CA vs CPA: Which is Smarter Choice for Finance Professionals

Page Contents

CA vs CPA: Which is Smarter Choice for Finance Professionals

When it comes to building a high-growth career in accounting & finance, two qualifications often top the list:

CA (Chartered Accountant – India)

CPA (Certified Public Accountant – US)

A side-by-side CA vs CPA comparison table (Duration, Cost, Eligibility, Recognition, Salary, Career Scope) right after the introduction would hook readers who prefer a visual summary before diving deep. Here’s a quick comparison to help you decide

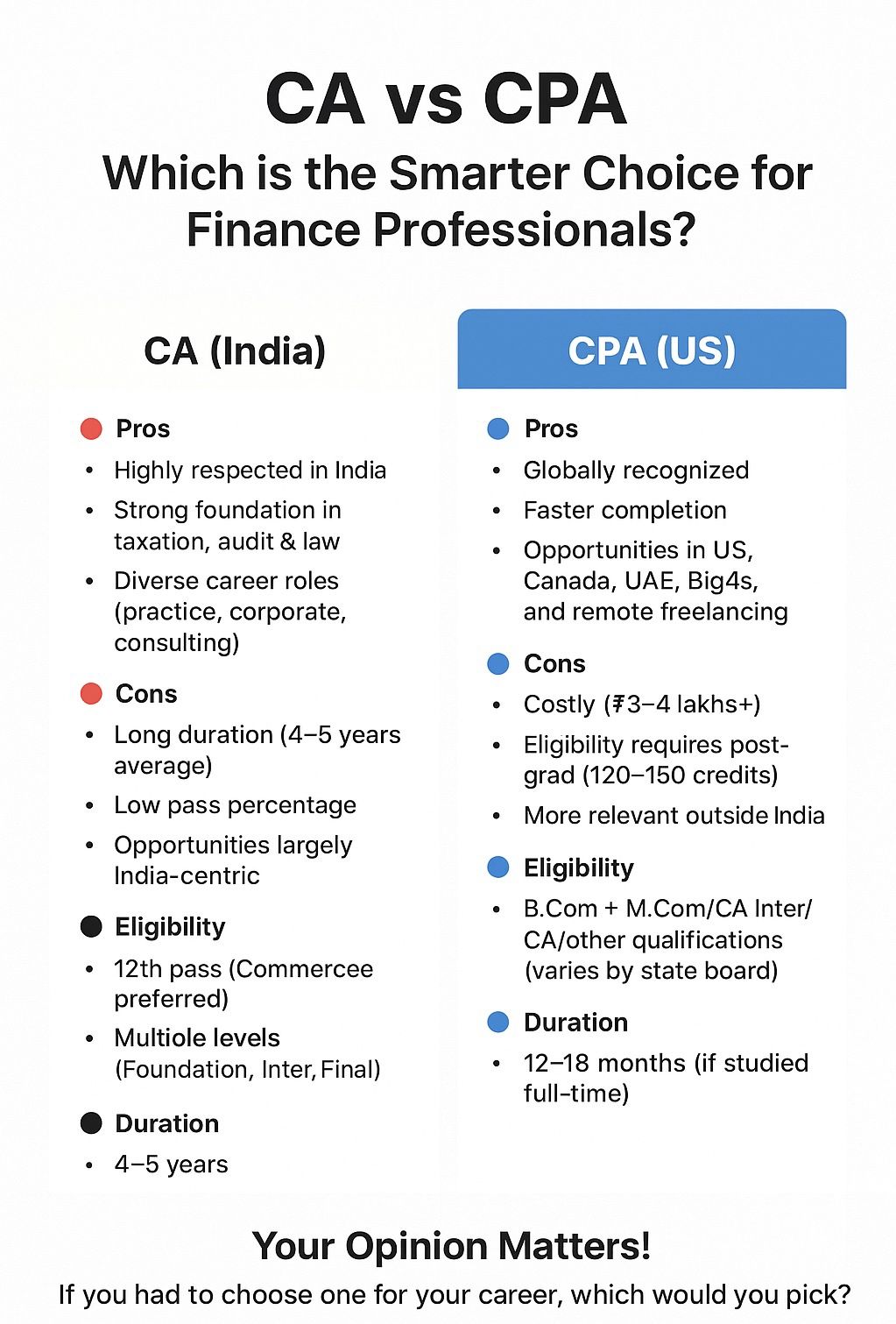

CA (India)

