Comparison of GSTR-1, GSTR-3B, GSTR-2A & GSTR-2B

Page Contents

Comparison of GSTR-1, GSTR-3B, GSTR-2A & GSTR-2B

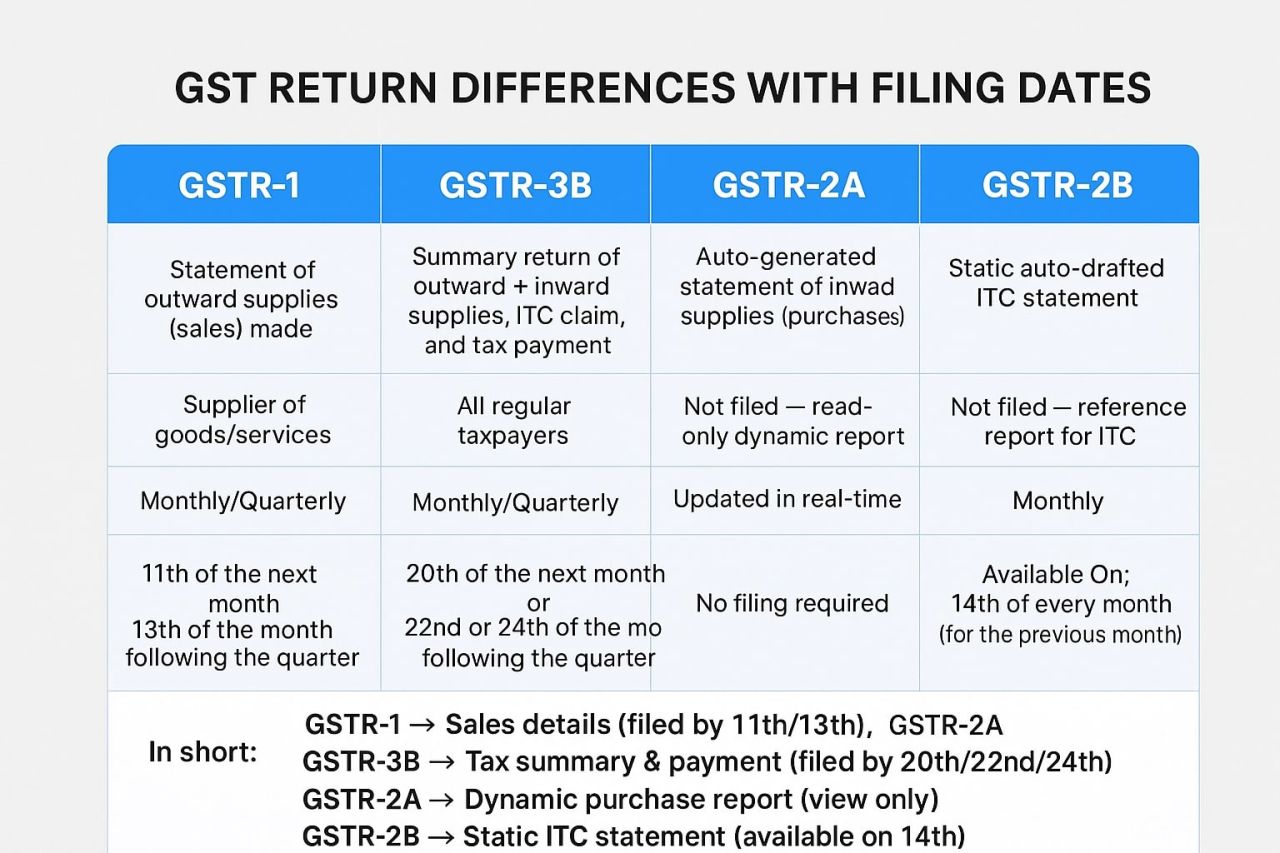

Difference of GST returns (GSTR-1, GSTR-3B, GSTR-2A, and GSTR-2B) along with their filing dates and key characteristics. Here’s a structured breakdown:

| Return Type | Purpose | Filed By | Nature | Frequency | Due Date / Availability | Remarks |

| GSTR-1 | Statement of outward supplies (sales) made | Supplier of goods/services | Filed return | Monthly / Quarterly (QRMP) | • Monthly: 11th of next month • QRMP: 13th of month following quarter |

Forms basis for recipient’s GSTR-2A/2B |

| GSTR-3B | Summary return of outward + inward supplies, ITC claim, and tax payment | All regular taxpayers | Filed return | Monthly / Quarterly (QRMP) | • Monthly: 20th of next month • QRMP: 22nd or 24th, depending on State |

Liability and ITC adjusted here |

| GSTR-2A | Auto-generated statement of inward supplies (purchases) based on supplier’s GSTR-1 | Auto-populated for recipient | Read-only (Dynamic) | Real-time | Continuously updated as suppliers upload invoices | Used for reconciliation only |

| GSTR-2B | Static auto-drafted statement of ITC available for claim | Auto-generated for recipient | Read-only (Static) | Monthly | Available on 14th of every month (for previous month) | Used for ITC matching with GSTR-3B |

Quick Summary of GSTR-1, GSTR-3B, GSTR-2A & GSTR-2B

GSTR-1

- Purpose: Statement of outward supplies (sales made).

