Financial Transactions That Can Trigger Income Tax Scrutiny

Page Contents

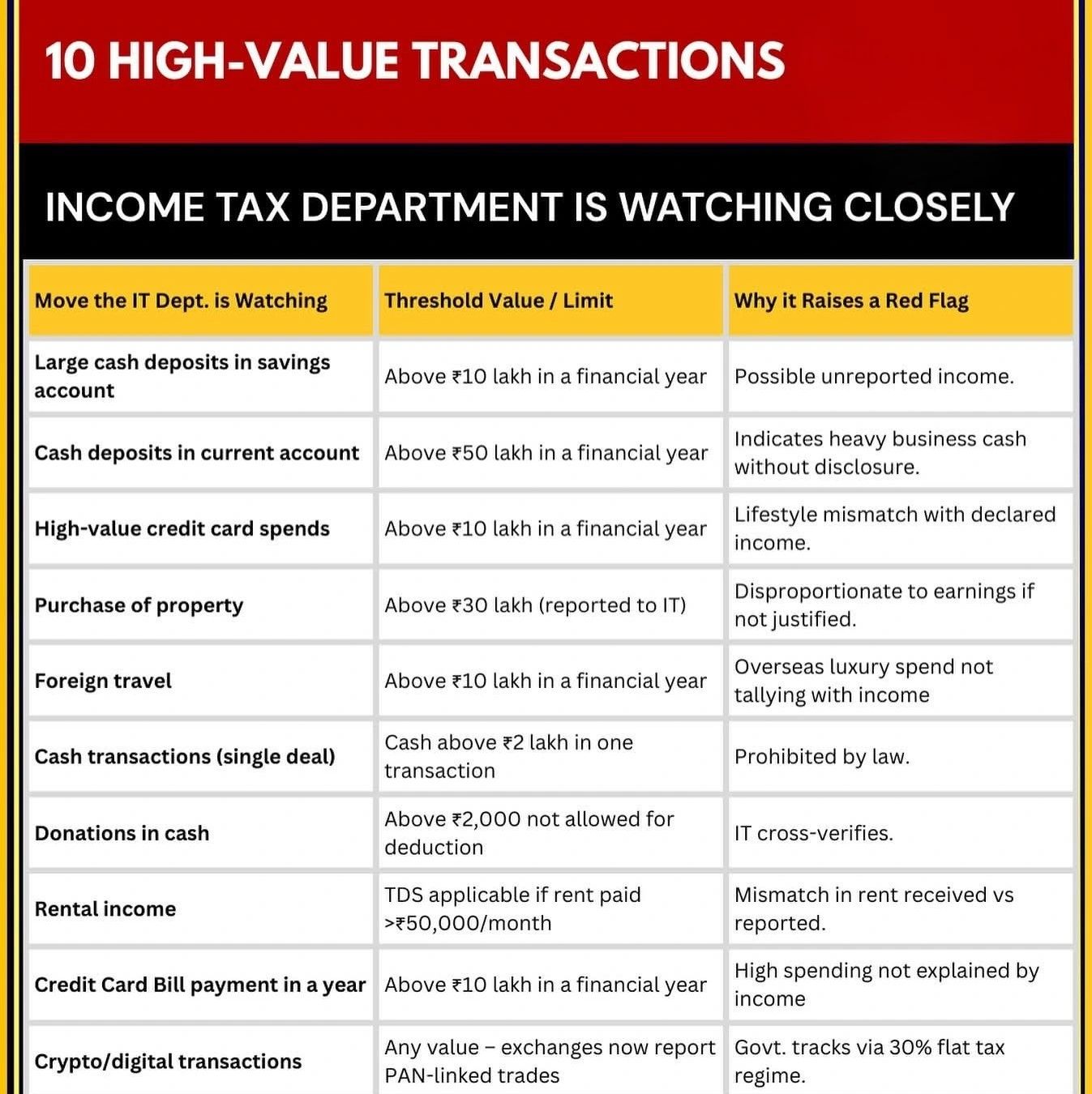

Top 10 Financial Transactions That Can Trigger Income Tax Scrutiny:

The Income Tax Department keeps a close watch on high-value financial transactions. Many individuals and professionals may not realize that even routine financial activities can raise red flags if not properly reported. Taxpayer compliance today prevents scrutiny tomorrow.

Stay informed. Stay compliant. Stay stress-free. Here are 10 key transactions that attract attention

- Large Cash Deposits in Savings Accounts: Deposits exceeding INR 10 lakh in a financial year may indicate potential unreported income.

- Cash Deposits in Current Accounts: Cash inflows above INR 50 lakh per year are monitored for undisclosed business receipts.

- High-Value Credit Card Spends: Annual spends crossing INR 10 lakh may invite scrutiny if they appear disproportionate to declared income.

- Property Purchases Above INR 30 Lakh: Reported by the registrar to the Income Tax Department for income-asset mismatch checks.

- Foreign Travel Expenditure Exceeding INR 10 Lakh

Such luxury spending often triggers verification of income sources and foreign exchange use. - Single Cash Transactions Above INR 2 Lakh: Strictly prohibited under Section 269ST of the Income Tax Act.

- Cash Donations Above INR 2,000: Not eligible for deductions under Section 80G and often cross-verified with donor PAN details.

- High-Value Rent Payments: If monthly rent exceeds INR 50,000, TDS under Section 194-IB applies; such payments are closely tracked.

