Introduced for Unregistered Dealers on E-Way Bill Portal

Page Contents

Form ENR-03: Introduced for Unregistered Dealers on E-Way Bill Portal

The E-Way Bill (EWB) system now allows unregistered dealers to generate e-Way Bills using Form ENR-03, eliminating the requirement for a GSTIN. This simplifies goods transportation compliance and enhances logistics efficiency. GSTN Issue Notification issued on ENR-03 filing process for Unregistered Persons (URPs) to generate e-Way Bills under the GST system, based on the latest GSTN advisory

- Unregistered Persons (URPs) can now generate e-Way Bills without registering for GST. They must enroll on the E-Way Bill (EWB) portal by filing Form ENR-03.

- The Enrolment ID generated will act as a substitute for Supplier GSTIN/Recipient GSTIN.

- Previously, if neither buyer nor seller was registered, the transporter had to generate the e-Way Bill. Now, any one party (buyer/seller) can enroll using ENR-03 and generate an e-Way Bill. Helps small businesses below the GST threshold to comply with GST rules without registering.

Key Highlights on Form ENR-03 Introduced for Unregistered Dealers on E-Way Bill Portal

- Unregistered dealers can now generate e-Way Bills without GST registration.

- Enrolment ID (15 characters) will serve as an alternative to GSTIN.

- PAN & mobile number verification (via OTP) required.

- Username & Password setup needed for login.

- Easy e-Way Bill Generation – Use the “Generate New” option after login.

- Effective Date: February 11, 2025 which is Issued By: GST Network (GSTN)

Key Advantages of ENR-03 Enrolment

- No GST registration needed for e-Way Bills.

- No third-party dependency (generate bills independently).

- Speeds up logistics & compliance processes.

- Better tracking & regulation of transported goods.

Step-by-Step Guide to Filing ENR-03 on the E-Way Bill Portal

Step 1: Access the E-Way Bill Portal

- Go to the GST E-Way Bill portal.

- Click on ‘Registration’ in the main menu.

- Select ‘ENR-03 Enrolment’ option.

- Enter State, PAN, Mobile Number, and Address Details → Verify via OTP

Step 2: Enter Business Details

- Select State and enter your PAN details (for verification).

- Choose the type of enrolment (Individual, Business, etc.).

- Provide address details and mobile number (OTP verification required).

- Set up Login Credentials → Submit & receive Enrolment ID.

Step 3: Create Login Credentials

- Choose a Username & Password and check availability.

- Submit the details.

- A 15-character Enrolment ID will be generated and displayed.

- Log in → Use Enrolment ID as Supplier/Recipient → Generate e-Way Bill.

Step 4: Generate an e-Way Bill

- Log in to the E-Way Bill Portal using your credentials.

- Click on ‘Generate New’.

- Your Enrolment ID will auto-fill as the Supplier/Recipient GSTIN.

Enter the transport details and generate the e-Way Bill. For the official user manual & guide: GST Portal

Impact of This Change For Unregistered Businesses:

- No need for GST registration just to generate an e-Way Bill. Easier movement of goods while staying GST-compliant., Reduces dependency on transporters for e-Way Bill generation.

- Help small traders, job workers, and transporters comply with GST without full registration.

- Removes dependency on registered buyers/sellers or transporters for e-Way Bills.

- Strengthens tracking of goods movement and reduces tax evasion.

The ENR-03 feature is a major relief for small businesses, traders, job workers, and transporters who don’t meet the GST registration threshold but still need to move goods. This update ensures better compliance, efficiency, and formalization of the economy.

GST E-Way Bill System Gets Stricter After CAG Points Out Gaps

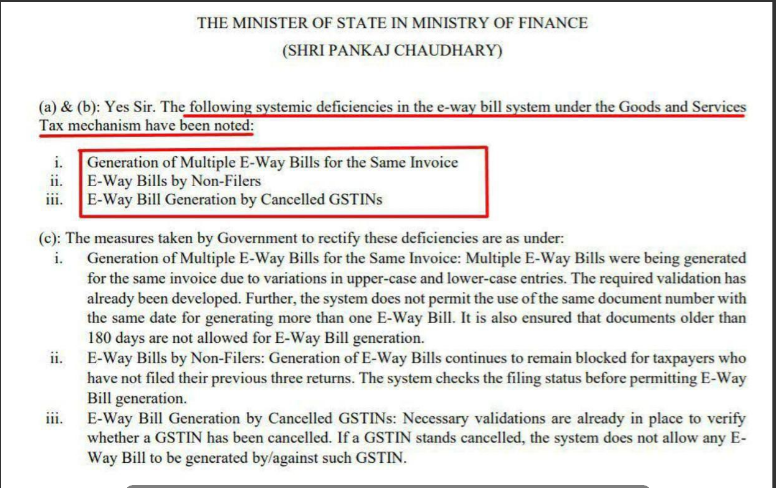

E-way bill system under the Goods and Services Tax mechanism.

Generation of Multiple E-Way Bills for the Same Invoice is a Systemic Deficiency Noted: E-Way Bills by Non-Filers. E-Way Bill Generation by Cancelled GSTINs. India’s GST E-Way Bill system has been tightened following a Comptroller and Auditor General audit that exposed key vulnerabilities. The Comptroller and Auditor General Report, tabled in Parliament on December 9, 2025, highlighted issues like multiple bills per invoice, non-filers generating bills, and use of cancelled Goods and Services Tax Identification Numbers.

The Comptroller and Auditor General -Identified Gaps : The audit revealed manipulation via case variations in invoice details, allowing duplicates, alongside failures in blocking bills for non-compliant taxpayers. Weak integration between portals also enabled invalid Goods and Services Tax Identification Numbers, incorrect HSN codes, and illogical routes.

Measures Taken by Government to Rectify These Deficiencies:

- Multiple E-Way Bills for Same Invoice: issue occurred due to variations in upper-case and lower-case entries. Validation has been developed. System does not permit the same document number on the same date for more than one E-Way Bill. Bills older than 180 days are not allowed for generation.

- E-Way Bills by Non-Filers: Generation remains blocked for taxpayers who have not filed the previous three returns. Filing status is checked before permitting E-Way Bill generation.

- E-Way Bill Generation by Cancelled GSTINs: Validations verify whether the Goods and Services Tax Identification Number is cancelled. If cancelled, system does not allow any E-Way Bill generation against such a Goods and Services Tax Identification Number.

- Government Fixes: Strict document-number validation now prevents duplicates and limits bills to invoices under 180 days old. Generation is auto-blocked for those missing the last three returns, and real-time Goods and Services Tax Identification Number checks bar cancelled registrations.

- Additional rules include phased invoice registration requirements and a 180-day invoice limit for bill creation, enhancing overall compliance. These changes aim to curb evasion and streamline logistics