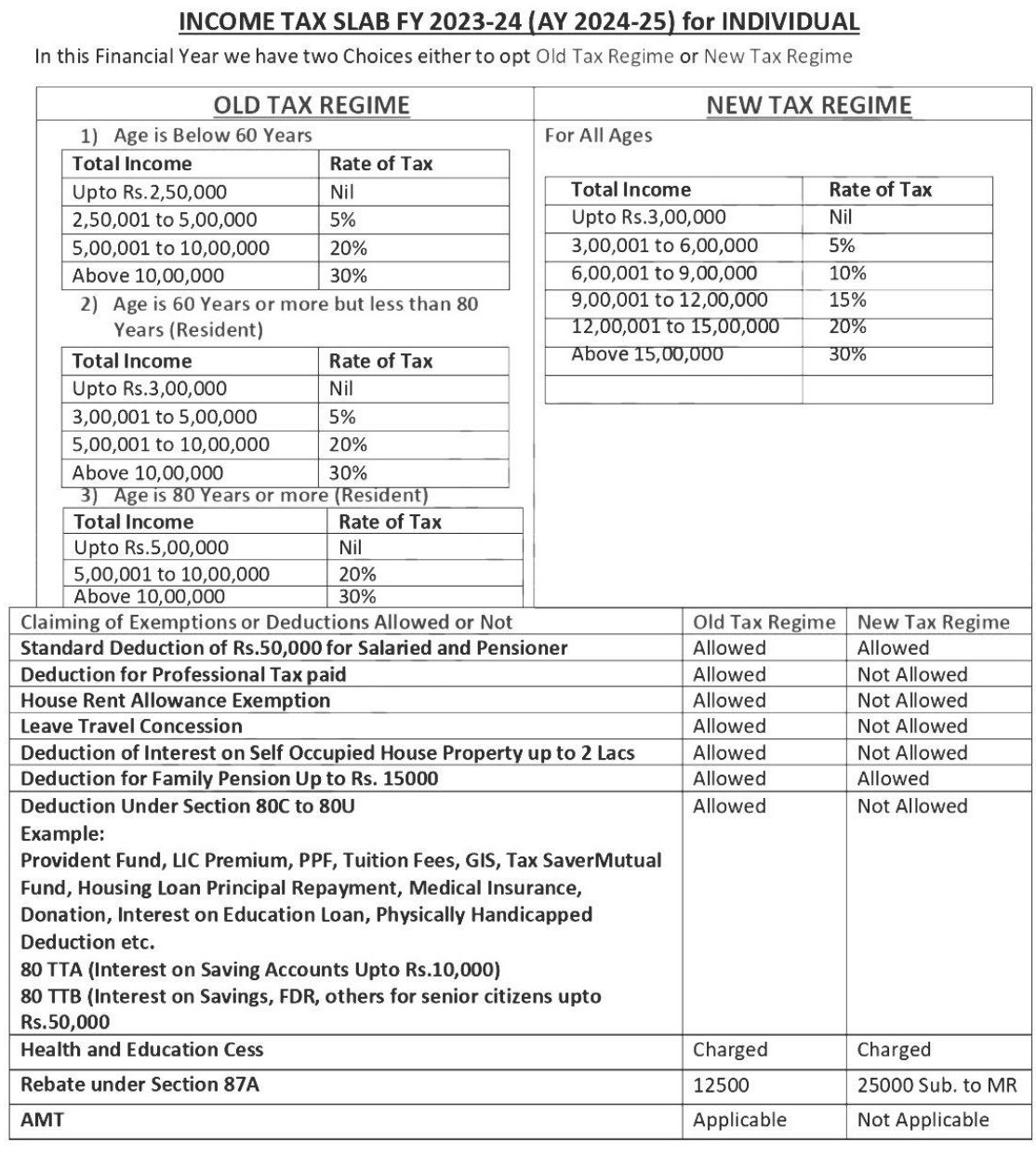

INCOME TAX SLAB FY 2023-24 (AY 2024-25) for INDIVIDUAL

Page Contents

INCOME TAX SLAB FY 2023-24 (Assessment Year 2024-25) for INDIVIDUAL

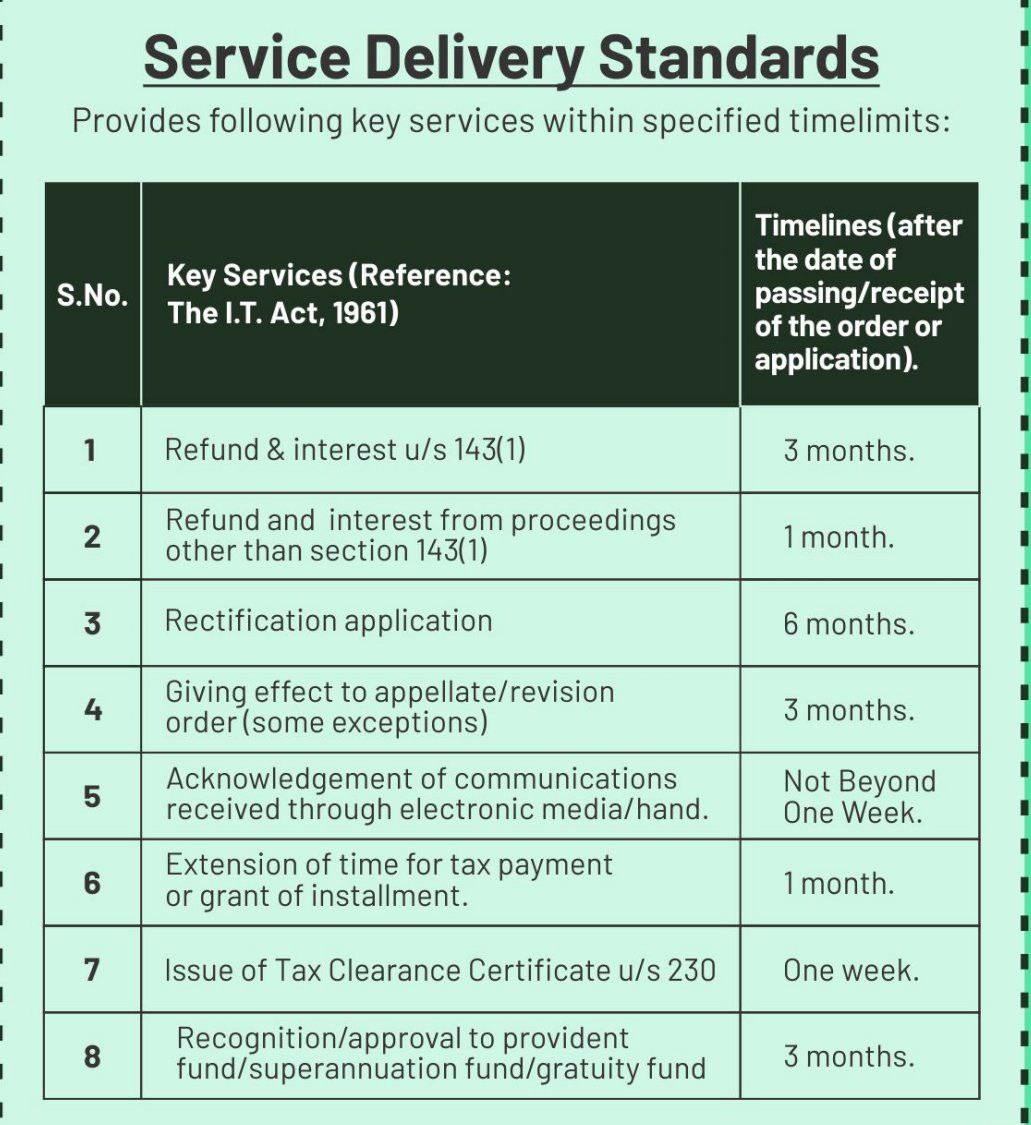

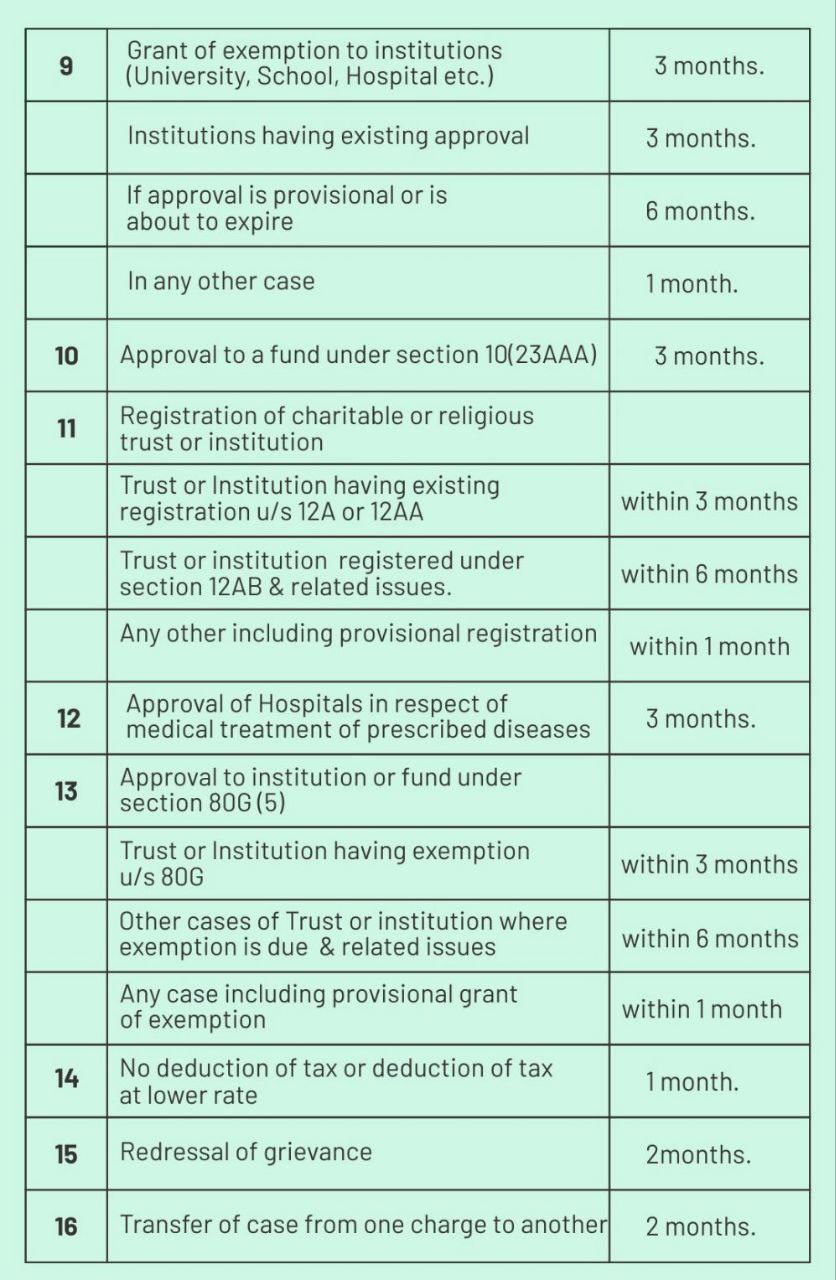

Tax Department given key services within specified timelines mentioned below :

