Exemption & compliance of GSTR-9 & 9C for small taxpayer

Page Contents

Due Dates & Applicability for GSTR-9 & GSTR-9C: Who Files & When? (FY 2024-25)

Separate GSTIN-wise Filing : Each GST registration (per state) requires separate GSTR-9 filing, irrespective of entity-wide consolidation.

Compulsory Filing Despite Cancellation : Even if registration was cancelled mid-year, taxpayers must file GSTR-9 if registered for even one day in FY 2024-25.

Prerequisite for Filing : All GSTR-1 and GSTR-3B for FY 2024-25 must be filed; pending returns block GSTR-9/9C on the GST portal.

Special Cases: Composition Taxpayers

- GSTR-4 acts as the annual return

- Due date: 30 April 2026

- GSTR-9A (old composition annual return) is permanently discontinued.

E-Commerce Operators : Await GSTR-9B notification for operator-specific annual reporting.

Exemption from filing GSTR-9 for small taxpayers Effective: FY 2024-25 onwards: The Central Board of Indirect Taxes and Customs has issued Notification No. 15/2025-CT, providing significant compliance relief to small taxpayers under GST. For FY 2024-25, filing of GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) continues with strengthened data validations and a revised compliance framework.

Effective from FY 2024-25 onwards, regular GST registrants with an aggregate turnover up to INR 2 crore are exempt from filing the annual return in Form GSTR-9. Notification No. 15/2025-CT marks an important compliance simplification for small taxpayers.

By exempting businesses with turnover up to INR 2 crore from filing the annual return (GSTR-9), the government has significantly eased the GST reporting workload, promoting efficiency and supporting business growth across the MSME sector.

Central Board of Indirect Taxes and Customs aims to Reduce procedural and compliance burden; Support MSMEs and emerging businesses; Streamline the GST ecosystem & Encourage voluntary compliance through simplification This measure aligns with the government’s broader aim of reducing compliance burden and promoting ease of doing business for MSMEs. Following are the basic Benefits of the Exemption :

- Reduced compliance burden for small businesses and MSMEs

- Cost and time savings in annual GST reconciliation

- Allows businesses to focus on timely filing of GSTR-1 and GSTR-3B

- Enhances ease of doing business and digital adoption under GST

Applicability of GSTR-9 (Annual Return)

GSTR-9 applies to all regular GST-registered taxpayers (except for excluded categories below) whose Annual Aggregate Turnover (AATO) exceeds INR 2 crore in FY 2024-25. Applicability of GSTR-9 (Annual Return) Excluded categories like Casual taxable persons; Input Service Distributors (ISDs); Non-resident taxable persons & TDS/TCS deductors

Taxpayers must Verify Turnover & Ensure aggregate turnover does not exceed INR 2 crore for the relevant financial year. & Taxpayers Maintain Proper Books & Records & The exemption does not dilute the responsibility of maintaining proper accounts, invoices, and GST audit trails. Moreover that Taxpayers must Continue Regular GST Compliance in Filing of GSTR-1, GSTR-3B, and e-invoicing (if applicable) remains mandatory.

Basic requirement U/s44(1) of the CGST Act : Section 44(1) mandates that every registered person must file an annual return (GSTR-9), which includes a comprehensive reconciliation of Outward and inward supplies; Input Tax Credit availed; Taxes paid during the year. Prior to this notification, the annual return requirement applied to all regular taxpayers, creating an additional compliance layer for small businesses. Following are Key Highlights of Notification No. 15/2025 are mentioned below :

- Permanent exemption from filing GSTR-9 for taxpayers with aggregate turnover up to INR 2 crore.

- Applies from FY 2024-25 onwards (not a one-time relief).

- Taxpayers above INR 2 crore must file GSTR-9; those above INR 5 crore must file GSTR-9C.

- Exemption does not apply to regular returns (GSTR-1, GSTR-3B).

Impact of Notification No. 15/2025-CT for FY 2024-25 :

- Small taxpayers (< INR 2 crore): No annual return filing.

- Medium taxpayers (> INR 2 crore): Must comply with new detailed ITC reporting and rule-wise reversals.

- Large taxpayers (> INR 5 crore): GSTR-9C reconciliation more stringent, includes e-commerce disclosures.