- Who files: Supplier of goods/services.

- Frequency: Monthly/Quarterly.

- Due Date:

- Monthly: 11th of the next month.

- Quarterly: 13th of the month following the quarter.

- GSTR-1 → Sales details (filed by 11th/13th).- Details of Sales / Outward Supplies : Filed by 11th / 13th

GSTR-1 is the return form for outward supplies under GST. It consists of multiple tables (and sub-tables) that categorize various types of transactions. Key Tables and Purpose

-

Table 4A – B2B Supplies (Registered – Regular) : Reports taxable sales to registered persons (other than RCM).

-

Table 4B – B2B Supplies Under Reverse Charge : Reports sales where GST is payable by the registered buyer under RCM.

-

Table 5 – B2CL (Inter-State Large Invoices) : Reports inter-state sales to unregistered persons exceeding ₹1,00,000 per invoice.

-

Table 6A – Exports (With/Without Payment) : Reports export invoices made with IGST or under LUT without IGST.

-

Table 6B – Supplies to SEZ Units/Developers : Reports supplies made to SEZ units or developers.

-

Table 6C – Deemed Exports : Reports transactions notified as deemed exports under GST law.

-

Table 7 – B2C (Others – Small Supplies) : Reports small intra-state and inter-state sales to unregistered persons.

-

Table 8 – Nil-Rated, Exempt & Non-GST Supplies : Reports outward supplies not liable to GST.

-

Table 9A – Amendments to B2B, B2CL, Exports, SEZ, Deemed Exports : Used to correct invoices of earlier tax periods.

-

Table 9B – Credit/Debit Notes

-

Registered: For notes issued to registered persons.

-

Unregistered: For notes issued for B2C supplies.

-

-

Table 9C – Amendments of Credit/Debit Notes : Corrects previously reported credit or debit notes.

-

Table 10 – Amendment of B2C (Others) : Used to correct previously reported B2C sales.

-

Table 11A – Advance Received (Not Invoiced Yet) : Reports advances received before issuing invoice.

-

Table 11B – Advance Adjustments : Adjusts advances against invoices issued during the period.

-

Table 11A/11B – Amendments to Advances : Corrects advance entries of previous periods.

-

Table 12 – HSN-Wise Summary of Supplies : Provides HSN-wise summary of taxable value and GST.

-

Table 13 – Summary of Documents Issued : Reports count of invoices, debit notes, and credit notes issued.

-

Table 14 – E-Commerce Operator Transactions : Reports supplies made through e-commerce platforms.

-

Table 15 – Section 9(5) Supplies : Reports supplies where GST is payable by the e-commerce operator.

-

Table 15A – Amendments for Section 9(5) Supplies : Corrects Section 9(5) supplies reported earlier.

GSTR-3B

- Purpose: Summary return of outward + inward supplies, ITC claim, and tax payment.

- Who files: All regular taxpayers.

- Frequency: Monthly/Quarterly.

- Due Date:

- Monthly: 20th of the next month.

- Quarterly: 22nd or 24th of the month following the quarter.

- GSTR-3B: Tax summary & payment (filed by 20th/22nd/24th). Tax Summary & Payment : Filed by 20th / 22nd / 24th

GSTR-2A

- Purpose: Auto-generated statement of inward supplies (purchases).

- Who files: Not filed — read-only dynamic report.

- Frequency: Updated in real-time.

- Due Date: No filing required.

- GSTR-2A : Dynamic purchase report (view only).- Dynamic Purchases Report : Auto-updated, view only

GSTR-2B

- Purpose: Static auto-drafted ITC statement.

- Who files: Not filed—reference report for ITC.

- Frequency: Monthly.

- Availability: 14th of every month (for the previous month).

- GSTR-2B : Static ITC statement (available on 14th). Static ITC Statement : Available on 14th each month

