Introduction to Section 45(5A) & Joint Development Agreement

Page Contents

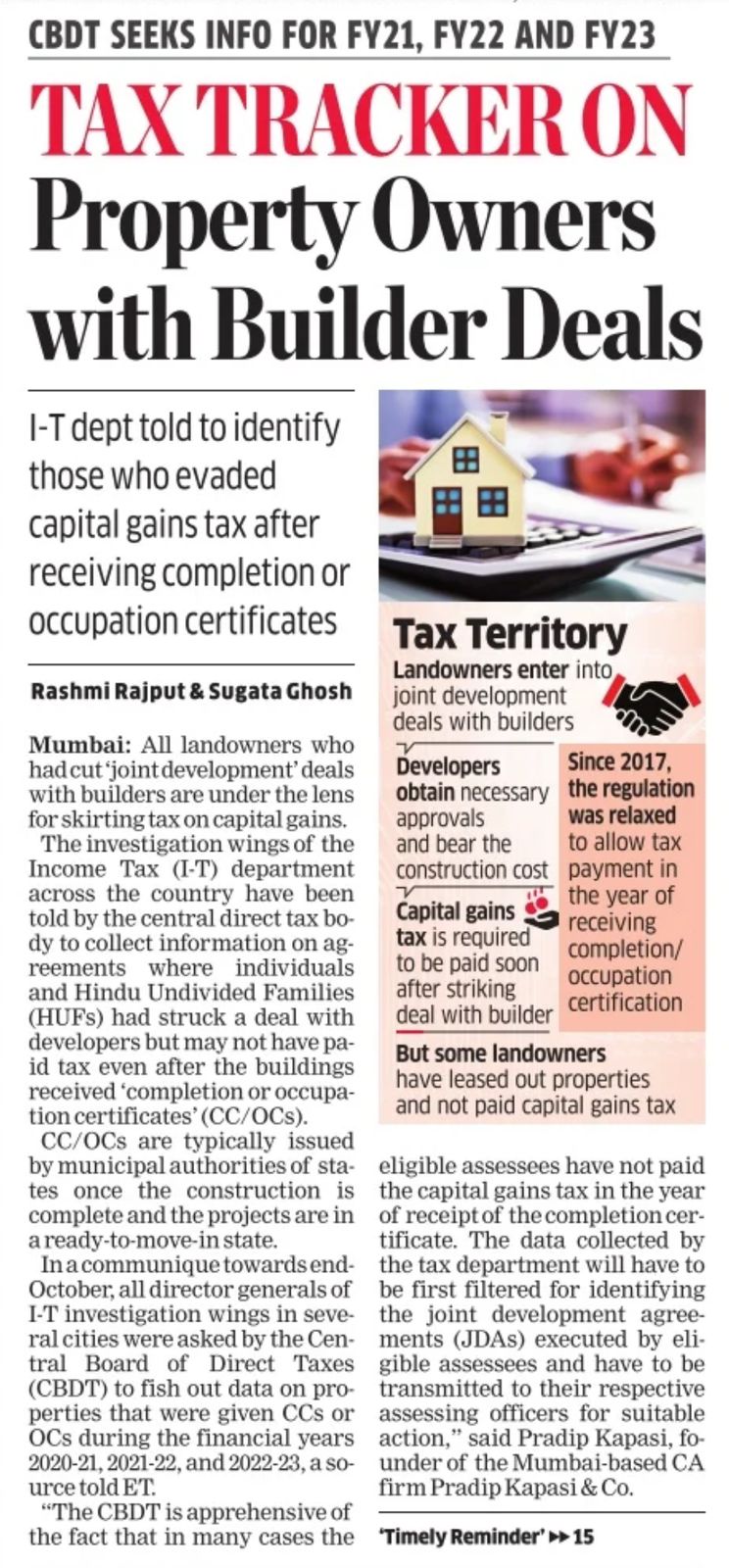

Income Tax Department identify cases where capital gain tax has not been paid by land owners :

The Income Tax Department’s recent focus on capital gains tax compliance under Section 45(5A) of the Income Tax Act emphasizes the importance for landowners (individuals and HUFs) involved in Joint Development Agreements to meet their tax obligations. Here’s a breakdown:

Introduction to Joint Development Agreements:

- A Joint Development Agreement is a contractual arrangement where a landowner contributes their land to a project and partners with a developer who undertakes the cost of construction and development. In return, the landowner typically receives either a share in the developed property or a mix of monetary compensation and property units.

- These transactions inherently involve the transfer of a capital asset by the landowner, making them subject to capital gains tax under the Income Tax Act.