Other Key Provisions of Notification No. 15/2025-CT

Meaning of Aggregate Turnover – What It Includes/Excludes- Key Rules for AATO Computation

- Computed PAN-India, across all GSTINs

- Excludes taxes (CGST, SGST, IGST, Cess)

- Includes:

- Taxable supplies- All taxable supplies (intra-state + inter-state)

- Exempt supplies- Exempt supplies

- Exports- Export of goods/services

- Inter-state supplies under same PAN- Inter-state supplies made under the same PAN

- Excludes:

- Reverse charge supplies- Supplies taxable under reverse charge

- Non-GST outward supplies- Non-GST supplies

Turnover-based filing matrix Eligible Provisions of Notification No. 15/2025-CT

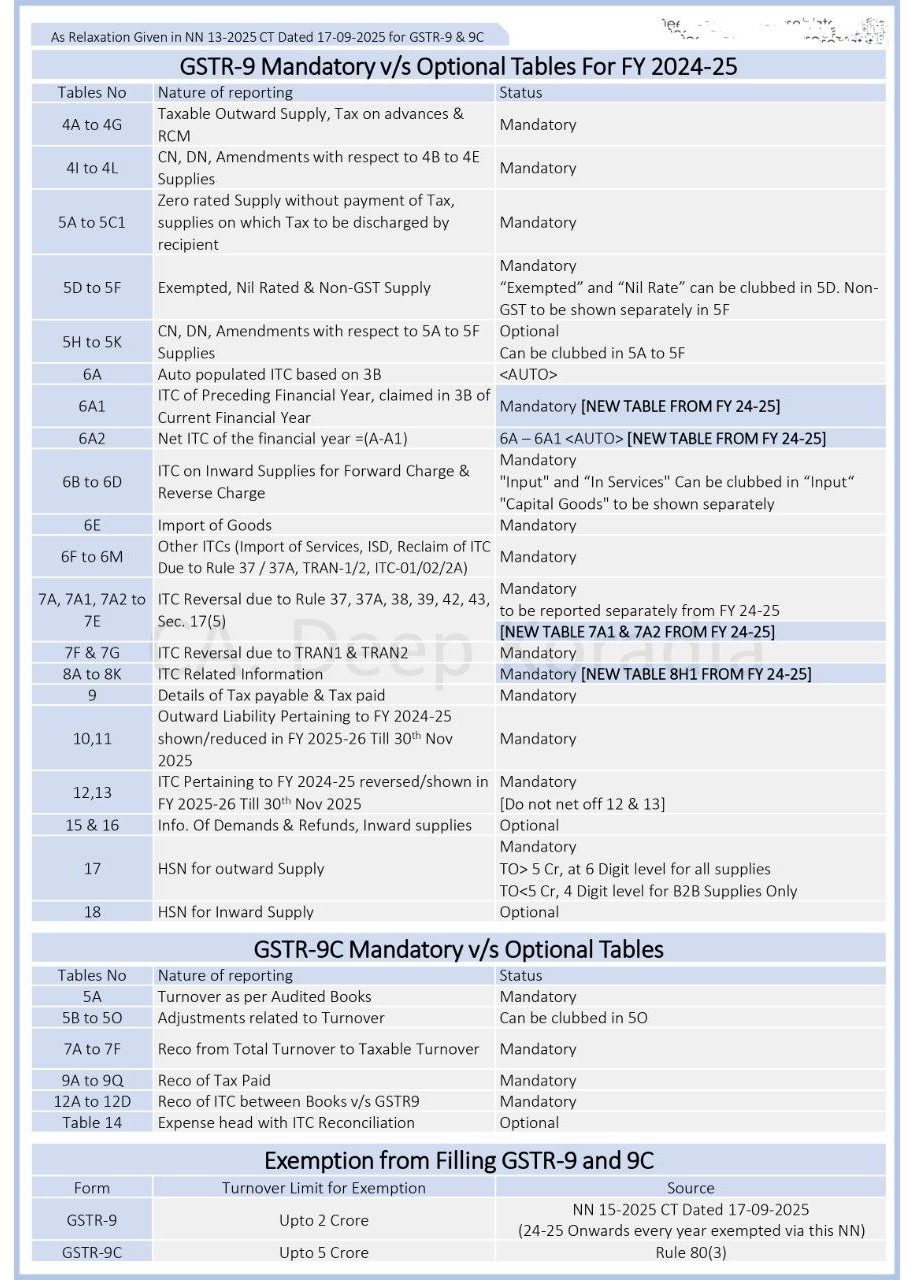

Based on CBIC Notification No. 13/2025 & 15/2025 dated Sept 2025 we are summaries here under GSTR-9 and GSTR-9C Mandatory vs Optional Tables for FY 2024-25, following are here under mention that exemption Limits for GSTR-9 and GSTR-9C for FY 2024-25,

- GSTR-9: Applicable from FY 2024-25 onwards & Taxpayers with aggregate turnover ≤ INR 2 crore are exempt from filing GSTR-9. Optional for taxpayers with turnover up to INR 2 crore. So Eligible person are Regular taxpayers with aggregate turnover ≤ INR 2 crore. For the Purpose of Reconciles data declared in GSTR-9 with the audited Annual Financial Statements (AFS) U/s35(5).

