key highlights of India’s New Income-tax Act, 2025

Page Contents

India’s New Income-tax Act, 2025 – Effective 1 April 2026

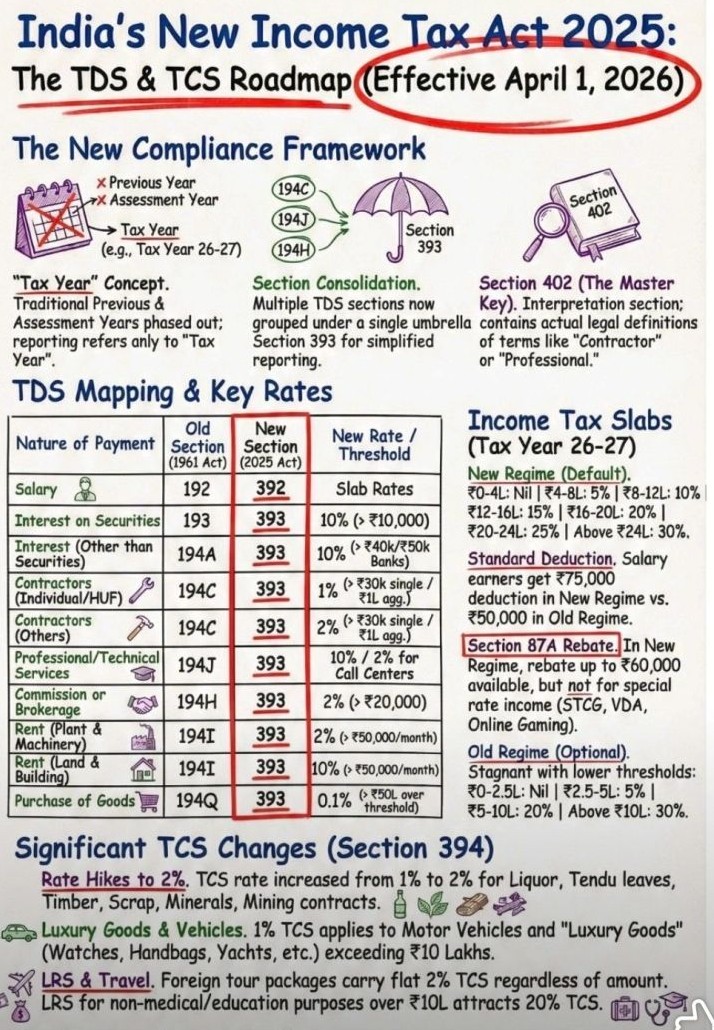

The Income-tax Act, 2025 represents a structural rewrite of India’s direct tax law. One of the most significant changes is the complete restructuring of the TDS and TCS framework, indicating a strong policy shift toward consolidation, simplification, and transaction-level monitoring. Below are the key highlights:

Unified TDS Framework – Section 393

The multiple provisions under the existing Section 194 series (194C, 194J, 194H, 194I, 194Q, etc.) are proposed to be consolidated under a single umbrella provision—Section 393. Objective of Unified TDS Framework – Section 393

-

Reduce fragmentation of provisions

-

Improve interpretational clarity

-

Enable streamlined compliance and reporting

-

Align better with technology-driven tax administration

The practical impact will largely depend on how rates, thresholds, and exclusions are preserved or modified in the final notified rules.

Section 402 – Interpretation & Definitions

A dedicated interpretation provision introduces clearer statutory definitions for key terms such as “Contractor,” “Professional,” Other classification-sensitive categories. This may significantly reduce long-standing litigation around professional vs. contractual payments, the applicability of specific TDS rates, Nature-of-payment disputes

Income-tax Slabs (FY 2026–27 | New Regime as Default)

The new regime continues to be positioned as the default tax system. Proposed slab structure under FY 2026–27 | New Regime as Default :

| Income Range | Tax Rate |

|---|---|

| ₹0 – ₹4 lakh | Nil |

| ₹4 – ₹8 lakh | 5% |

| ₹8 – ₹12 lakh | 10% |

| ₹12 – ₹16 lakh | 15% |

| ₹16 – ₹20 lakh | 20% |

| ₹20 – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

- Standard Deduction: INR 75,000 (under New Regime)

- Section 87A Rebate: Up to INR 60,000 (subject to specified exclusions)

- This structure strengthens the shift toward a simplified, deduction-light tax regime.

Significant TCS Rationalisation – Section 394

Key proposed changes to significant TCS Rationalization in the section 394 include the following:

-

2% TCS on specified goods (Liquor, Timber, Minerals, etc.)

