Commission Booking in family member/low-income PAN holder

Page Contents

Booking “sales commission” in names of family members or low-income PAN holders

Applicability of Section 194H

- Section 194H of the Income Tax Act, 1961, governs Tax Deducted at Source on payments made by way of commission or brokerage (other than insurance commission). From 1 April 2025, TDS under this section is required to be deducted at 2%, subject to a threshold of INR 20,000 in a FY.

- TDS under Section 194H applies when payment is made to a resident and the nature of the payment is commission or brokerage. & Aggregate payment exceeds INR 20,000 in a financial year. Payer is Any person (including individual/HUF), provided Business turnover exceeds ₹1 crore, or Professional receipts exceed INR 50 lakh in the preceding FY.

Rate of TDS under Section 194H

| Particulars | Rate |

| Normal TDS rate | 2% |

| If PAN not furnished | 20% |

| Surcharge / Cess | Not applicable |

Time of Deduction of TDS: TDS under Section 194H must be deducted at the earlier of credit of commission to the payee’s account or actual payment (by cash, cheque, adjustment, or otherwise). Even if commission is retained or netted off, TDS obligation still arises.

Meaning of “Commission or Brokerage”

As per the explanation (i) to Section 194H, commission or brokerage includes any payment received or receivable, directly or indirectly, by a person acting on behalf of another person:

- For services rendered (excluding professional services)

- During the course of buying or selling of goods

- In relation to transactions involving Assets or Valuable articles or things

(excluding securities) - Common Examples Sales commission, Real estate brokerage, distribution commission, and referral or incentive commission

When TDS under Section 194H is NOT Applicable

Section 194H does not apply in the following cases:

- Aggregate commission ≤ INR 20,000 in the FY

- Insurance commission (covered under Section 194D)

- Professional services (covered under Section 194J)

- Brokerage on securities transactions

- Commission paid to employees (covered under Section 192)

- Payments by BSNL / MTNL to PCO franchisees

- In case Payments by TV channels/newspapers to advertising agencies

- Turnover commission paid by RBI to Agency Banks\

- Mobile service providers to distributors (as per Supreme Court ruling)

Lower or NIL Deduction – Section 197

- The deductee may apply to the Assessing Officer for lower or NIL TDS under Section 197. Compliance checks for deductor PAN validation, Certificate validity (Section, Rate & FY), Threshold monitoring & Correct certificate number reporting in Form 26Q

TDS Deposit & Return Due Dates (FY 2025-26)

TDS Deposit Due Dates

| Month of Deduction | Due Date |

| April – Feb | 7th of next month |

| March | 30th April |

TDS Return – Form 26Q

| Quarter | Due Date |

| Apr – Jun | 31 July 2025 |

| Jul – Sep | 31 October 2025 |

| Oct – Dec | 31 January 2026 |

| Jan – Mar | 31 May 2026 |

Important Practical Points related to TDS under Section 194H

- TDS applies even if commission is adjusted against receivables

- Splitting payments to stay below INR 20,000 may attract scrutiny

- Family commission arrangements face substance-over-form tests

- GST registration may be mandatory even if income-tax exemption applies

- Section 194H applicable on airline ticket discounts to travel agents : TDS depends on whether it is a commission or a trade discount; substance matters.

- TDS applicable on trade incentives to dealers : If the incentive is linked to services rendered → Yes; if pure trade discount → No.

- The TDS applicable on RBI turnover commission to banks : → No, specifically excluded.

- Income tax TDS required to be deducted: → At the earlier of credit or payment.

- Expenses are deducted from commission income before TDS: No. TDS is on gross commission, not net income.

GST Impact on Commission Payments: If commission is subject to GST, TDS is deducted on the value excluding GST; then GST liability and TDS compliance are independent, and non-GST registration does not override Section 194H applicability

Consequences of Non-Compliance

- Disallowance of commission expense (u/s 40(a)(ia))

- Interest u/s 201(1A)

- Penalty exposure

- GST backdated registration risk (where applicable)