- GSTR-9C: Mandatory for taxpayers with turnover above INR 5 crore. Mandatory for taxpayers with AATO > INR 5 crore in FY 2024-25. Applicability of GSTR-9C (Self-Certified Reconciliation Statement).

| Annual Aggregate Turnover (AATO) | GSTR-9 | GSTR-9C |

| Up to INR 2 crore | Exempt | Not applicable |

| INR 2–5 crore | Mandatory | Not required |

| Above INR 5 crore | Mandatory | Mandatory |

This structure significantly simplifies compliance for MSMEs.

Not eligible for the purpose of Provisions of Notification No. 15/2025-CT : Taxpayers with turnover above INR 2 crore & Taxpayers required to furnish GSTR-9C (reconciliation statement/audit)

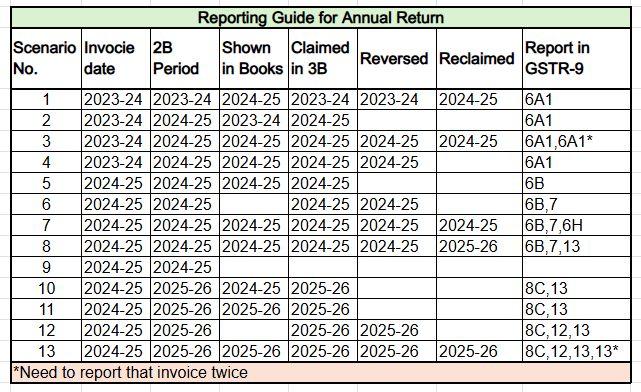

Amendments to CGST Rules (Third Amendment Rules, 2025) under Notification No. 13/2025 – Central Tax which is effective from 22nd September 2025. FY 2024-25 marks the most data-driven and precision-focused version of GSTR-9 and GSTR-9C to date. Robust bookkeeping, early reconciliations, and professional oversight will ensure zero-variance filing, optimized ITC, and avoidance of penalties. Key Changes via under Key Changes introduced via CBIC Notification No. 13/2025 & 15/2025 dated Sept 2025 for FY 2024-25 are mentioned below :

New ITC Reporting Structure: New Tables Introduced to Objective to Prevent double counting, ensure 6J difference approaches zero.

- Table 6A1: ITC of preceding FY claimed in current FY. 6A1 (ITC of preceding FY claimed in current FY), ITC of FY 2023-24 claimed during FY 2024-25 (up to 30 Nov 2025) excluding Rule 37/37A reclaims Reclaimed ITC under Rule 37/37A → report in 6H

- Table 6A2: Net ITC for current FY. 6A2 (Net ITC of current FY), Remaining current-year ITC (FY 2024-25)

- 8H1 (IGST on imports claimed next FY)

- Expanded Table 6M: Captures ITC availed through ITC-01, ITC-02, ITC-02A (new registration, merger/demerger).

- Rule-wise ITC Reversal Reporting: Separate disclosure under Rules 37, 37A, 38, 42, 43 & Sec 17(5). Rule-wise ITC reversal reporting (Rules 37, 37A, 38, 42, 43, Sec 17(5)). Emphasis on Rule 37A reconciliations using vendor filing data. Other notable ITC changes

- Table 6M limited strictly to ITC-01/02/02A (no longer residual)

- Table 7 — granular reporting required:

- 7A1 – Rule 37

- 7A2 – Rule 37A

- All reversals must be itemised.

- Deferred ITC & Import Credits: New Table 8H1 for IGST on imports claimed in next FY. Additional liabilities may now be paid through ITC, not cash-only. Changes focus on enhanced auto-population, improved ITC accuracy, and error reduction.

- Tables 10–13 Revised: Prior-period amendments, ITC adjustments, and differential tax payments.

- Auto-population: Data from GSTR-2B integrated for ITC reconciliation. Auto-population from GSTR-2B for ITC reconciliation

- Separate disclosure for e-commerce supplies U/s9(5).

- Strengthened Auto-Population Across Tables : Tables 4, 5, 6, 8, and 9 now draw data from GSTR-1; GSTR-1A (amendments); IFF; GSTR-2B; GSTR-3B. Example Enhancements

- Tables 4 & 5 (supplies) now include GSTR-1A data, preventing missed amendments.

- Table 8B derives only from Table 6B (except row 6H), reducing Table 8D mismatches.

