Applicability TDS on Payments to Partners Section 194T

Page Contents

TDS on Payments to Partners Section 194T (w.e.f. 1.04.2025)

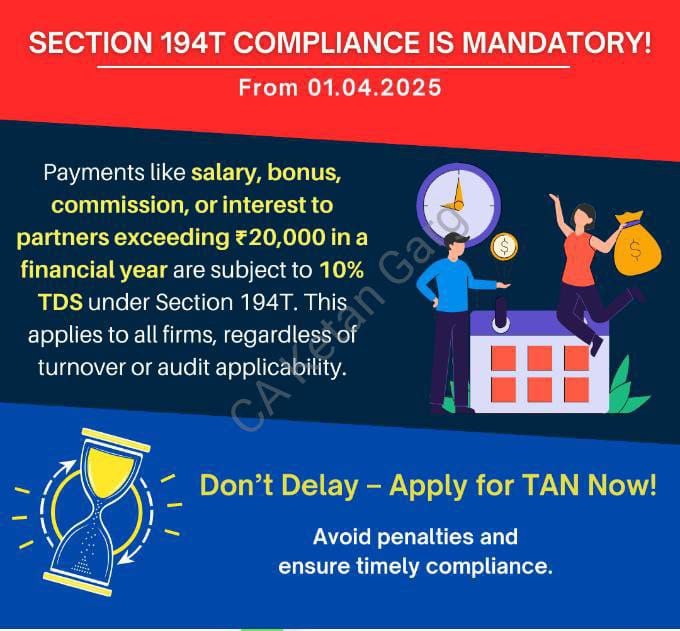

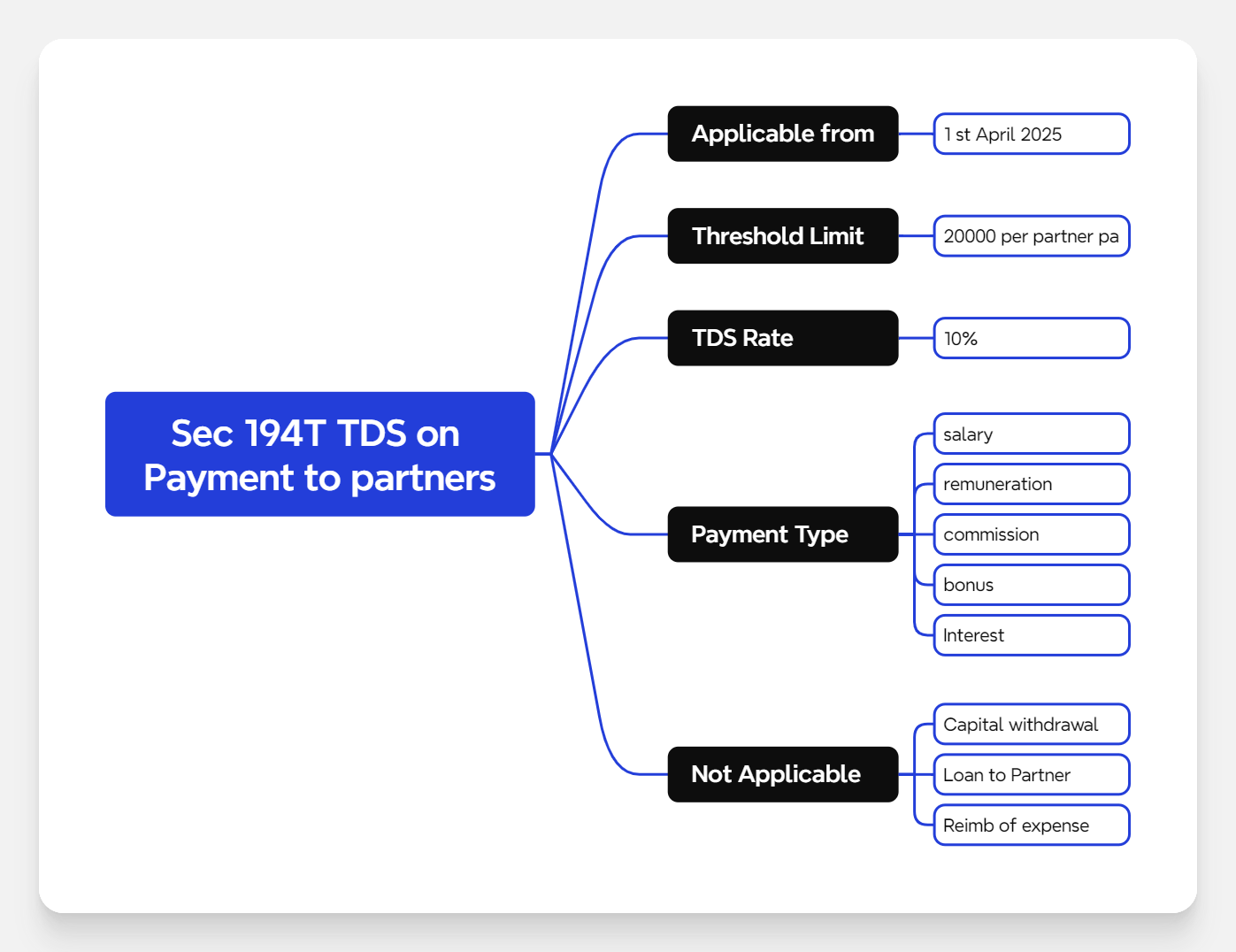

Payments Covered U/s 194T : The Union Budget 2024 introduced Section 194T, which mandates Tax Deducted at Source (TDS) on certain payments made by a firm to its partners. This provision aims to increase tax compliance and transparency in partner remuneration and other payments. The following payments by a firm to its partners will be subject to TDS on Salary, Remuneration, Commission, Bonus, Interest (on capital or loan accounts). Even if the payment is not made in cash but credited to the partner’s capital account, TDS will still be applicable. TDS should be deducted at the earlier of the following dates:

- When the amount is credited to the partner’s account in the books of the firm (including credit to the capital account).

