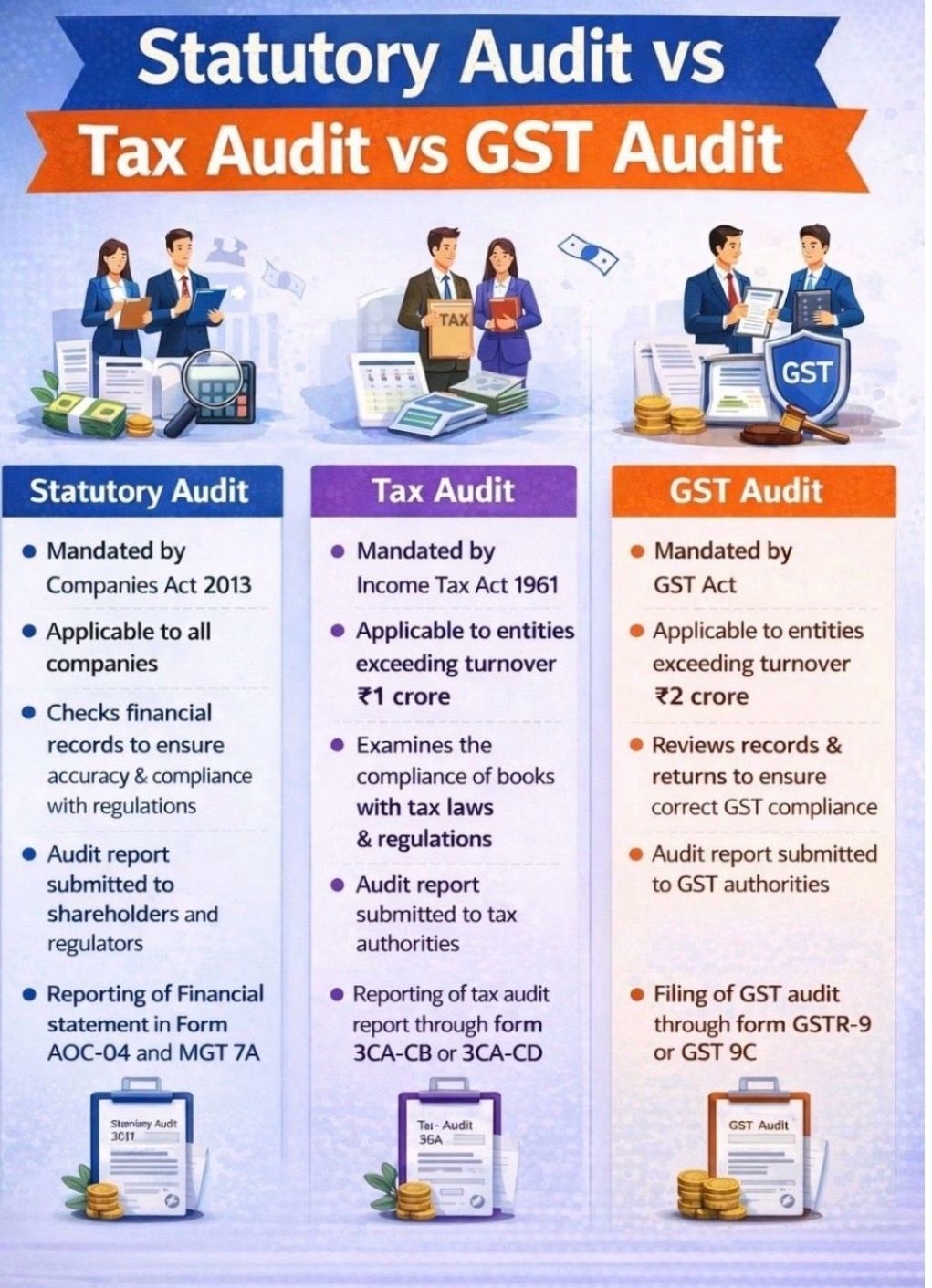

Difference between Statutory Audit vs Tax Audit vs GST Audit

Difference between Statutory Audit vs Tax Audit vs GST Audit

Meaning | Applicability | Authority | Objectives | Reporting

Many businesses undergo multiple audits under different laws, yet confusion around their scope, purpose, and reporting often leads to mismatches, departmental notices, and avoidable litigation. Each audit serves a distinct statutory objective. Understanding these differences is essential for robust compliance and risk management.

Statutory Audit

A statutory audit is governed by Companies Act, 2013, Mandatory for all companies. Objective: To ensure a true and fair view of financial statements & scope includes accounting standards compliance, internal financial controls & statutory disclosures. Report addressed to shareholders and regulators. Key filings AOC-4, MGT-7 / MGT-7A

Tax Audit

Tax audit is governed by the Income-tax Act, 1961. Applicable where turnover exceeds INR 1 crore (general cases) or INR 10 crore (subject to cash transaction conditions). Tax audit The objective is the verification of income computation and tax compliance, and focus areas include deductions & disallowances, TDS/TCS compliance, Section 43B payments, MSME dues (Section 43B(h)), & related-party transactions. Also, a report is filed with the Income-tax Department. Tax audit reports: Form 3CA / 3CB along with Form 3CD

GST Audit / GST Reconciliation

GST Audit / GST Reconciliation is governed by the GGST Act, 2017. The mandatory statutory GST audit withdrawn, but reconciliation still critical, Applicable where aggregate turnover exceeds prescribed limits (as per current law) Objective of GST Audit / GST Reconciliation: Reconciliation of books with GST returns which Covers ITC eligibility and reversals, Tax liability accuracy, Disclosure mismatches & compliance gaps across returns. Compliance through GSTR-9 and GSTR-9C (where applicable)

While books of accounts remain common, objectives differ, reporting authorities differ, & risk exposure differs. Consistency across financials, income tax returns, and GST filings is the backbone of audit defense. A well-aligned audit framework Reduces notices, Prevents interest and penalties, Minimizes litigation exposure

Comparison between Statutory Audit vs Tax Audit vs GST Audit

| Feature | Statutory Audit | Tax Audit | GST Audit |

| Law | Companies Act | Income Tax Act | GST Act |

| Mandatory For | All companies | Businesses/professions crossing limits | Turnover > ₹5 cr (GSTR‑9C) |

| Auditor | CA | CA | Self‑certified (post‑2021 reforms) |

| Objective | True & fair financial reporting | Correct income & tax compliance | Reconciliation & GST compliance |

| Report | Statutory Audit Report + CARO | 3CD (with 3CA/3CB) | GSTR‑9 & GSTR‑9C |

| Covers | Entire financial statements | Only tax‑related aspects | Turnover, ITC, tax liability |

Audit readiness should not be year-end firefighting. It must be a continuous, integrated compliance strategy across statutes. Simple Understanding for Clients

- Statutory Audit = Accuracy of financial statements (company law).

- Tax Audit = Accuracy of taxable income (income tax law).

- GST Audit = Accuracy of GST turnover & ITC (GST law).