- Table 9 taxes payable auto-fills from net liability in GSTR-3B.

- Table 8 – Critical Improvements

- Table 8A now pulls data exclusively from GSTR-2B of April–October 2025, eliminating prior spillover issues.

- Downloadable Excel file added for accuracy.

- New Table 8H1: IGST on imported goods claimed next FY (also reported in Table 13).

- Ensures Table 8I = 0 when done properly.

- Mandatory Tables 12 & 13- (Current FY reversals/availments made in next FY up to 30 Nov 2025). Previously optional; now compulsory for FY 2024-25.

Key Changes for GSTR-9C (Reconciliation Statement) for FY 2024-25: Stronger Reconciliation Architecture.

- Table 5B merged into 5O

- Tables 5C–5N require separate disclosure of all adjustments

- Table 7D1: Non-taxable e-commerce supplies under 9(5)

- Table 9K2: Operator supplies under 9(5)

- Tables 12B & 12C mandatory:Total ITC as per AFS; Reconciliation with GSTR-9 Table 13

- New disclosure for supplies where tax is payable by e-commerce operators under Sec 9(5).

- Enhanced reconciliation of turnover and tax liability with additional rows.

- Auto-population extended for FY 2024-25.

Other Changes

- Refunds: Rule 91 amended – refund order in FORM GST RFD-04 within 7 days; no revalidation needed.

- Appellate Tribunal:

- New Rule 110A – Single Member Bench for cases below INR 50 lakh without question of law.

- New forms: APL-02A, APL-04A, revised APL-05 to APL-07.

- Certification by CA/CMA is mandatory for turnover above INR 5 crore.

Guide for GSTR-9 and GSTR-9C Mandatory vs Optional Tables for FY 2024-25,

GSTR-9 Mandatory vs Optional Tables (FY 2024-25)

| Table No. | Nature of Reporting | Status |

| 4A to 4G | Taxable outward supply, tax on advances & RCM | Mandatory |

| 4I to 4L | CN/DN & amendments for 4B–4E supplies | Mandatory |

| 5A to 5C1 | Zero-rated supplies without payment of tax | Mandatory |

| 5D to 5F | Exempted, Nil Rated & Non-GST supplies | Mandatory (Exempted & Nil Rated can be clubbed in 5D; Non-GST separately in 5F) |

| 5H to 5K | Amendments for 5A–5F supplies | Optional (Can be clubbed in 5A–5F) |

| 6A | Auto-populated ITC from GSTR-3B | Auto |

| 6A1 | ITC of preceding FY claimed in current FY | Mandatory (New Table from FY 2024-25) |

| 6A2 | Net ITC of current FY (= A – A1) | Mandatory (New Table) |

| 6B to 6D | ITC on inward supplies under forward & reverse charge | Mandatory (Inputs & Services can be clubbed; Capital Goods separately) |

| 6E | Import of goods | Mandatory |

| 6F to 6M | Other ITCs (Import of services, ISD, TRAN, Rule 37/37A reclaim) | Mandatory |

| 7A to 7E | ITC reversals under Rules 37–43 & Sec 17(5) | Mandatory (Separate tables from FY 2024-25) |

| 7F & 7G | ITC reversal due to TRAN-1 & TRAN-2 | Mandatory |

| 8A to 8K | ITC reconciliation with GSTR-2B & Books | Mandatory (New Table 8H1 for IGST imports claimed next year) |

| 9 | Tax payable & tax paid | Mandatory |

| 10 & 11 | Outward liability adjustments for next FY (till 30 Nov) | Mandatory |

| 12 & 13 | ITC adjustments for next FY (till 30 Nov) | Mandatory (Do not net-off) |

| 15 & 16 | Info on demands, refunds, inward supplies | Optional |

| 17 | HSN summary for outward supply | Mandatory (> INR 5 Cr: 6-digit; ≤ INR 5 Cr: 4-digit for B2B) |

| 18 | HSN summary for inward supply | Optional |

Other Notable Updates

- Removal of obsolete “65% concessional rate” checkbox from Tables 17/18.

- Mandatory separate disclosures for credit/debit notes in Tables 4I–4L.

- Table 17 HSN auto-populates from GSTR-1 Table 12 (excluding advances/Schedule III).

- Section 9(5) supplies now tracked via Tables 4G1 and 5C1.

