Labour Code Impact – Q3 FY26 (as of 17 Jan 2026)

Page Contents

Labour Code Impact – Q3 FY26 (as of 17 Jan 2026)

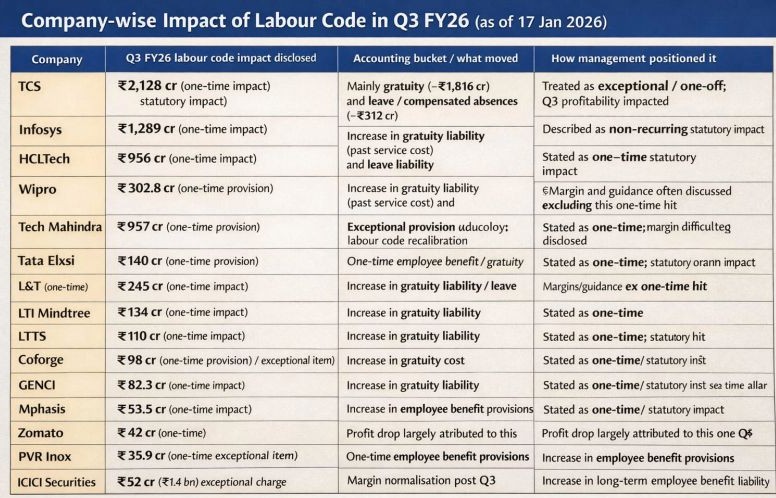

IT Services Sector: Largest Impact—What stands out immediately

Across the IT services sector, the labour code impact reported in Q3 is largely one‑time and statutory in nature. The primary drivers of the impact have been gratuity and employee benefit liabilities, rather than any deterioration in underlying business performance.

Management teams across companies have consistently positioned these charges as non‑recurring, emphasizing that the impact reflects accounting and compliance adjustments rather than operational weakness. While reported margins were temporarily pressured in the quarter, the core demand environment and execution metrics remain intact.

These impacts have been most visible in IT services due to the sector’s employee‑heavy cost structure. The revised labour codes alter the definition of wages, which directly affects the calculation base for statutory liabilities such as gratuity and leave encashment. As a result, companies were required to re‑measure past service obligations, leading to higher provisions being recognized upfront in Q3 FY26.

Importantly, these are balance‑sheet driven adjustments with limited immediate cash outflow, and management guidance across the sector has largely focused on normalized margins excluding this one‑time statutory hit.

- Tata Consultancy Services (TCS)

- Statutory Impact: INR 2,128 cr one-time charge due to labour codes.

- Profit Effect: Net profit down 13.9% Year-over-Year to INR 10,657 cr.

- Margin Drag: Codes expected to shave margins by 10–15 bps going forward.

- Notes: One of the largest individual headline impacts across India Inc.

- Infosys

- One-time Charge: INR 1,289 cr from labour code provisions.

- Profit Effect: Net profit dipped 2.2% Year-over-Year to INR 6,654 cr; operating margins compressed.

- Guidance: Company raised FY26 revenue outlook despite the impact.

- Analysts note margin impact 15 bps ongoing.

- HCLTech

- Provision: INR 956 cr charge related to labour code implementation.

- Profit Effect: Net profit fell 11.2% Year-over-Year to INR 4,076 cr.

- Commentary: Without the labour code hit, profit would have grown.

- Wipro

- Impact: INR 302.8 cr one-time cost booked due to labour codes.

- Profit Effect: Reported 7 % decline in net profit (to INR 3,119 cr).

- Guidance: Company cited labour code costs alongside other items.

- Tech Mahindra

- Provision: INR 272 cr (USD 30 m) set aside linked to new codes.

- Profit Effect: Net profit dragged down 6 % in the quarter even though revenue rose.

- Impact noted on margins going forward.

- LTIMindtree

- Labour Code Cost: INR 590 – INR 590.3 cr one-time charge.

- Profit Effect: Net profit down 10–11 % Year-over-Year (INR 970–INR 971 cr); sequential decline larger.

- Adjusted Profit: Excluding one-time cost, profit up 29% YoY.

- Revenue increased 12% YoY.

- Combined IT Sector Hit : Total: Top six IT players (TCS, Infosys, HCLTech, Wipro, Tech Mahindra, LTIMindtree) posted a combined one-time impact of INR 5,400 cr from labour code provisions in Q3 FY26. & Indicates a broad structural impact across the sector.

Selective Other Companies : While the IT sector dominates labour code reporting due to its higher wage & benefits exposure, other companies have mentioned it alongside other operational factors:

ITC Hotels : Reported profit up 9.6% Year-over-year in Q3 FY26. Noted that labour code effects (alongside weather/cyclone-related items) contributed to higher costs, but profit still rose due to revenue growth. & Total expenses increased significantly.

Impact Indicators due to Labour Code Impact

| Company | Labour Code Impact (INR cr, one-time) | Profit Effect | Notes |

| TCS | 2128 | Profit ↓ 13.9% Year-over-Year | Largest individual impact |

| Infosys | 1289 | Profit ↓ 2.2% Year-over-Year | Raised guidance |

| HCLTech | 956 | Profit ↓ 11% Year-over-Year | Margin drag |

| Wipro | 302 | Profit ↓ 7% | Mixed other costs |

| Tech Mahindra | 272 | Profit ↓ 6% | Revenue up |

| LTIMindtree | 590 | Profit ↓ 10–11% Year-over-Year | Strong adjusted results |

| ITC Hotels | Not separately disclosed | Profit ↑ 9.6% Year-over-Year | Labour codes noted among costs |

Key Takeaways (as of 17 Jan 26) for investors & Analysts:

- IT services firms were most visibly impacted in headline Q3 FY26 results due to large one-time provisions for gratuity/leave liabilities and wage definition changes under the new labour codes.

- Margin compression is expected to persist modestly (10–15 basis points) as the structural change normalizes.

- Some companies still delivered profit growth (e.g., ITC Hotels), but noted the codes as part of rising expenses

- This is not a demand or execution issue, Impact is accounting + compliance driven, Cash outflow is limited; largely provision‑based. Comparable impact will not repeat in FY27. Forward‑looking margins are more meaningful than Q3 reported numbers