EBITDA-Earnings Before Interest, Taxes, Dep. & Amortization

Page Contents

All about EBITDA—Earnings Before Interest, Taxes, Dep. & Amortization

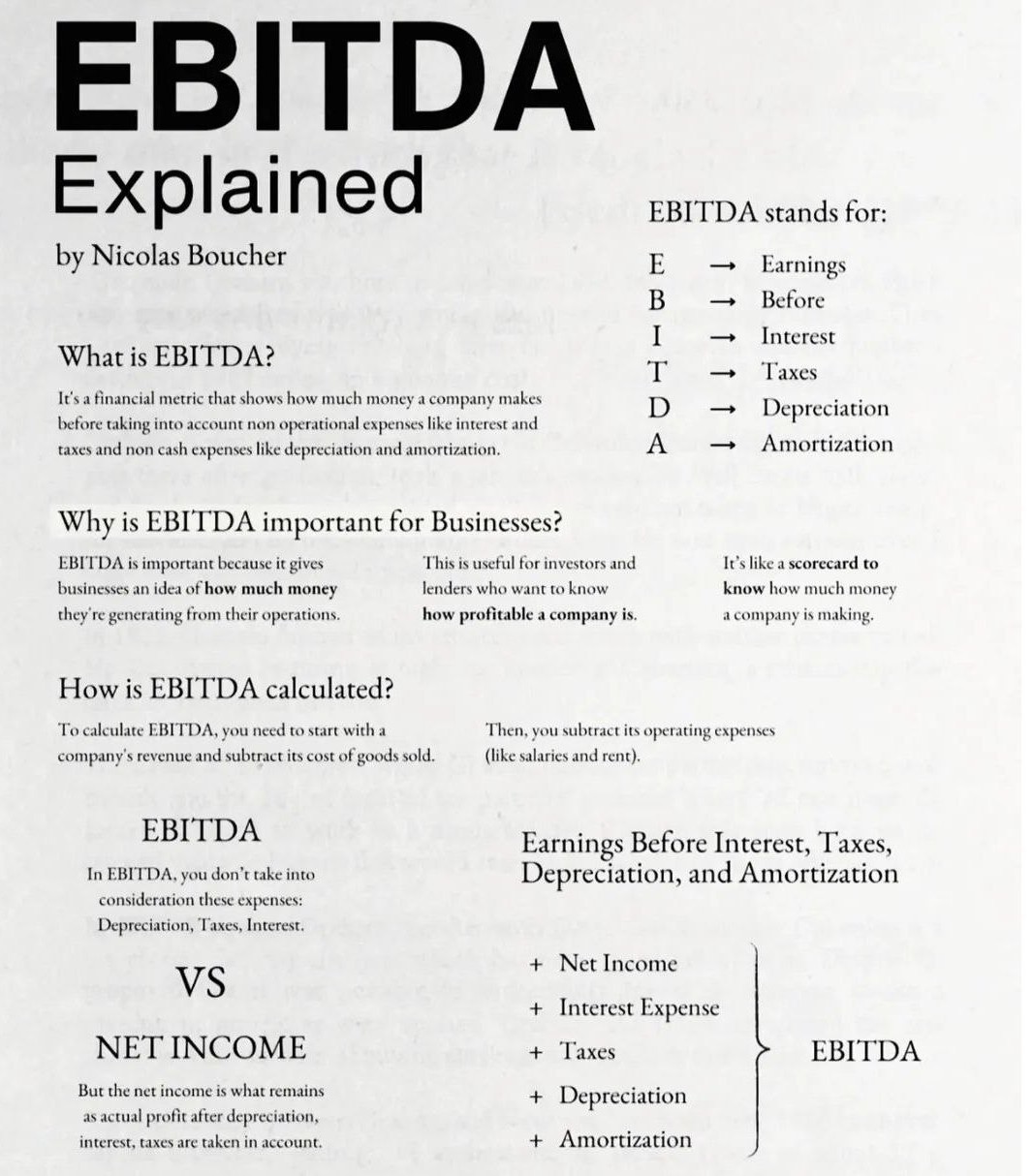

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric that shows how much money a company makes before accounting for non-operational expenses like interest and taxes, and non-cash expenses like depreciation and amortization. EBITDA tells you how much money a company makes from its core operations, before financial decisions, tax impact, and non-cash charges.

Breaking Down the Term

- E → Earnings (Profit) – This is the company’s operating profit.