GSTR-9C Mandatory vs Optional Tables

| Table No. | Nature of Reporting | Status |

| 5A to 5O | Turnover as per audited books | Mandatory |

| 12A to 12D | ITC reconciliation between books & GSTR-9 | Mandatory |

| Expenses Reconciliation | Detailed expense mapping | Mandatory |

| Adjustments linked to turnover | Can be clubbed in 5O | Optional |

Reconciliation Strategies: Bridging Books, GSTR-1, GSTR-3B & GSTR-9

Key objective of Bridging Books, GSTR-1, GSTR-3B & GSTR-9 is to Zero-difference reporting in critical tables (6J, 8D, 8I). A structured 15+ point reconciliation is essential for clean reporting: Key Areas

- Turnover reconciliation (AFS vs. GSTR-9C Table 5A)

- Rate-wise tax liability matching (Books vs. GSTR-3B)

- Invoice-level GSTR-1 vs. GSTR-3B audit

- ITC matching: Books vs. GSTR-3B vs. GSTR-2B

- Imports reconciliation (ICEGATE vs. GSTR-3B)

- Rule 42/43 annual reversals

- E-way bill vs. sales register matching

- Avoiding double ITC via 6A1/6A2 accuracy

Due Dates for FY 2024-25

- GSTR-9: 31 December 2025

- GSTR-9C: 31 January 2026

Filing Process & Best Practices for GSTR-9 and GSTR-9C

Do’s

- File GSTR-1, GSTR-3B first

- Use Table 8A and HSN Excel tools

- Validate auto-populated data thoroughly

- Maintain invoice-wise working papers

Don’ts

- Don’t rush filing before 1 December 2025 (Table 8A stabilises only after this date)

- Don’t ignore mismatches in GSTR-1A

- Don’t submit without verifying Table 6 (common source of errors)

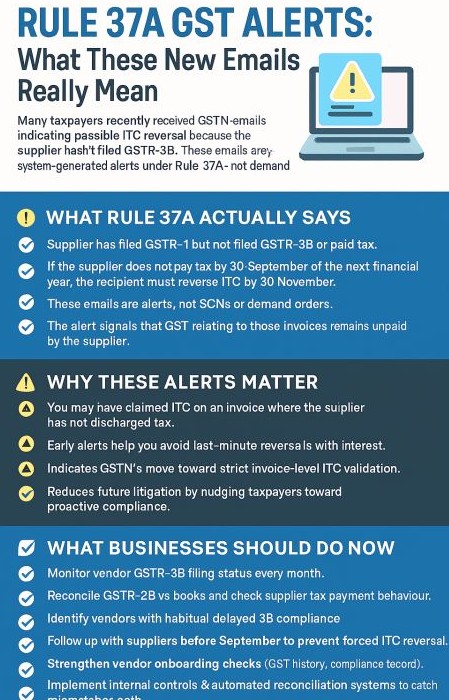

Rule 37A GST Alerts: What These New Emails Really Mean

- Many GST taxpayers have received Goods and Services Tax Network emails indicating possible ITC reversal because the supplier hasn’t filed GSTR-3B. These emails are system-generated alerts under Rule 37A, not demand notices.

What Rule 37A Actually Says

- Supplier has filed GSTR-1 but not filed GSTR-3B or paid tax.

- If the supplier does not pay tax by 30 September of the next FY, the recipient must reverse ITC by 30 November.

- These Goods and Services Tax Network emails are alerts, not Show Cause Notices or demand orders.

- The Goods and Services Tax Network alert signals that GST relating to those invoices remains unpaid by the supplier.

Why These Alerts Matter

- GST taxpayer may have claimed ITC on an invoice where the supplier has not discharged tax.

- Goods and Services Tax Network early alerts help avoid last-minute reversals with interest.

- This indicates Goods and Services Tax Network’s move toward strict invoice-level ITC validation.

- it may reduces future litigation by nudging taxpayers toward proactive compliance.

What Businesses owner registerd Under GST Should Do Now

- Taxpyaer must monitor vendor GSTR-3B filing status every month. & Reconcile GSTR-2B vs books and check supplier tax payment behavior.

- GST registered person should identify vendors with habitual delayed 3B compliance.

- Taxpayer should follow up with suppliers before September to prevent forced ITC reversal.

- Strengthen vendor onboarding checks (GST history, compliance record).

- Taxpayer should implement robust controls and automated systems to track compliance.

Late Fees & Penalties for the non-compliance of GSTR-9 and GSTR-9C

Late Fee for GSTR-9 – Section 47(2)

- INR 100 per day per Act (CGST + SGST)

- Effective late fee: INR 200 per day

- Maximum cap: 0.50% of turnover in the relevant State/UT

Penalty for GSTR-9C Delay

- Up to INR 50,000 (INR 25,000 under each Act) U/s125

- Often waived in cases involving bona fide errors, but not assured.