Pros:

Highly respected & recognized in India

Strong foundation in taxation, audit & corporate law

Diverse opportunities – practice, corporate, consulting

Cons:

Long duration (avg. 4–5 years)

Low pass percentage

Career opportunities largely India-centric

Eligibility: 12th pass (Commerce preferred) – Foundation → Inter → Final

Duration: 4–5 years on average

CPA (US)

Pros:

Globally recognized credential

Faster to complete (12–18 months)

Opportunities in US, Canada, Middle East, Big 4s, remote freelancing

Cons:

Higher cost (INR 3–4 lakhs+)

Eligibility requires 120–150 credits (B.Com + M.Com / CA Inter / CA etc.)

More relevant for careers outside India

Eligibility: Varies by state board (generally B.Com + PG/CA equivalent)

Duration: 12–18 months (if studied full-time)

Correct Minor Inaccuracies

In the Program Completion Requirements, you wrote “CPA has 3 exams” : Actually, the new CPA Evolution model (2024 onwards) has 3 core exams (FAR, AUD, REG) + 1 discipline (BAR/ISC/TCP), i.e., 4 sections total, not 3.

CA practical training (articleship) is 3 years but some students take longer to clear Final, so average completion is 4.5–5 years.

Salary Ranges in INR + USD for Both : Right now, CA salary is given in INR and CPA in USD. For better comparison

CA: Freshers in India: INR 7–10 LPA (can rise to INR 20–25 LPA+ in Big 4/industry with experience).

CPA: Freshers globally: $55k–$120k (~INR 45–90 LPA depending on location, role, and experience).

Tighten Language for Flow

Passing Percentages:

- CPA pass rate → ~45–50% (per section globally).

- CA pass rate → closer to 10–15% (aggregate), not flat 5%. You can frame it as: CA exams have a low pass percentage (around 10–15% overall), making it one of the toughest qualifications in IndiaTop of Form

Bottom of Form

Who Should Choose What?

Your Opinion Matters! If you had to choose one for your career, which would you pick? A short 3–4 line conclusion could directly guide readers:

- Choose CA (Chartered Accountant – India): if you want to build a career in India, taxation, auditing, corporate law, or practice.

- Choose CPA (Certified Public Accountant – US): if you want international exposure, quicker qualification, US GAAP/IFRS focus, or work in MNCs/Big 4.

- Choose Both(Both (depending on career goals): You aim to lead in MNCs or want the strongest profile in international finance & accounting. if aiming for cross-border finance, global mobility, or senior leadership roles. This acts as a career decision framework, which readers will love.

- Neither CPA or CA then exploring other options.

Frequently Asked Questions on CA vs CPA :

Q.: Which earns more, Chartered Accountant or Certified Public Accountant ?

Ans. : It is difficult to determine definitively, as compensation varies with factors like experience, location, and the organization. However, in India, Chartered Accountants (CAs) generally tend to earn more than Certified Public Accountants, since CA is more widely recognized domestically.

Q.: Is CPA harder than Chartered Accountant?

Ans. : Both Chartered Accountant and CPA are challenging qualifications. However, the CPA exam is often considered somewhat easier because of its flexible structure, shorter duration, and modular exam pattern compared to Chartered Accountant. The Chartered Accountant course is longer and involves a more rigorous training process in India.

Q.: Is CPA valuable in India?

Ans. : Yes. Pursuing Certified Public Accountant can be highly rewarding in India. It opens up job opportunities in accounting, finance, audit, taxation, and consulting, especially with multinational corporations (MNCs) and Big 4 firms that value global credentials. CPAs are also eligible for opportunities in the US.

Q.: Is CA and Certified Public Accountant a good combination?

Ans. : Absolutely. A Chartered Accountant + Certified Public Accountant combination is considered one of the strongest professional profiles in finance and accounting. It provides recognition in both Indian and global markets, enhancing career prospects in MNCs, international firms, and cross-border advisory roles.

Cast your vote & share your thoughts in the comments : your experience could help future finance professionals make smarter career choices!