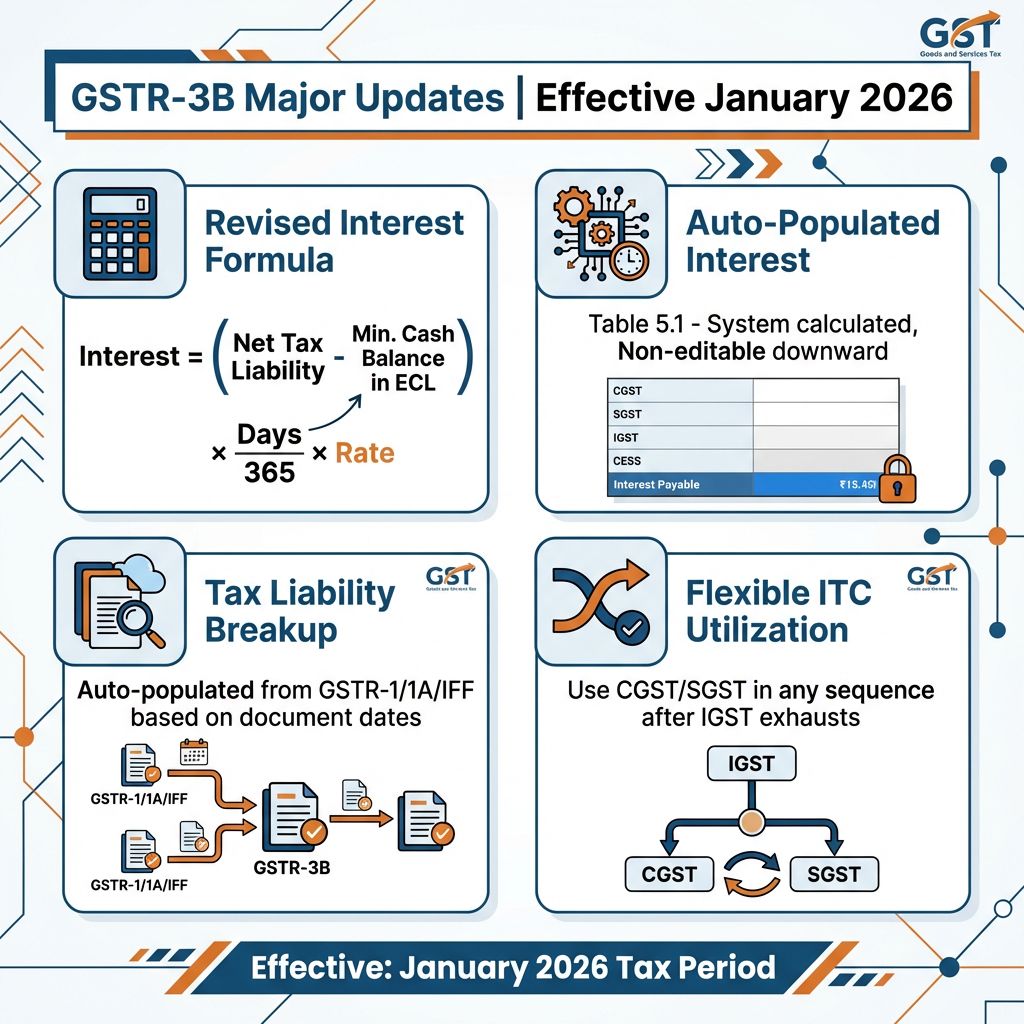

GSTR‑3B Interest Calculation & Filing Enhancements | Effective January 2026

The GST portal has rolled out major taxpayer-friendly upgrades that every business and tax professional should prepare for. These changes directly impact interest liability, ITC utilisation, return accuracy, and final return compliance.

REVISED INTEREST CALCULATION FORMULA

The new system fundamentally changes how interest under Section 50 is calculated. New Formula

Interest = (Net Tax Liability – Minimum Cash Balance in ECL) × (Days Delayed ÷ 365) × Interest Rate

Interest will now apply ONLY on the actual shortfall, not the entire liability. If a GST taxpayer keeps money in the Electronic Cash Ledger (ECL) before the due date, it directly reduces interest. This ensures a fair, realistic, and taxpayer‑friendly computation. GST taxpayers should maintain a sufficient ECL balance before the due date to minimize interest. following are KEY CHANGES FROM JANUARY 2026

Auto-Populated Interest (Table 5.1)

The system auto-calculates the minimum interest based on delay. Downward editing is not allowed (prevents under-reporting). and upward editing is allowed if self-assessment requires it. Also, taxpayer responsibility continues; self-assessment is still mandatory.

Tax Liability Breakup – Auto‑Populated

The table auto-fills using Document dates from GSTR‑1 / 1A / IFF and also Helps us Correctly map previous-period supplies and Align with Section 50 interest provisions and reduces mismatches between GSTR‑1 and GSTR‑3B.

Greater Flexibility in ITC Utilisation (Table 6.1)

New Sequence Rules : After exhausting IGST credit, taxpayers may use CGST and SGST in any order. Increased liquidity and planning flexibility. and Removes earlier rigid utilisation hierarchy.

GSTR‑10: Interest on Late Final Return Filing

For cancelled taxpayers: Delayed filing of final GSTR‑3B (for the cancellation period) and interest now collected through GSTR‑10. This closes loopholes and ensures consistent interest recovery.

Implementation Timeline

| Change | Effective From |

|---|---|

| New interest rules | January 2026 tax period |

| Auto‑population of interest | GSTR‑3B of February 2026 onwards |

Keep your ECL funded before the due date. Even a small balance can significantly reduce interest liability under the minimum cash balance method.