Comparison between Debit Note & Credit Note

Page Contents

Comparison between Debit Note and Credit Note.

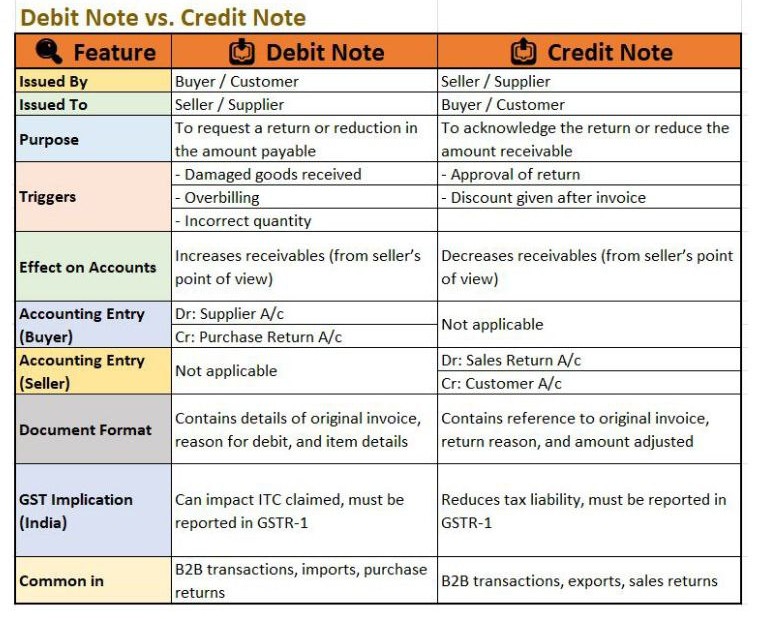

Businesses use debit notes & credit notes to record & communicate adjustments in purchase and sale transactions. These documents help identify how much the buyer owes or how much credit is due from the seller. Understanding the difference between debit & credit notes is important, especially for businesses dealing with frequent purchase returns or sales returns. While perspectives differ for buyers and sellers, the table below explains the differences in common business usage.

Debit Note

- Issued By: Buyer / Customer

- Issued-To: Seller / Supplier

- Purpose: To request a return or reduction in the amount payable.

- Triggers when Damaged goods received, Overbilling & Incorrect quantity

- Effect on Accounts: Increases receivables (from seller’s point of view).

- Accounting Entry (Buyer):

- Dr: Supplier A/c

- Cr: Purchase Return A/c

- Accounting-Entry (Seller): Not applicable

- Document Format: Contains details of original invoice, reason for debit, and item details.

- GST Implication (India): Can impact ITC claimed, must be reported in GSTR-1.

- Common In: B2B transactions, imports, purchase returns.

Credit Note

- Issued By: Seller / Supplier

- Issued-To: Buyer / Customer

- Purpose: To acknowledge the return or reduce the amount receivable.

- Triggers when Approval of return & Discount given after invoice

- Effect on Accounts: Decreases receivables (from seller’s point of view).

- Accounting-Entry (Seller):

- Dr: Sales Return A/c

- Cr: Customer A/c

- Accounting Entry (Buyer): Not applicable

- Document Format: Contains reference to original invoice, return reason, and amount adjusted.

