How Statutory Compliances Increase with Turnover (India)

Page Contents

How Statutory Compliances Increase with Turnover (India)

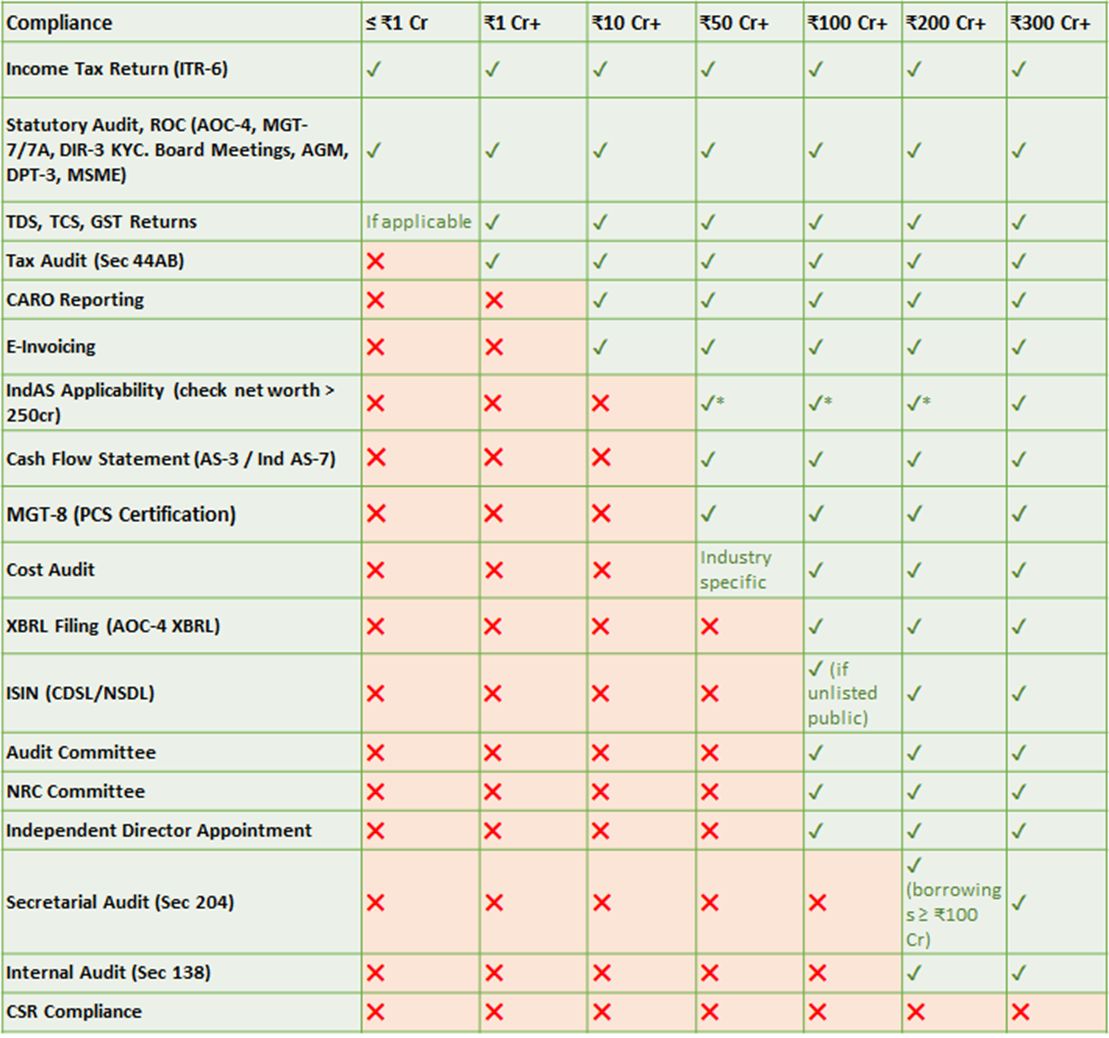

As businesses scale, regulatory obligations don’t rise linearly; they jump in slabs. Understanding these thresholds early helps founders and finance leaders plan systems, costs, and governance before compliance becomes reactive. Turnover-based summary only. Other triggers like capital, borrowings, deposits & net worth also apply. Scaling revenue without scaling compliance is a hidden business risk. Anticipating statutory thresholds early helps avoid last-minute firefighting, penalties, and governance gaps. Below is a simplified and logical explanation of how compliance requirements increase as turnover increases.