-

1% TCS on luxury goods & motor vehicles exceeding ₹10 lakhs

-

2% TCS on overseas tour packages

-

20% TCS under LRS (for non-medical/education remittances) exceeding INR 10 lakhs

The taxpayer has to enhance tracking of high-value and discretionary transactions through strengthened reporting mechanisms. Taxpayers and professionals required to implement the Enterprise Resource Planning system and payroll systems will require reconfiguration; contract classification must be reviewed; vendor onboarding processes may need updates; the cash flow impact due to TCS expansion must be assessed; and advisory opportunities for restructuring high-value transactions must be explored.

Major Revisions in Allowances & Perquisite Valuation

The allowances and perquisite values that had been static since the 1960s have been substantially revised upward, Old vs Draft 2026—Verified mentioned under following Table

| Item | BEFORE (Old Rules) | AFTER (Draft 2026 Rules) | |

|---|---|---|---|

| Children Education Allowance | ₹100/month/child | ₹3,000/month/child | |

| Hostel Allowance | ₹300/month/child | ₹9,000/month/child | |

| Free Meals | ₹50/meal | ₹200/meal | |

| Gifts (Non‑cash) | ₹5,000/year | ₹15,000/year | |

| Car (<1.6L engine) | ₹1,800 + ₹900 (driver) | ₹5,000 + ₹3,000 (driver) | |

| Car (>1.6L engine) | ₹2,400 + ₹900 (driver) | ₹7,000 + ₹3,000 (driver) | |

| Overseas Medical Treatment | Tax‑free only if income < ₹2L | Tax‑free if income < ₹8L |

- Aligns exemptions with inflation → first major revision in decades.

- Makes CTC structuring meaningful and modern.

- Reduces unnecessary taxation created by archaic limits.

PAN Quoting Requirements—Revised Thresholds

News24 confirms sweeping rationalization of PAN reporting rules. ClearTax provides the detailed table

PAN Requirement—Old vs Draft 2026

| Transaction Type | Old Limit | Draft 2026 Limit | |

|---|---|---|---|

| Motor Vehicle Purchase | PAN for all except 2‑wheelers | PAN for vehicles > ₹5 lakh (incl. 2‑wheelers) | |

| Hotel/Restaurant Cash Payment | > ₹50,000 | > ₹1,00,000 | |

| Life Insurance Premium | > ₹50,000/year | PAN required for account‑based relationship | |

| Immovable Property | > ₹10 lakh | > ₹20 lakh | |

| Cash Deposits/Withdrawals | ≥ ₹20 lakh | ≥ ₹10 lakh/year |

Higher limits reduce the compliance burden for mid‑range transactions, there is a clear shift toward monitoring large and structured financial behavior, and cash withdrawals become more tightly monitored.

Other Structural Changes—Verified

ClearTax and News24 confirm additional compliance-oriented reforms.

Summary of Other Revisions

| Item | BEFORE | AFTER (2026 Rules) | |

|---|---|---|---|

| Property SFT Reporting | ₹30 lakh | ₹45 lakh | |

| Books of Accounts (Professionals) | Manual allowed | Mandatory digital books | |

| CBDC (Digital Rupee) | Not recognised | Recognised as valid payment mode |

Mandatory digital books = serious push for end‑to‑end digital compliance, strengthens tax administration and reduces audit disputes. and CBDC integration modernizes the tax ecosystem.

Old vs. New Regime: Which Survives in 2026?

Financial Express confirms that the old tax regime is absolutely NOT being phased out, and the draft rules show clear intent to keep both regimes operational. Key Insights .

- Draft rules do not distinguish exemptions between new and old regimes.

- Upgraded allowances and perquisites hugely benefit the old regime.

- Old‑regime benefits (80C, 80D, HRA, LTA) remain fully intact.

Deductions & Exemptions Allowed Under New Tax Regime (FY 2025-26)

Standard Deduction : ₹75,000 – Salaried individuals & pensioners (from salary/pension income)

Family Pension: Deduction of ₹25,000 or 1/3rd of family pension, whichever is lower (under “Income from Other Sources”)

Section 80CCD(2) – Employer Contribution to NPS

-

Employer’s contribution to NPS is allowed. Maximum deduction allowable under NPS :

-

14% of salary (Basic + DA) for Government employees

-

Up to 10% (earlier 10%, enhanced to 14% in new regime for private sector as per amendments) — subject to applicable limits

-

-

Employee’s own contribution NOT allowed under 80CCD(1) or 80CCD(1B).

-

Combined employer contribution to NPS + EPF + Superannuation exempt up to ₹7.5 lakh per year (excess taxable).

