ITR 3: New Code Introduced for Nature of Business/Profession

Page Contents

Update in ITR Utility—New Codes Introduced for “Nature of Business/Profession”

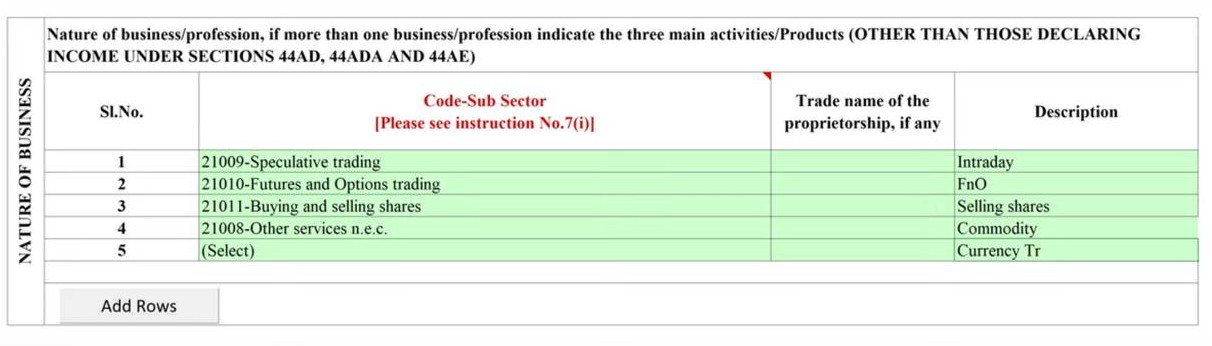

The Income Tax Department has updated the Income Tax Return (ITR) utility with new codes under the “Nature of Business/Profession” section to align with evolving sectors and taxpayer activities. These changes are applicable for Assessment Year 2025–26. The Tax Dept has updated the ITR-3 utility with new Nature of Business/Profession codes to reflect the growth of emerging sectors such as online trading and digital content creation. Following Key New Codes Introduced:

Newly Introduced Codes for Nature of Business/Profession

-

09029 – Commission Agents (Kachcha Arahitya)

-

16021 – Social Media Influencers

-

21009 – Speculative Trading

-

21010 – Futures & Options (F&O) Trading

-

21011 – Buying and Selling of Shares

Why This Matters in ITR Utility—New Codes Introduced ?

Taxpayers and professionals must select the correct business/profession code while filing ITR to Ensure accurate classification of income. Avoid notices or scrutiny due to mismatched data & Facilitate seamless ITR processing by the Income Tax Department. Selecting the appropriate code ensures:

-

Proper classification of income

-

Faster and more accurate ITR processing

-

Reduced risk of tax scrutiny or mismatches

If Taxpayer you’re engaged in trading, influencing, agency work, or any newly categorized profession, please review your ITR forms carefully and choose the appropriate code. Need help with code selection or ITR filing for AY 2025–26? Feel free to reach out.

Who is Eligible to File the ITR-3 Form?

The ITR-3 is applicable to individuals and Hindu Undivided Families (HUFs) who earn income from a business or profession, including both tax audit and non-audit cases. Filing the correct ITR form ensures faster processing and reduces the risk of notices from the Income Tax Department.

Who is eligible to file ITR-3 : Individuals and Hindu Undivided Families are required to file ITR-3 if they earn income from:

- Business or profession (tax audit and non-tax audit cases),

- And do not opt for presumptive taxation under Sections 44AD, 44ADA, or 44AE.

Eligible Assessees Include:

-

Individuals/HUFs carrying on a proprietary business or profession

-

Those receiving remuneration, interest, or commission from a partnership firm

-

Individuals with income from multiple sources, such as:

-

Salary or pension

-

House property

-

Capital gains

-

Other sources (e.g., interest, dividends)

-

Who is Not Eligible to File the ITR-3 Form?

Ineligible persons include:

-

Entities other than individuals and HUFs (e.g., companies, LLPs, AOPs, etc.)

-

Individuals or HUFs not earning income from business/profession or partnership firms

-

Taxpayers eligible to file under ITR-1 (Sahaj), ITR-2, or ITR-4 (Sugam) based on their income profile

Note: If you’re eligible to file ITR-1, ITR-2, or ITR-4, you should not file ITR-3.

Due Date for Filing ITR-3 for AY 2025–26 (FY 2024–25)

For Non-Audit Cases: 15th September 2025 (extended from 31st July 2025)

For Audit Cases (u/s 44AB): 31st October 2025

Online Filing for ITR-3 is Finally Enabled

After 121 Days into FY 2024–25, Online Filing for ITR-3 is finally enabled. The Excel utility for income tax return Form 3 AY 2025–26 was released by the Income Tax Dept on July 11, 2025, nearly 100 days after the commencement of the income tax return filing season. Now, with both online and offline (Excel/Java) utilities available, Income taxpayers can finally file ITR-3 online on the official e-filing portal. This is significant for those:

- Earning business or professional income (other than under presumptive taxation),

- Having income from share trading, such as futures & options (F&O) or intraday,

- Holding unlisted shares.