Compliance Requirements Based on Company Turnover

This is a turnover-based summary only. Additional compliance triggers may arise due to paid-up capital, borrowings, deposits, net worth & sector-specific laws. A snapshot of how statutory compliances for Indian companies increase with business turnover helps founders and finance leaders anticipate regulatory obligations as they scale.

Applicable to ALL Companies (Regardless of Turnover)

- Income Tax Return (ITR-6) : All companies must file ITR‑6.

- Statutory Audit + ROC Compliance : Includes AOC‑4, MGT‑7/7A, DIR‑3 KYC, AGM, Board Meetings, DPT‑3, MSME. Mandatory across all turnover slabs.

- TDS, TCS, GST Returns : Always applicable if the business activity triggers applicability.

Up to INR 1 Crore Turnover

Basic compliance stage

-

Income Tax Return (ITR)

-

GST returns (if registered)

-

TDS compliances (if applicable)

-

ROC annual filings (AOC-4, MGT-7 / 7A)

Suitable for early-stage / bootstrapped entities

Above Turnover ≥ INR 1 Crore

Tax audit visibility begins

- Tax Audit u/s 44AB (subject to cash transaction limits) : Tax Audit (44AB) : Required if turnover crosses ₹1 crore (subject to 95% digital transactions relaxation).

- CARO Reporting : Applicable from ₹1 crore onward.

-

Increased scrutiny of books & documentation

-

Stronger accounting discipline required

-

Finance function starts becoming critical

Above INR 2 Crore

Audit becomes the norm

-

Mandatory Tax Audit in most cases

-

Detailed reporting in Form 3CD

-

Higher risk of notices if books are weak

Informal accounting no longer sustainable

Above INR 5 Crore

Digital & system-driven compliance

-

Presumptive taxation mostly not available

-

Robust ERP / accounting systems advisable

-

Greater GST reconciliations & vendor compliance tracking

Shift from compliance filing to compliance management

Turnover ≥ INR 10 Crore

Regulatory maturity stage

-

Cost Audit / Secretarial Audit (sector-specific)

-

Enhanced disclosures & Board oversight

-

Lender, investor & regulator reliance on compliance quality

- E-Invoicing : Mandatory once turnover exceeds ₹10 crore (as per threshold in the chart).

- Cash Flow Statement (AS‑3 / Ind AS‑7) : Required for companies with ₹10+ crore turnover.

- MGT‑8 (PCS Certification) : Mandatory for certain classes of companies once turnover exceeds ₹10 crore.

- Compliance failures now have reputational and financial impact

Turnover ≥ INR 50–100 Crore

Cost Audit : Applicable depending on industry (specified sectors such as pharma, engineering, power, etc.).

Turnover ≥ INR 200 Crore

- No major changes noted at ₹200 crore level in your table (Requirements are same as ≥ ₹100 crore).

Turnover ≥ INR 300 Crore

CSR Applicability : Triggered when:

- Turnover ≥ ₹1000 crore, OR

- Net worth ≥ ₹500 crore, OR

- Net profit ≥ ₹5 crore

But according to your table, CSR ✓ appears at ₹300 crore. This may reflect an internal threshold model or a simplified representation.

Turnover ≥ ₹100 Crore

- XBRL Filing (AOC‑4 XBRL) : Mandatory once turnover exceeds ₹100 crore OR if company meets other XBRL criteria.

- ISIN (CDSL/NSDL) : Required if the company is an unlisted public company.

- Audit Committee : Required from this threshold.

- NRC Committee : Remuneration-related committee mandatory beyond ₹100 crore turnover.

- Independent Director Appointment : Required once turnover exceeds ₹100 crore.

- Secretarial Audit (Sec 204) : Required if the company’s turnover exceeds ₹250 crore OR borrowings ≥ ₹100 crore (as per your chart: ✓ for borrowing ≤ ₹100 crore).

Simplified Turnover –Compliance Ladder

| Turnover Slab | Key New Compliances |

|---|---|

| Up to INR 1 Cr | Basic ROC + ITR |

| INR 1 Cr+ | Tax Audit, CARO |

| INR 10 Cr+ | E‑Invoicing, Cash Flow, MGT‑8 |

| INR 50 Cr+ | Cost Audit (sector-specific) |

| INR 100 Cr+ | XBRL, Audit & NRC Committee, Independent Director, ISIN (unlisted public) |

| INR 250–INR 300 Cr+ | Secretarial Audit, CSR (as per table) |