Section 80CCH – Agniveer Corpus Fund

-

Contribution by Agniveer or Central Government to Seva Nidhi account is fully deductible.

Section 80JJAA (Business Deduction)

-

30% of additional employee cost (available to eligible businesses opting for new regime, subject to conditions).

Home Loan – Limited Benefit

-

Interest on loan for let-out property allowed (as deduction while computing income from house property).

-

Self-occupied property interest deduction under Section 24(b) NOT allowed.

-

No set-off of house property loss against other income.

Retirement & Terminal Benefits (Exemptions Continue)

The following remain exempt (subject to limits):

-

Gratuity (₹20 lakh for non-govt; fully exempt for govt employees)

-

Leave encashment on retirement (as per limits)

-

Voluntary Retirement (VRS) – up to ₹5 lakh

-

Retrenchment compensation

-

Death-cum-retirement benefits

-

Commuted pension (1/3rd or ½ depending on gratuity receipt)

Provident Funds & Retirement Schemes

-

Employer contribution within ₹7.5 lakh limit exempt.

-

EPF interest exempt up to prescribed limits.

-

PPF interest & maturity – exempt.

-

NPS lump sum withdrawal (60%) exempt.

-

Partial Tier I withdrawal – exempt.

Savings & Insurance

-

Section 10(15)(i): Post Office Savings interest exempt up to:

-

₹3,500 (individual)

-

₹7,000 (joint)

-

-

Section 10(10D): Life insurance maturity proceeds (subject to premium conditions).

-

Sukanya Samriddhi – interest & maturity exempt.

Allowances Still Exempt (Limited)

Only allowances related to official duties remain exempt, such as:

-

Travel on transfer

-

Conveyance for official duties

-

Daily allowance on tour

-

Allowances to meet official expenditure

-

Transport allowance for specially-abled employees. Most salary structuring allowances (HRA, LTA etc.) NOT allowed.

Deductions & Exemptions NOT Allowed Under New Regime

Approximately 70+ deductions removed. Key disallowances:

Section 80C Investments : LIC Premium, PPF, ELSS, EPF (employee contribution), Tuition fees & Principal repayment of home loan

Home Loan (Major Restriction): No deduction for Interest on self-occupied property (Section 24(b)), Additional interest (80EE / 80EEA), and Principal repayment (80C). No house property loss set-off.

Section 80D : Medical insurance premium – NOT allowed.

Section 80E: Education loan interest – NOT allowed.

Section 80G : Donations including PM Relief Fund, National Defence Fund etc. – NOT allowed.

Salary-Related Exemptions Not Allowed like HRA, LTA, Professional tax deduction, Entertainment allowance (Govt employees), Minor child allowance, Children education allowance, and Most Section 10(14) special allowances

Savings Account Interest : 80TTA / 80TTB – NOT allowed.

Business / Other Deductions Removed

-

80IA, 80IB, 80IAC etc.

-

Additional depreciation (32(1)(iia))

-

35 series research deductions

-

10AA (SEZ deduction)

-

Unabsorbed depreciation adjustment (subject to conditions)

Quick Comparison Snapshot

| Category | Old Regime | New Regime |

|---|---|---|

| Standard Deduction | INR 50,000 | INR 75,000 |

| 80C | Allowed | Not Allowed |

| 80D | Allowed | Not Allowed |

| HRA | Allowed | Not Allowed |

| Home Loan (Self-Occupied) | Allowed | Not Allowed |

| Employer NPS (80CCD2) | Allowed | Allowed |

| Official Allowances | ||

| Gratuity |

Old Regime VS New regime

The New Regime is beneficial when:

-

Deductions < ₹3–4 lakh

-

No housing loan

-

No heavy insurance/ELSS investments

-

Simplified compliance preferred

Old Regime may be better when:

-

Housing loan interest (₹2L+)

-

High HRA exemption

-

80C + 80D fully utilised

-

Large donation deductions

Why the Old Regime May Regain Popularity

- Sharply increased allowance limits (education, hostel, meals, etc.).

- Higher perquisite thresholds aligned with inflation.

- Better fit for salaried individuals with structured CTC components.

- New regime becomes less advantageous where exemptions are maximized.

- Financial Express experts confirm that increased limits (e.g., education allowance from ₹200 to ₹3,000) signal that the old regime will continue and remains practical for many taxpayers

Summary—High-Level Takeaways

- Salary & perquisite valuation modernised after decades

- PAN reporting thresholds rationalised and simplified

- Strong movement toward digital compliance

- CBDC formally integrated

- Old tax regime gets a “soft revival” due to massive exemption hikes

- The Draft Rules reflect a complete modernization of tax administration