- Annual Credit Card Bill Payments Above INR 10 Lakh

: Banks report these to the department; mismatches with declared income can trigger inquiries. - Crypto and Digital Asset Transactions: All virtual digital asset trades are reported and taxed at 30%, irrespective of value.

Why It Matters

These thresholds are part of the Income Tax Department’s data analytics and surveillance systems. Transactions are reported by banks, credit card companies, property registrars, and other institutions under Form 26AS and AIS (Annual Information Statement). A mismatch between lifestyle and declared income can lead to notices, scrutiny, or reassessment. The department uses AI-based analytics to identify income mismatches and undisclosed transactions. & Even genuine taxpayers can face notices if reporting is inconsistent or incomplete.

In Summary: 10 High-Value Transactions That Can Trigger Income Tax Scrutiny

| Transaction Type | Threshold / Limit | Why It Raises a Red Flag |

| Cash Deposits in Savings Account | Above INR 10 lakh/year | May indicate unreported personal income. |

| In case Cash Deposits in Current Account | Above INR 50 lakh/year | Suggests undisclosed business cash flows. |

| High-Value Credit Card Spends | Above INR 10 lakh/year | Lifestyle may not match declared income. |

| Property Purchase | Above INR 30 lakh | Reported to IT; may be disproportionate to earnings. |

| Foreign Travel Expenses | Above INR 10 lakh/year | Luxury spending not aligned with income. |

| Single Cash Transactions | Above INR 2 lakh | Prohibited under income tax rules. |

| Cash Donations | Above INR 2,000 | Not eligible for deduction; cross-verified. |

| Rental Income (TDS Trigger) | Rent paid > INR 50,000/month | Mismatch between rent received and reported income. |

| Annual Credit Card Bill Payments | Above INR 10 lakh/year | High spending may need income justification. |

| Crypto/Digital Transactions | Any value | PAN-linked trades tracked; 30% flat tax applies. |

Stay Smart, Stay Compliant Ensure that all high-value transactions are properly disclosed in your ITR. Income sources are verifiable and traceable through banking channels. & Professional or business accounts maintain clear audit trails. Report all income sources accurately, including rental, crypto, and foreign income. Avoid large cash transactions—use banking channels. Maintain documentation for high-value spends and investments. File returns on time and reconcile Form 26AS/AIS with your ITR.

The Income Tax Department are taking digital Tracking in action.

![]()

High-value cash transactions and TDS-linked payments are digitally tracked, reported, and cross-verified through banking systems, SFT (Statement of Financial Transactions), AIS, and Form 26AS. Any inconsistency can trigger system-generated notices under the Income Tax Act. (Cash Expense Rules—Income Tax Act 2025 (Effective 1 April 2025) .

Cash transaction rules must be remembered: Cash Receipt & Cash Payments – INR 200,000/- Overall Rule

- Under Section 269ST: Cash receipt above INR 200,000 not permitted (applies per person/per day/per transaction/per event)

- Section 269SS: Cash acceptance of loan, deposit or specified sum restricted to INR 20,000

- Under Section 269T: Cash repayment of loan or deposit restricted to INR 20,000, and violations may attract a penalty equal to the amount involved. (Impact: 100% penalty of loan amount)

- Section 194—Cash receipt from sale of goods/services, Limit: ₹2,00,000 (Impact: 100% penalty equal to cash received)

- Cash in property transactions (Bayana/Token Money), Limit: ₹2,00,000 (Impact: 100% penalty)

- Repayment of Bayana/Token Money in cash (Impact: 100% penalty of repayment amount)

- Cash Security Deposits:

- Section 2897 — Cash security deposit (received), Limit: INR 2,00,000/- (Impact: 100% penalty)

- Section 56—Cash security deposit (repaid), Limit: INR 2,00,000 (Impact: 100% penalty)

- In case Cash Gifts, Section 56—Cash gift (other than relatives & weddings), Limit: Up to INR 50,000 (Impact: Beyond INR 50k → taxable)

- Salary in Cash : Cash salary (retrospective rule), Limit: INR 20,000 (Impact: Taxed at slab rate)

- Unexplained Income : Section 56, Limit: INR 2,00,000 (Impact: 114% tax/penalty)

- Cash Withdrawal—TDS Rules: Section 6BA—TDS for return filers, Limit: > ₹1 crore/year (Impact: 2% TDS (or 6% above threshold)

- Section 19AN—TDS for non-filers, Limit: > ₹20 lakh/year (Impact: 2% up to ₹1 crore, 6% above)

- Current Account Cash Deposit/Withdrawal: Section 114B—Current A/c rules : Limit: > ₹50 lakh/year,( Impact: If explained → only reporting, If unexplained → 84% tax)

- Cash Business Expenses – Section 43 — Capital asset purchase in cash, Limit: > INR 10,000 (Impact: Expense disallowed + 30% tax impact)

TDS & TRACES Compliance

- TRACES is the centralised compliance portal for TDS

- TDS credits, defaults, interest & late fees are auto-processed.

- Mismatch between TDS returns, AIS & Form 26AS can lead to denial of TDS credit

- Taxpayer must prefer banking channels for high-value transactions; taxpayers Ensure timely TDS deduction & accurate reporting and regular reconciliation prevents penalties, notices & future litigation

- Compliance is not complicated; it only requires awareness, discipline, and accuracy.