Income-tax notices are increasingly data-driven

Page Contents

Income-tax notices are increasingly data-driven

The Income Tax Department now leverages Annual Information Statement/Taxpayer Information Summary/Statement of Financial Transactions reports, foreign remittance data, and cross-border information exchange to identify inconsistencies often before returns are processed. Key risk areas to reassess before filing/revising your income-tax return

- Foreign stocks, dividends, or assets not disclosed in Schedule FA

- Incorrect/false claims u/s 80G / 80GGC

- Donations to unverified or non-compliant entities

- Non-filing of income-tax return despite high turnover or high-value transactions

- Income reported under incorrect heads

- Wrong income-tax return form selection

- Mismatch between Annual Information Statement, Taxpayer Information Summary & Form 26AS

- Significant transactions flagged in Annual Information Statement and Taxpayer Information Summary without explanation.

Why this matters:

Automated risk engines flag even small inconsistencies, triggering notices under various provisions of the Income-tax Act, 1961. Action points

- Reconcile Annual Information Statement and Taxpayer Information Summary thoroughly before filing

- Disclose foreign income/assets accurately

- Claim deductions strictly as per law

- Respond to notices within timelines with proper documentation

- Proactive compliance today prevents litigation tomorrow.

Income-Tax Notices in India Are Now AI-Driven, Not Random

Income-tax enforcement in India has undergone a fundamental shift. Notices are no longer issued based on random scrutiny or manual selection. They are now the result of advanced data analytics, AI, and machine-learning models that proactively detect non-compliance.

Initiatives such as the NUDGE campaign and Project Insight demonstrate how the dept is moving towards predictive, preventive, and faceless tax administration. Following are key data-driven initiatives:

