Cash Credit vs Overdraft: Key Differences & Uses

Page Contents

Cash Credit vs Overdraft: Key Differences & Uses

Both Cash Credit (CC) and Overdraft (OD) are short-term financing options provided by banks, but they serve different purposes and have distinct features.

What is Cash Credit?

Cash Credit is a short-term loan offered to businesses to meet their working capital needs. It is typically secured against stocks, receivables, or fixed assets.

Features of Cash Credit:

✔ Short-Term Loan – Must be repaid within 12 months.

✔ Predefined Limit – Based on the business’s financial strength.

✔ Security Required – Usually backed by inventory or assets.

✔ Lower Interest Rate – Compared to Overdraft facilities.

✔ For Business Use Only – Not available for personal financial needs.

What is an Overdraft?

An Overdraft allows an individual or business to withdraw more than the available balance in their current account, up to a pre-approved limit.

Features of Overdraft:

✔ Flexible Withdrawal – Transactions continue even with insufficient funds.

✔ Higher Interest Rate – Compared to Cash Credit.

✔ No Collateral Required – Based on creditworthiness.

✔ Personal & Business Use – Covers unexpected expenses.

✔ Minimal Paperwork – Can be availed on an existing account.

Key Differences Cash Credit (CC) vs Overdraft (OD)

| Basis | Cash Credit (CC) | Overdraft (OD) |

|---|---|---|

| Purpose | Designed to meet working capital needs (e.g., inventory, receivables, raw materials). | Used mainly for temporary liquidity or to meet short-term cash flow mismatches. |

| Eligibility | Granted mainly to businesses against stock-in-trade, debtors, or receivables. | Available to both individuals and businesses, often against fixed deposits, salary accounts, property, or investments. |

| Security / Collateral | Usually secured by hypothecation of current assets and may require additional collateral. | Can be secured or unsecured, depending on the relationship and security offered (FDs, property, etc.). |

| Limit Determination | Based on drawing power, calculated from stock and receivables statements submitted periodically. | Based on the value of collateral or creditworthiness of the borrower. |

| Interest Calculation | Interest is charged only on the amount utilized, not the full limit. | Same — interest is charged only on the utilized amount. |

| Repayment & Tenure | Continuous credit facility; limit reviewed annually based on turnover and financials. | Usually renewed yearly; repayment terms can vary based on security and bank policy. |

| Account Nature | Operates like a separate current account with credit and debit transactions. | Operates as an overdraft facility on an existing current/savings account. |

| Documentation & Monitoring | Requires regular submission of stock statements, debtor lists, and other financial data. | Minimal documentation (especially when secured by FDs or property). |

| Typical Users | Traders, manufacturers, wholesalers — businesses needing regular working capital. | Professionals, individuals, or businesses needing occasional short-term funds. |

Cash Credit (CC)

-

To finance day-to-day business operations.

-

To manage inventory, raw material, and receivables.

-

Ideal for businesses with fluctuating working capital cycles.

Overdraft (OD)

-

To handle temporary cash shortages.

-

To pay urgent business expenses or bills before receivables are realized.

-

Useful for individuals for short-term liquidity (e.g., backed by FD or salary).

Key Differences Between Cash Credit and Overdraft- Quick Summary

| Feature | Cash Credit (CC) | Overdraft (OD) |

|---|---|---|

| Purpose | Business needs (working capital) | Personal & business financial shortfalls |

| Interest Rate | Lower | Higher |

| Loan Tenure | Usually 1 year | Flexible (monthly, quarterly, yearly) |

| Security Required | Yes (inventory, fixed assets) | No (credit score-based) |

| New Account Needed? | Yes | No (can be used on existing account) |

| If you are a… | Preferred Facility | Why? |

|---|---|---|

| Business with recurring working capital needs | Cash Credit (CC) | Continuous access to funds tied to inventory and receivables. |

| Individual or small business with occasional liquidity gaps | Overdraft (OD) | Easier approval, flexible usage, and lower documentation. |

Bottom Line

- Cash Credit is ideal for businesses needing regular working capital.

- Overdraft is useful for individuals or businesses facing temporary cash shortages.

- Always compare interest rates, fees, and terms before choosing the best option.

Would you like help comparing current interest rates on CC and OD from different banks?

