All about Rule 86B under GST– Restriction on ITC Utilisation

Page Contents

Overview about Rule 86B under GST – Restriction on ITC Utilisation

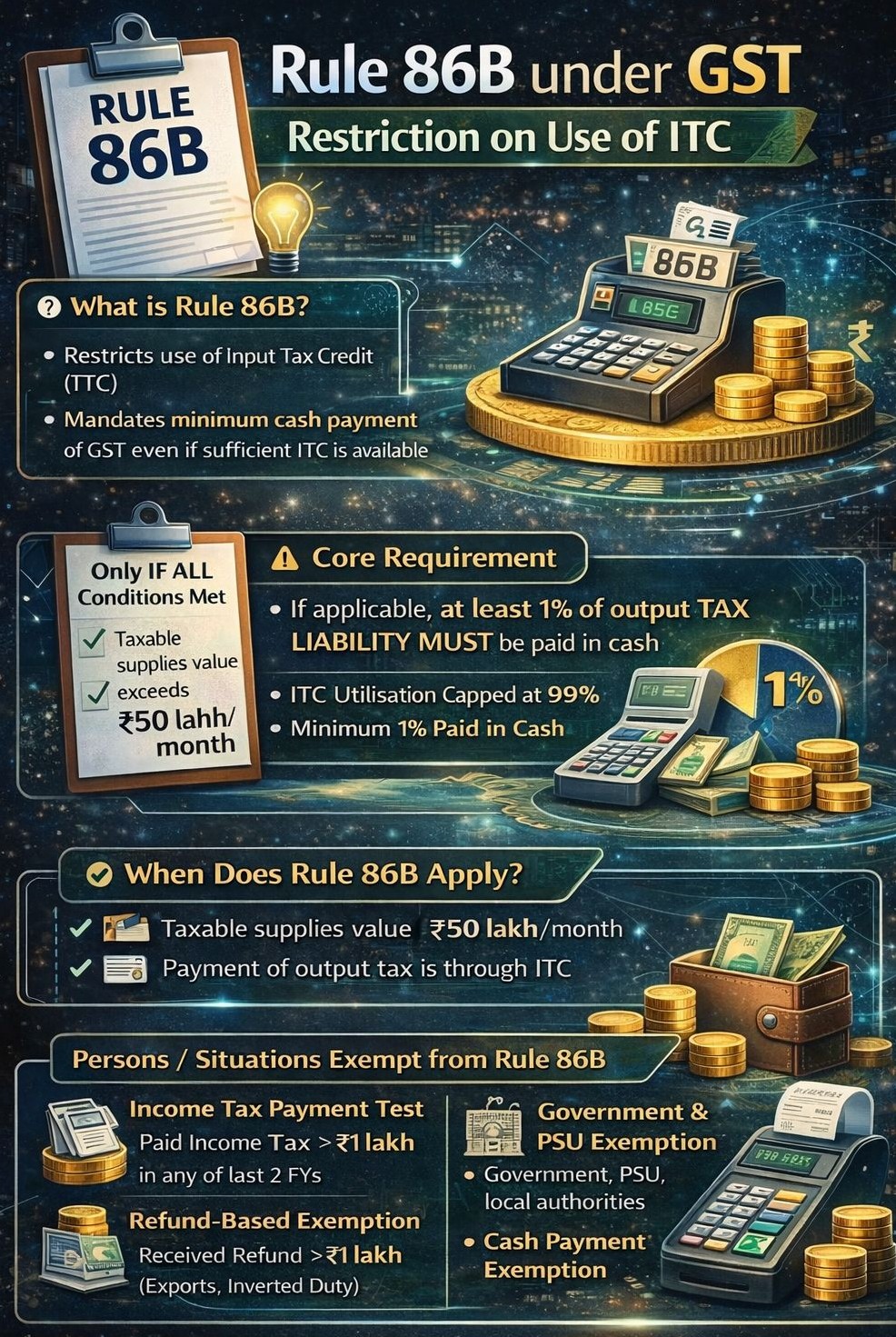

Rule 86B of the Central Goods and Services Tax (CGST) Rules, 2017, restricts the use of Input Tax Credit for payment of output Goods and Services Tax in certain situations. This rule was implemented to curb fake invoicing & improve tax discipline. Even if a taxpayer has enough input tax credit, they must pay a minimum of 1% of GST liability in cash. with Effective From: 1 January 2021

Before Rule 86B under the Central Goods and Services Tax (CGST) Rules, 2017, businesses could pay their entire Goods and Services Tax liability using Input Tax Credit, which opened the door to fake invoicing, bogus Input Tax Credit claims, & shell companies issuing Input Tax Credit without actual supply. To discourage these practices, Rule 86B introduces a financial deterrent by enforcing a compulsory minimum cash payment. This ensures real tax flow to the government, Greater authenticity of transactions, Improved compliance discipline

The GST commissioner or authorized officer may remove the restriction after verification if satisfied. Useful in cases of ITC fraud suspicion being cleared, Exceptional business circumstances, and technical blockage despite genuine operations.

When Does Rule 86B Apply?

It applies only if all the following are true:

- Monthly taxable turnover (excluding exempt/zero‑rated) exceeds INR 50 lakh

- Output tax liability is being paid mainly through input tax credit.