- When the payment is actually made to the partner.

TDS Deduction & Accounting Adjustments: Firms must update their accounting systems to track and deduct TDS at 10% on partner payments exceeding ₹20,000 per financial year. Partners must account for TDS deductions in their income tax returns to claim credit for the tax deducted. Rate of Deduction and Threshold Limit

| Condition | TDS Rate | TDS Threshold |

| Aggregate payments (salary, remuneration, interest, bonus, or commission) exceed ₹20,000 in a financial year | 10% | ₹20,000 per financial year |

What do firms need to do for compliance?

- Obtain TAN: Firms must secure a Tax Deduction and Collection Account Number (TAN) if they don’t already have one.

- Deduct TDS @10%: For payments exceeding ₹20,000 per financial year starting April 1, 2025.

- Deposit TDS timely: Ensure TDS is deposited monthly with the government.

- File quarterly TDS returns: Firms must submit Form 26Q detailing partner payments and TDS deductions.

- Issue Form 16A: Provide TDS certificates to partners for tax filing.

- Improved tax compliance and reduced tax evasion. Wider tax base, ensuring more income is taxed at source. Encourages financial discipline by requiring firms to maintain proper records.

Practical Implications for Firms and Partners on payments Covered U/s 194T

- Timely TDS Compliance : Firms must deduct and deposit TDS before year-end to avoid non-compliance penalties. TDS for the March quarter must be deposited by April 30, making early account finalization crucial.

- Section 194T will be applicable from April 1, 2025, as per the Finance Bill 2024. Firms must ensure compliance from April 1, 2025, to avoid penalties for non-deduction of TDS. interest payments to partners will be subject to TDS under section 194T.

- Increased Compliance Costs & Tax Planning : Additional compliance burden on firms to maintain proper records and ensure timely TDS filings. Partners may need advance tax planning to optimize cash flows and avoid excess tax deductions.

Section 194T – TDS on Partner Payments

-

Not applicable for FY 2024–25 (AY 2025–26): Partner’s remuneration or interest can be booked without deduction of TDS.

-

Applicable from FY 2025–26 (AY 2026–27): 10% TDS to be deducted if payment to a partner exceeds ₹20,000 in a year.

- No TDS compliance needed in FY 2024–25, but ensure 40(b) limits. From FY 2025–26 onwards, both TDS under 194T and 40(b) restrictions must be followed.

- Exemption for Capital Repayments : TDS under Section 194T is NOT applicable on repayment of capital contributions to partners.

- Impact on Partner Withdrawals: In family-owned firms, partner withdrawals are often ad hoc based on cash flow needs and tax planning. With TDS at 10% on withdrawals exceeding ₹20,000, partners must now plan their withdrawals in a structured manner.

- Challenges in Year-End TDS Compliance : Partner remuneration is often linked to the firm’s profitability, which is typically determined at financial year-end (March 31). Since TDS for the March quarter is due by April 30, firms may need to finalize accounts earlier than usual to comply with TDS deductions.

- Impact on Cash Flow Management : Since TDS is deducted at the time of payment or credit to the partner’s account, partners will experience reduced immediate cash availability. Firms must ensure timely TDS compliance to avoid penalties.

Section 40(b) – Deductibility of Remuneration/Interest

-

While recording partner’s remuneration or interest, ensure compliance with prescribed limits under Section 40(b) to maintain admissibility.

-

Any amount exceeding these limits will be disallowed while computing taxable business income.

Comparison: Section 194T vs. Section 192

| Aspect | Section 192 (TDS on Salaries) | Section 194T (TDS on Partner Payments) |

| Applicability | Applies to employees receiving salary income. | Applies to partners receiving payments from a firm. |

| Type of Payments Covered | Salary and wages paid by an employer. | Salary, remuneration, commission, bonus, and interest paid to a partner. |

| Income Classification | Classified under “Salaries” as per Section 15. | Not considered “Salaries” as per Explanation 2 to Section 15. |

| TDS Deduction Rate | Based on income slab rates of the employee. | Fixed 10% TDS rate if annual payments exceed ₹20,000. |

| Threshold for Deduction | No specific threshold—deduction applies as per salary slabs. | TDS applies only when total partner payments exceed ₹20,000 per financial year. |

| Due Date for TDS Payment | 7th of the following month (30th April for March payments). | 7th of the following month (30th April for March payments). |

| TDS Certificate Issued | Form 16 | Form 16A |

| Employer/Firm’s Compliance | Deduct and deposit TDS as per slab rates, file TDS return (24Q). | Deduct and deposit TDS at 10%, file TDS return (26Q). |