Challenges Before the Introduction of Section 45(5A): Pre-2017 Position

- Capital gains were taxed under Section 45(1) in the year of “transfer” as defined under Section 2(47).

- In a JDA, this “transfer” was deemed to occur when the landowner signed and registered the agreement with the developer, despite the owner not receiving any tangible consideration at that time.

- This caused cash flow issues for landowners as they were required to pay capital gains tax before receiving any financial or physical benefits.

Key Aspects of Section 45(5A) and JDA :

Trigger Point for Tax Liability: The capital gain is taxed in the year the developer receives the completion certificate from the local authority, not at the time of entering into the JDA.

- Applicability of section 45(5A) : Pertains to landowners (individuals or HUFs) transferring land/buildings through Joint Development Agreements (JDAs) with developers. overview on Applicability of JDA is mention here under :

- Applies only to individuals and Hindu Undivided Families (HUFs).

- The land or building must be treated as a capital asset and not stock-in-trade.

- Effective for JDAs entered into on or after April 1, 2017.

- Conditions for Availment: The JDA must be registered under relevant property laws. The landowner should not sell or transfer their share in the project before the issuance of the completion certificate.

- Capital gains are now taxed in the year when the completion certificate for the project (or part thereof) is issued by the competent authority.

Capital Gains Method of Computation u/s 45(5A):

- Full Value of Sale Consideration: Deemed to be the stamp duty value of the landowner’s share in the project, as on the date of issuance of the completion certificate

- Cost of Acquisition: Original cost of the land/building or indexed cost if long-term capital asset. The original cost of acquisition (or indexed cost, if long-term capital asset) of the land/building is deducted from the full value of consideration to compute the capital gains.

- Non-Monetary Consideration: Not applicable where the landowner receives the entire consideration in monetary terms (cash). The consideration for computing capital gains is based on the stamp duty value (circle rate) of the landowner’s share in the project as on the date of the completion certificate.

- Exemptions u/s 54 / 54EC : Landowners may claim capital gains exemptions under Sections 54 (purchase of a residential house) or 54EC (investment in specified bonds), subject to eligibility.

TDS in Joint Development Agreements : Section 194IC

To ensure tax compliance in JDAs, Section 194IC was also introduced by the Finance Act, 2017. Developers must deduct TDS on any monetary consideration paid to the landowner under a JDA. This TDS provision applies to payments made by developers to individual or HUF landowners in addition to the property share.

Rate of TDS:

-

- 10% on the monetary consideration.

- If the landowner does not furnish their PAN, the TDS rate increases to 20%

Current Measures by the Income Tax Department:

- Data Collection by Investigation Wing: CBDT has instructed investigation units to obtain completion certificate data from local authorities. This data will help identify landowners who may not have reported or paid capital gains tax arising from JDAs.

- Income Tax Deptt to identify cases where capital gain tax has not been paid by land owners ( Individual & HUF ) who have entered into Joint Development Agreement. CBDT has issued instructions to Investigation Deptt to collect data from Local Authority issuing completion certificate.

- As per Section 45(5A) of Income Tax Act, Capital Gain tax consequent to joint development agreement entered with the Developer is to be paid by land owners ( Individual & HUF ) computed on the basis of circle rate and in the year Completion certificate is recd by Developer. It will be advisable in case Capital Gain tax has not been paid , to file updated return before formal notice is issued from tax Deptt to avoid penal consequences.

- Risk of Non-Compliance: Non-payment of capital gains tax is likely to attract scrutiny, penalties, and interest under applicable provisions of the Income Tax Act.

What are the basis Steps to be taken care by Landowners :

- Landowner should Verify whether capital gains from JDAs have been appropriately reported in the year of the completion certificate. Ensure compliance with Section 45(5A) and Section 194IC for transactions involving JDAs. Report capital gains in the year of the completion certificate

- The Landowner should ensure the correct computation based on stamp duty value and other factors. In case Landowner should has not reported ITR than File an updated return under Section 139(8A) for the relevant assessment year, provided it’s within the permissible time limit to avoid penalties.

- Landowner should Filing an updated return voluntarily may help avoid penal consequences, including scrutiny, penalties, and prosecution. Explore avenues for exemption under Sections 54/54EC for reinvestment of gains.

Consequences of Non-Compliance:

- Penalties: If identified by the Income Tax Department before voluntary disclosure, hefty penalties under Section 270A (for underreporting or misreporting of income) and interest under Section 234A/B/C may apply.

- Prosecution: Persistent or willful non-compliance can lead to prosecution under Section 276C for tax evasion.