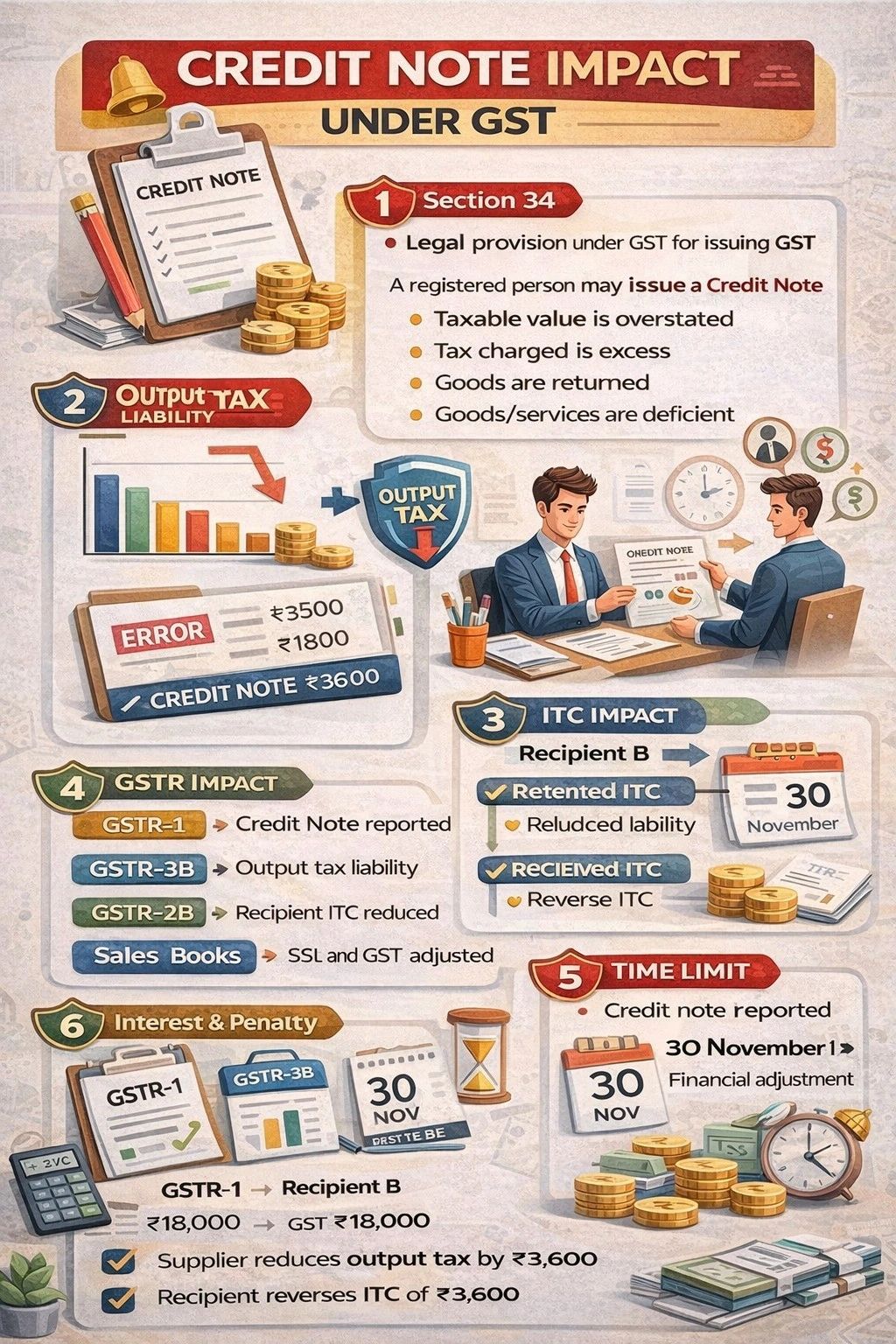

- GST Implication (India): Reduces tax liability, must be reported in GSTR-1.

- Common In: B2B transactions, exports, sales returns.

Comparative Table: Debit Note vs Credit Note

| Particulars | Debit Note | Credit Note |

| Who issues it? | The buyer issues it. | The seller issues it. |

| Meaning | Issued by the buyer to the seller to return goods due to quality issues, damage, excess quantity, etc. Contains reasons for return. | Issued by the seller confirming acceptance of the purchase return or reduction in invoice value. |

| When issued? | Only when goods were originally purchased on credit. | Only when goods were originally sold on credit. |

| Impact | Reduces accounts receivable in the seller’s books. | Reduces accounts payable in the buyer’s books. |

| Amount Type | Shows a positive amount. | Shows a negative amount. |

| Represents | A form of purchase return. | A form of sales return. |

| Accounting Effect | Updates purchase return or return outward records. | Updates sales return or return inward records. |

| Journal Entry | Buyer’s books: Supplier A/c Dr. To Purchase Return A/c |

Seller’s books: Sales Return A/c Dr. To Customer A/c |

| Issued in exchange for | Issued in exchange for a credit note. | Issued in exchange for a debit note. |

| Seller issuing a debit note | Seller issues a debit note when the buyer is undercharged or additional goods are supplied. | Buyer issues a credit note acknowledging the seller’s debit note. |

| Ink colour (traditional practice) | Typically issued in blue ink. | Typically issued in red ink. |

Key Difference comparison between Debit Note and Credit Note—Quick Summary

- A debit note is initiated by the buyer to request a reduction in the payable amount. A debit note is issued by the buyer to return goods or request a reduction in the payable amount.

- credit note is issued by the seller to acknowledge the reduction in the receivable amount. A credit note is issued by the seller confirming the return or reduction in invoice value.

- Both notes help maintain correct accounting records for purchase returns and sales returns.