- B → Before Interest – Interest is excluded because it depends on how the company is financed (debt vs equity).

- T → Before Taxes – Taxes differ based on geography and tax laws, so they’re removed.

- D → Depreciation- Non-cash expense for wear & tear of physical assets (machines, buildings).

- A → Amortization – Non-cash expense for intangible assets (patents, trademarks, goodwill).

Why is EBITDA Important for Businesses?

- Gives insight into operational performance: Shows how much money is generated from core operations.

- Useful for investors and lenders: Helps assess how profitable a company is without the impact of financing and accounting decisions.

- Acts as a scorecard: Indicates how much money the company is making from its main business activities.

- Shows true operating performance—removes non-cash and non-operating items. Helps compare companies fairly.

- Widely used for business valuation (M&A)—EV/EBITDA is the most common valuation multiple.

- Helps lenders evaluate repayment ability—banks look at EBITDA to judge if the business can generate enough cash to service loans.

- Useful for internal decision-making—management tracks EBITDA growth to monitor efficiency.

Why Banks Use EBITDA

Banks commonly use the EBITDA method to judge whether your business can comfortably repay its debts. When you apply for a business loan or any financial assistance, lenders look at EBITDA because it helps them understand your company’s operating performance and repayment capacity.

EBITDA became popular in the 1980s leveraged buyout (LBO) era, where distressed companies were restructured and loaded with debt.

Investors needed a simple way to test whether the company generated enough cash & whether the business could at least pay interest costs. Today, banks still use EBITDA because it to Removes the effect of financing decisions, Removes tax differences, Removes non-cash expenses like depreciation and amortization, and shows core operational earning capacity

How is EBITDA calculated?

Start with Net Income, then add back Interest Expense, Taxes, Depreciation & Amortization Formula: EBITDA=Net Income+Interest+Taxes+Depreciation+Amortization\text{EBITDA} = \text{Net Income} + \text{Interest} + \text{Taxes} + \text{Depreciation} + \text{Amortization}

EBITDA Formula – Three Commonly Used Methods:

- From Profit Before Tax (PBT): EBITDA = PBT + Interest + Depreciation + Amortization + Taxes

- EBIT: EBITDA = EBIT + Depreciation + Amortization

- From Operating Profit (EBITDA is often same as Operating Profit): EBITDA = Operating Profit + Other Income (if applicable)

Depreciation and amortization are not included in operating expenses.

EBITDA vs Net Income

- EBITDA: Excludes depreciation, taxes, and interest.

- Net Income: Includes all expenses, giving actual profit after depreciation, interest, and taxes.

EBITDA is widely used for valuation, comparing companies, and assessing cash flow potential because it focuses on operational profitability. It measures a company’s operating performance by showing how much profit it makes from its core business, before accounting for financing costs, tax costs, and non-cash expenses.

Limitations of EBITDA

EBITDA is helpful but not perfect. It ignores interest (real cash outflow if debt is high), Ignores taxes, Ignores capital expenditure needs & Can overstate cash flow if depreciation is large. That’s why EBITDA ≠ Cash Flow.

EBITDA vs EBIT vs EBT

| Metric | Stands For | Meaning |

|---|---|---|

| EBITDA | Earnings Before Interest, Taxes, Depreciation & Amortization | Pure operating profit |

| EBIT | Earnings Before Interest & Taxes | Includes non-cash expenses (D&A) |

| EBT | Earnings Before Taxes | Includes interest and D&A |

EBITDA ≠ Cash Flow

| Basis | EBITDA | Cash Flow |

|---|---|---|

| Includes non-cash adjustments? | -No (adds back D&A) | -Yes |

| Considers working capital changes? | No | Yes (inventory, receivables, payables) |

| Includes interest? | -No | -Yes |

| its Includes taxes? | No | Yes |

| Reflects actual liquidity? | Partially | Fully |

| it Used for valuation? | ✔ Commonly (EV/EBITDA) | But less common |

| Used by banks to test repayment? | ✔ For profitability | For real cash coverage |

In simple terms, EBITDA shows profit from core operations (even if cash has not yet come in). & Cash flow shows actual money available to run the business.

-

EBITDA shows operating performance

-

Cash Flow shows the real money you have

-

Debt/EBITDA is used by banks to judge loan repayment capacity

-

High EBITDA does not guarantee strong cash flow

-

Strong cash flow is essential for survival