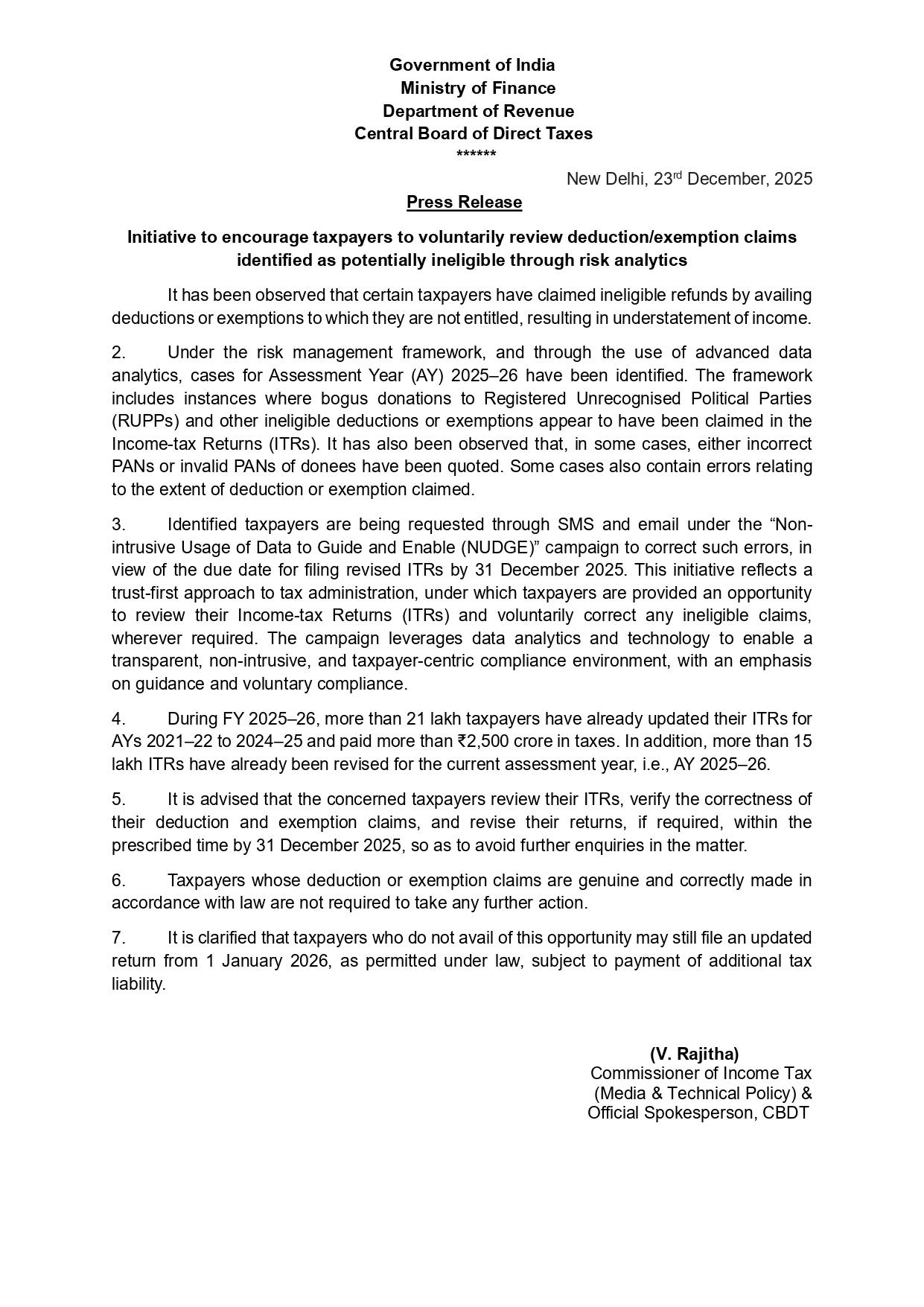

Overview of NUDGE Campaign (AY 2025-26) :

- The Income Tax Dept launched the data-driven Non-intrusive Usage of Data to Guide and Enable campaign, which uses risk analytics to identify bogus or ineligible donations, invalid or misused PANs, and incorrect deduction claims. Moreover, taxpayers receive SMS and email nudges prompting voluntary correction.

- CBDT has launched a data-driven Non-intrusive Usage of Data to Guide and Enable campaign for Assessment Year 2025–26, aimed at encouraging taxpayers to voluntarily review and correct deduction/exemption claims that have been identified as potentially ineligible through advanced risk analytics.

- Impact so far Over 21 lakh taxpayers revised their income-tax return & more than ₹2,500 crore in additional tax was paid voluntarily. Key Highlights of the NUDGE Campaign

What is Non-intrusive Usage of Data to Guide and Enable (NUDGE) Campaign ?

-

Risk-Based Identification : Claims under deductions, exemptions, and allowances are being analyzed using AIS/TIS, Form 26AS, third-party reporting, advanced data analytics & risk parameters, and only cases showing a high probability of ineligibility or mismatch are being nudged.

The outreach is purely advisory in nature, with no notice, no scrutiny, and no penalty at this stage. Taxpayers are encouraged to review their return, reconcile claims & file a revised/updated return, if required. This reflects the Department’s shift from “enforcement-first” to “compliance-by-design.”

Taxpayers receiving a Non-intrusive Usage of Data to Guide and Enable communication should verify deduction/exemption claims made in the ITR, cross-check with supporting documents, reconcile with AIS/TIS/Form 26AS, and voluntarily revise or update the return if any ineligible claim is identified.

A NUDGE is not a notice under the tax Act, Ignoring the advisory does not automatically trigger action, but uncorrected high-risk mismatches may be picked up later for verification/scrutiny based on risk assessment. Timely voluntary correction can avoid future scrutiny, interest, and penalties.

Press Release related to NUDGE campaign for AY 2025–26

Project Insight (Since 2017):

- Project Insight integrates big data, AI and machine learning, and third-party information (SFTs, banks, registrars, GST, and foreign exchanges).

- It cross-verifies reported income with actual financial behavior, significantly improving detection and voluntary compliance.

How Does AI Detect Non-Compliance ?

- Monitoring high-value transactions (property, securities, foreign remittances)

- Analysing spending patterns vs declared income

- Tracking portal activity and filing behavior

- Comparing past income-tax return trends to flag under-reporting or incorrect deductions

- Automated scrutiny under faceless assessment (Section 144B) ensures impartial, tech-led allocation.

- Even small mismatches between the Annual Information Statement, the Taxpayer Information Summary, and Form 26AS can now trigger system-generated notices.

Implications for Taxpayers & Professionals when AI Detects Non-Compliance

- Manual audits may be fewer, but automated notices are rising

- Errors are identified early often before assessment proceedings

- December 31 deadline for revised income-tax return is a crucial compliance window

- Faceless systems mean documentation quality matters more than explanations.

What taxpayer needed to take care Compliance Takeaways ?

- Verify Annual Information Statement and Taxpayer Information Summary thoroughly before filing

- Avoid mechanical deduction claims; substance over form matters

- Disclose foreign income and assets accurately

- Respond to nudges and notices within timelines

- Tax expert Proactive client advisories are no longer optional.