhaar-registered mobile OTP.

- Verify completion online and retain acknowledgement.

Inactive vs Deactivated PAN

- Inactive/Inoperative: Temporarily suspended; can be reactivated after compliance.

- Deactivated: Permanently cancelled (e.g., duplicate PAN); cannot be restored.

Who is Exempt from PAN–Aadhaar linking: Linking is not mandatory for the following categories like NRIs, Foreign citizens holding PAN, Residents of Assam, Meghalaya, and J&K, and individuals above 80 years (super senior citizens). Those without Aadhaar (and exempted under Aadhaar Act)

How to Check if Your PAN is Already Linked ?

Go to Income Tax e-filing portal thereafter Quick Links option then PAN–Aadhaar Link Status. Thereafter go to Enter PAN, Aadhaar, Captcha. It will show: Linked / Not Linked / Inoperative / Operative.

How to Link PAN and Aadhaar (Simple Process) ?

Step 1: Pay INR1,000 late fee : Visit https://onlineservices.tin.egov-nsdl.com/etaxnew/ . Choose thereafter Challan No. 280 → Other Receipts (Code 610). Pay through net banking/UPI/debit card

Step 2: Link your PAN & Aadhaar : Login to https://www.incometax.gov.in. ‘Link Aadhaar’ option under Profile. Enter Aadhaar number and OTP. Linking usually takes 5–10 days after payment.

The PAN–Aadhaar linking deadline is 31 Dec 2025. If not linked, your PAN becomes inoperative. ITR processing, refunds, TDS rates, and high-value transactions will be affected. A late fee of INR1,000 applies. Link on income tax portal after fee payment. Key Points of PAN–Aadhaar Linking

- Deadline: 31 December 2025

- PAN becomes inoperative if not linked

- An INR 1,000 late fee must be paid

- Mandatory for filing ITR for AY 2026–27

- TDS/TCS complications if not linked

- Linking can be done online in minutes

- “Inoperative PAN means a pause, not a death link it, pay INR1,000 if due, and restore full tax functionality before Jan 2026.”

Penalty/Late Fee for Linking PAN and Aadhaar

The penalty for linking PAN with Aadhaar after the earlier deadlines continues INR1,000 late fee must be paid (Fee Code 610 on NSDL portal). Taxpayer cannot link PAN-Aadhaar without paying this fee if you missed the previous deadlines.