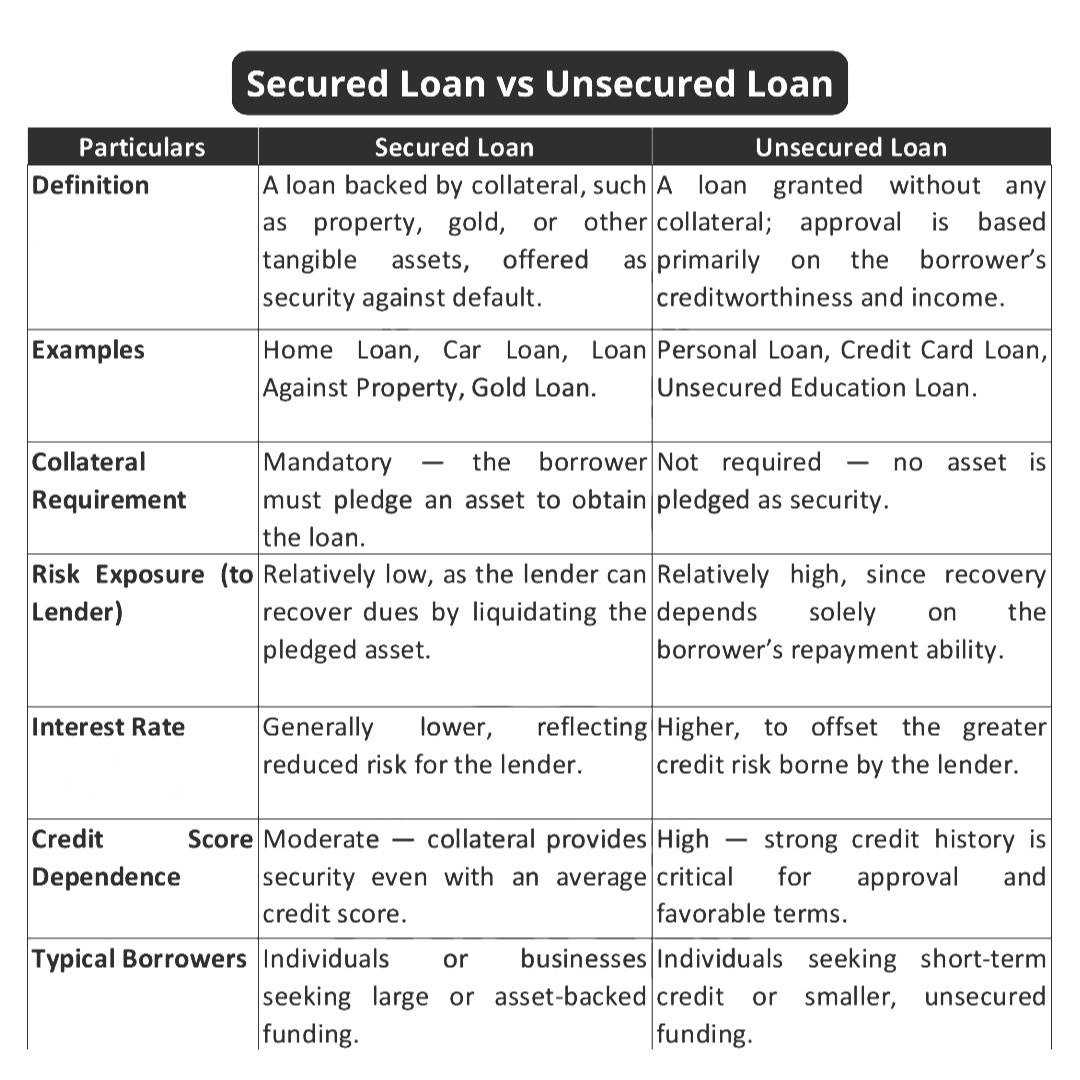

Secured Loan vs Unsecured Loan

Secured Loan Features

- Definition: Backed by collateral (property, gold, or other tangible assets).

- Examples: Home Loan, Car Loan, Loan Against Property, Gold Loan.

- Collateral Requirement: Mandatory—borrower must pledge an asset.

- Risk Exposure (to Lender): Low — lender can recover dues by liquidating the asset.

- Interest Rate: Generally lower (reduced risk).

- Credit Score Dependence: Moderate—collateral offsets average credit score.

- Typical Borrowers: Individuals/businesses seeking large or asset-backed funding.

- Secured Loan – Pros-

- Lower interest rate

- Larger loan amount

- Longer repayment period

- Easier approval for those with low credit score.

Secured Loan Cons:

- Asset must be pledged

- Longer processing time

Unsecured Loan feature

- Definition: Granted without collateral; based on creditworthiness and income.

- Examples: Personal Loan, Credit Card Loan, Unsecured Education Loan.

- Collateral Requirement: Not required.

- Risk Exposure (to Lender): High—recovery depends on borrower’s repayment ability.

- Interest Rate: Higher (greater credit risk).

- Credit Score Dependence: High — strong credit history is critical.

- Typical Borrowers: Individuals seeking short-term or smaller funding.

- Unsecured Loan – Pros

-

- No collateral required

- Quick disbursal (same-day in many cases)

- Simple documentation

- Unsecured Loan Cons:

- Higher interest rate

- Lower loan amount

- Strict credit score & income checks

Key Differences in Secured Loan vs Unsecured Loan

| Particulars | Secured Loan | Unsecured Loan |

|---|---|---|

| Security/Collateral | Required | Not required |

| Risk for Lender | Low | High |

| Interest Rate | Lower (7–12%) | Higher (12–24%) |

| Loan Amount | Higher | Limited |

| Repayment Tenure | Longer (up to 20–30 years) | Shorter (1–5 years) |

| Processing Time | Longer (valuation, verification) | Faster (instant approvals possible) |

| Eligibility | Less strict | More strict (credit score important) |

| Recovery Method | Sell collateral | Legal action, civil suit, Section 138, etc. |

When to Choose What?

- Secured loans = collateral, cheaper, higher amount, longer tenure. Choose a secured loan if you need a large amount (home, business expansion), you want lower EMIs, You have an asset to pledge, & you want to reduce interest costs.

- Unsecured loans = no collateral, expensive, have a limited amount, and have fast processing. Choose an unsecured loan if you need urgent funds, You do not want to offer collateral, a smaller amount is sufficient, and your income and credit score are strong.

-