- No applicable exemption is available

Rule 86B under Central Goods and Services Tax (CGST) Rules, 2017, applies to registered persons whose taxable supplies (excluding exempt and zero‑rated supplies) exceed INR 50 lakh in a month : If applicable, the taxpayer cannot use more than 99% of their Input Tax Credit to discharge output tax. A minimum of 1% of the output tax liability must be paid in cash through the Electronic Cash Ledger.

Who Is Exempt from Rule 86B?

Rule 86B under Central Goods and Services Tax (CGST) Rules, 2017, does not apply if ANY of these criteria are met:

- Income Tax Paid (> INR 1 lakh) : In any of the last two FYs by Proprietor, Partner, Director, Karta, (and other related persons)

- Refund-based exemption : Refund > INR 1 lakh in previous FY on account of Exports (with/without payment of tax), Inverted duty structure

- Government Entities : Departments, PSUs, Local authorities, Statutory bodies

- Cash payment already ≥ 1% : If 1% tax has already been paid in cash cumulatively in the current month → Rule satisfied.

How Compliance Is Monitored by GST Dept.

- Tax authorities track taxpayers using GSTR‑1 & GSTR‑3B, E‑way bill data, and system-based red flags. Non-compliance may result in Goods and Services Tax Notices, Input Tax Credit blocking, & suspension of Goods and Services Tax Identification Number in extreme cases. Maintaining documentation proving exemption eligibility is crucial.

- Practical Best Practices for compliance include tracking monthly turnover to check the threshold. Maintain exemption documentation, Update accounting software to compute restricted Input Tax Credit, Plan monthly working capital, review status of income tax filings of key persons, and also Check refund history for exemption eligibility

Practical Points related to Rule 86B under Goods and Services Tax

Applied monthly, not yearly; zero‑rated supplies are excluded from the INR 50 lakh threshold; Input Tax Credit auto‑blocking may occur in non‑compliance cases, and It is procedural, not penal, but non‑compliance triggers notices. We can understand Rule 86B under Central Goods and Services Tax (CGST) Rules, 2017 via a simple example.

- Output GST: INR 10,00,000

- Maximum ITC allowed: INR 9,90,000

- Minimum cash payment (1%): INR 10,000

Even with full Input Tax Credit of INR 10 lakh → INR 10,000 must be paid via cash ledger.

Due to Central Goods and Services Tax (CGST) Rules, 2017 Rule 86B—Cash Flow Impact on Businesses : Even genuine taxpayers may feel the impact of increased working capital requirements, the need for advance cash planning, possible strain on cash-strapped businesses, & the need to integrate 1% cash rule into budgeting

In Summary: Judicial Interpretation

Courts have generally upheld Rule 86B as a reasonable & non-arbitrary restriction, a valid anti-evasion measure, and acceptable if exemptions are properly applied. Central Goods and Services Tax (CGST) Rules, 2017 Rule 86B enforces a minimum cash outflow to discourage fake Input Tax Credit claims while safeguarding genuine taxpayers through multiple exemption pathways. Central Goods and Services Tax (CGST) Rules, 2017 Rule 86B is a targeted anti-evasion measure aimed at blocking misuse of Input Tax Credit. While it increases cash flow obligations, it affects only high-turnover cases and includes multiple safeguards to protect genuine taxpayers. Understanding its provisions and tracking exemptions ensures smooth and compliant Goods and Services Tax operations. Consolidated Exemption Table

| Exemption Category | Requirement |

|---|---|

| Income Tax Criteria | Income tax paid > INR 1 lakh in each of last two FYs |

| New Registrations | Goods and Services Tax registration < 1 year |

| Cash Payment | Output tax already paid in cash > 1% cumulatively in FY |

| Government Bodies | Dept., PSUs, Local Authorities |

| Export Refunds | Refund > INR 1 lakh due to exports or inverted duty |

- The objective is not to burden genuine businesses but to tighten compliance among high-risk taxpayers. Key goals reduce fake invoicing chains, ensure minimal genuine tax flow every month, discourage shell companies with zero cash trail, & improve credibility of reported turnover. Rule 86B impacts large taxpayers only, not MSMEs.

Frequently Asked Questions on Rule 86B under GST

Q.1: Is Rule 86B applicable to all GST-registered businesses?

Ans. No. Only if taxable turnover exceeds INR 50 lakh in a month and no exemption applies. Central Goods and Services Tax (CGST) Rules, 2017 Rule 86B restricts the utilization of Input Tax Credit for the payment of output tax. Even if adequate Input Tax Credit is available in the Electronic Credit Ledger, the rule mandates that a minimum portion of Goods and Services Tax liability must be paid in cash.

Q.2: Does the INR 50 lakh threshold include exempt or zero-rated supplies?

Ans. No. It includes only taxable supplies.

Q.3: What happens if I don’t comply with Rule 86B?

Ans. Non-compliance may lead to Return mismatch, Invalidation, Penalties for delayed tax payment

Q.4: Can unused input tax credit be refunded due to Rule 86B?

Ans. No. Input Tax Credit remains in the Electronic Credit Ledger for future use. Rule 86B does not generate refund.