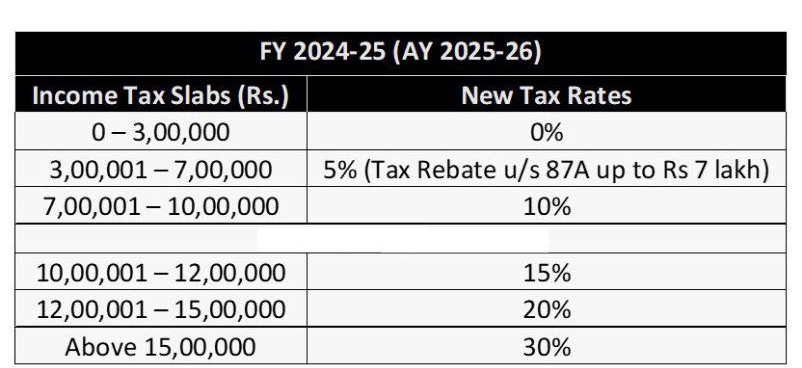

Income tax slab rates for FY 2024-25 (AY 2025-26)

The income tax slab rates for FY 2024-25 (AY 2025-26) as per the provided chart are:

New Tax Regime Slabs

- INR 0 – INR 3,00,000: 0% tax

- INR 3,00,001 – INR 7,00,000: 5% tax (Tax rebate under Section 87A applicable up to ₹7 lakh, resulting in zero tax liability)

- INR 7,00,001 – INR 10,00,000: 10% tax

- INR 10,00,001 – INR 12,00,000: 15% tax

- INR 12,00,001 – INR 15,00,000: 20% tax

- Above INR 15,00,000: 30% tax

This slab structure reflects the new tax regime, encouraging taxpayers with reduced tax rates and the benefit of a rebate for incomes up to INR 7 lakh.