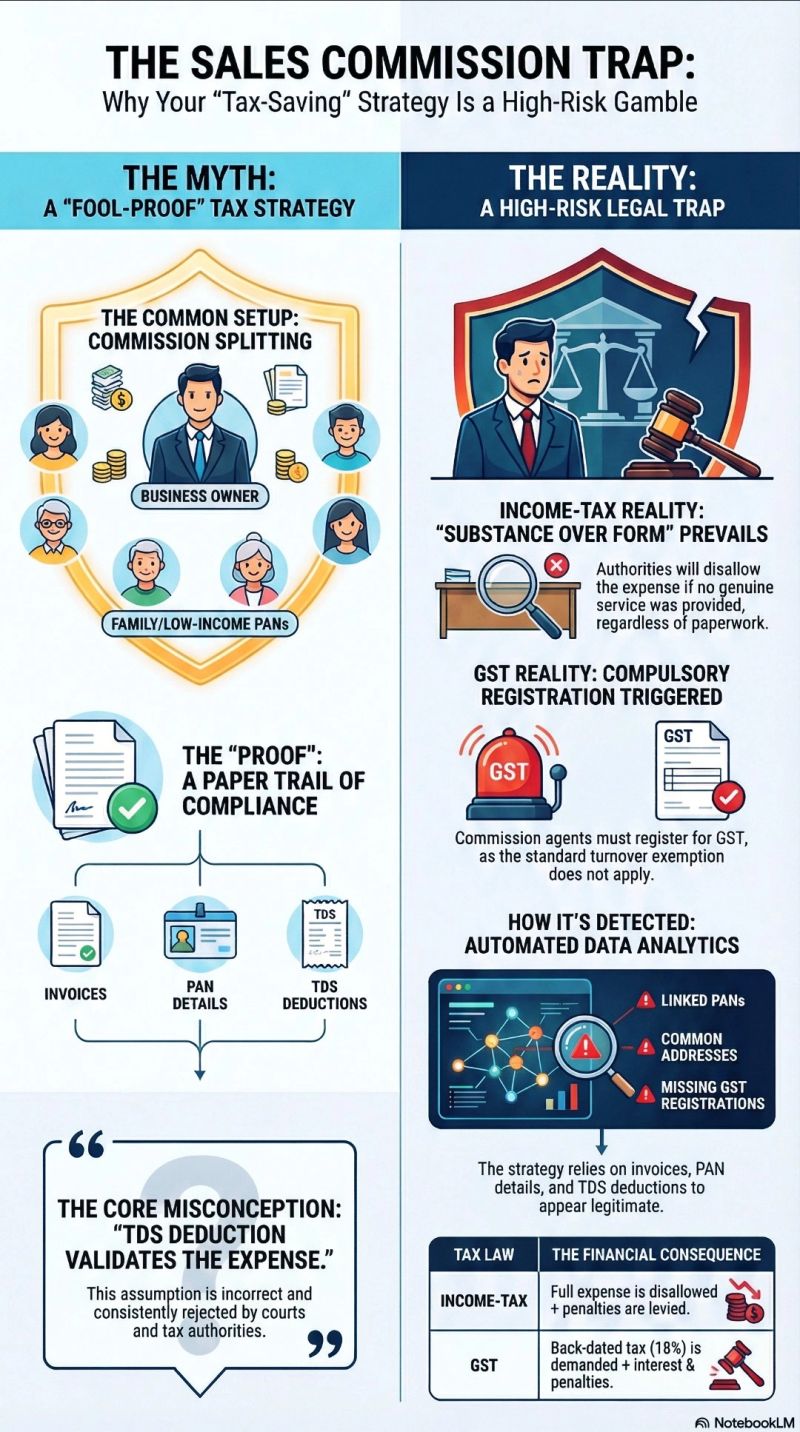

Sales commission Booking in family members name or low-income PAN holders

“Invoice + PAN + TDS = Safe Tax Planning?”

One of the costliest misconceptions in Indian taxation today. In many businesses, especially MSMEs, a familiar practice still survives: Booking “sales commission” in the names of family members or low-income PAN holders, supported by invoices and TDS, to reduce profits and stay below GST thresholds. On paper, it looks compliant. On tax analytics dashboards, it flashes RISK

What professionals must clearly understand

- TDS deduction does NOT establish genuineness

- Invoices prove form, not substance

- Commission without capability = disallowance

- Family PANs invite “human probability” & related-party tests

- GST law ignores Income-tax exemption limits

- Agents acting on behalf of others require GST registration irrespective of turnover

- AI now auto-detects clustered commissions, common addresses, bank patterns & family linkages

What authorities actually examine today

- Who actually generated the sales?

- What commercial capability did the recipient possess?

- Why are amounts consistently just below threshold limits?

- If Why no GSTIN despite regular commission income?

- Why identical narration, timing & values across family PANs?

What typically follows (ground-level assessment reality)

- Income-tax: Commission disallowed u/s 37

• GST: Backdated registration + 18% tax demand

• Interest: Mandatory & non-negotiable

• Penalty: Substantial

• Individuals: Personal tax exposure

• Company: Allegation of facilitation / colourable device

What courts have said consistently, for decades

- Substance over form

- Colourable devices ≠ tax planning

- Family transactions need commercial justification, not paperwork theatrics

- Documentation supports reality; it does not create it.

Why this structure is dying fast : Earlier days, manual scrutiny, limited cross-verification, and now AIS + 26AS + GST returns + bank data + address mapping + PAN-family analytics.

What once looked “smart” now looks reckless.

- If commission is real: Prove capability, effort, linkage to sales, arm’s-length pricing & GST compliance.

- In case it’s only tax-driven: The risk today far outweighs any temporary saving.

- Invoice + PAN + TDS does not guarantee allowability. Tax authorities now evaluate commercial substance, capability, GST linkage, and data analytics footprints.